This document provides an overview of Apple Inc., including its history, products, financial performance, competitors and corporate social responsibility efforts. It notes that Apple was founded in 1976 and released the Macintosh in 1984. Key facts highlighted include that Apple has become the largest publicly traded company in the world by market capitalization, generating over $74 billion in revenue in 2014. The document also summarizes Apple's mission to provide innovative technology products, main competitor Samsung, sources of revenue, and commitment to environmental sustainability and ethical sourcing.

![Road Map

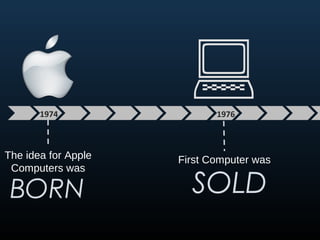

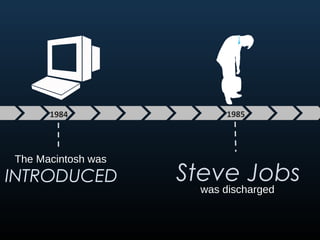

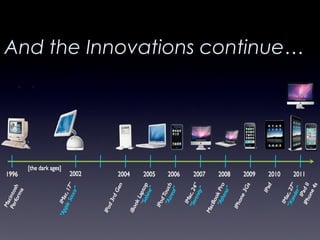

History

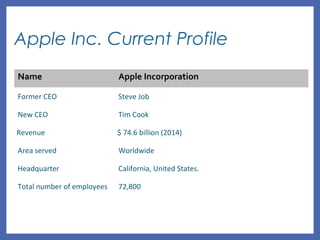

Company Profile

Mission , Vision and Goal

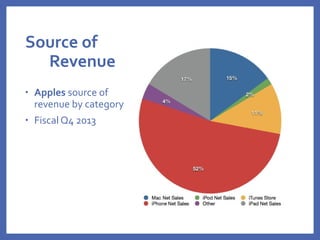

Source of revenues

Main Competitor [ Samsung ]

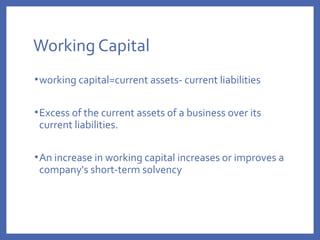

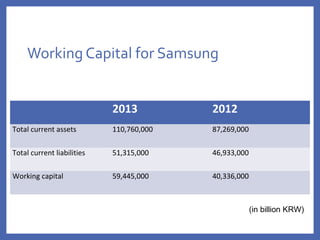

Working Capital

Conclusion](https://image.slidesharecdn.com/final-samsungvsapple-1b-150527163707-lva1-app6892/85/Samsung-VS-Apple-2-320.jpg)

![Community

Involvement

- Minimization on Apple’s carbon foot-print

and restricted use of harmful materials

[Environmental]

- -They do different special events to increase

public awareness about issues [Social]

- - Apple is very involved with its community

at its headquarters in Cupertino, California.](https://image.slidesharecdn.com/final-samsungvsapple-1b-150527163707-lva1-app6892/85/Samsung-VS-Apple-17-320.jpg)

![Apple’s Inc.

Main Competitor

[ Samsung ]](https://image.slidesharecdn.com/final-samsungvsapple-1b-150527163707-lva1-app6892/85/Samsung-VS-Apple-25-320.jpg)

![The elements of an annual report [ SEC ]

• Letter to Shareholders

• Audited Financial Statements

• Management Discussion & Analysis

• Annual Meeting Information

• Certifications by Auditors & Management

2/24/15](https://image.slidesharecdn.com/final-samsungvsapple-1b-150527163707-lva1-app6892/85/Samsung-VS-Apple-53-320.jpg)