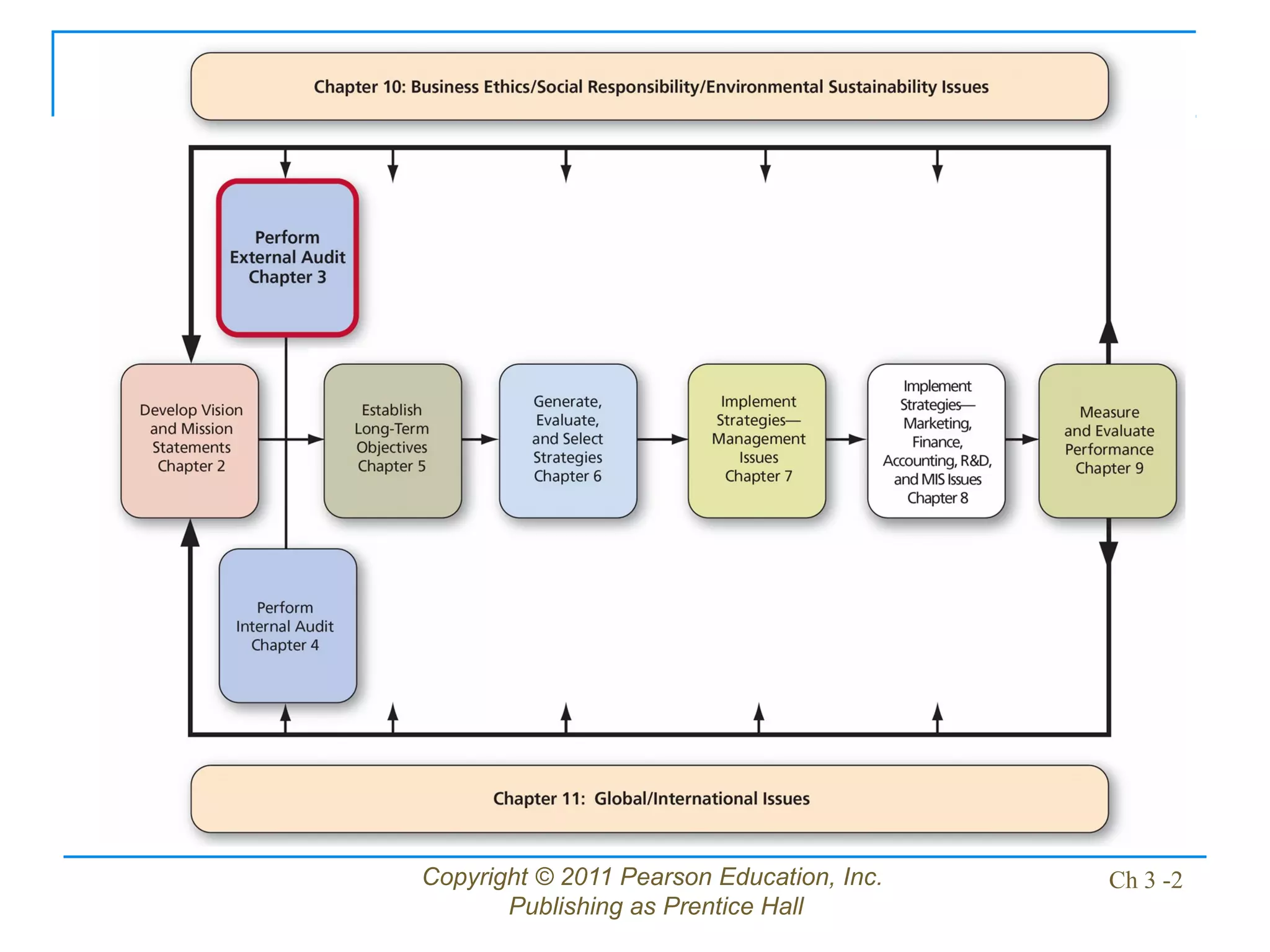

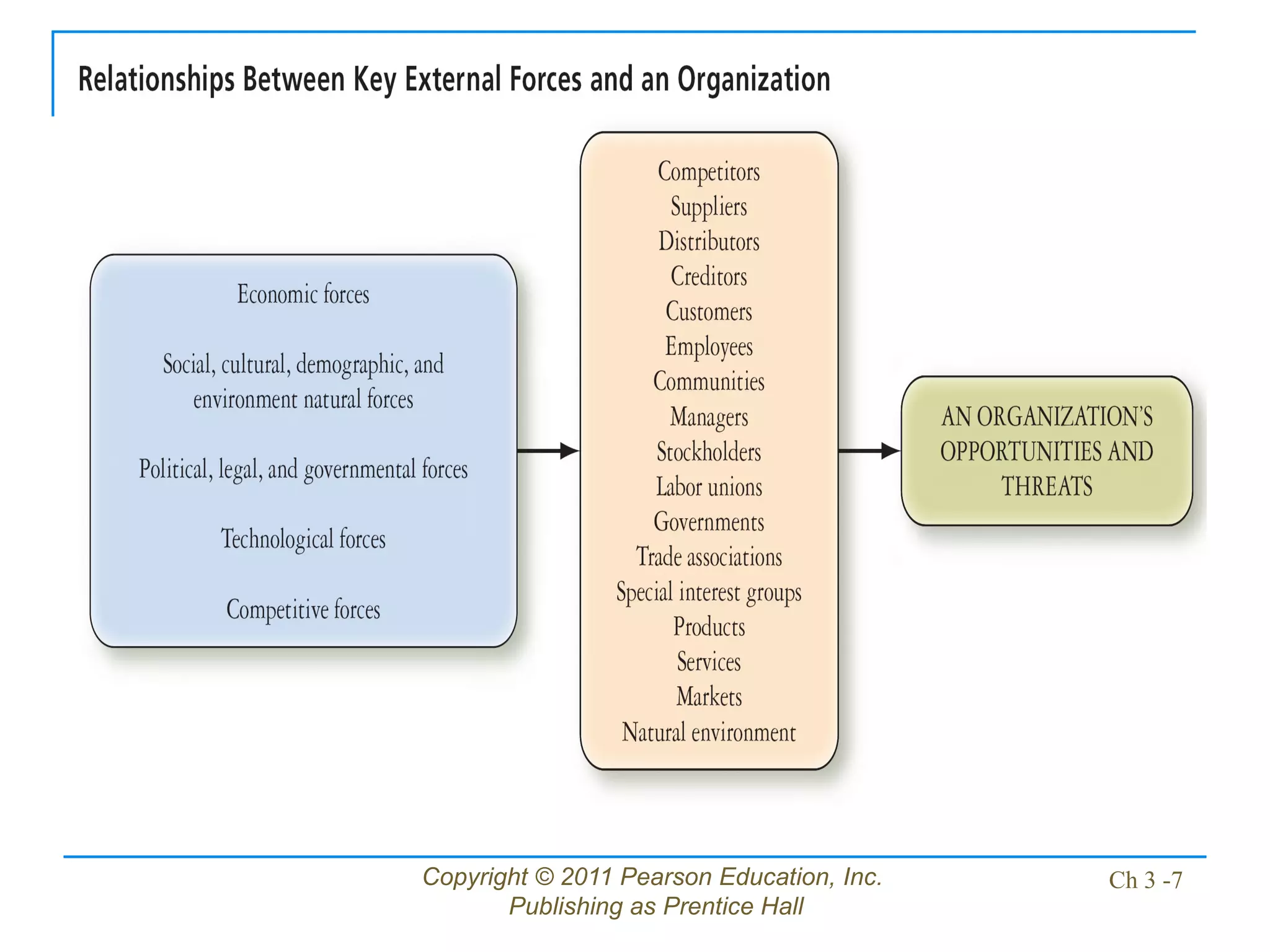

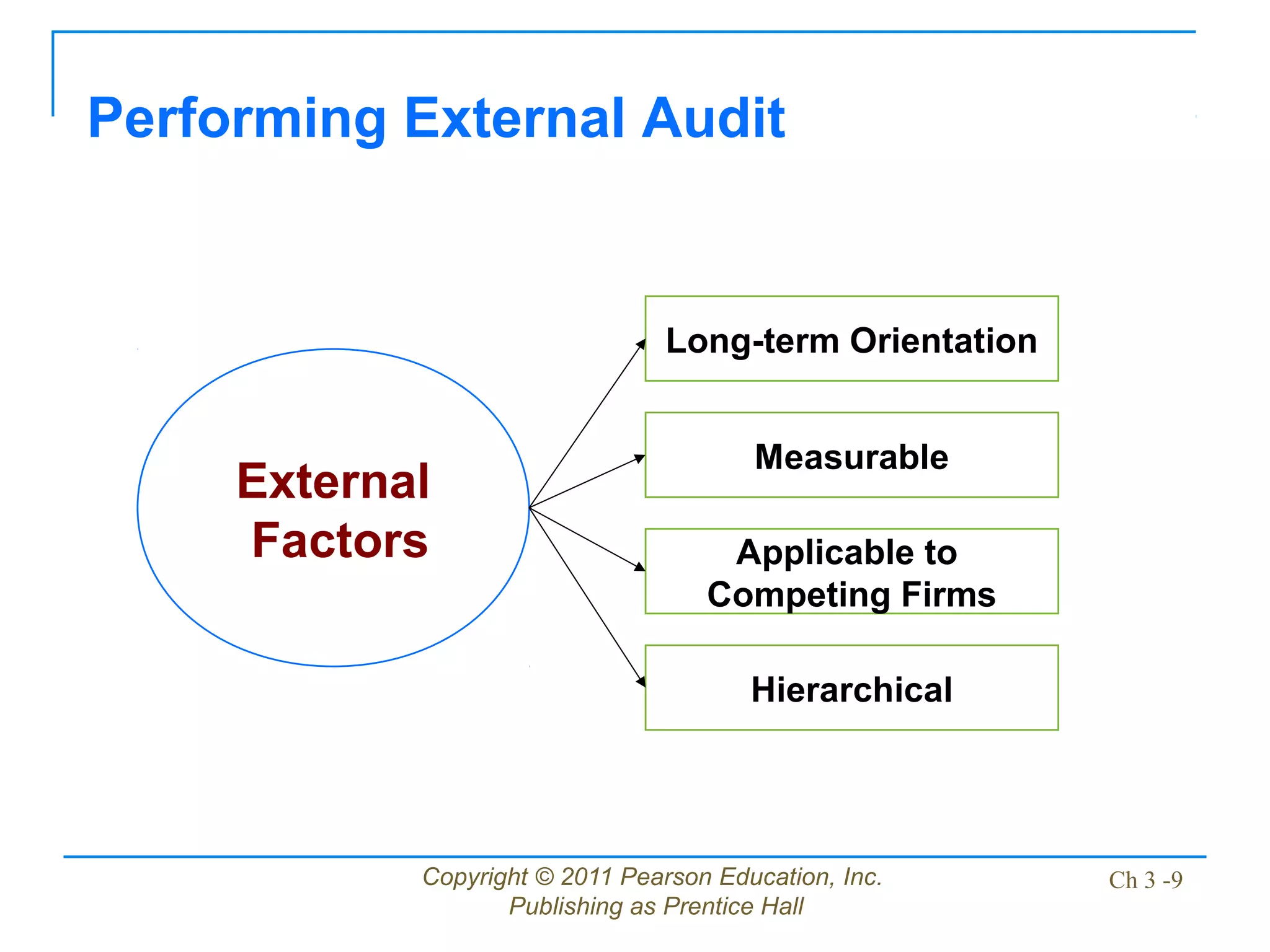

