This document provides an overview of data analysis techniques and their application for audit purposes. It discusses:

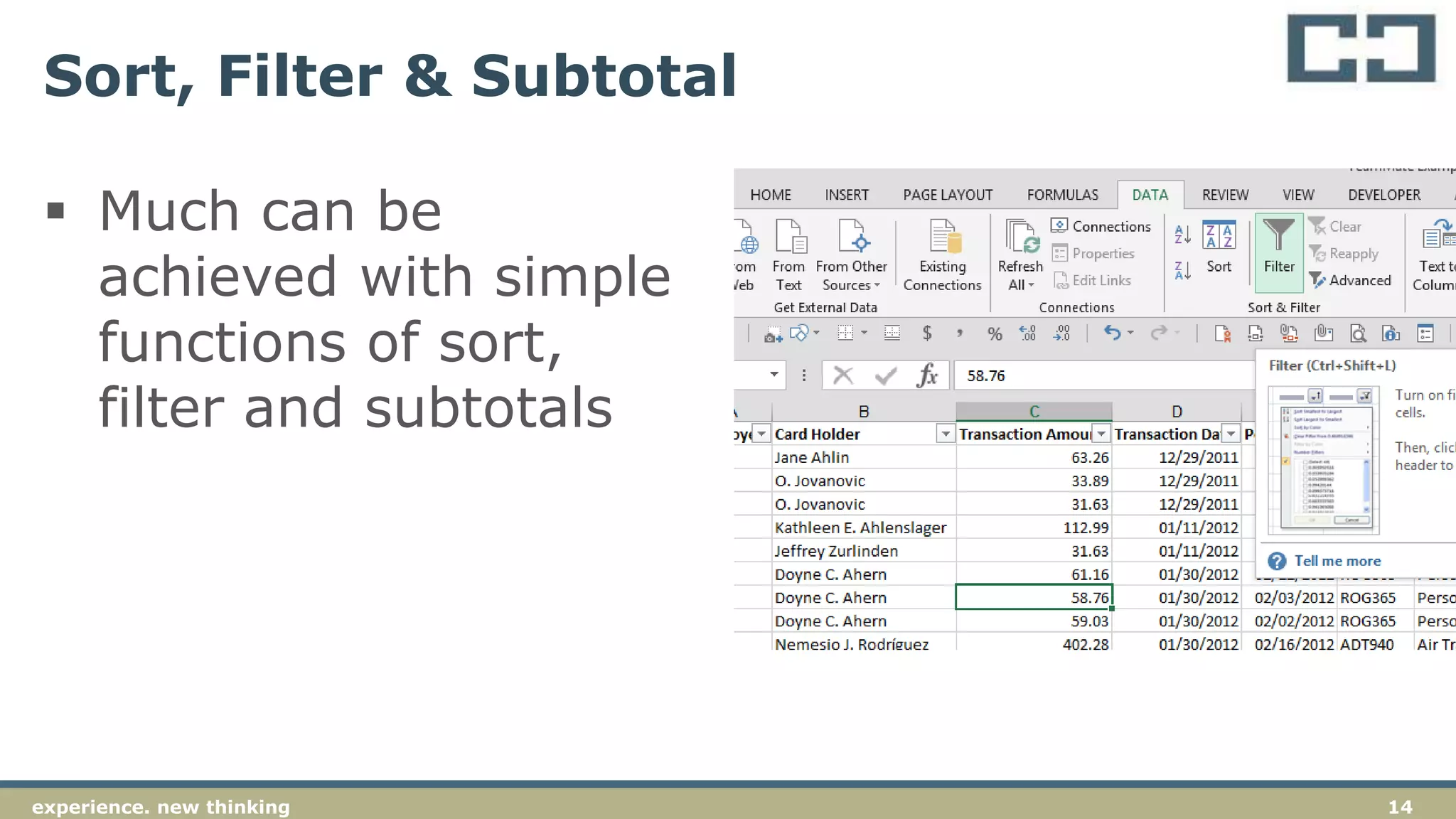

