This document provides an introduction to corporate finance options, including:

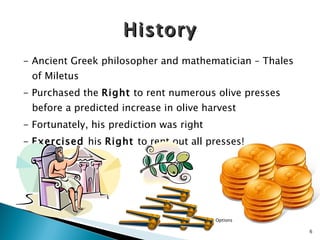

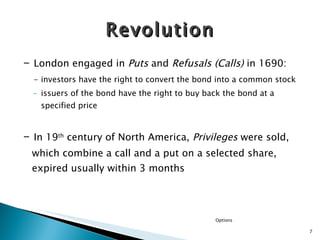

1. A brief history of options and their evolution over time from ancient Greece to modern markets.

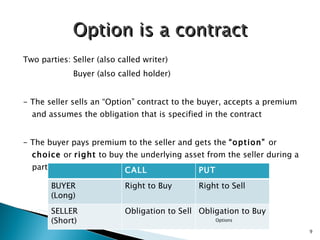

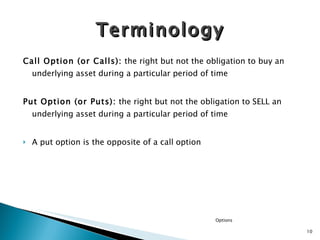

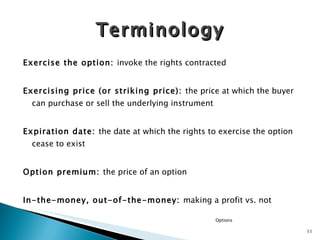

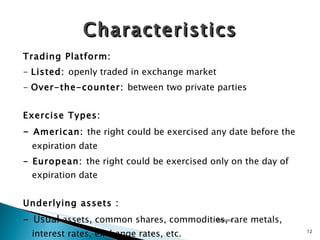

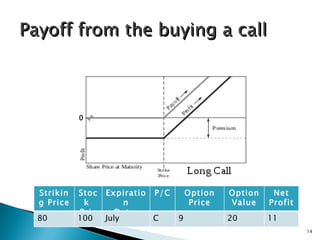

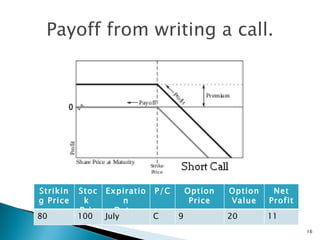

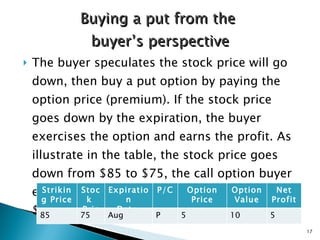

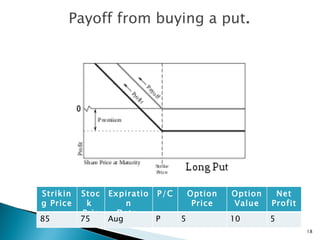

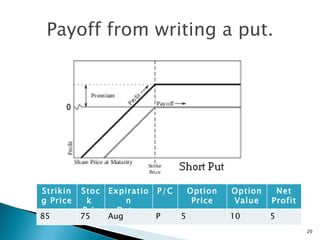

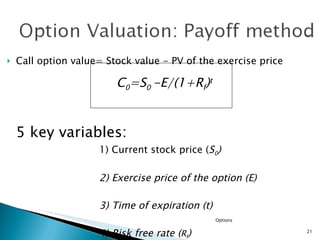

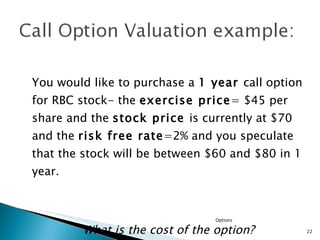

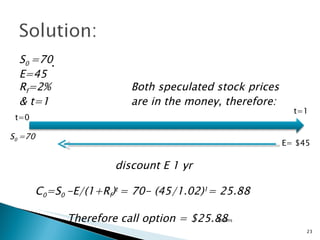

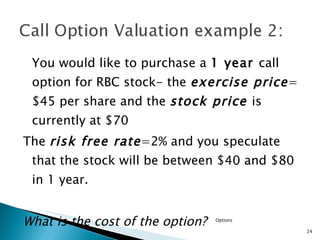

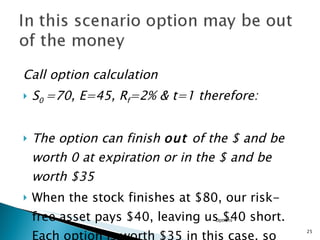

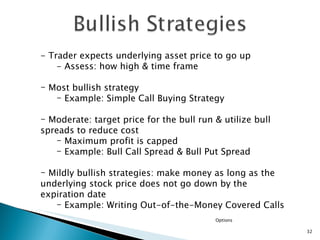

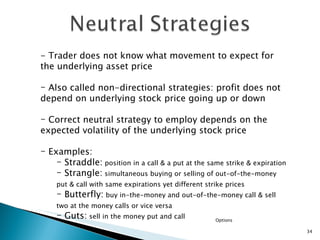

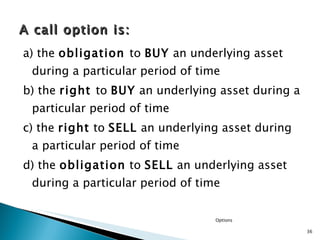

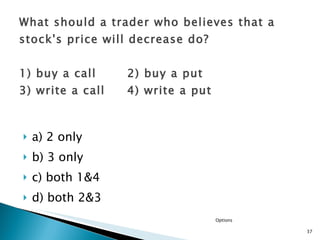