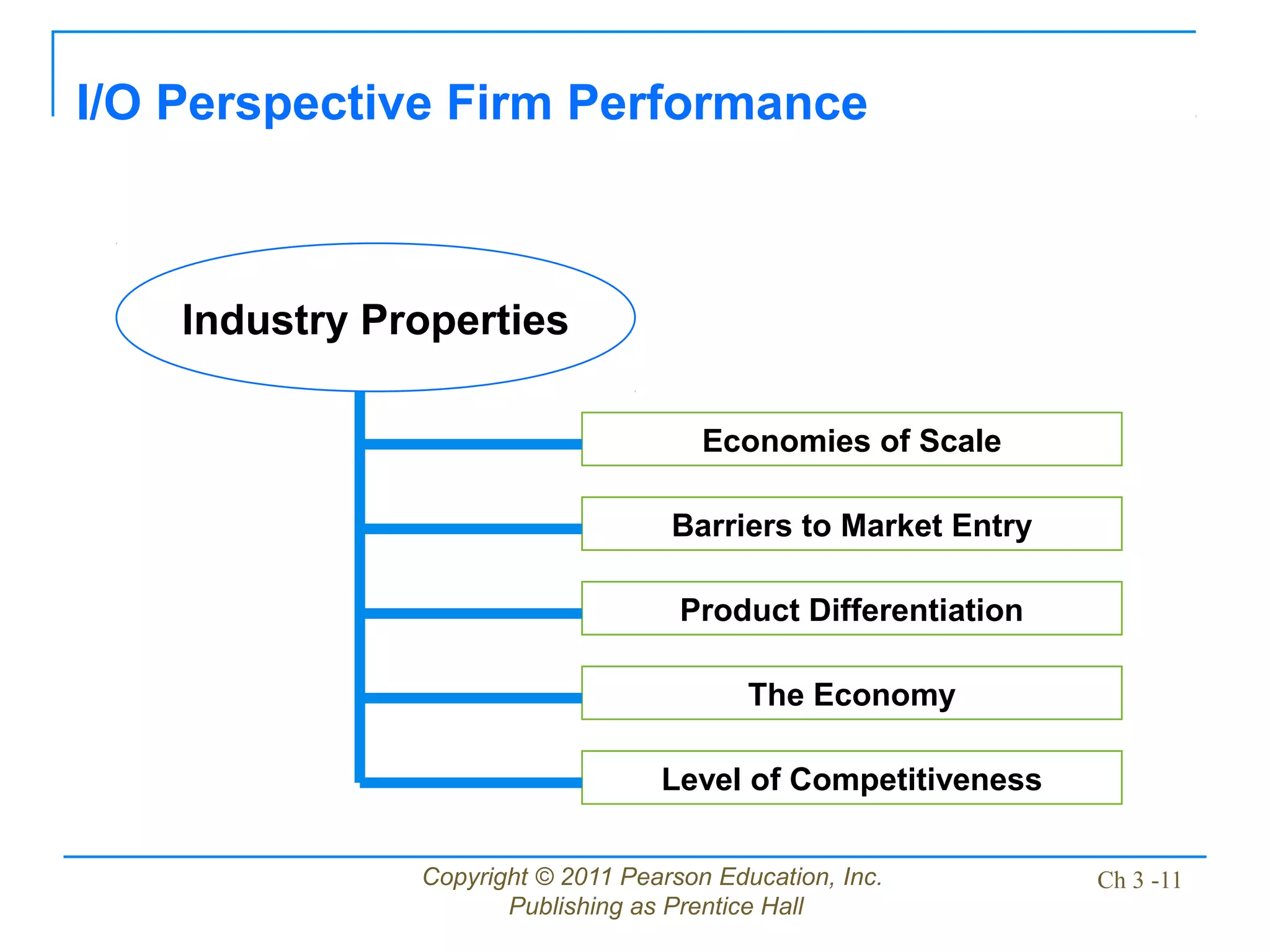

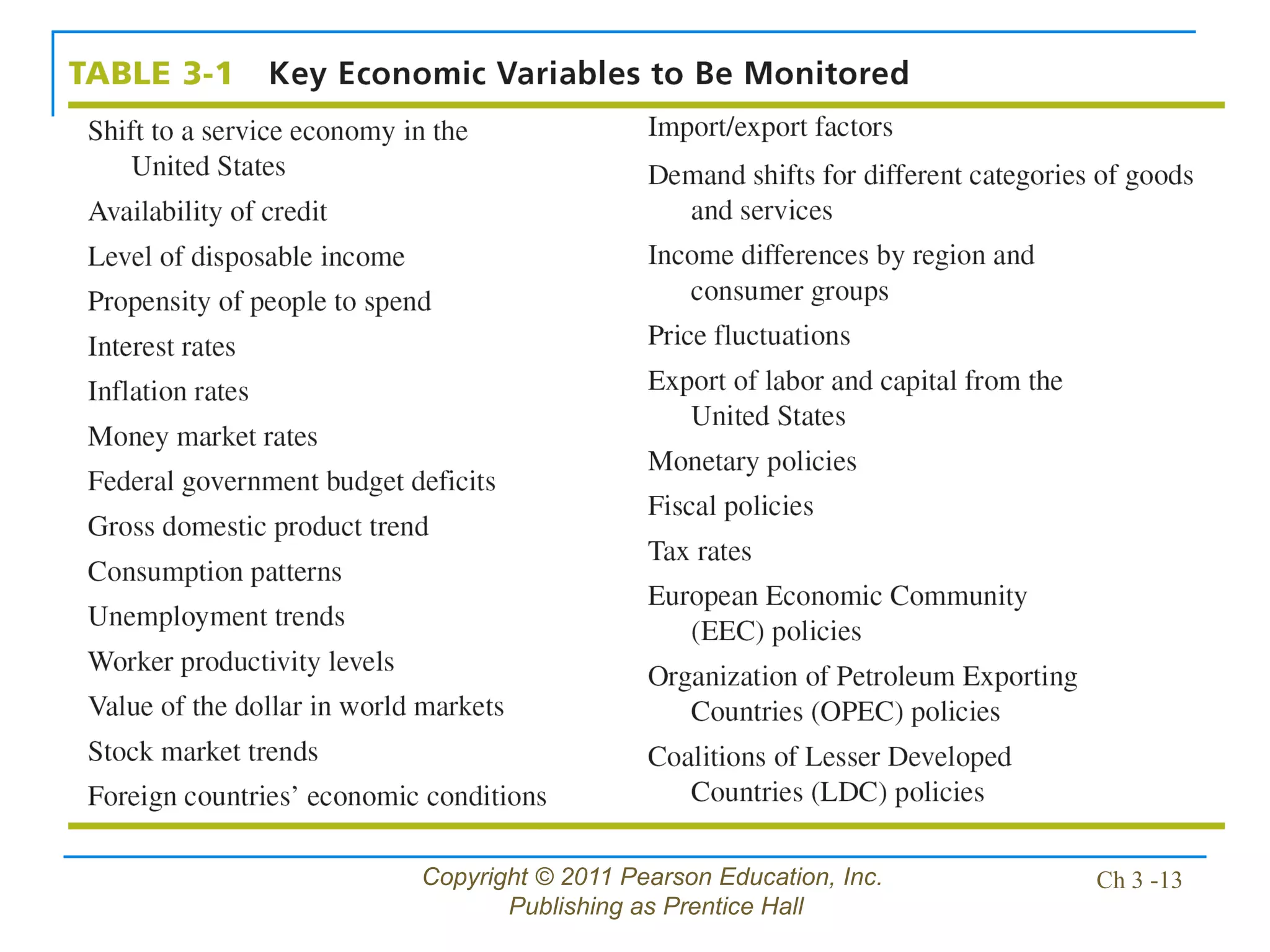

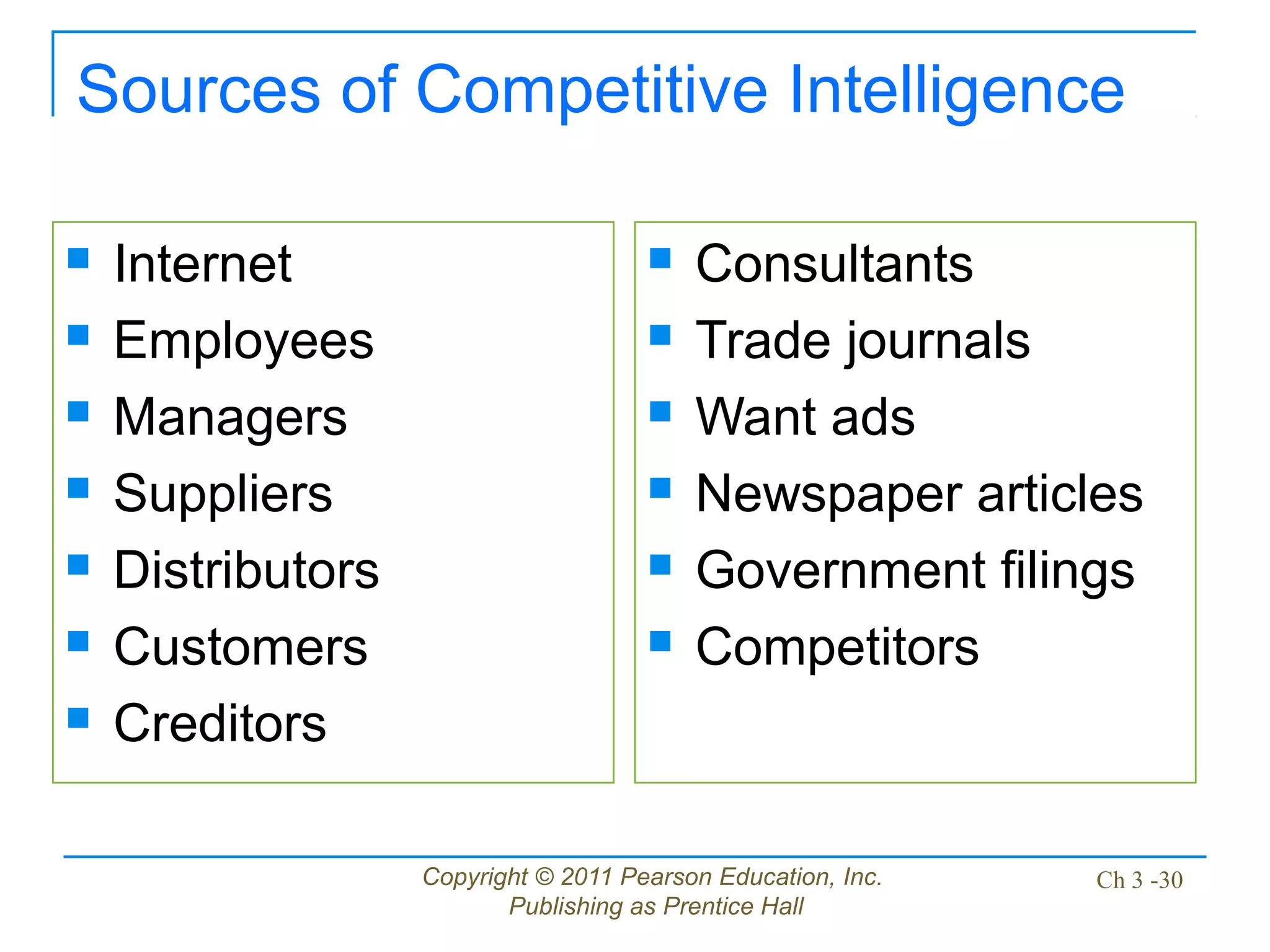

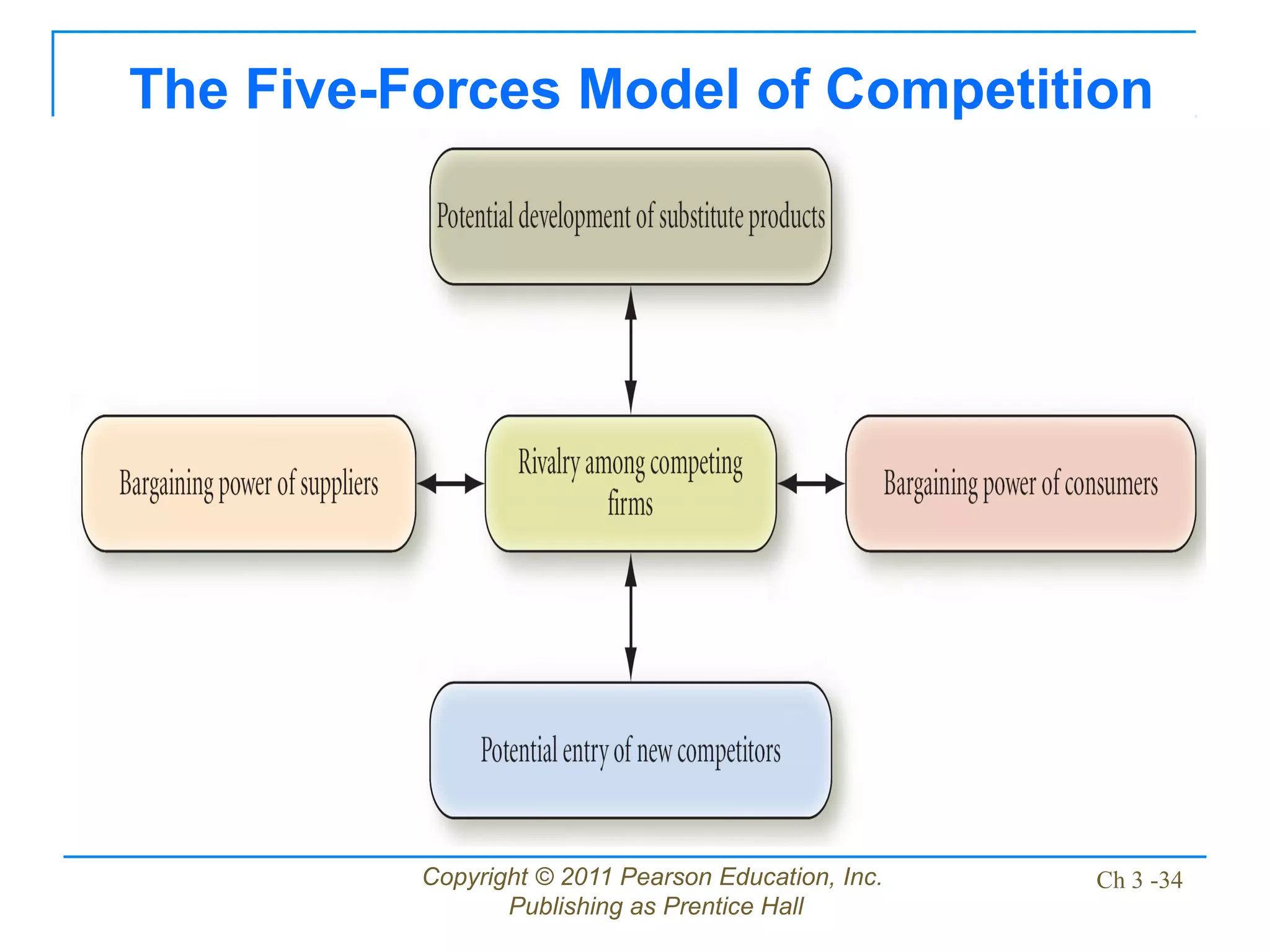

