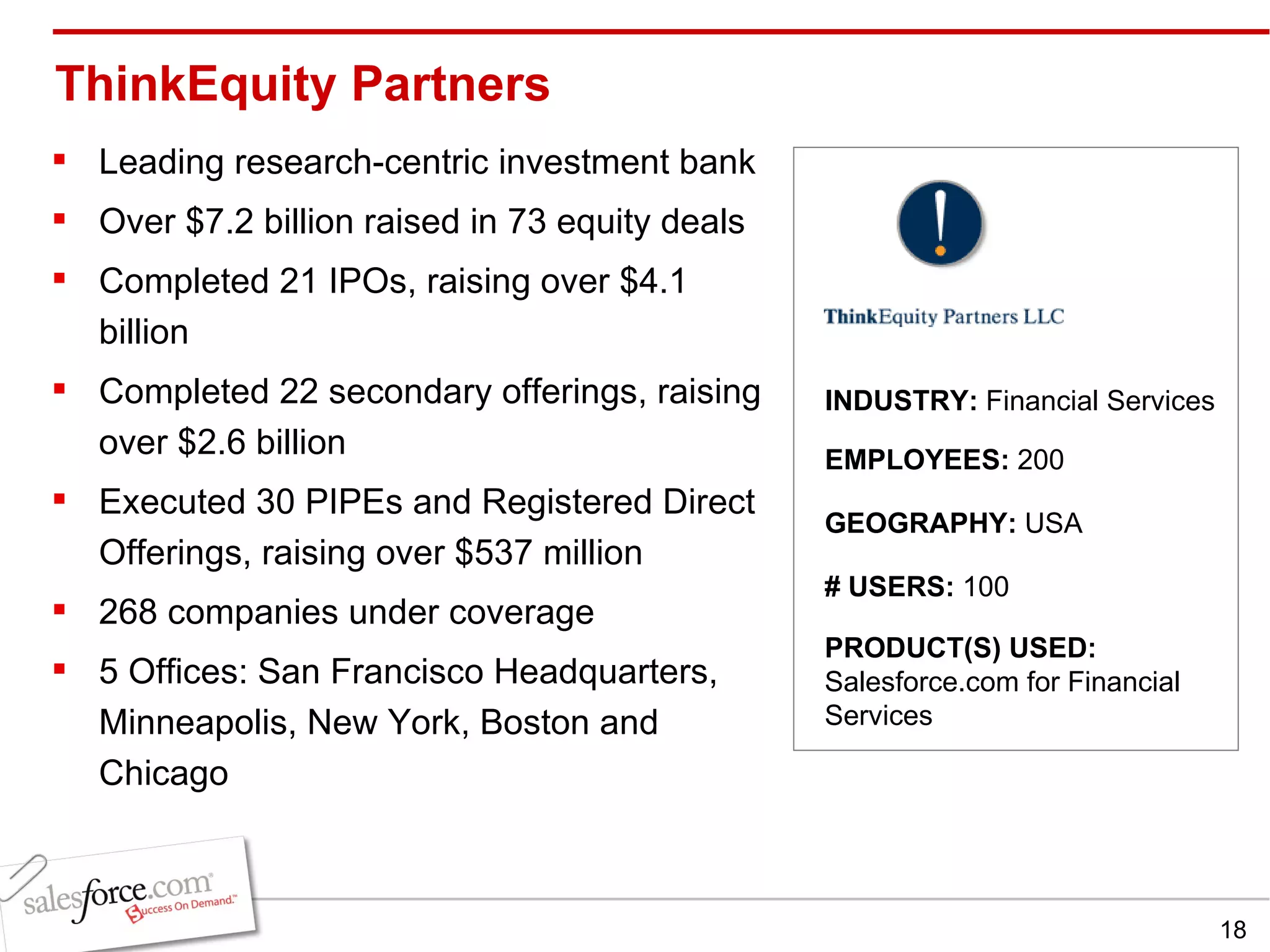

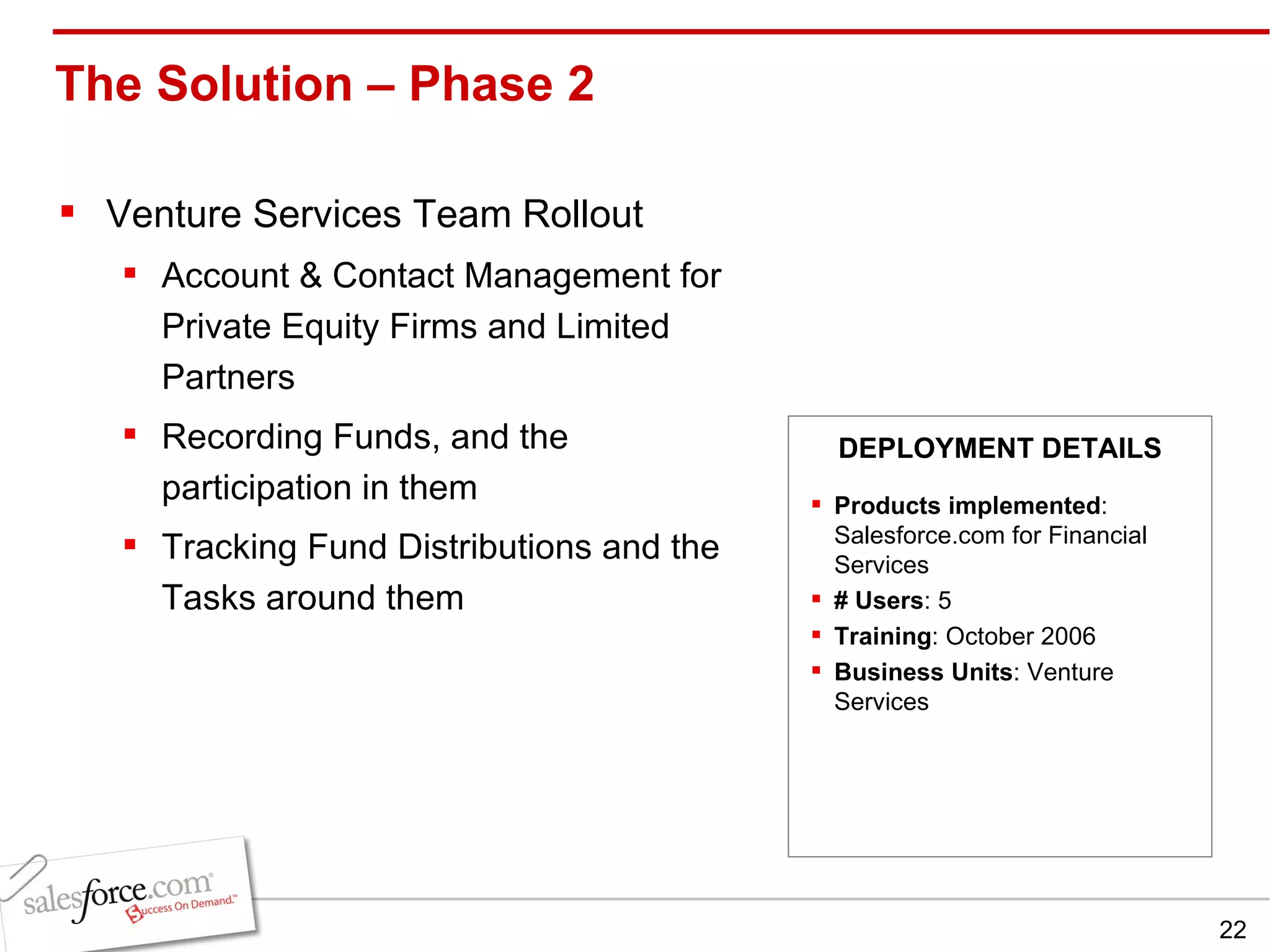

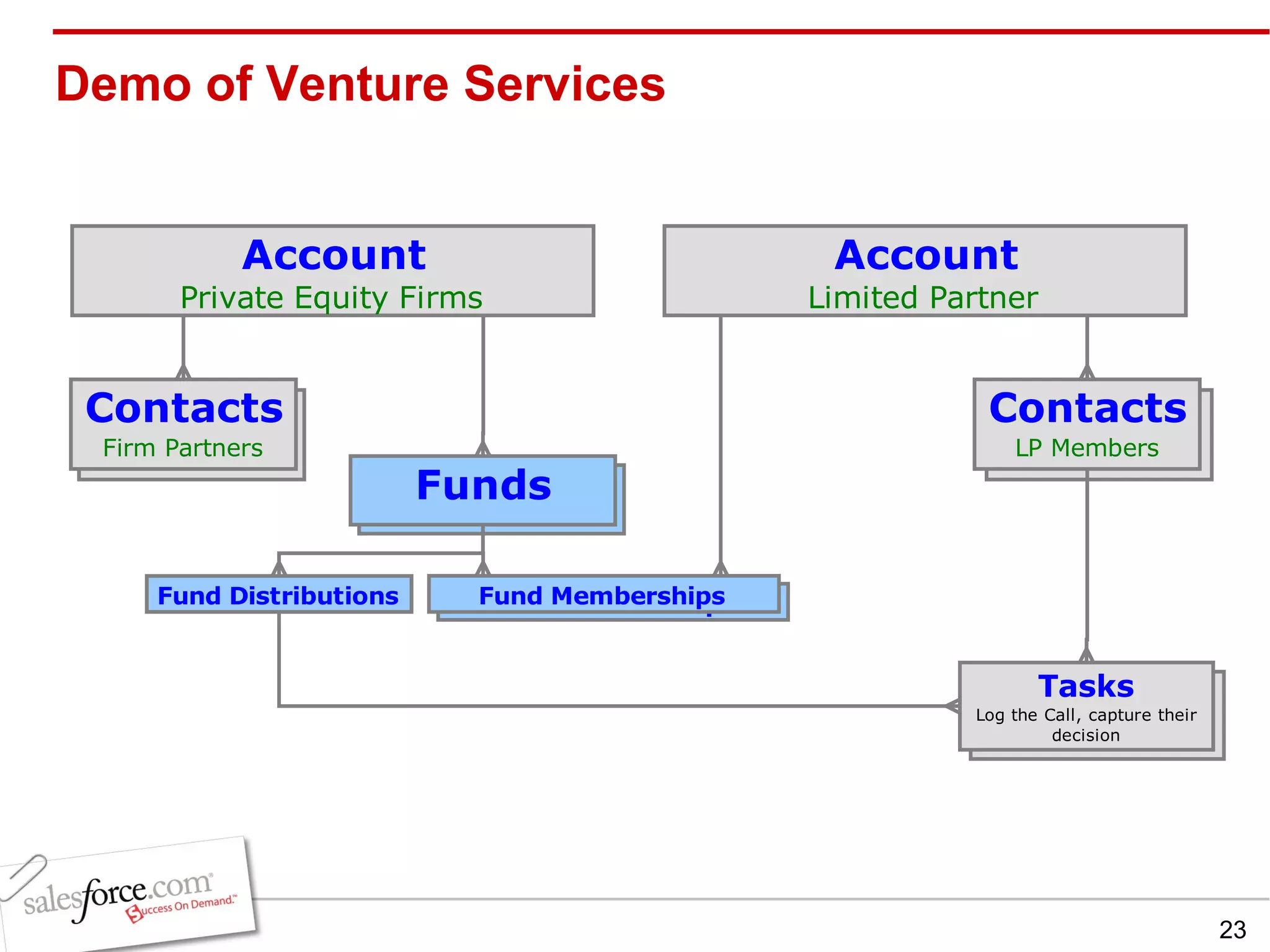

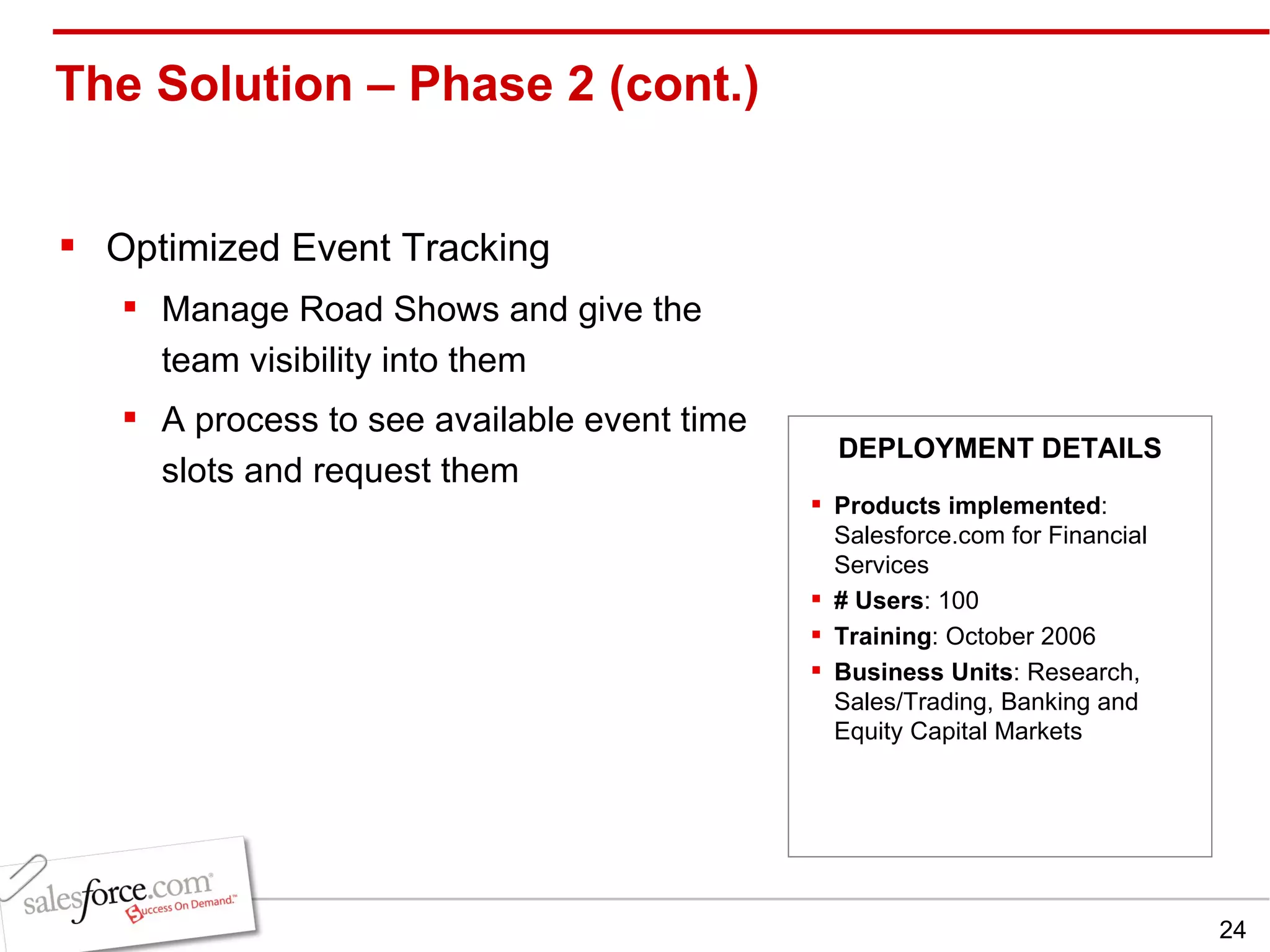