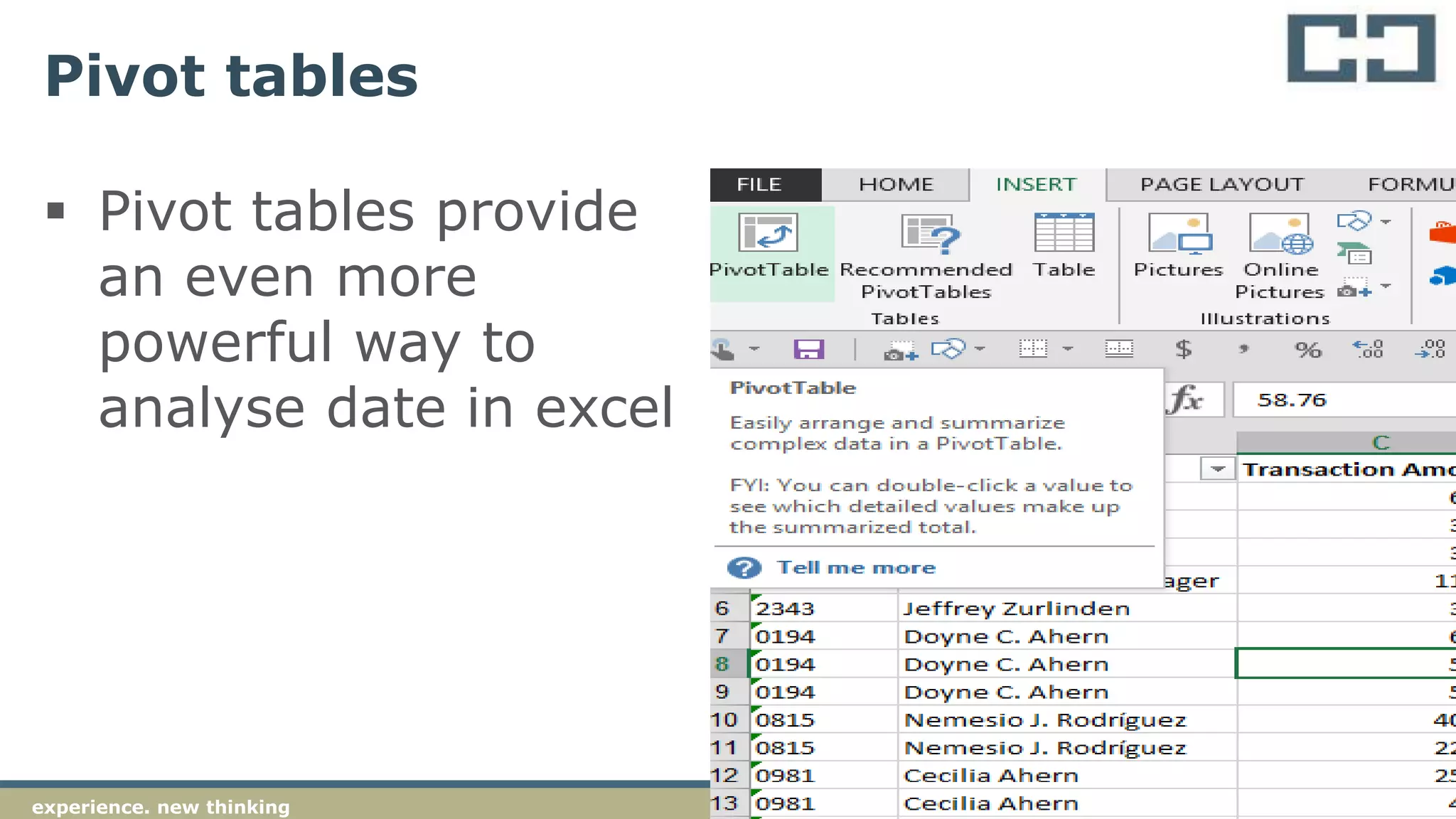

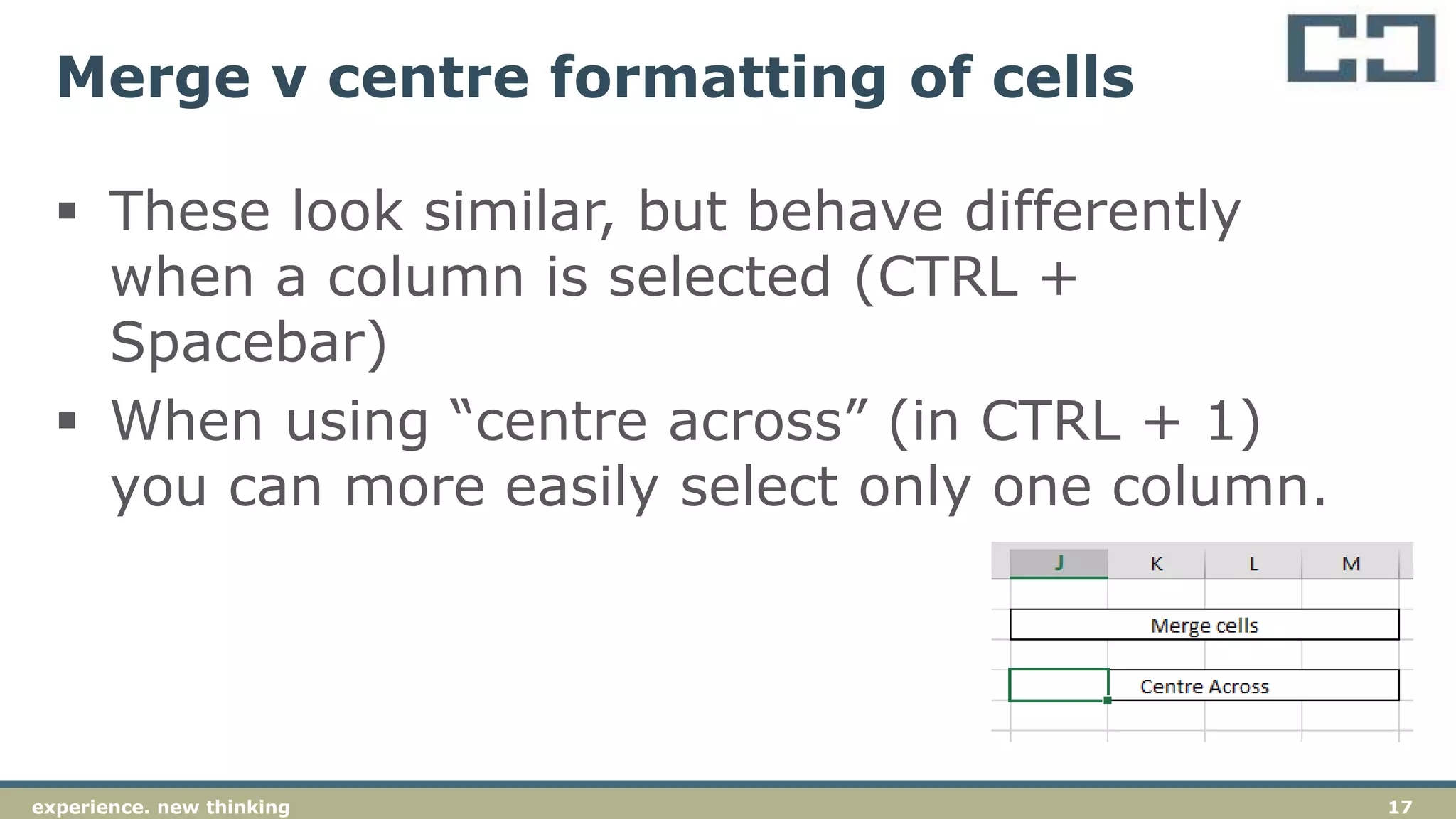

- The basics of performing data analysis and computer-assisted audit techniques using Excel and TeamMate software.

