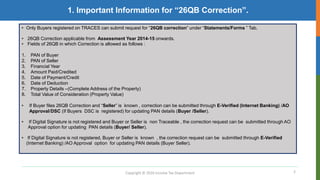

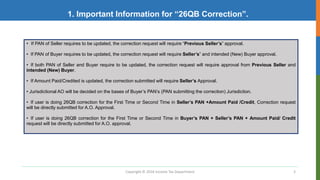

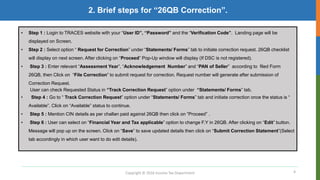

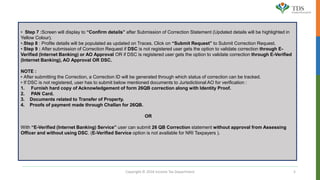

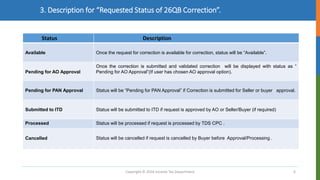

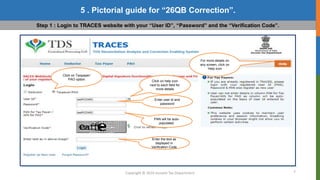

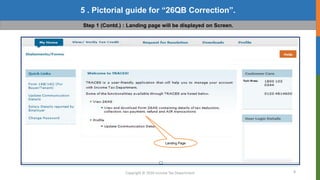

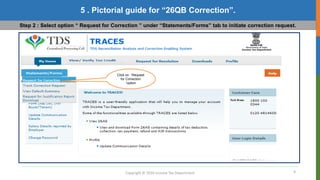

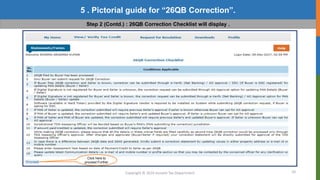

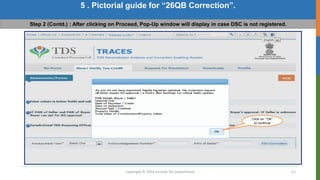

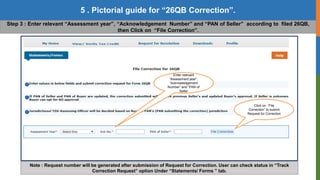

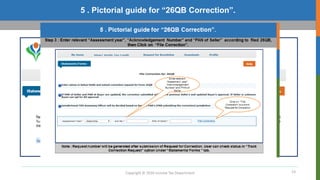

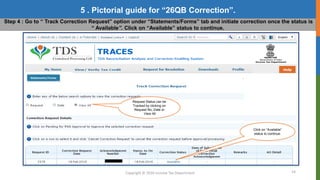

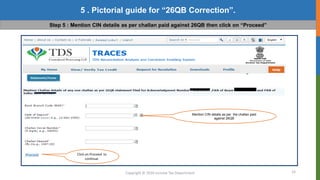

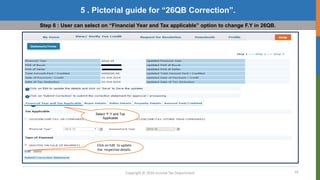

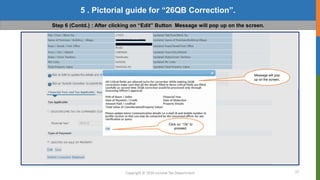

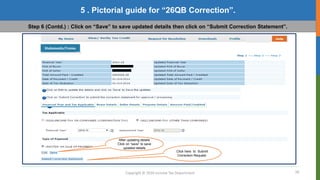

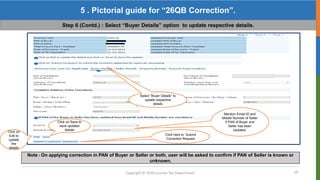

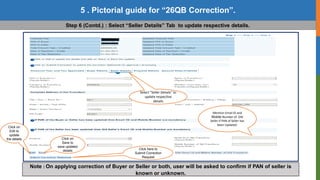

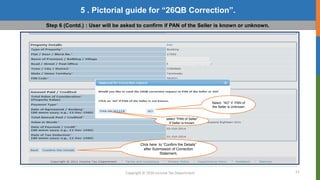

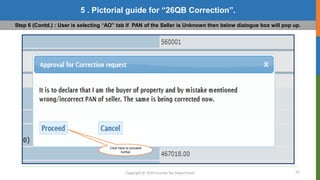

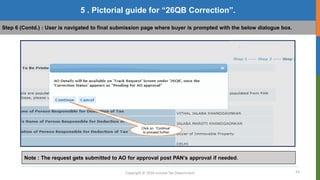

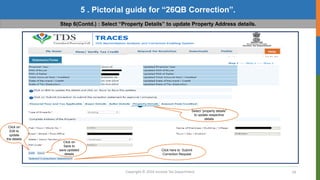