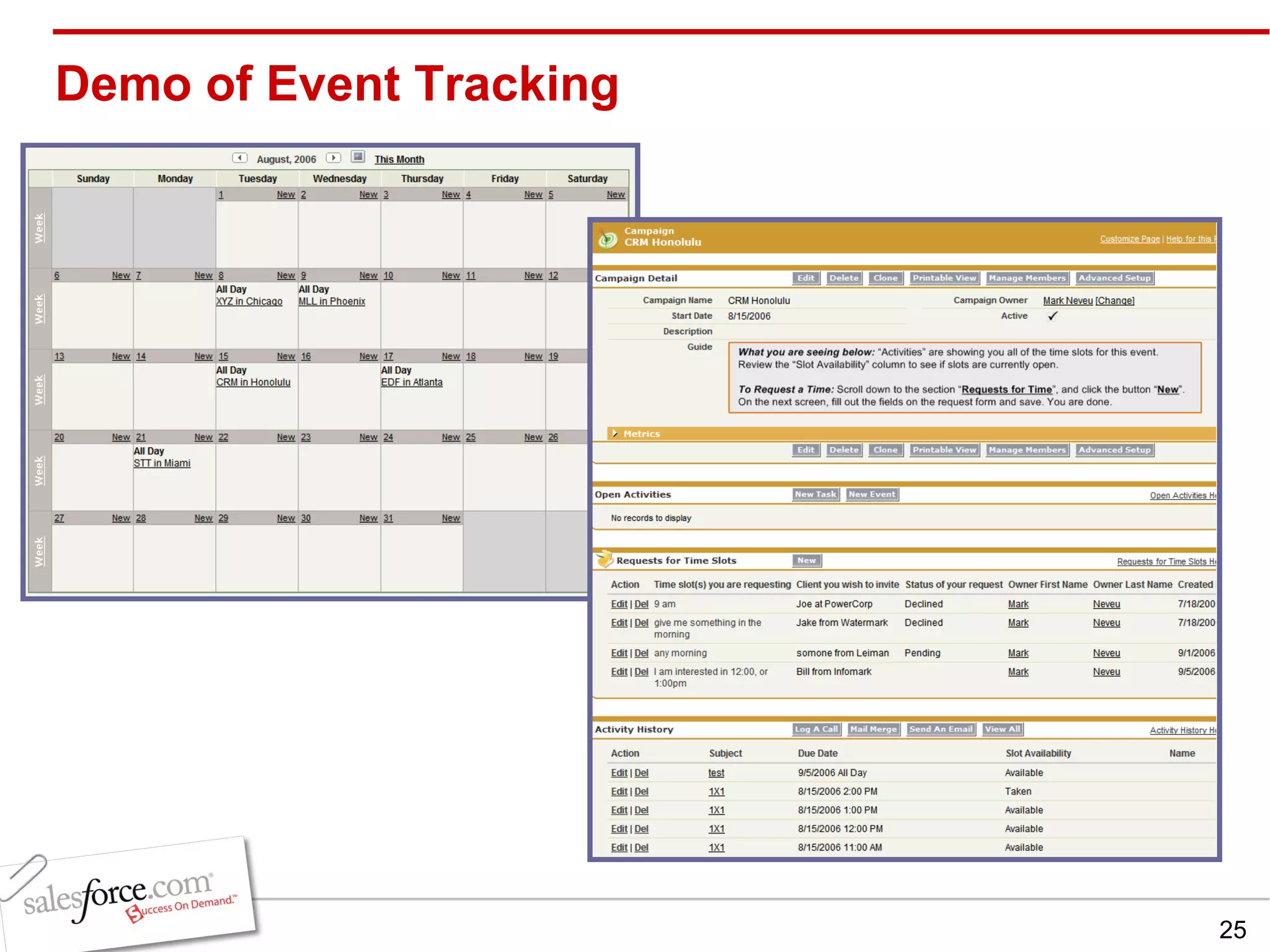

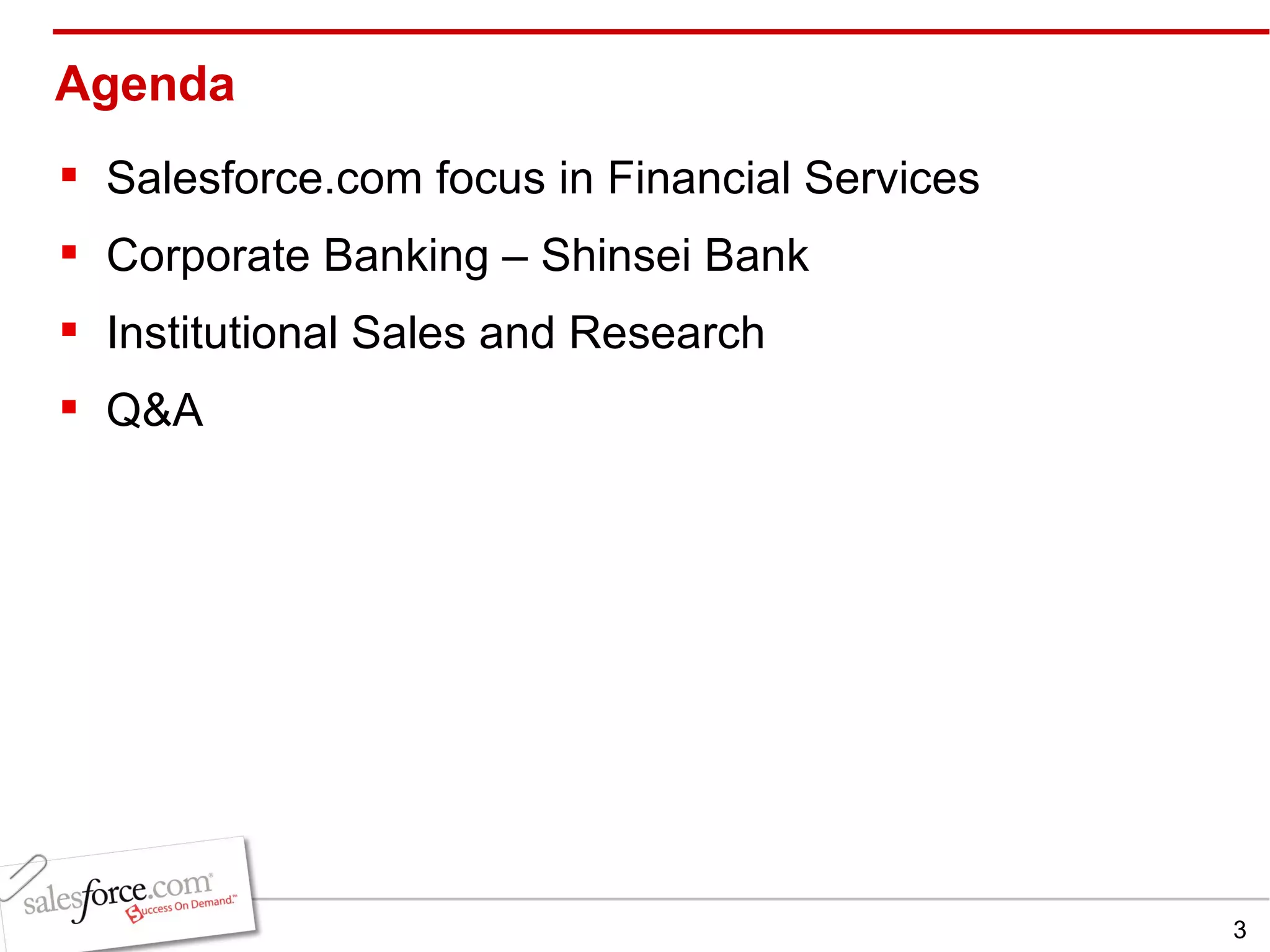

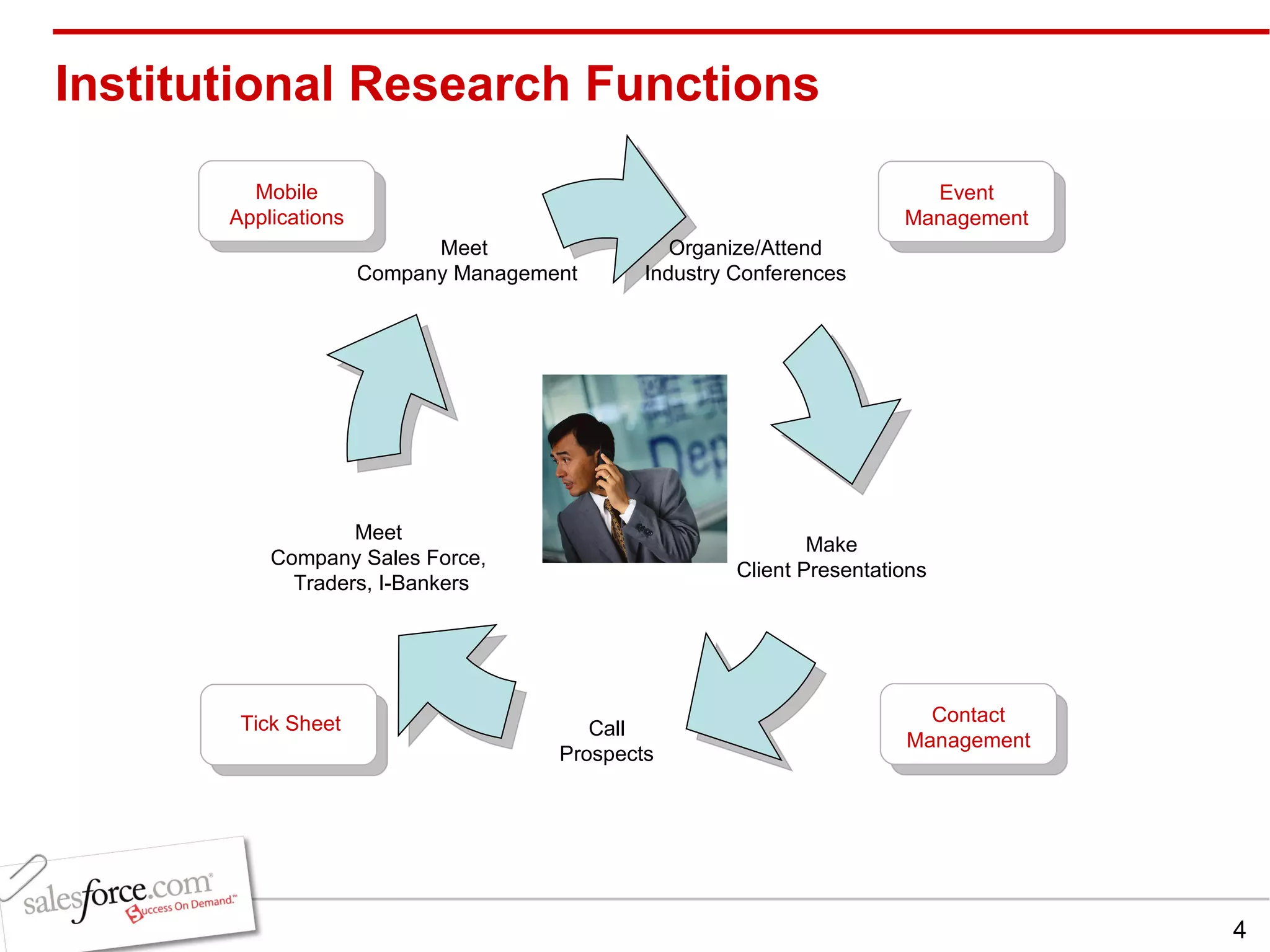

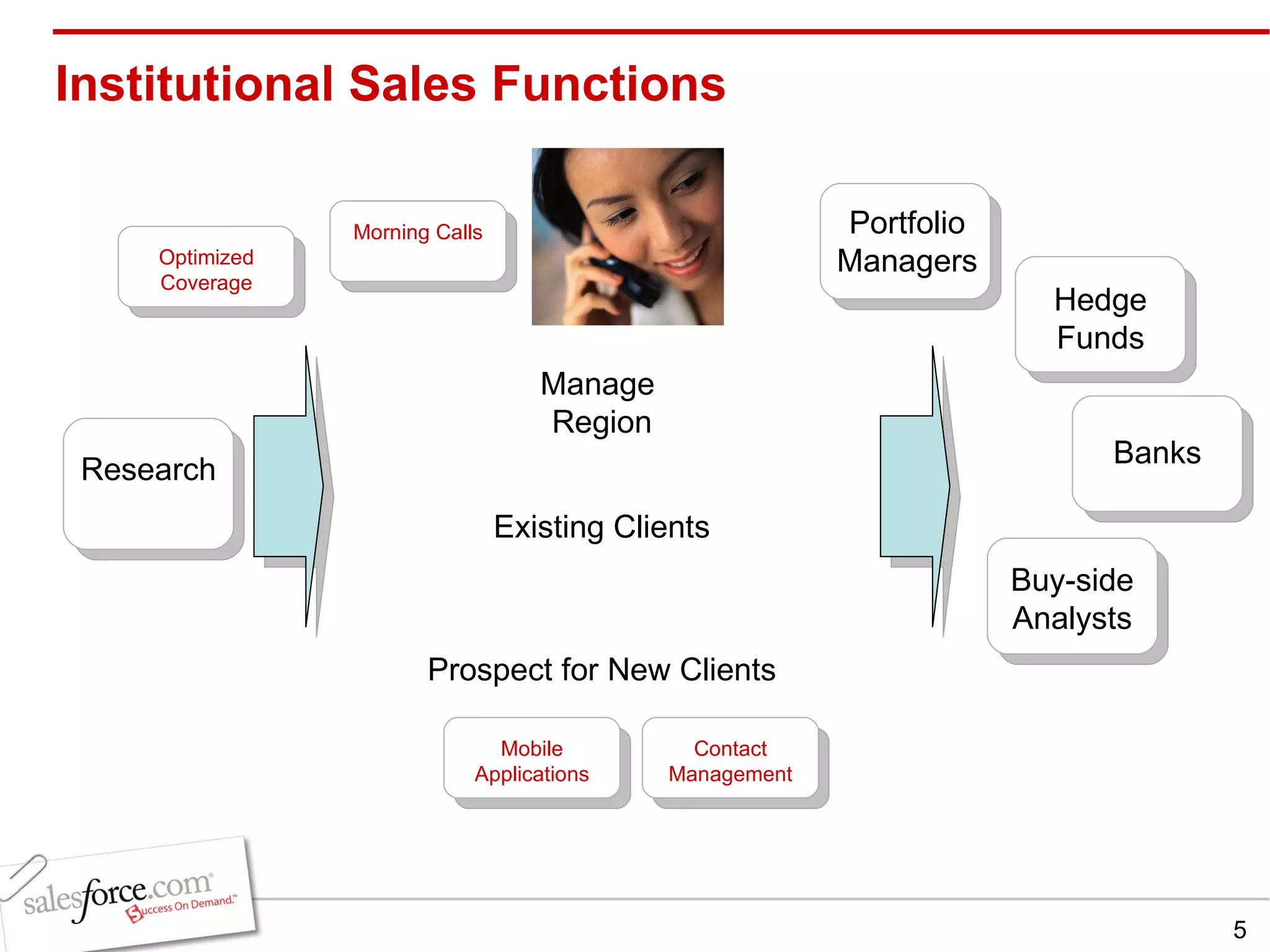

