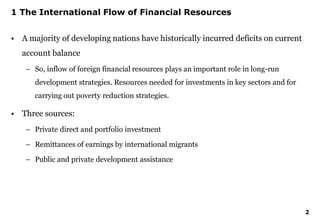

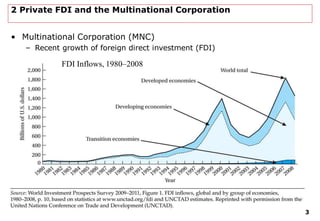

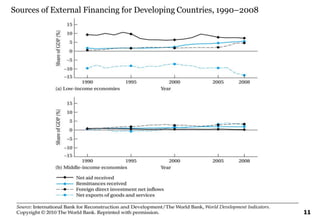

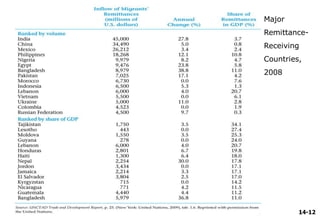

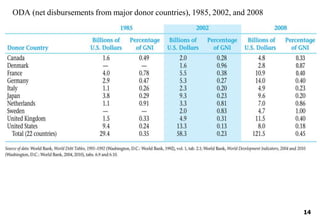

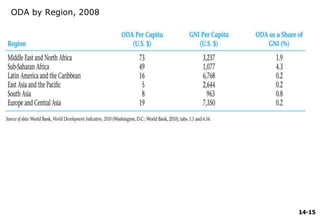

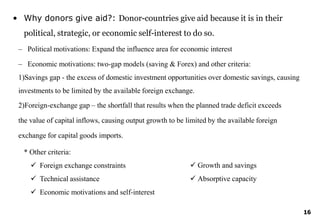

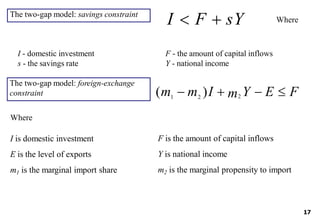

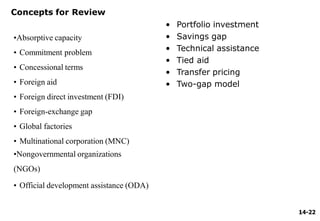

This chapter discusses the international flow of financial resources to developing countries, including private investment, remittances, and foreign aid. It outlines both the benefits and risks of each. Private investment can fill savings and foreign exchange gaps, but may also crowd out domestic firms. Remittances now exceed $5% of GDP for some countries. Foreign aid aims to supplement domestic resources and promote growth, but may also exacerbate debt and trade deficits. The chapter also examines the causes of armed conflict and how development efforts can help resolve and prevent conflicts.