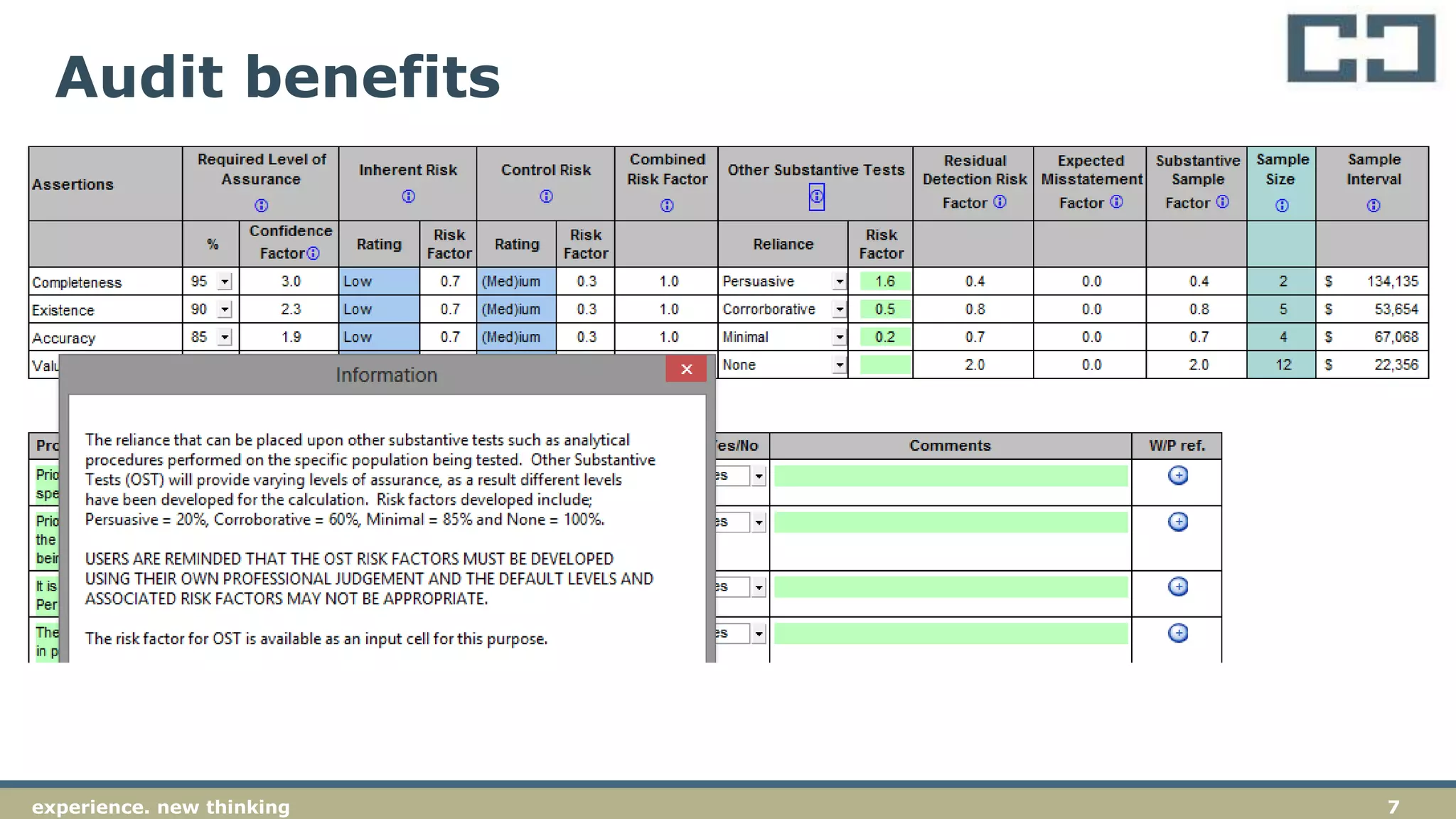

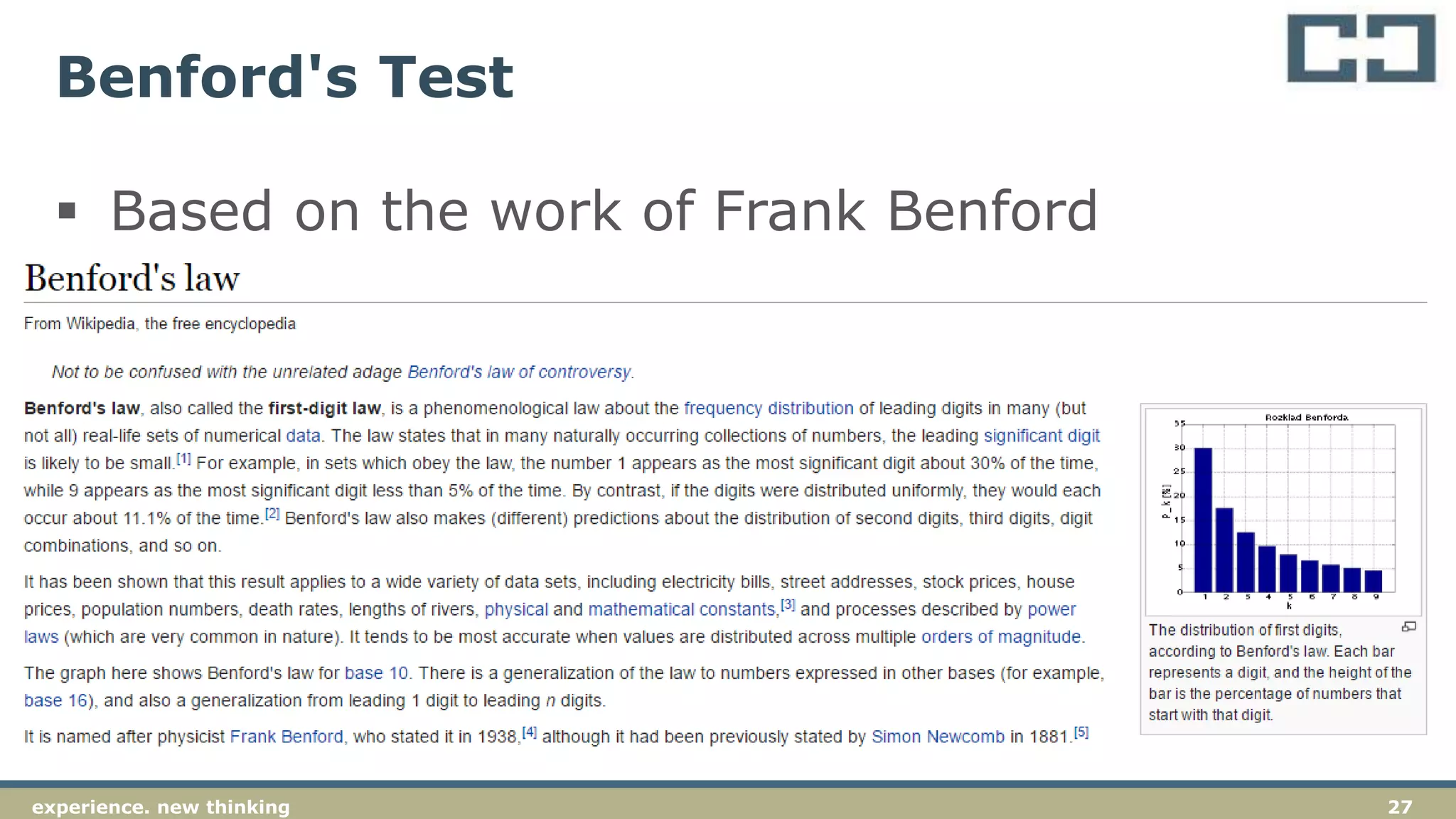

- How to extract, analyze, and evaluate data to identify anomalies, duplicates, outliers, and gaps to provide evidence to support the audit opinion.

