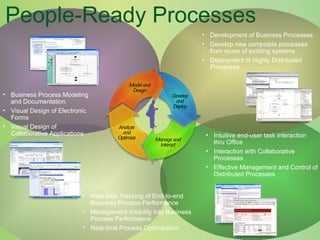

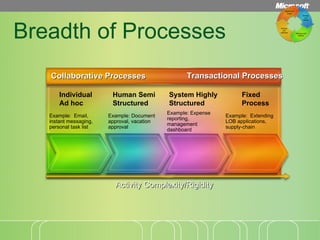

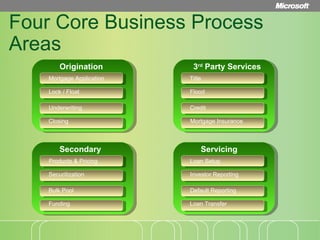

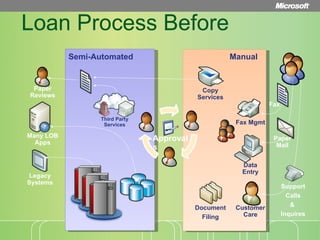

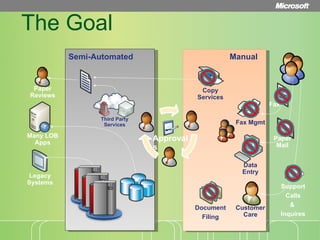

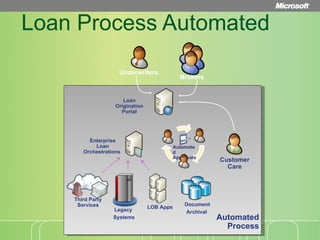

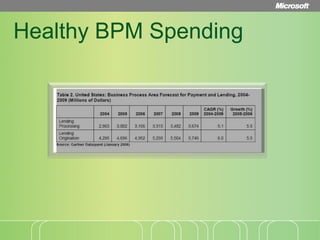

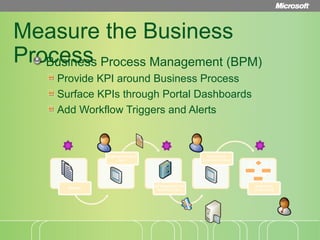

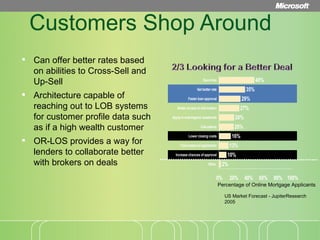

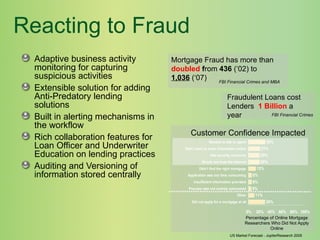

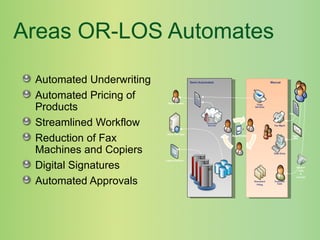

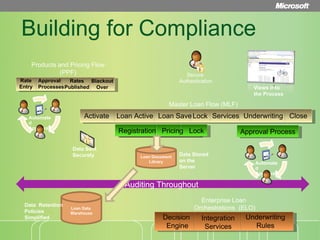

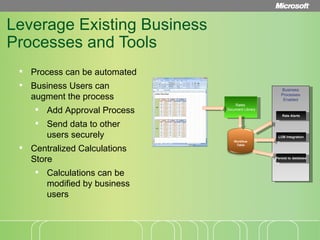

The document discusses how automating lending business processes with office agenda software can help address lending challenges by enabling paperless, streamlined processes. Key benefits include reducing costs by automating manual tasks, improving compliance through centralized data storage and controls, and empowering business users to manage processes and monitor KPIs through intuitive interfaces. The software aims to automate core lending areas like origination, underwriting, closing, and servicing to improve efficiency, customer experience, and regulatory compliance.