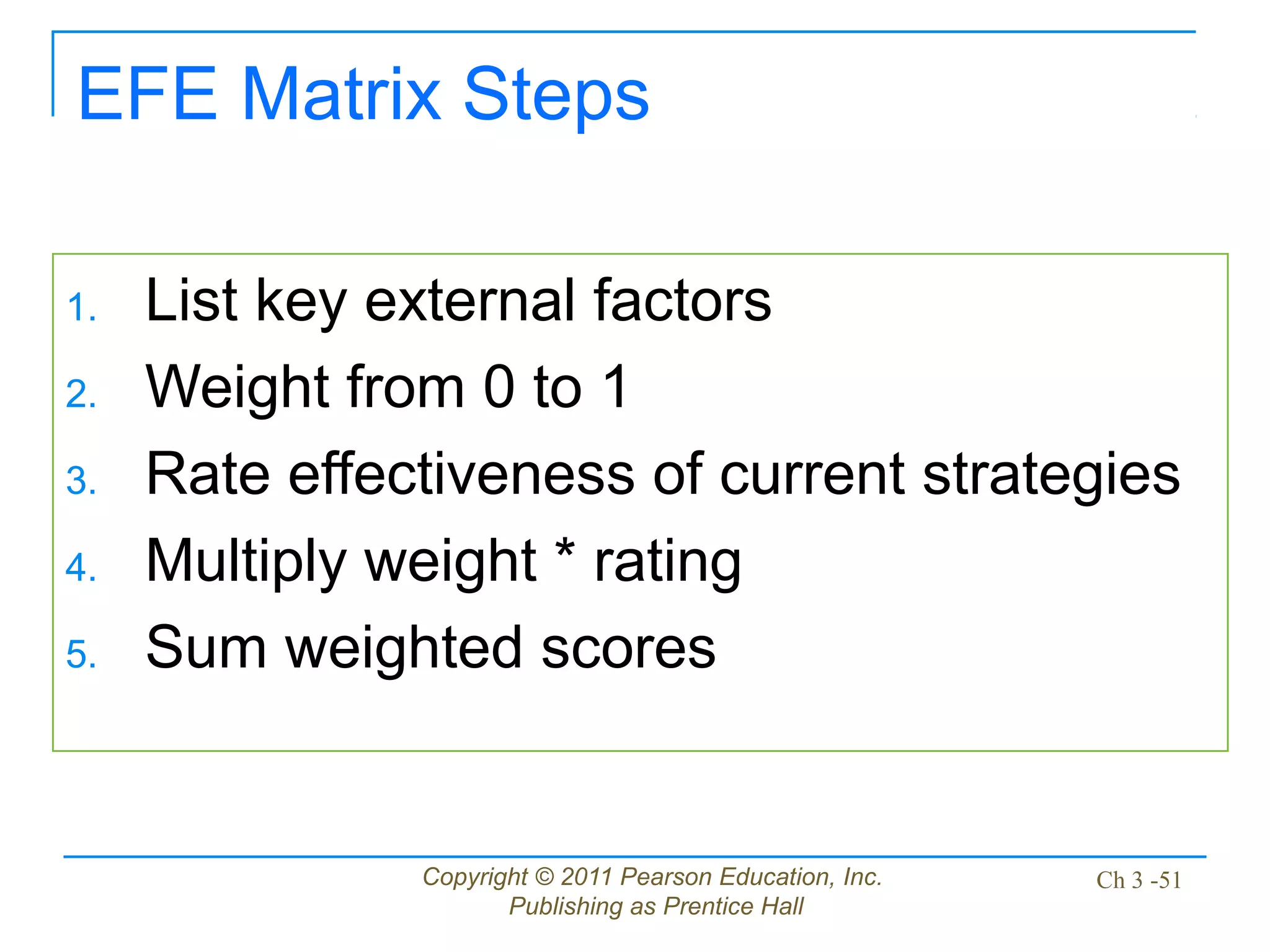

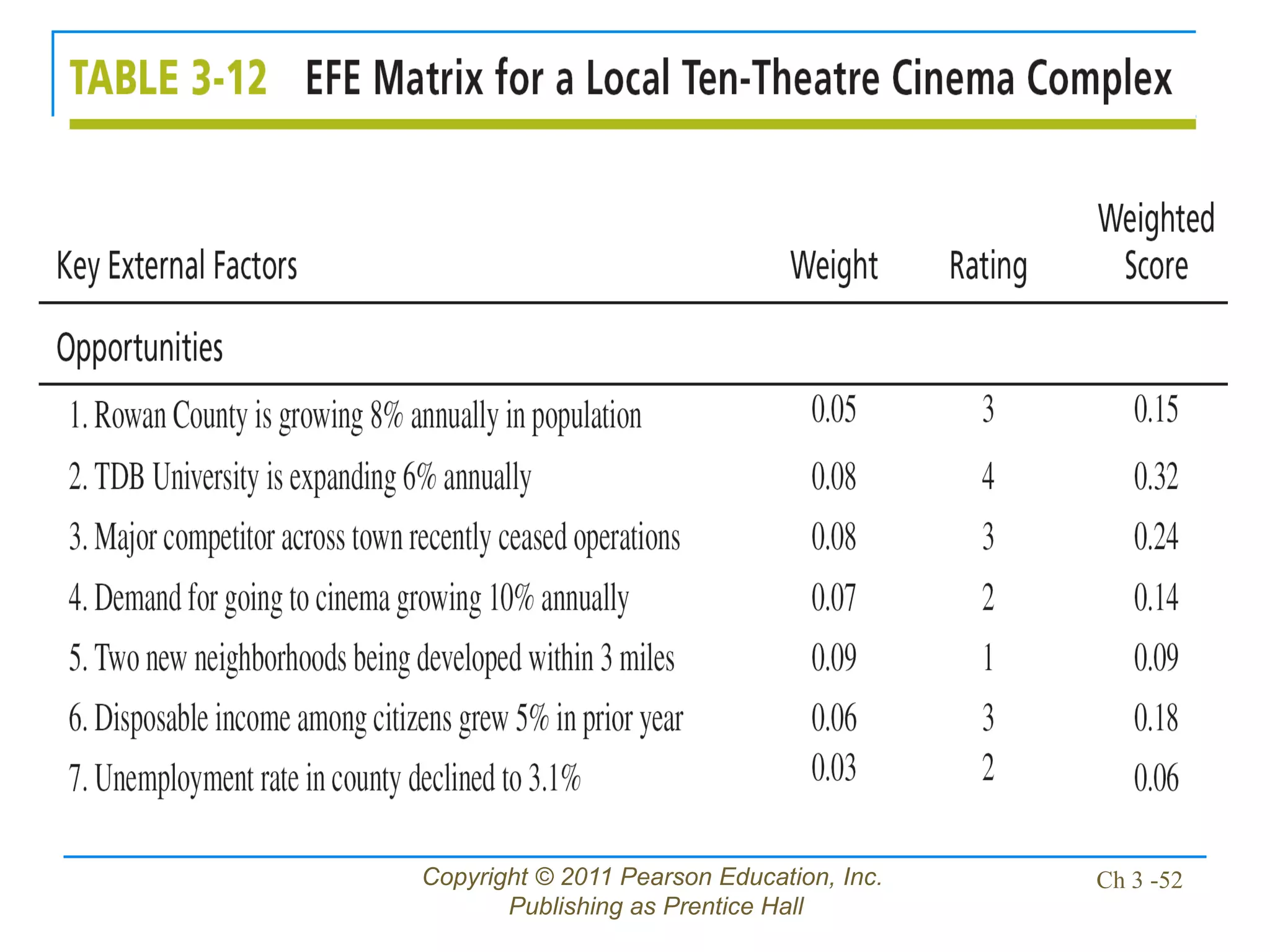

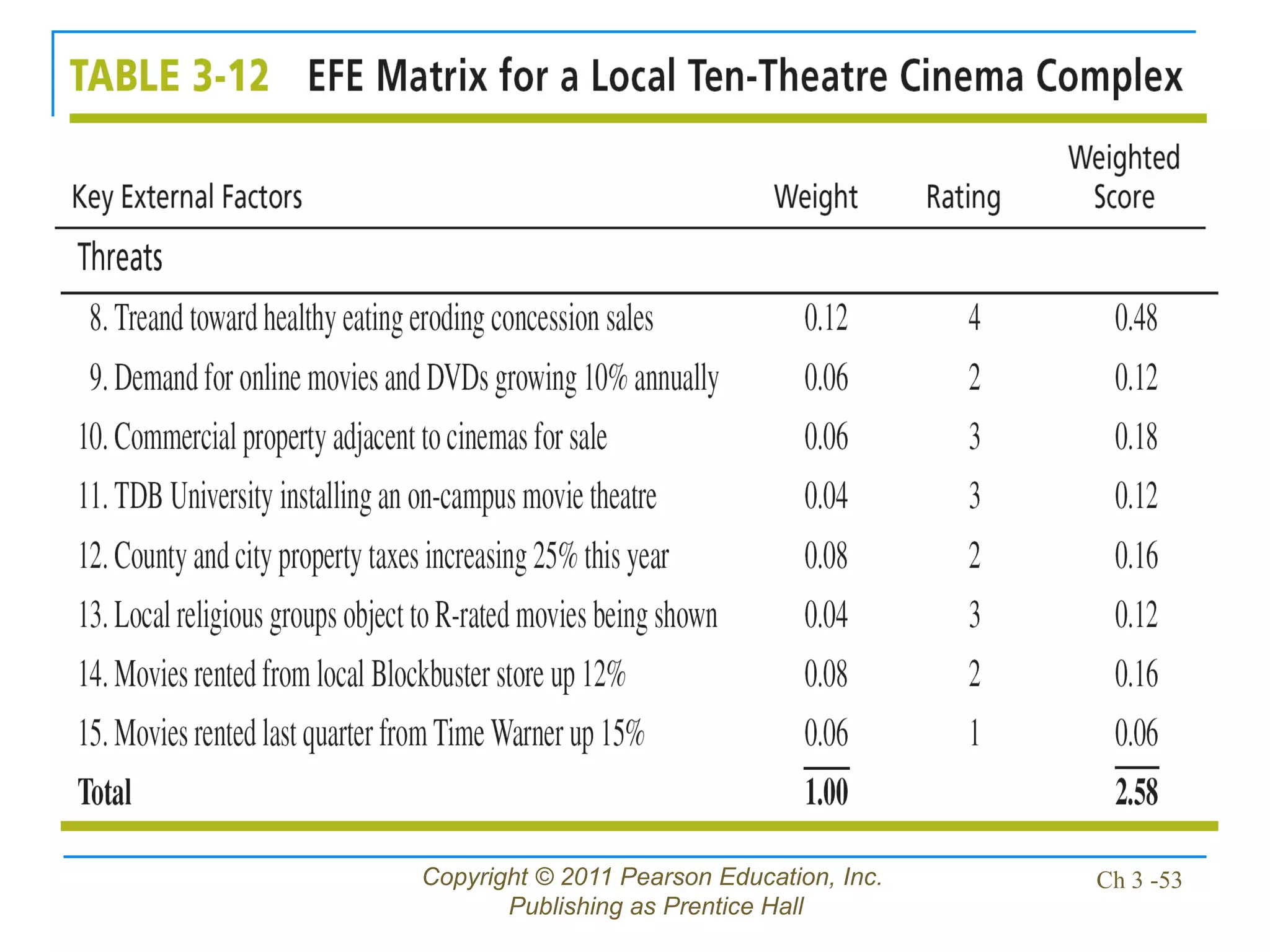