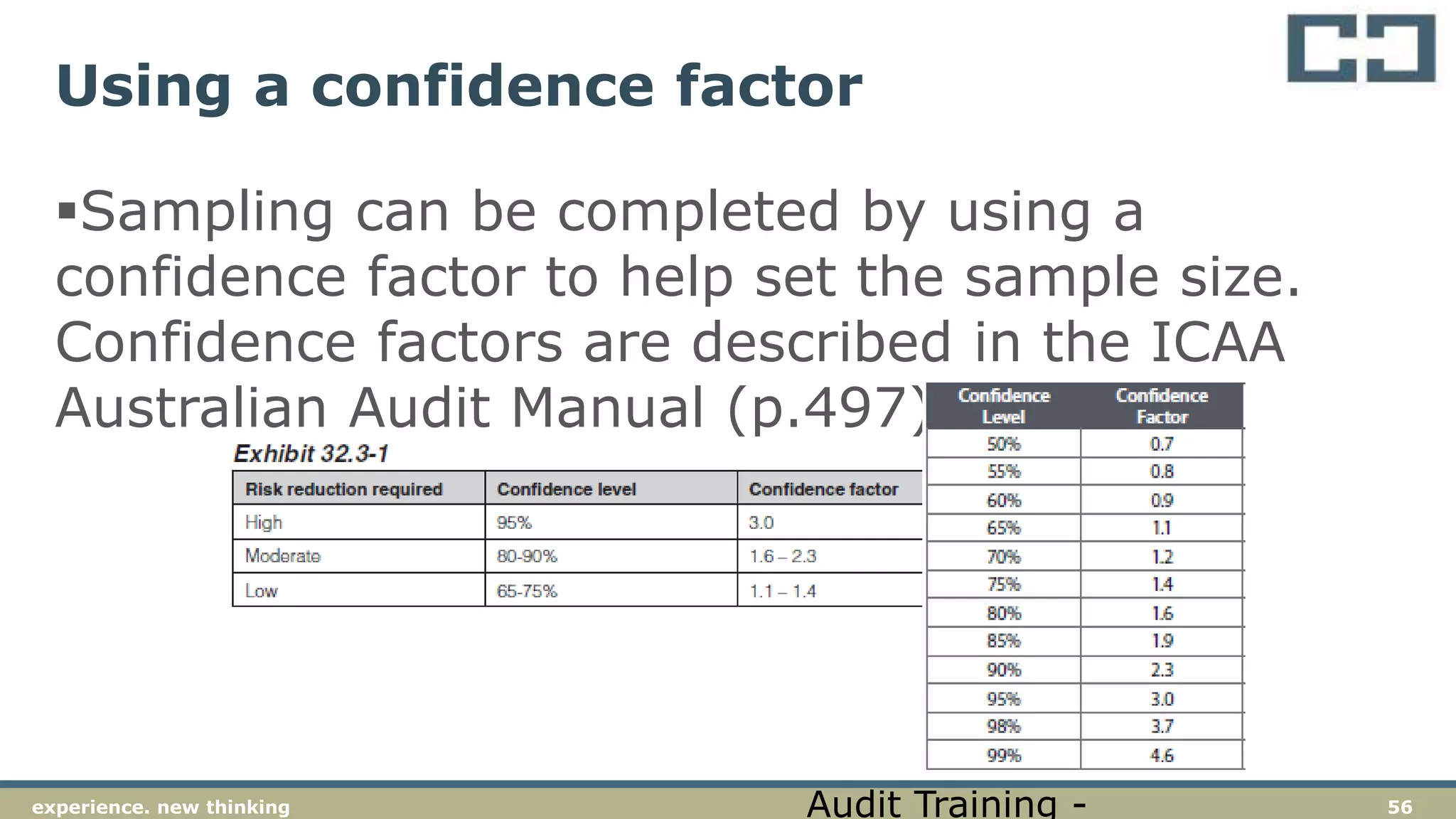

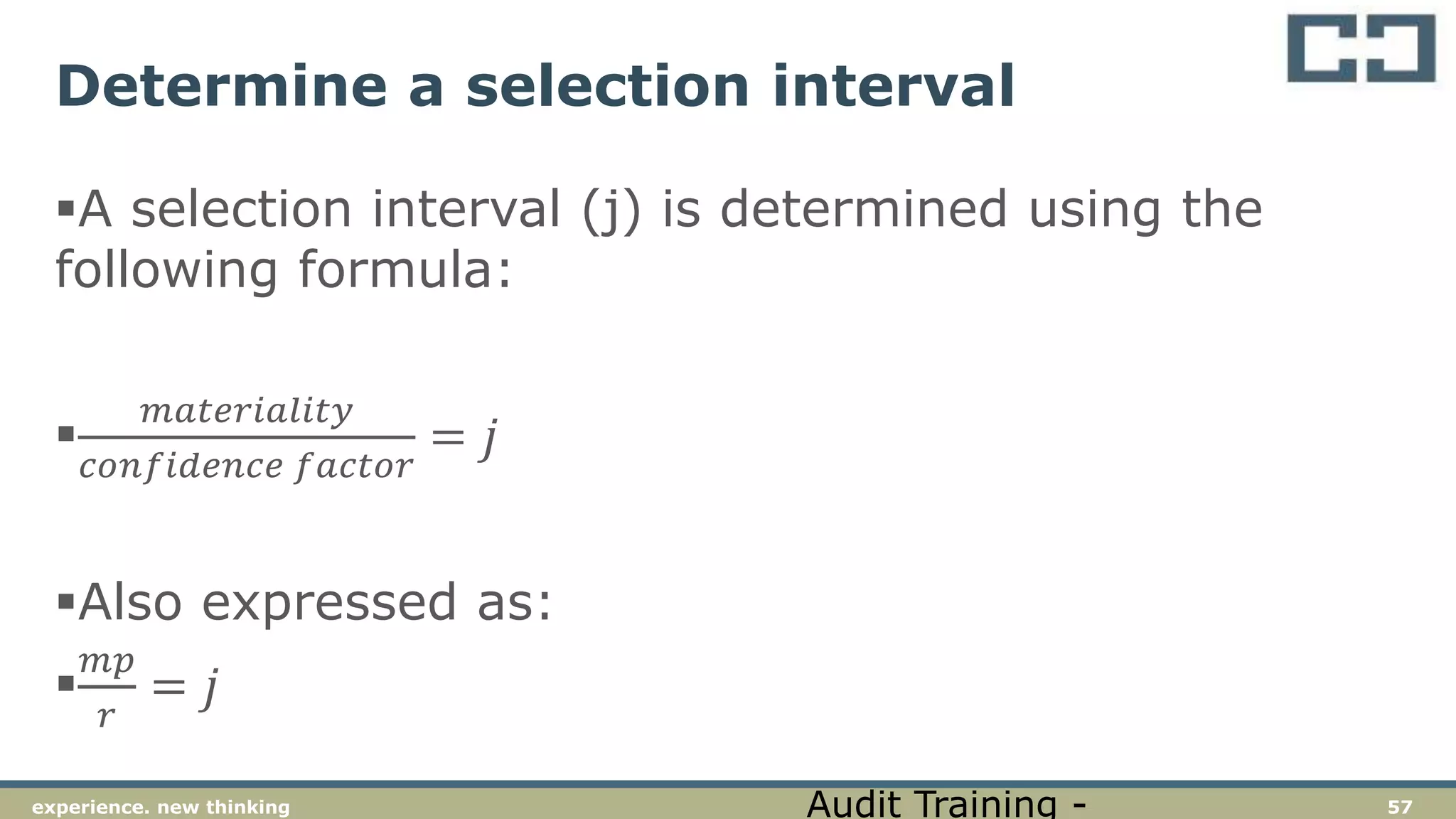

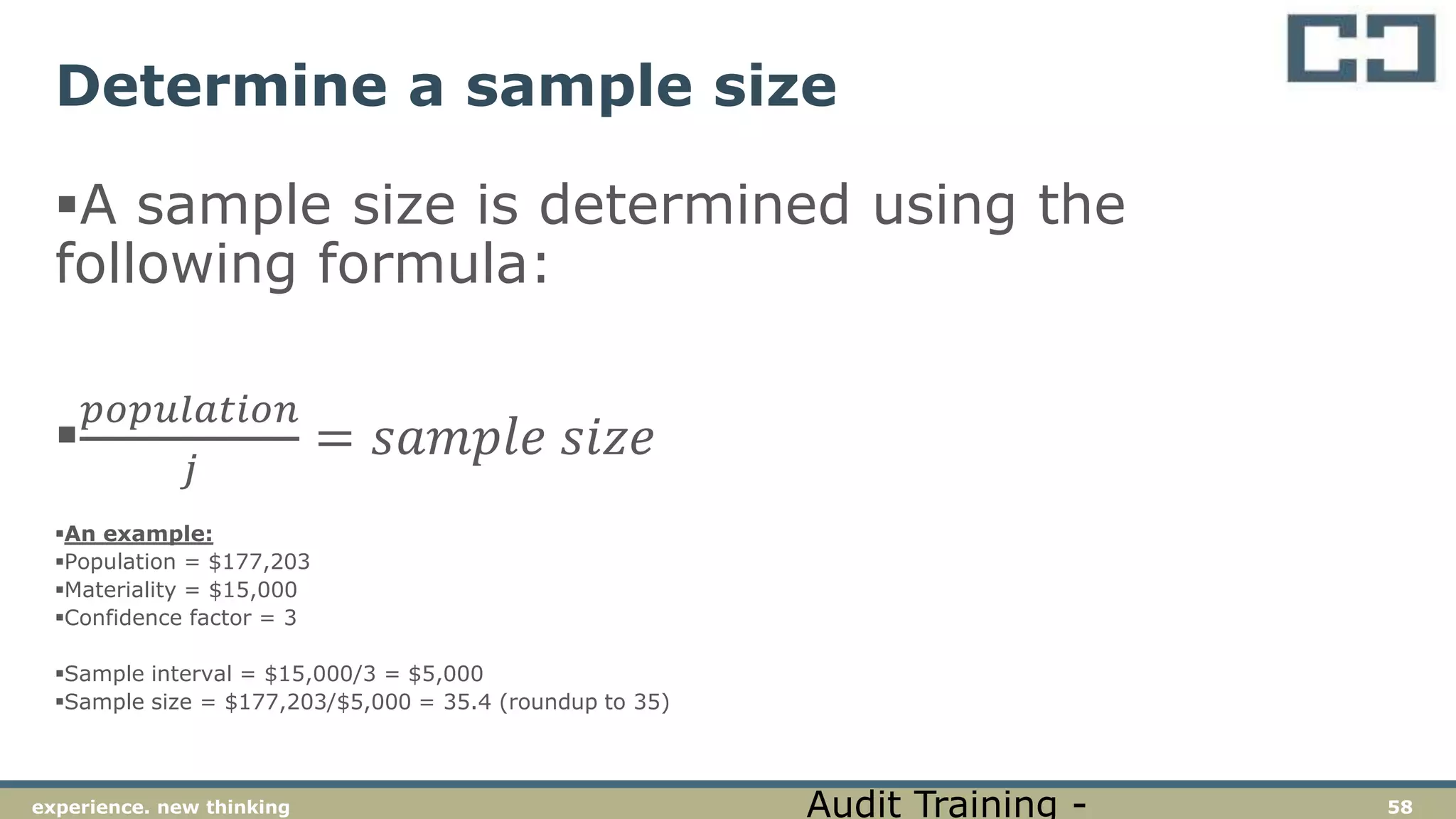

