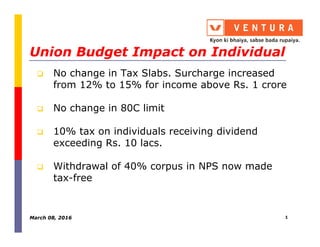

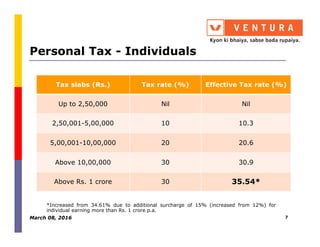

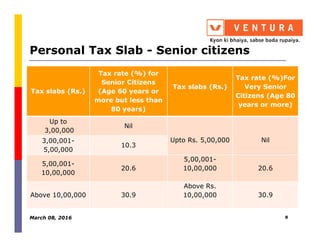

- No changes were made to income tax slabs. Surcharge was increased from 12% to 15% for income over Rs. 1 crore.

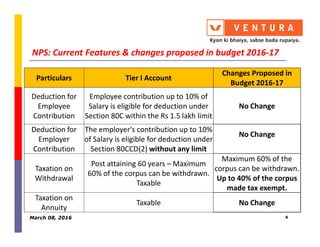

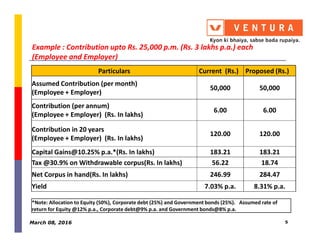

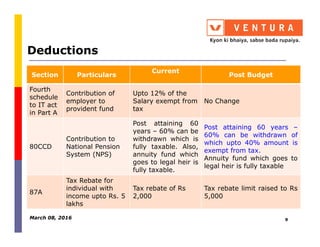

- Withdrawal of up to 40% of the corpus from National Pension System (NPS) is now tax-free.

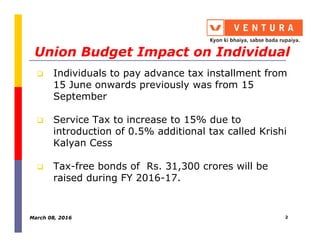

- Individuals must pay advance tax installments starting from June 15th, previously the first installment was due in September.

- Service tax is increasing to 15% with the introduction of a 0.5% Krishi Kalyan Cess. Tax-free bonds of Rs. 31,300 crores will be raised in FY 2016-17.

![Investment

Tax incentive

when investing

Tax implication of

Interest

Tax implication on Sale

Tax-Free

Bonds

No tax exemption at

the time of

investment

Interest from notified

tax-free bonds is exempt

from tax

LTCG – taxable @10%

(without indexation)

[if held more than 1 yr]

STCG – taxable as per tax

slab (if sold before 1 yr)

Debentures

Interest income from

debentures is taxable.

However, no TDS if held

Tax impact on your

investments

slab (if sold before 1 yr)

Debentures

However, no TDS if held

in demat

Bank/

Company

Fixed Deposits

Investment in 5

year tax saving

bank deposit is

eligible for

deduction within the

overall cap of Rs.

1.5 lacs available

under Sec 80C

Interest income will be

taxable as per the tax

slab of the individual.

TDS would be deducted

as applicable

Not Applicable

March 08, 2016 11](https://image.slidesharecdn.com/budgetandyourmoney-final-160318115319/85/Budget-Your-Money-12-320.jpg)