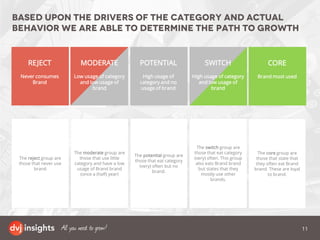

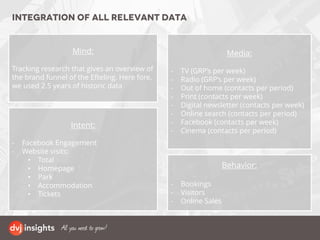

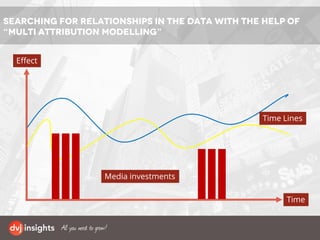

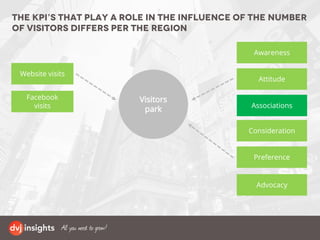

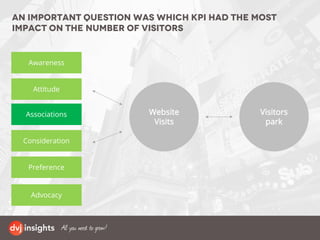

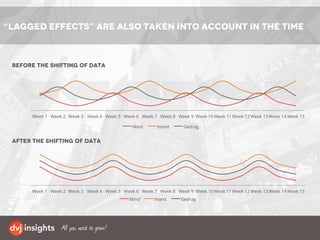

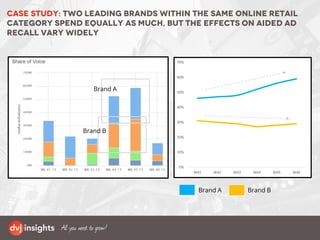

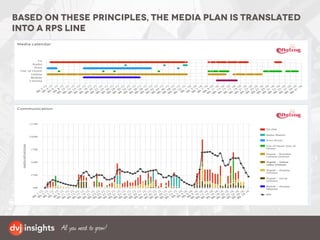

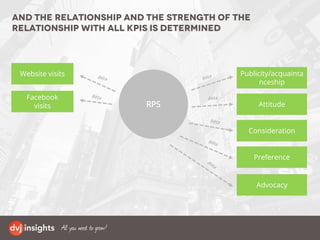

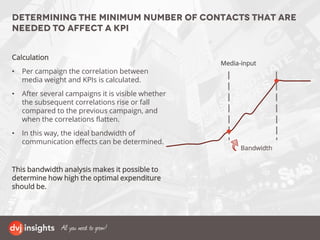

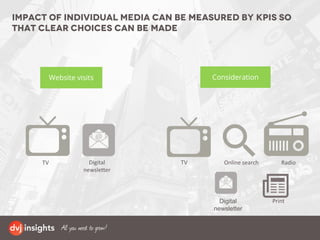

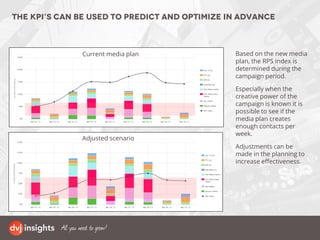

This document outlines a stepwise approach to using data to drive marketing growth. It involves: 1) integrating all relevant customer data sources, 2) determining relationships between sources and KPIs, 3) establishing the minimum contacts needed to impact KPIs, 4) predicting effects of new plans using an RPS index, and 5) defining audiences and growth drivers. The approach was used by a company to develop a growth path, launch a new campaign, and optimize their media plan to better achieve marketing goals.