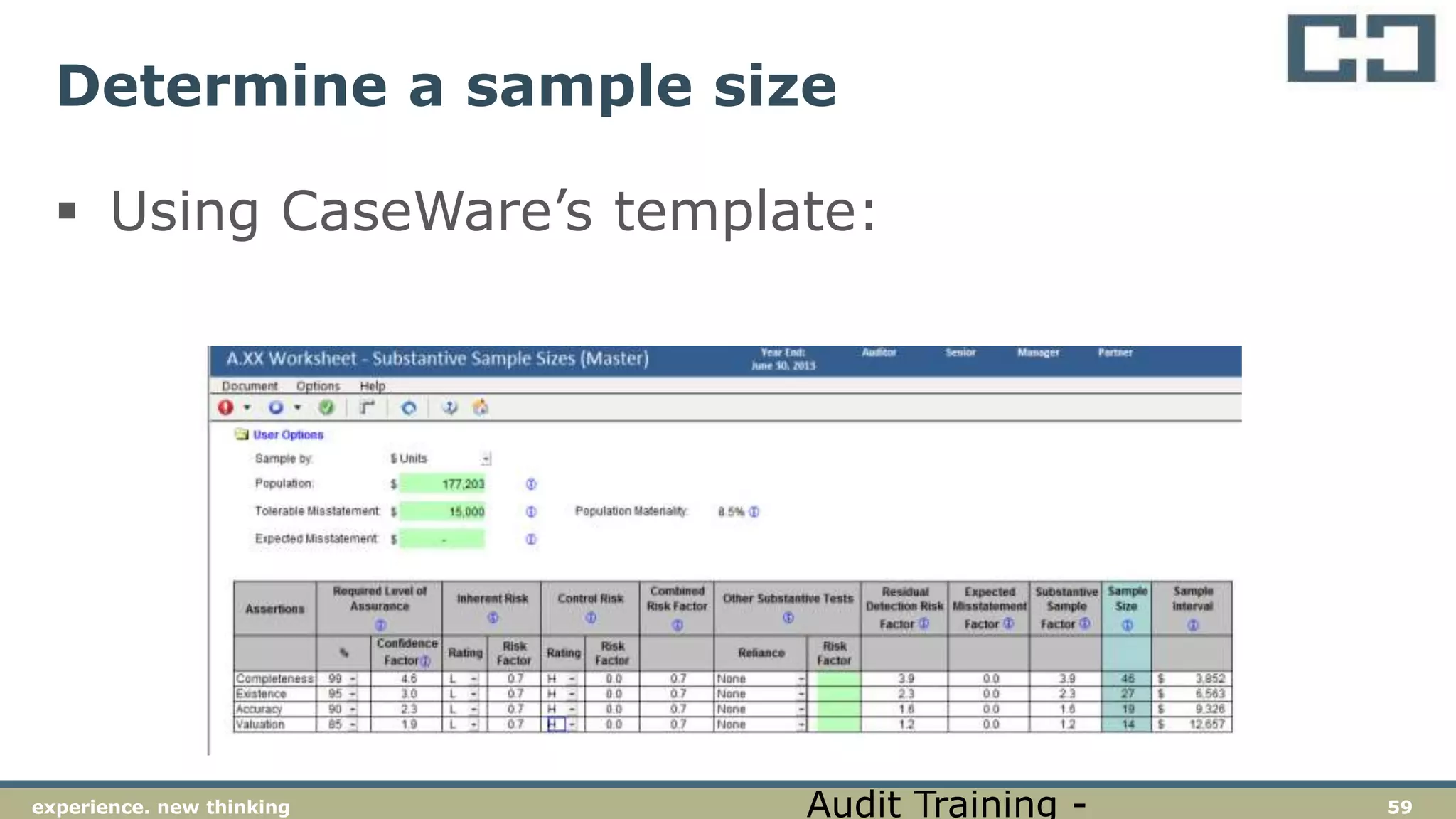

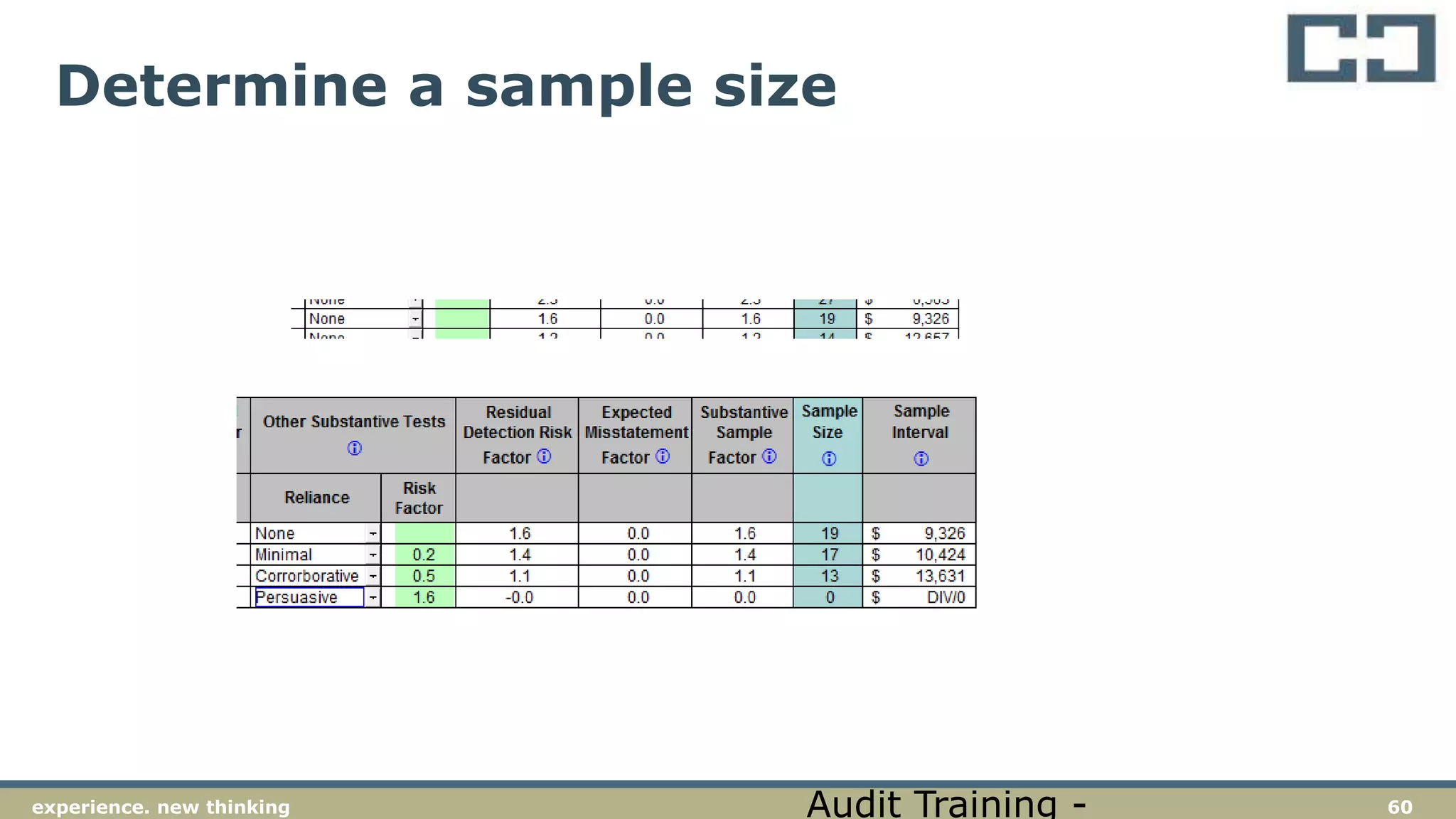

- Sampling techniques like monetary unit sampling