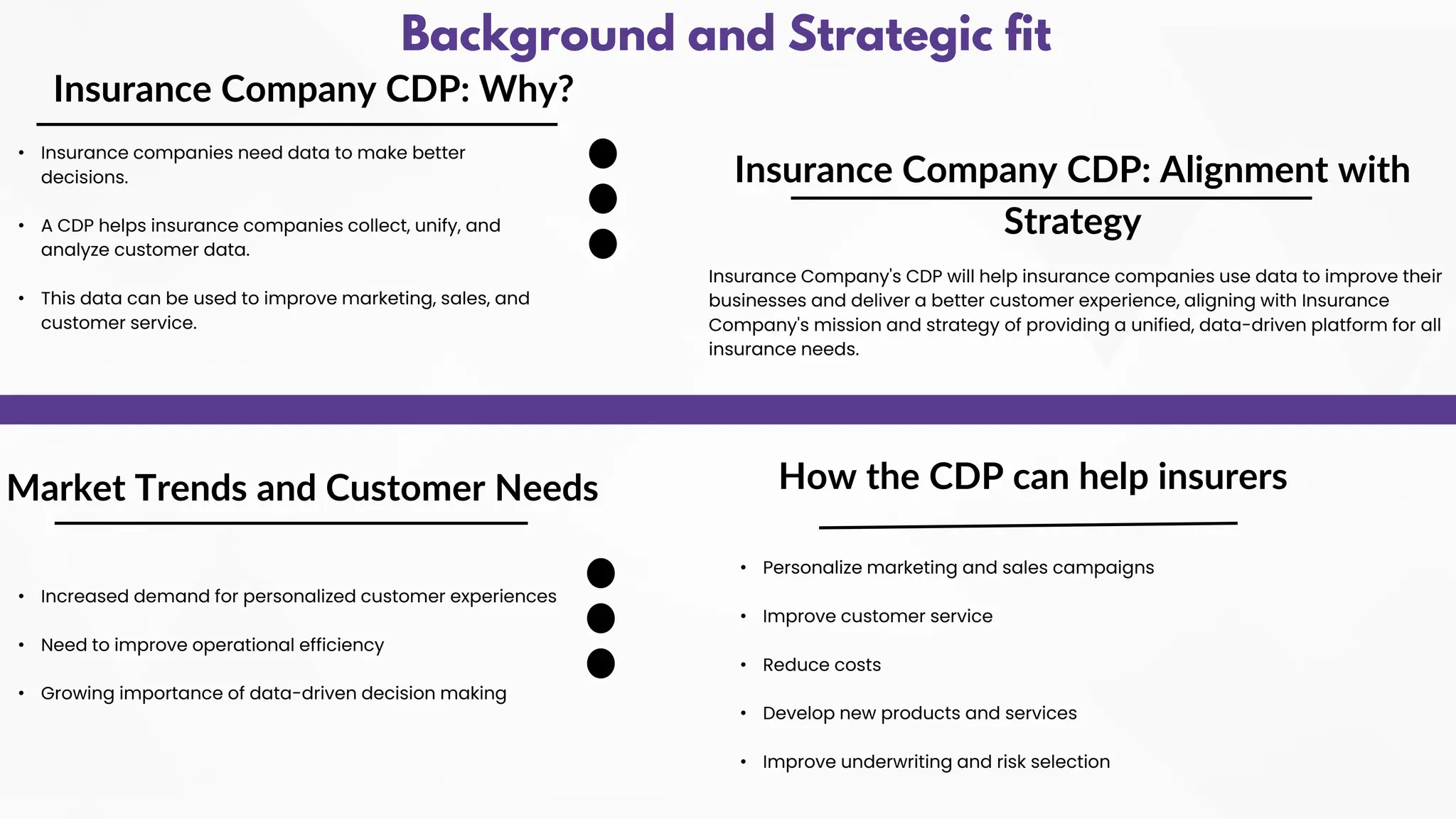