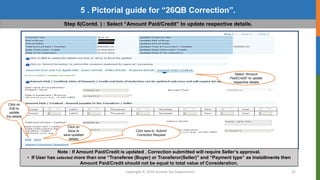

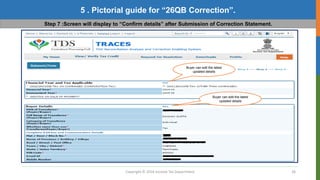

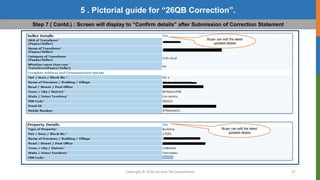

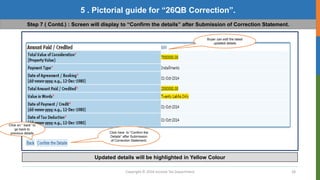

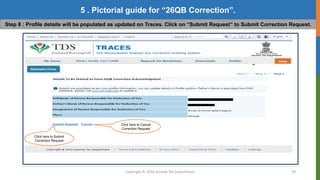

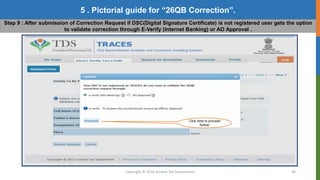

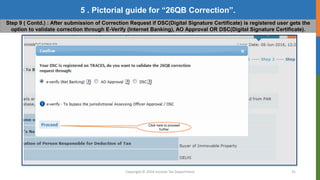

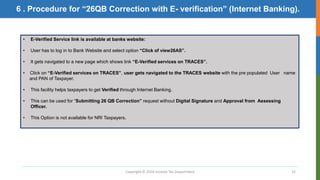

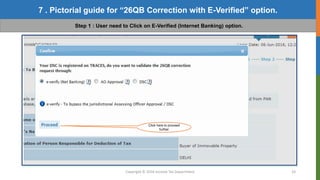

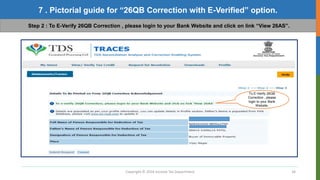

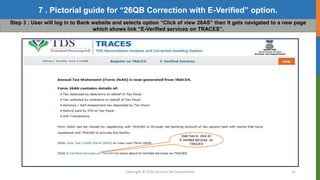

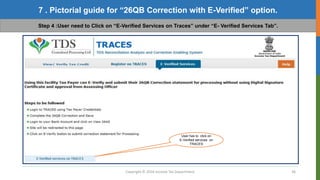

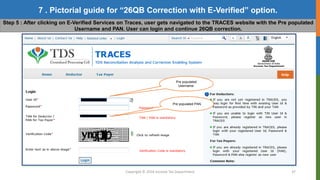

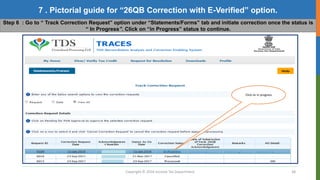

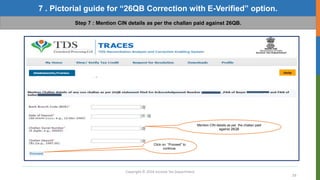

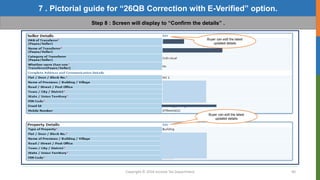

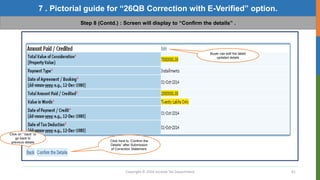

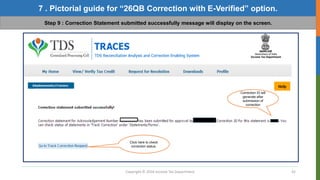

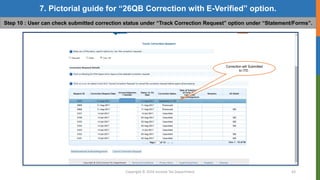

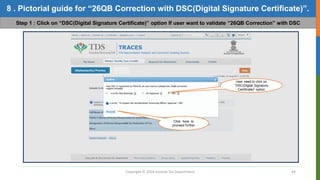

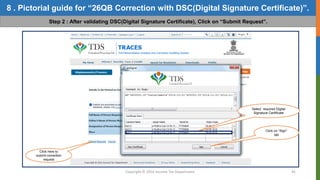

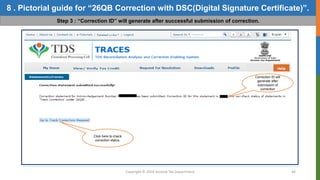

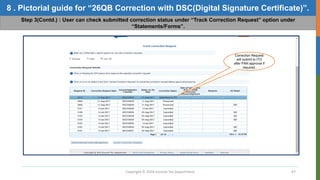

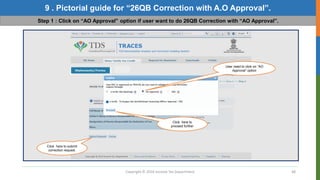