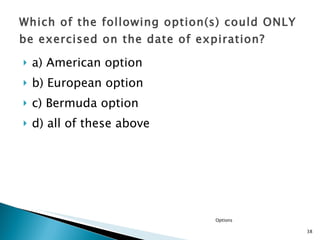

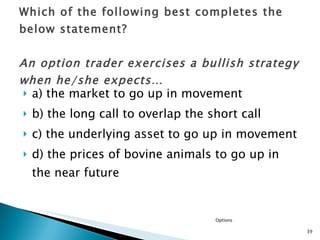

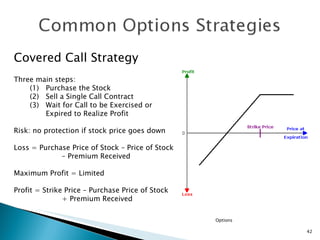

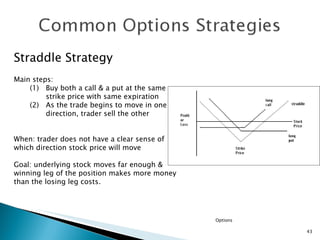

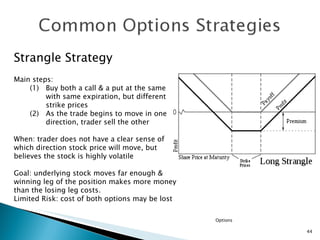

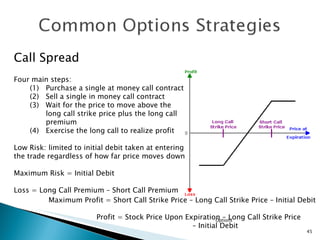

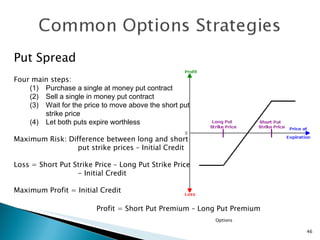

2. An overview of the key characteristics of options contracts, including the types of options (calls, puts), how they are valued, and common strategies (bullish, bearish, neutral).

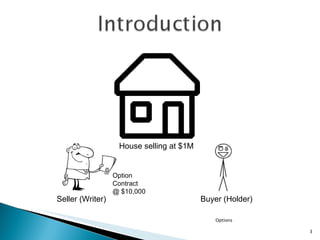

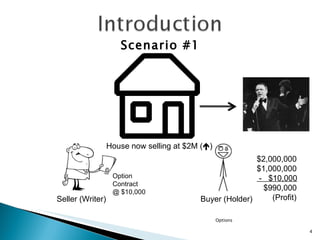

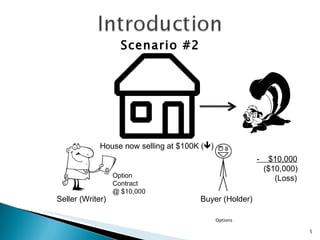

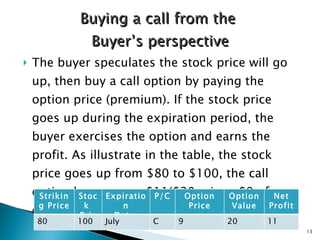

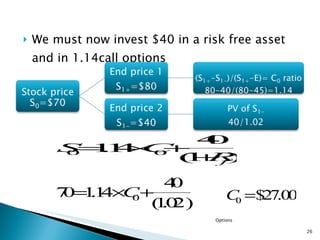

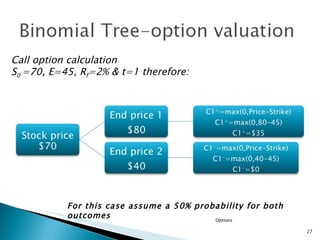

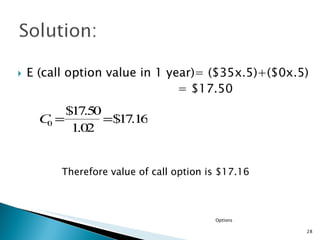

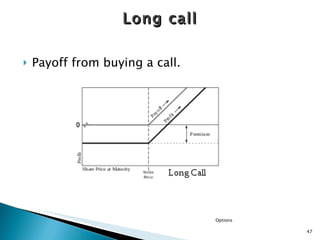

3. Examples of how options work from the perspective of buyers and sellers, including payoffs and breakeven points. Valuation methods like the binomial tree approach are also introduced.