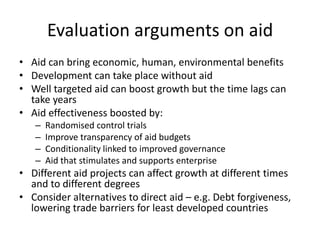

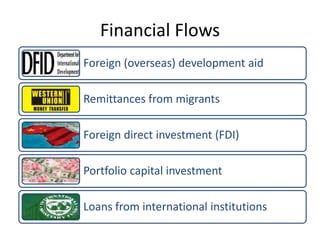

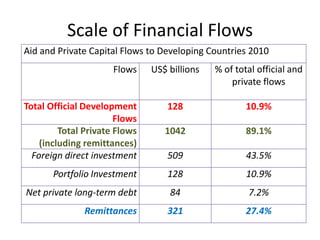

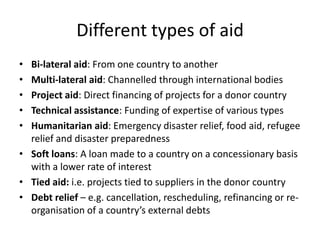

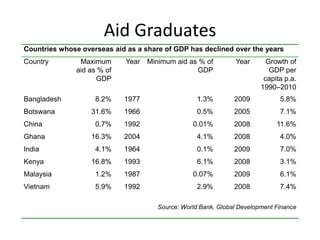

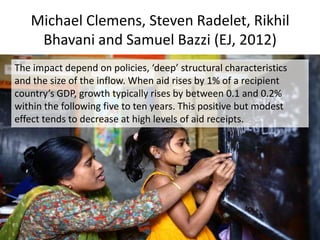

This document provides information on different types of financial flows to developing countries, including foreign aid, remittances, foreign direct investment, and loans. It discusses the scale of these flows, noting that in 2010 private flows such as FDI made up 89.1% of total official and private flows, compared to 10.9% for official development aid. The document also outlines different types of foreign aid and perspectives on the impact and effectiveness of aid, including debates around whether aid fosters long-term growth and self-sufficiency or dependence.

![Duflo and Banerjee – Poor Economics

• Duflo and Banerjee - Poverty Action Lab

“Precisely because

• Have pioneered use of randomised

controlled trials to find out what works [the poor] have so

in development little, we often find

• Test efficacy of projects / interventions them putting much

within a population – 2 or more groups careful thought into

(inc control)

• Many “top-down” aid projects afflicted their choices: They

by have to be

– Ideology (prejudices, beliefs) sophisticated

– Ignorance (info gaps about local economists just to

conditions)

– Inertia (failure to change when project survive.”

does not work)](https://image.slidesharecdn.com/aidanddevelopment-121014142930-phpapp02/85/Aid-and-Economic-Development-14-320.jpg)