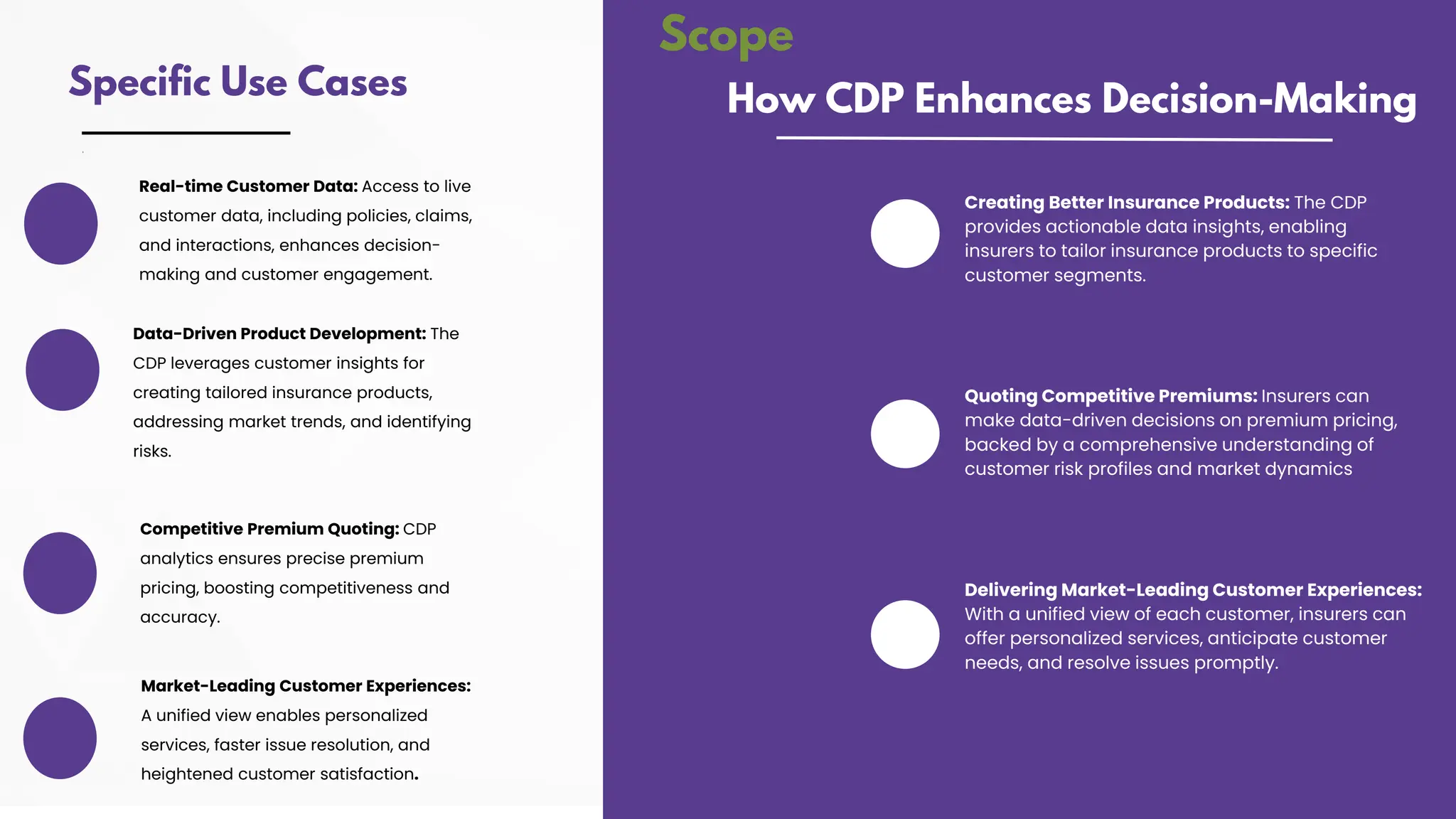

