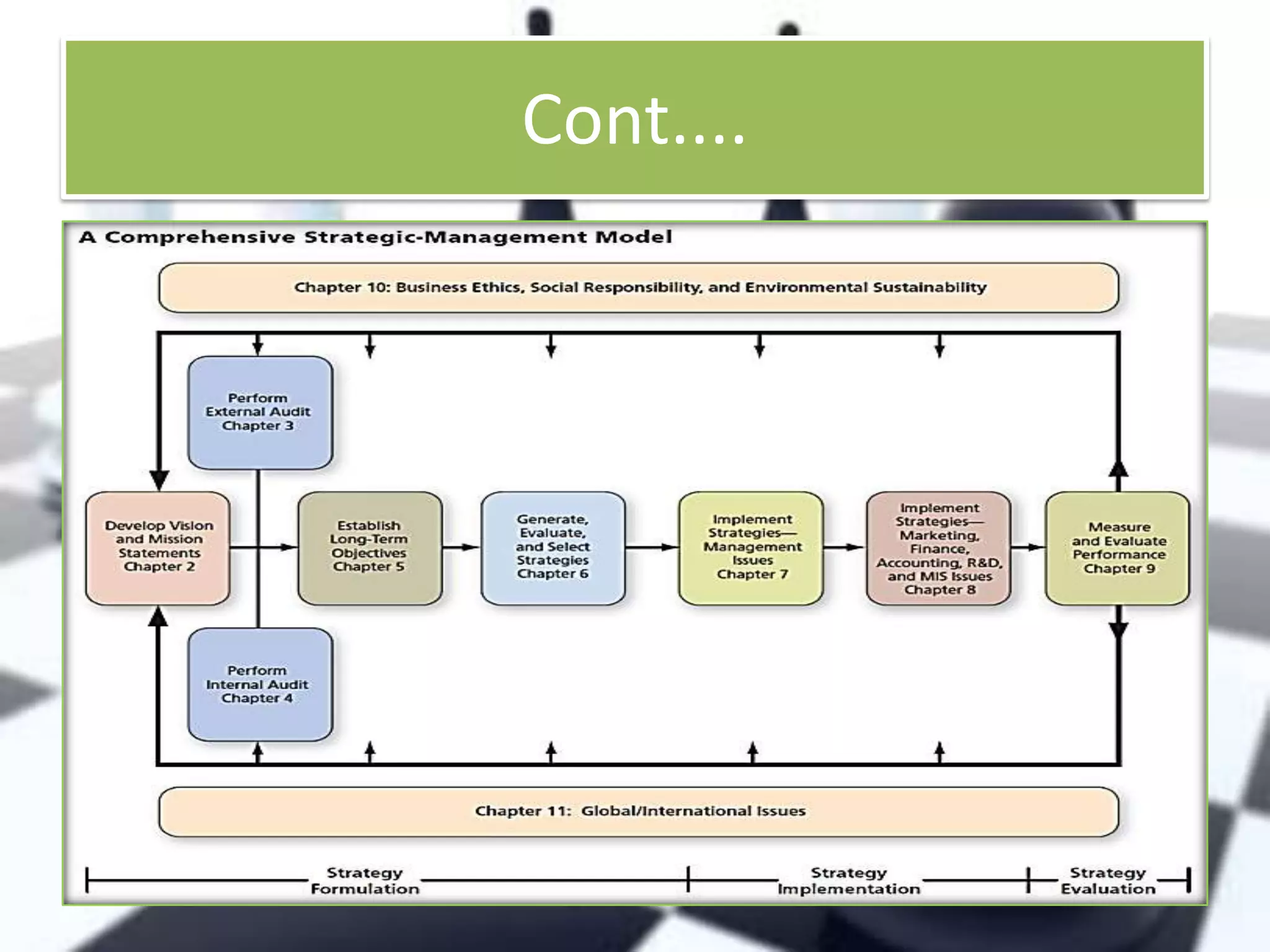

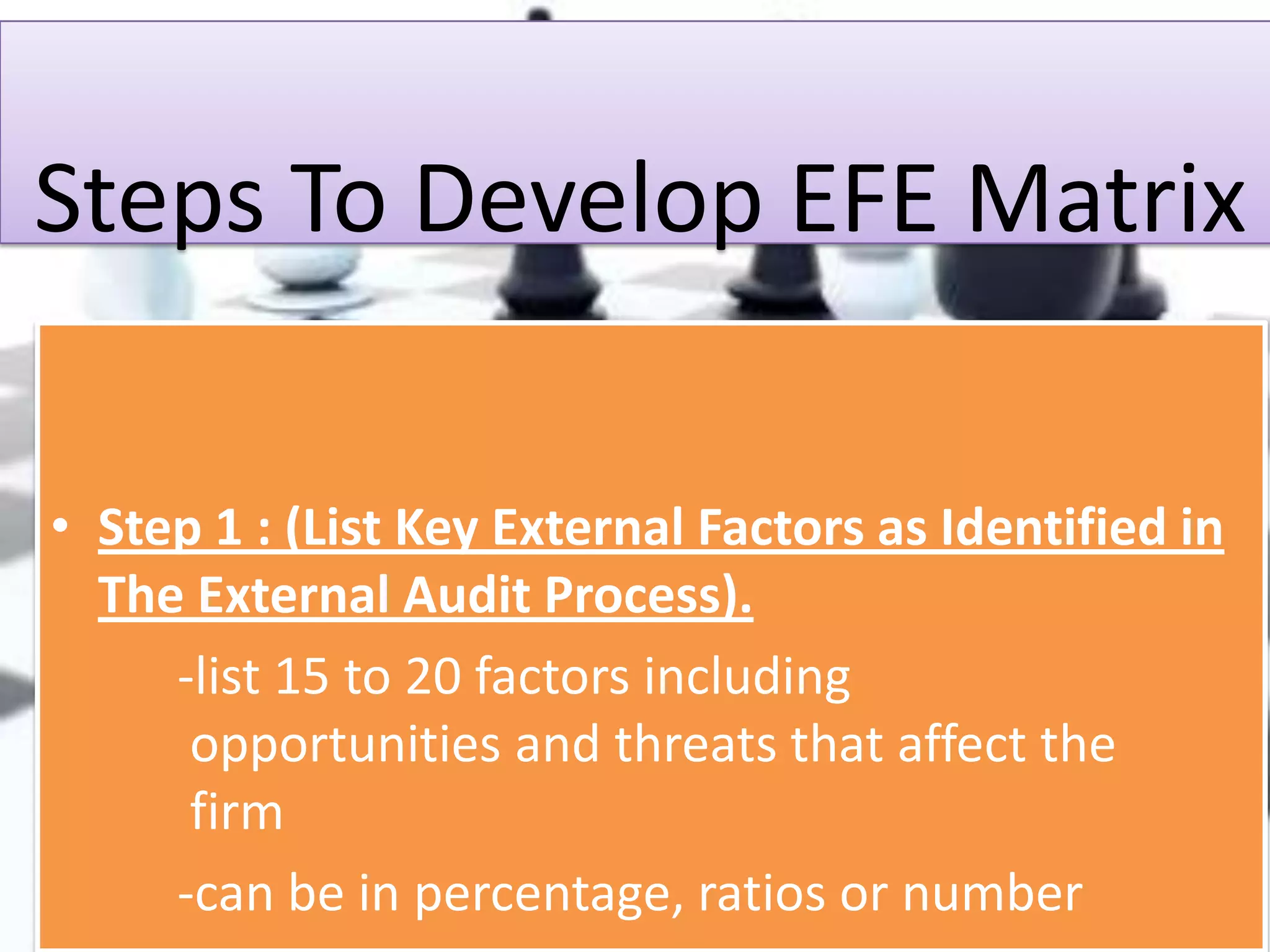

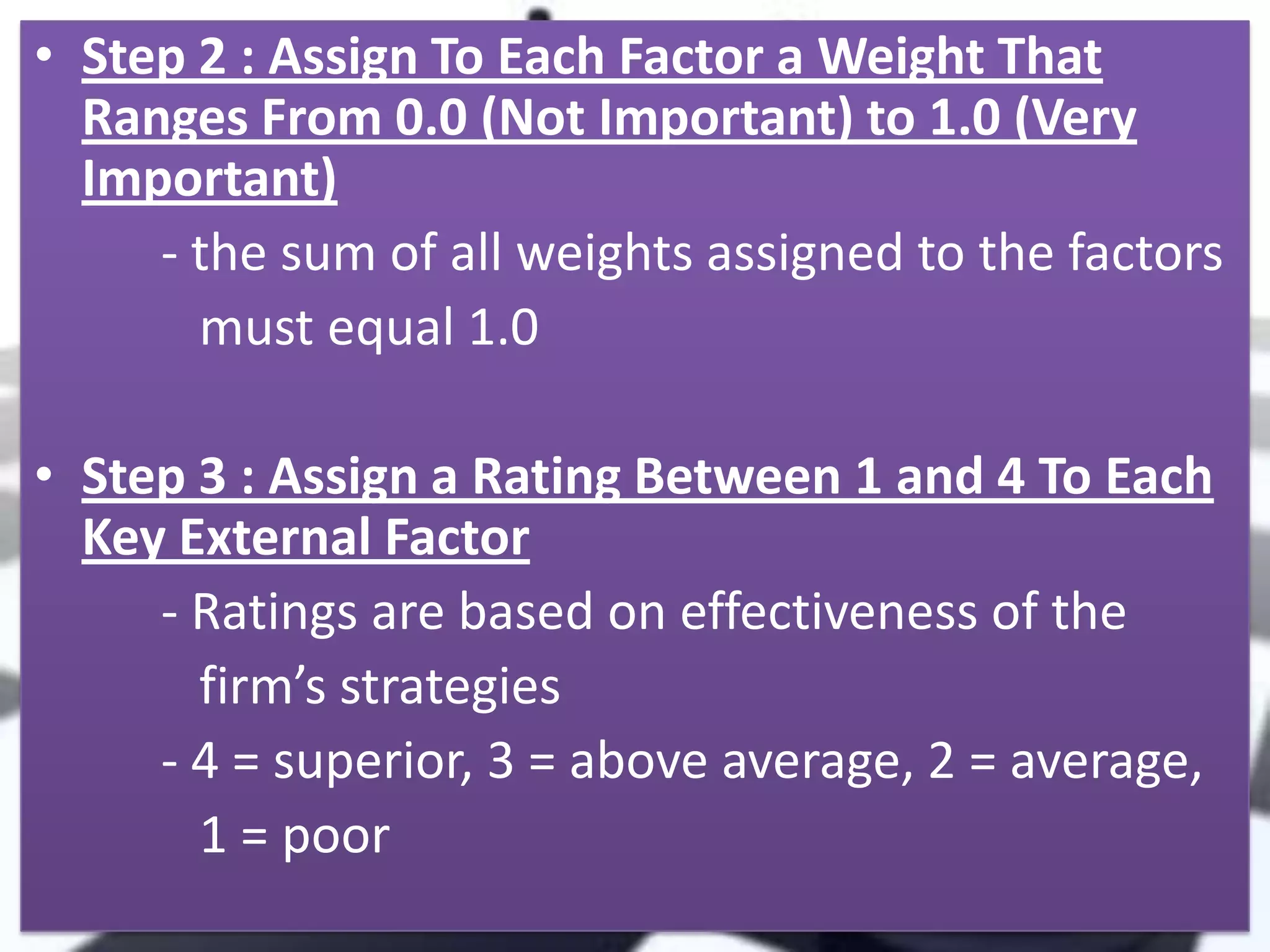