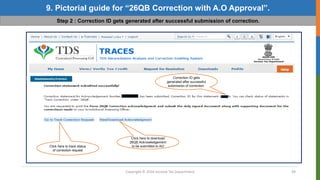

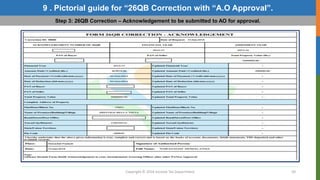

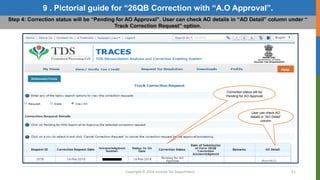

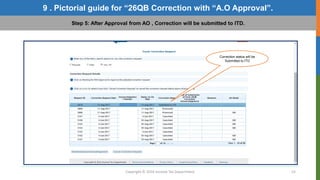

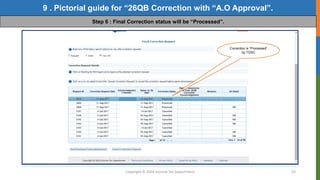

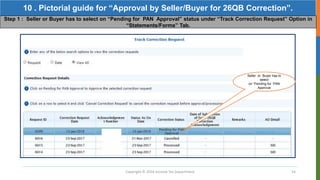

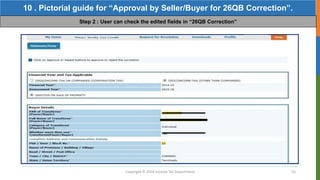

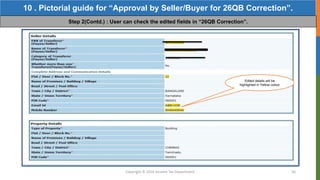

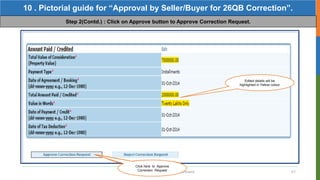

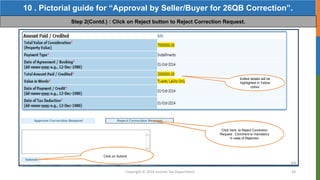

This document provides step-by-step instructions and pictorial guides for submitting a correction request for Form 26QB through the Tax Information Network (TRACES) website. It outlines 9 steps for submitting a correction request, including selecting the correction option, entering required details, updating fields, confirming details, and submitting the request. It also describes the status updates users can expect and verification options if a digital signature is not registered, including E-Verification through internet banking.