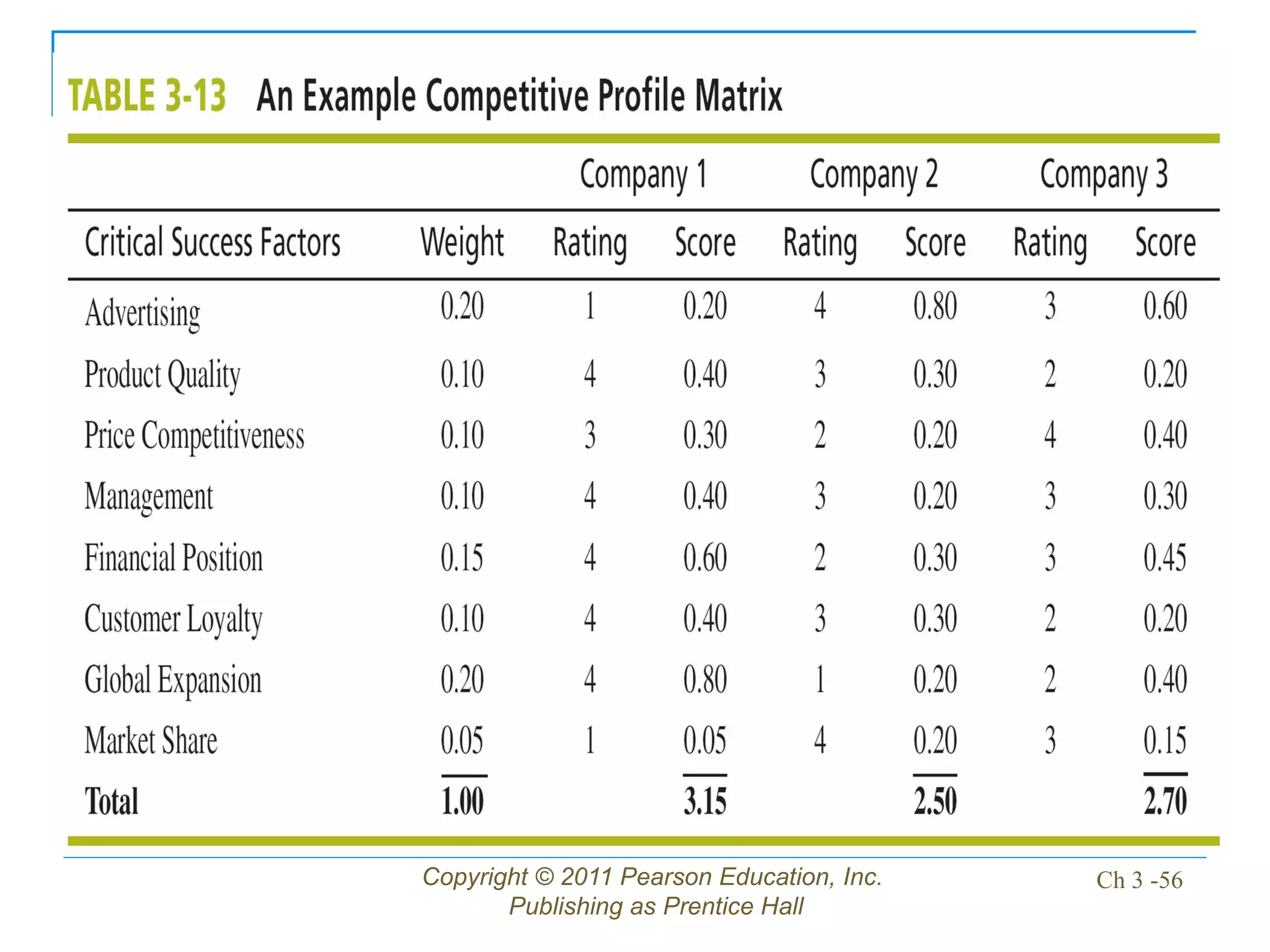

The document summarizes key concepts from Chapter 3 of the textbook Strategic Management: Concepts & Cases. It discusses performing an external assessment of the industry environment through an external audit. This involves analyzing factors such as economic, social, technological and competitive forces. Tools like the External Factor Evaluation Matrix and Competitive Profile Matrix are presented to help evaluate opportunities and threats in the external environment. The five forces model of competition is also introduced to analyze industry rivalry, potential new entrants, substitute products, supplier power and buyer power.