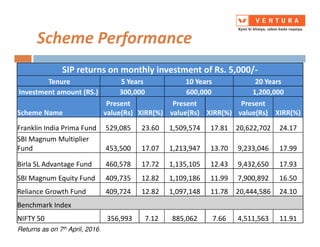

The document emphasizes the importance of investment planning and setting financial goals across different life phases. It highlights that many investors overlook inflation and real returns, urging a disciplined approach to investing through methods like Systematic Investment Plans (SIPs). Additionally, it illustrates the significant benefits of starting early and investing in equity to maximize returns over time.