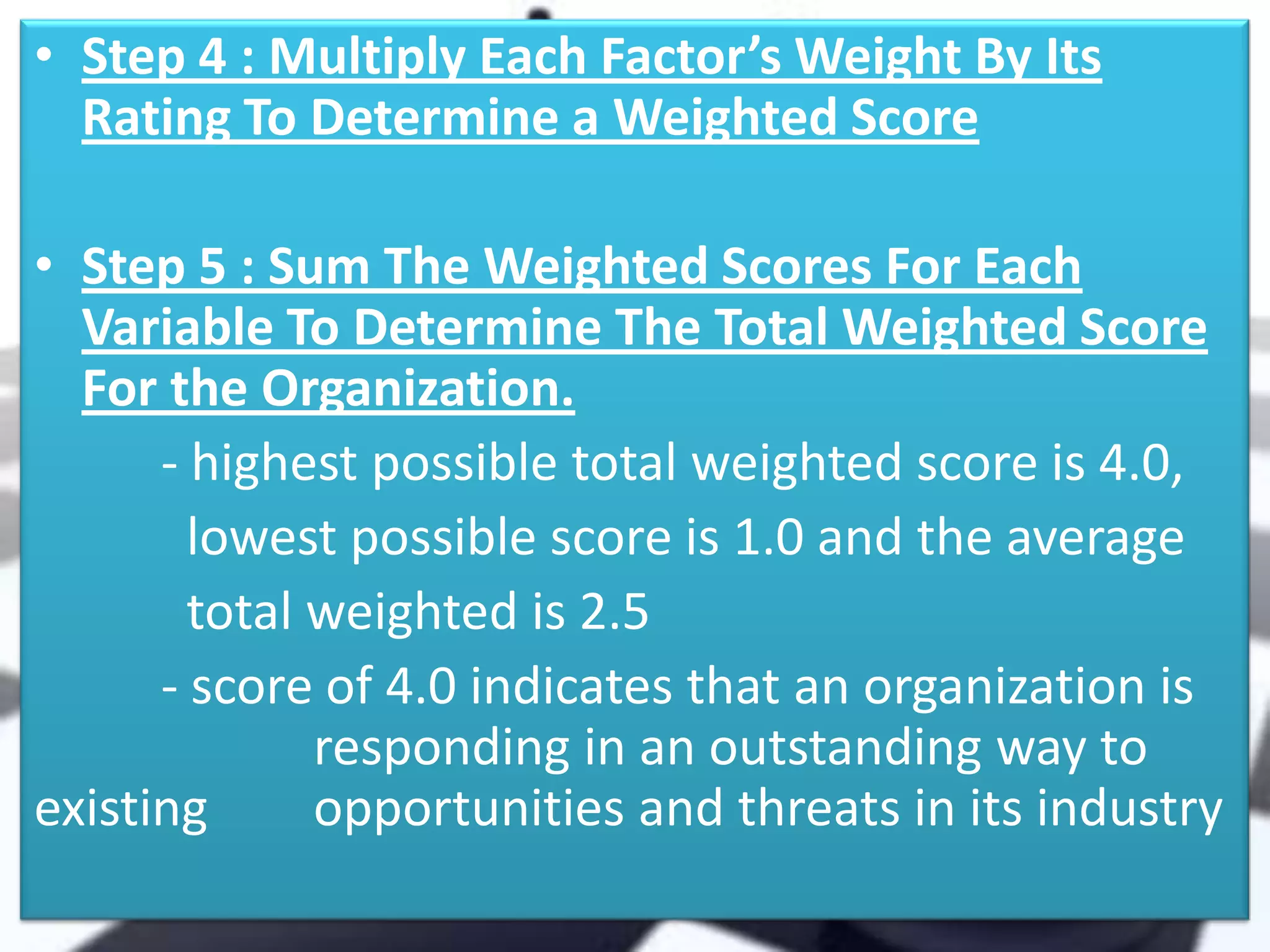

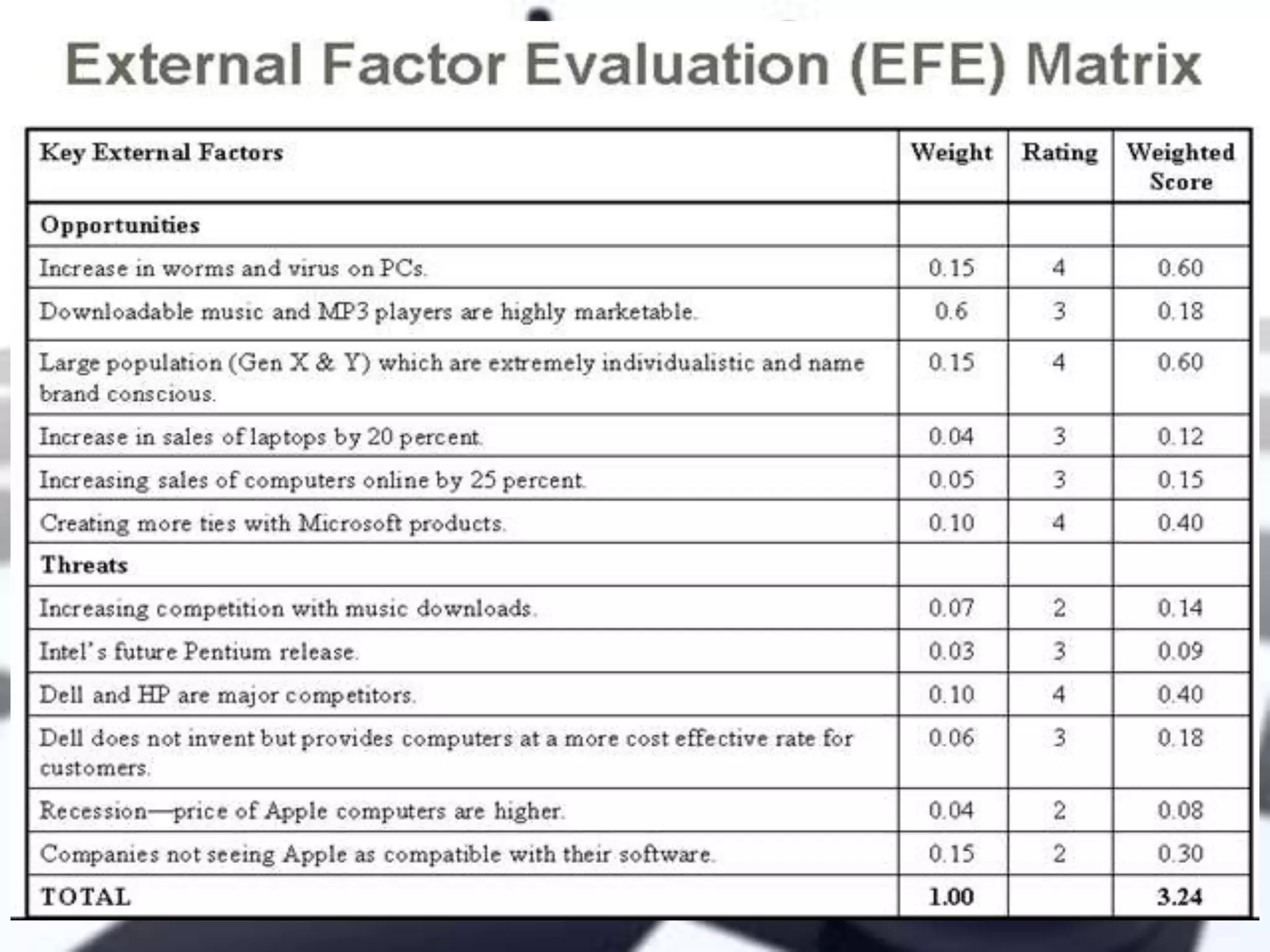

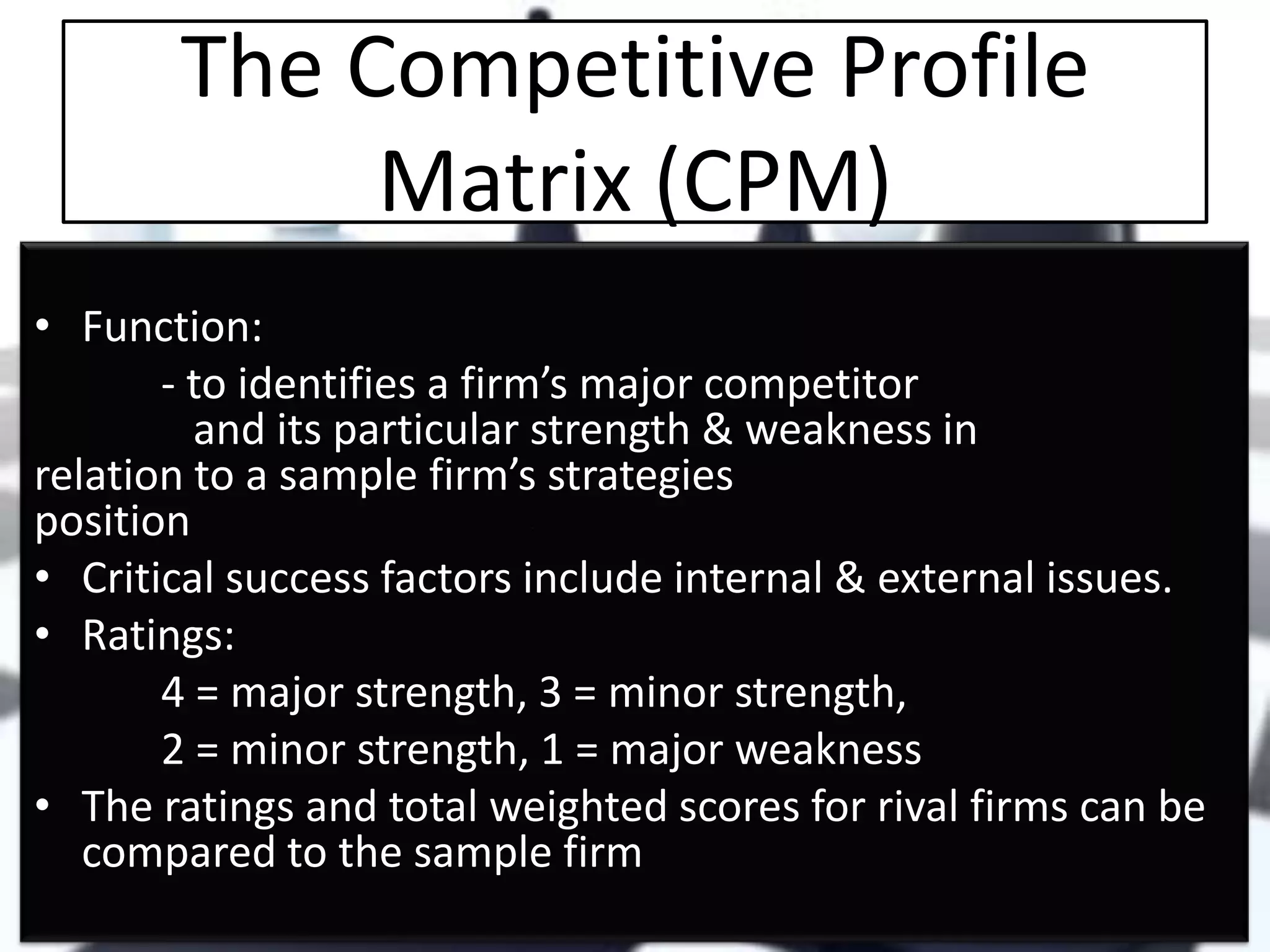