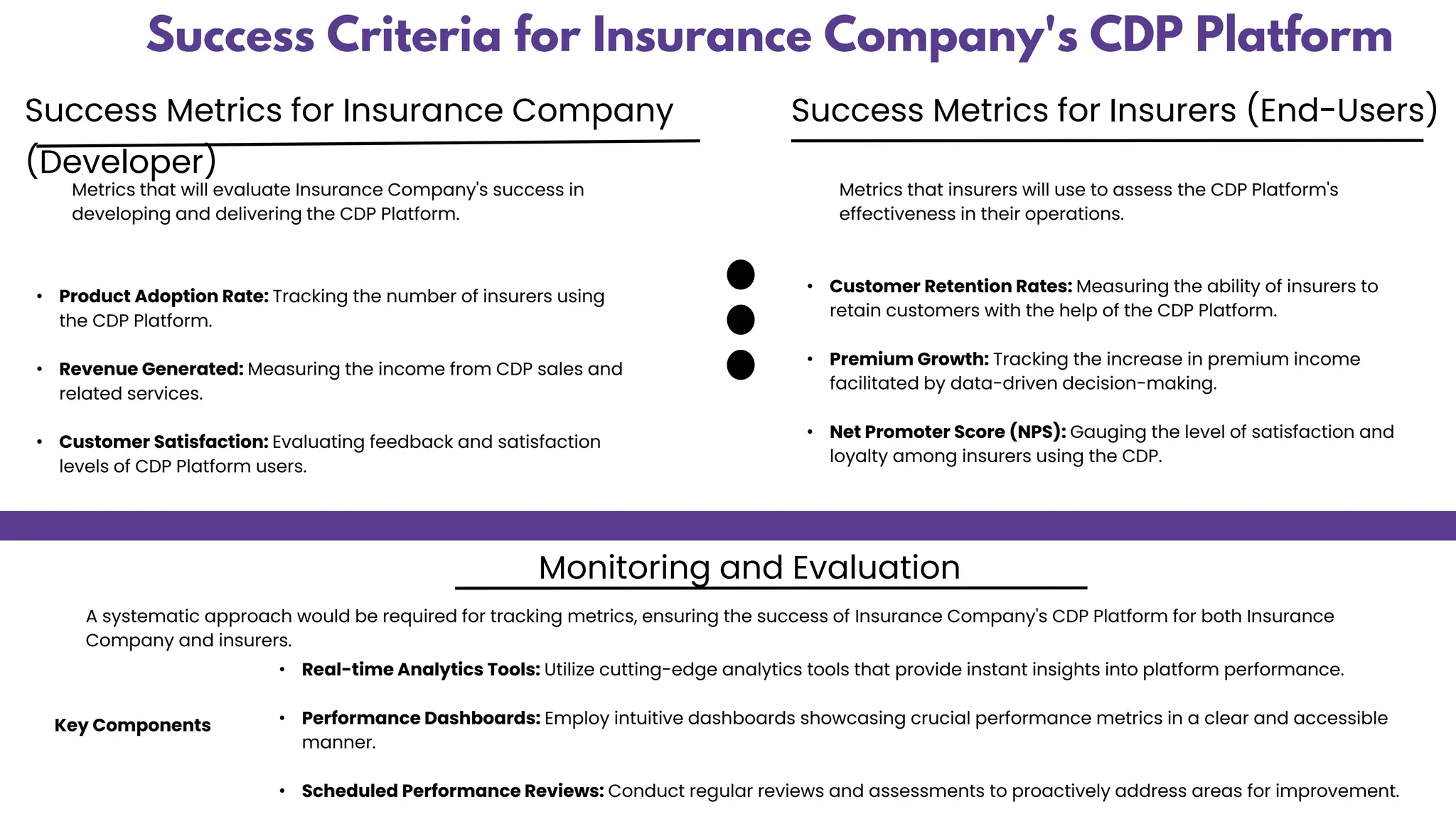

