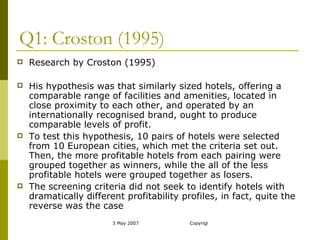

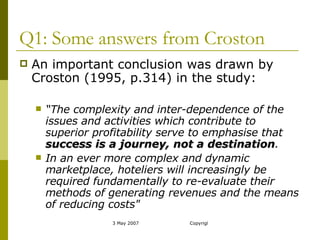

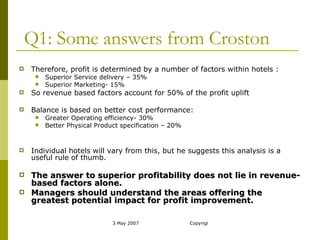

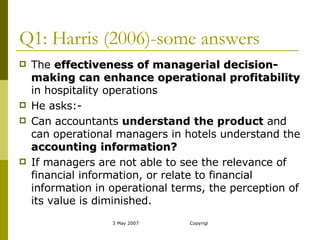

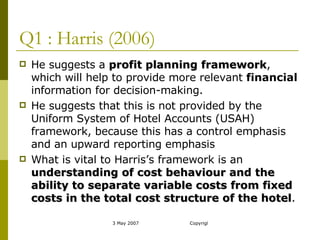

The document discusses several key accounting issues in hotels that impact profitability. It summarizes several studies that examined why some similarly situated hotels are more profitable than others. The studies found that the more profitable hotels generated 46% higher profits through a combination of 5% higher revenues and 7.3% lower costs. Superior performance was attributed to factors like better operating efficiency, marketing, product specifications, and service delivery. Understanding cost behavior and using techniques like customer profitability analysis can help hotel managers make more informed decisions to improve profits.