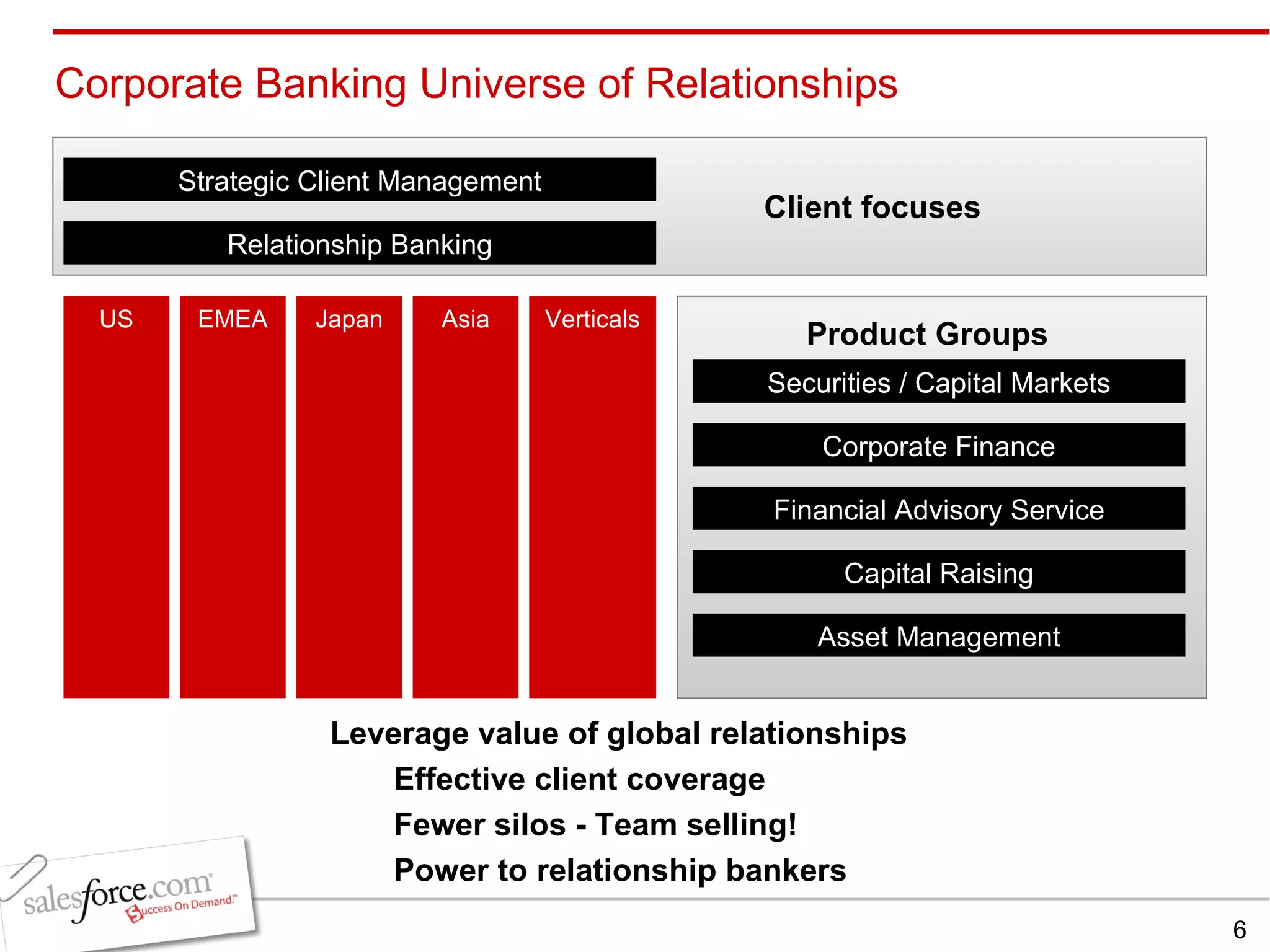

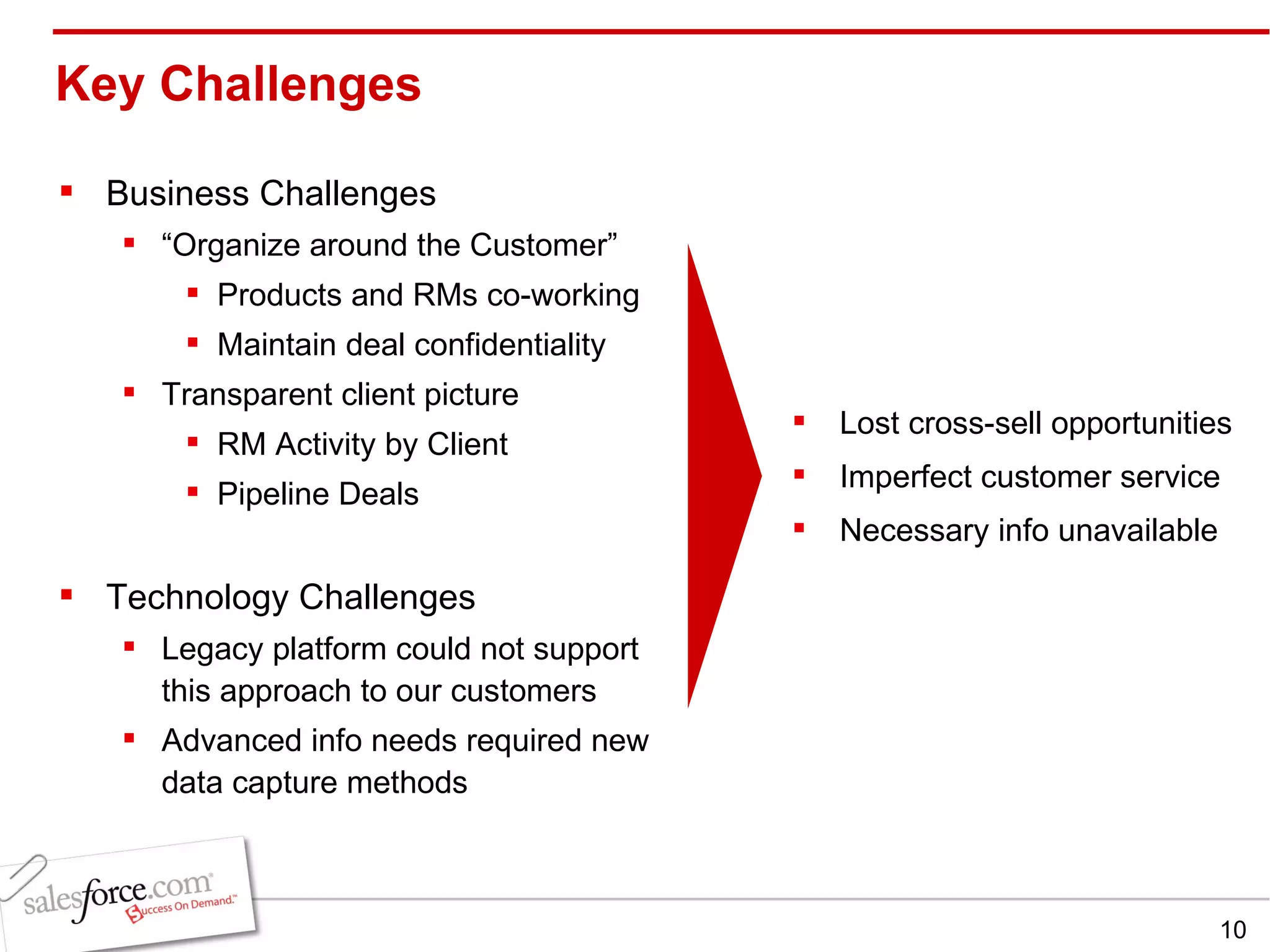

The document provides an overview of how Salesforce helped Shinsei Bank and ThinkEquity Partners improve their client relationships and internal collaboration. For Shinsei Bank, Salesforce enabled information sharing across teams, improved reporting, and facilitated a more customer-centric approach. For ThinkEquity Partners, Salesforce provided activity monitoring, optimized event and call tracking, and supported additional functionality for different business units. Both companies saw increased user adoption and satisfaction after implementing Salesforce.

![Scott Harper IBG Project Manager [email_address]](https://image.slidesharecdn.com/success-with-salesforce-for-capital-markets-20740/75/Success-with-Salesforce-for-Capital-Markets-7-2048.jpg)

![Peter Coleman Director of Research & Head of Equities [email_address]](https://image.slidesharecdn.com/success-with-salesforce-for-capital-markets-20740/75/Success-with-Salesforce-for-Capital-Markets-17-2048.jpg)