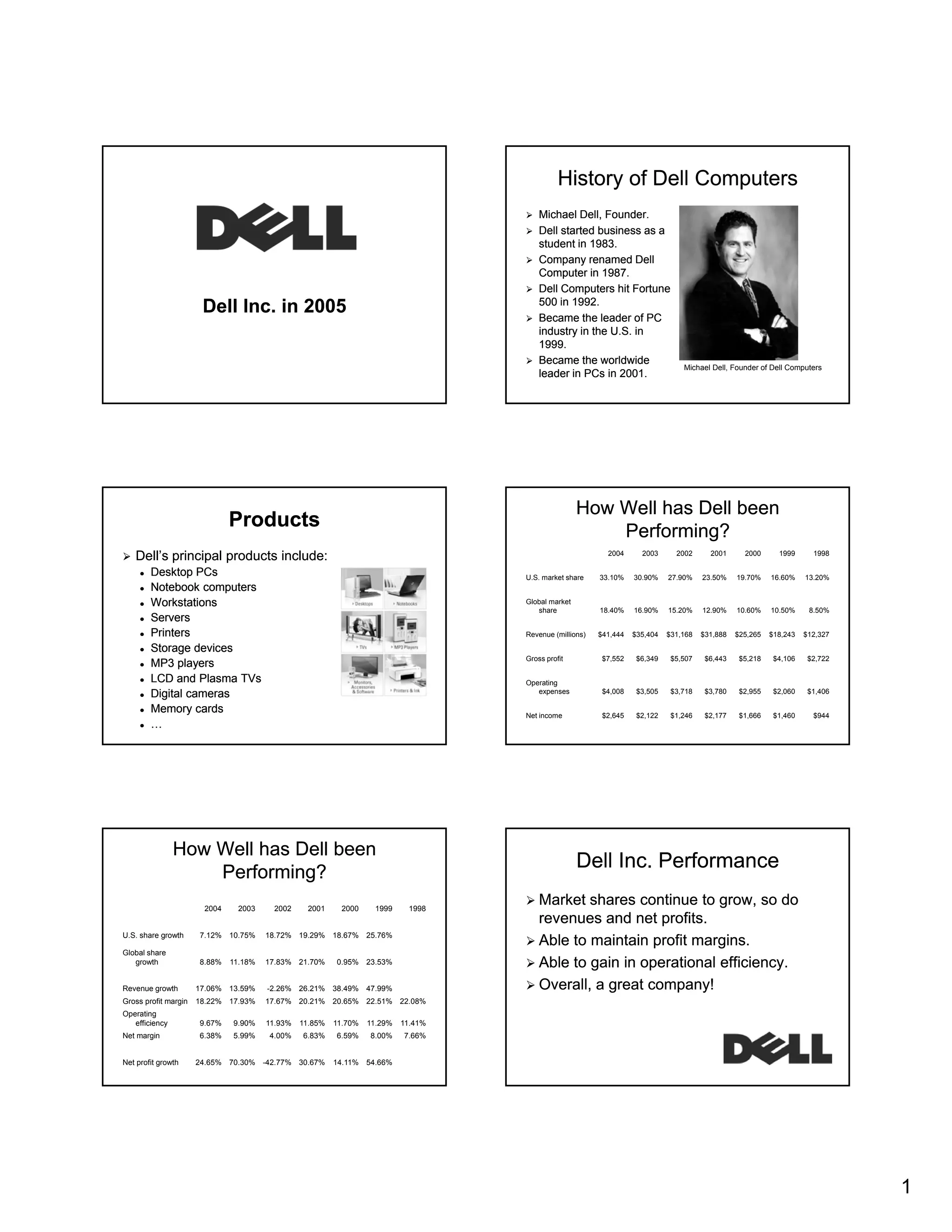

Michael Dell founded Dell Computers in 1983 and grew it to become the worldwide leader in PCs by 2001. Dell pioneered a direct sales model and build-to-order manufacturing approach that allowed it to offer customized computers at lower prices than competitors. While Dell experienced strong growth and increasing market share for many years, it now faces challenges of slowing PC markets, intense competition, and shifting customer preferences toward laptops and business IT services. To achieve long-term growth, Dell needs to leverage its strengths in supply chain management and manufacturing while developing new capabilities in areas like research and development, IT services, and building viable product categories.