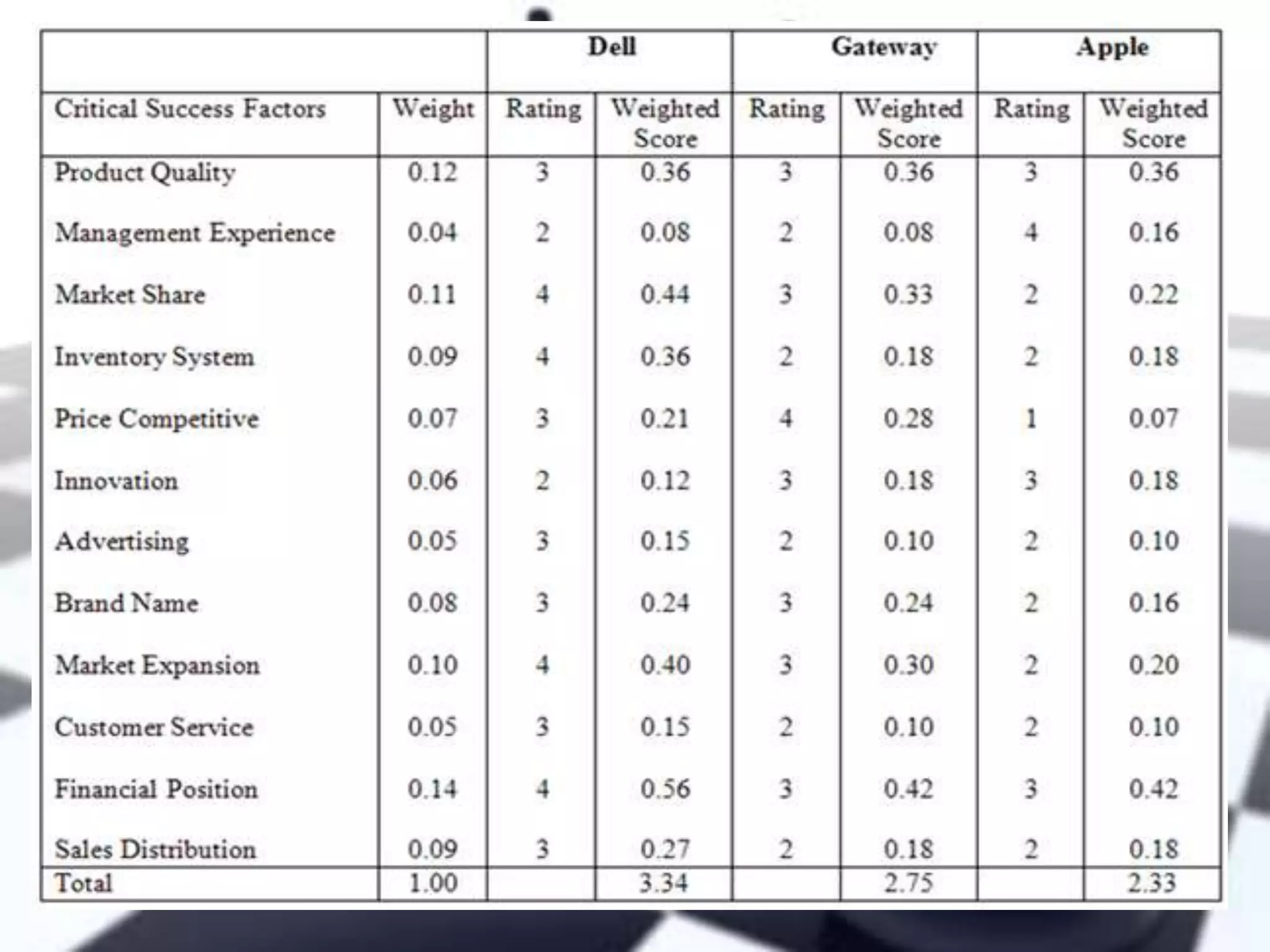

The document provides details of a group presentation on performing an external audit. It includes the group members' names and student IDs. It then discusses the purpose and process of an external audit, including gathering information on key external factors such as economic, social, cultural, political, and technological forces. It also explains tools for external analysis such as Porter's Five Forces model and how to develop an EFE matrix to evaluate external factors that present opportunities and threats.