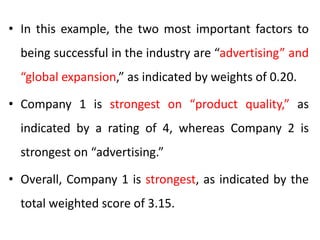

This document provides an overview of conducting an environmental analysis, which involves external and internal audits of an organization. The external audit identifies opportunities and threats in the organization's environment. Key parts of the external environment include economic, social, political, technological, and competitive forces. An External Factor Evaluation matrix is used to evaluate these external factors. The internal audit examines the organization's strengths and weaknesses. Relationships between different functional areas are also assessed. An Internal Factor Evaluation matrix summarizes findings from the internal audit. The environmental analysis provides important information for strategy formulation.