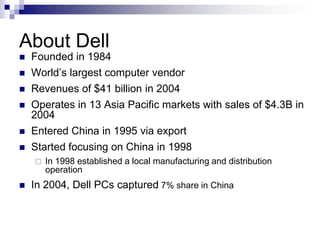

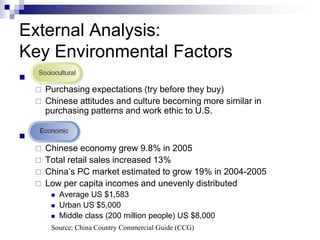

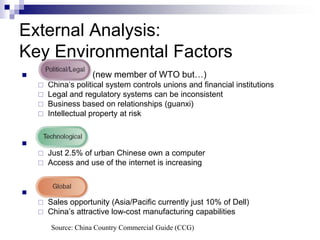

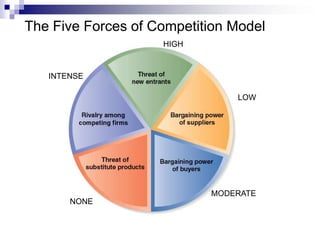

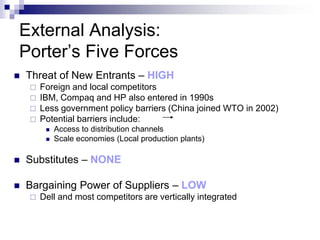

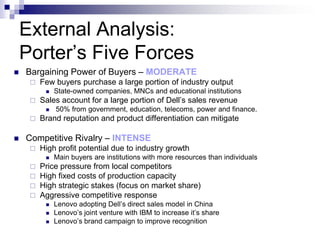

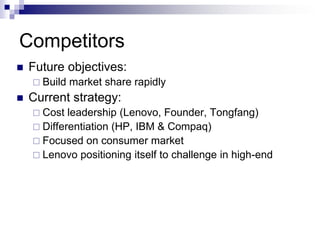

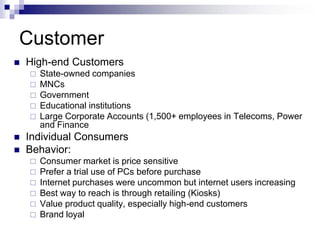

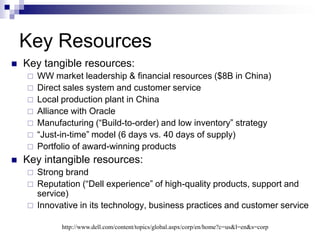

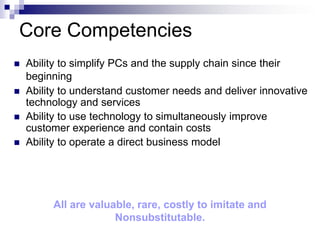

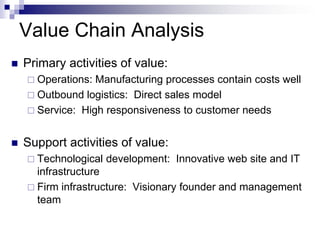

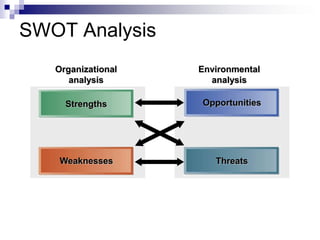

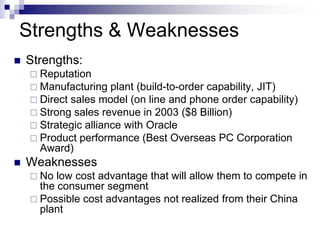

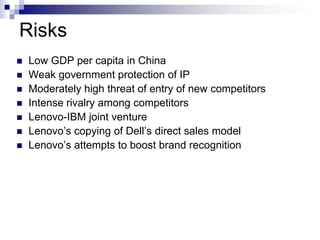

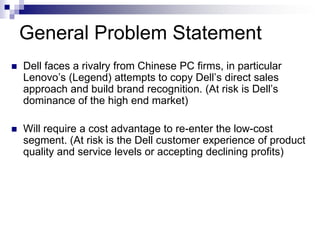

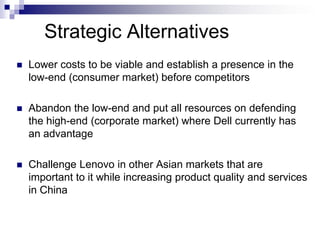

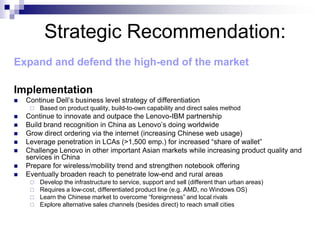

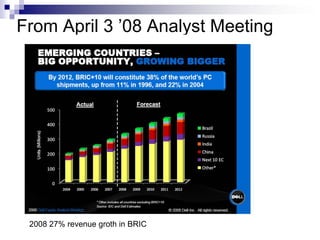

The document discusses Dell's operations and strategy in China. It provides background on Dell, including that it entered China in 1995 and started focusing on the country in 1998. It then summarizes Dell's external and internal analysis for China, including Porter's Five Forces analysis identifying intense competitive rivalry and threats from new entrants. The SWOT analysis identifies strengths like Dell's reputation and manufacturing plant, but weaknesses in lacking a low-cost advantage. It recommends Dell expand and defend its position in China's high-end corporate PC market while preparing for the growing consumer and low-end segments.