that can be used to select transactions for detailed testing.

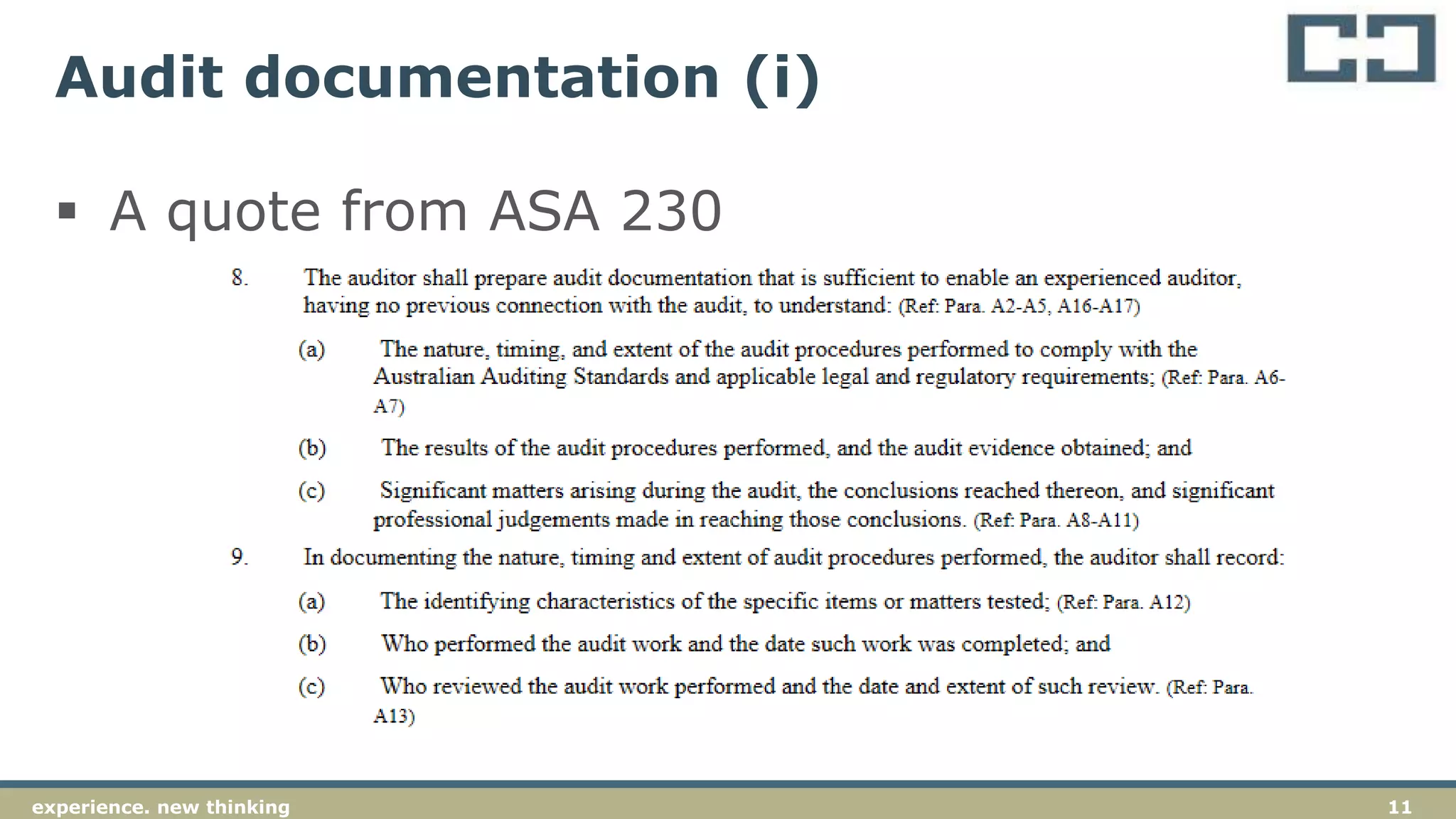

- Ensuring audit evidence obtained from data analysis is appropriate, relevant, reliable, and sufficient according to the requirements of auditing standards.