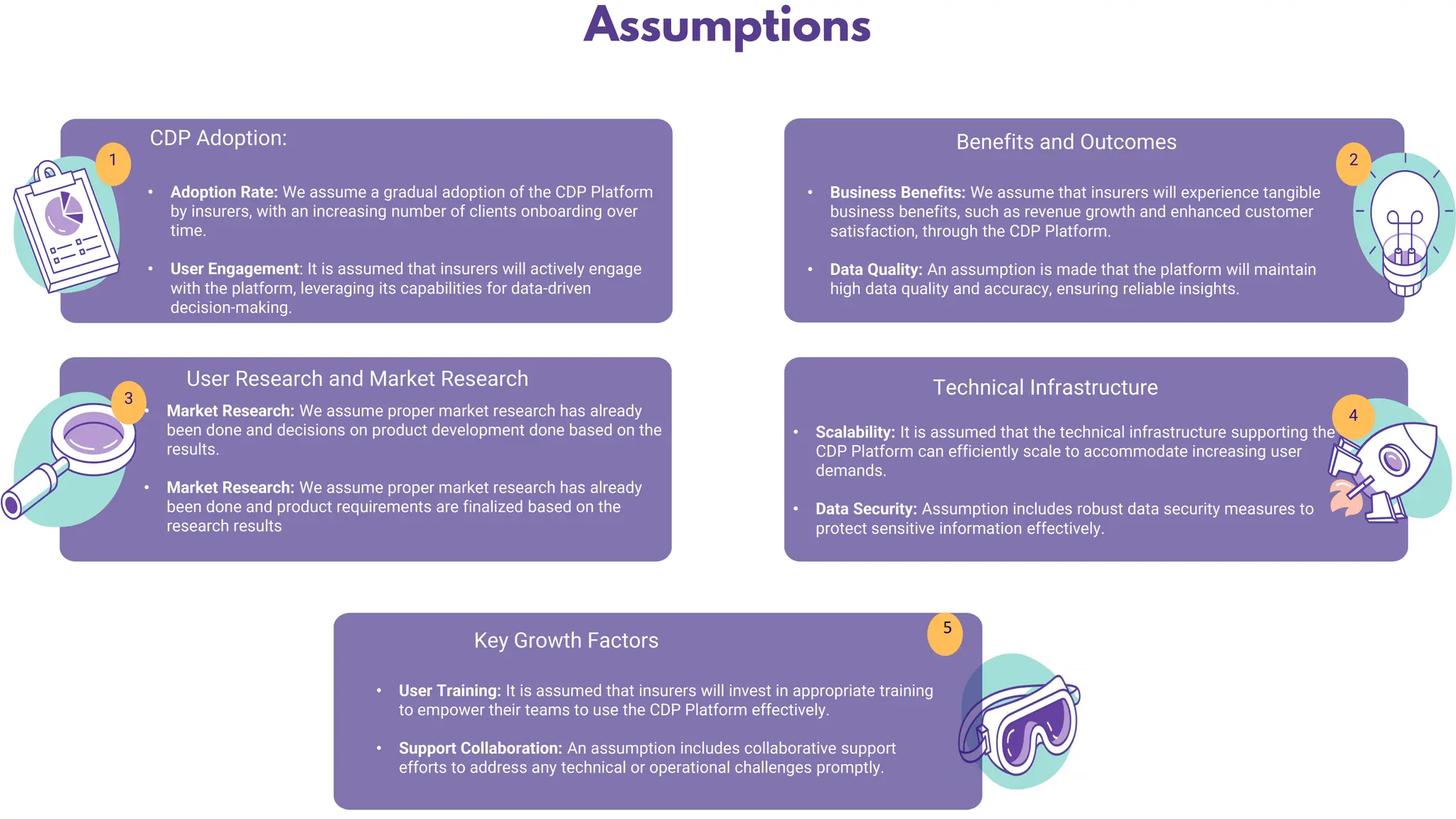

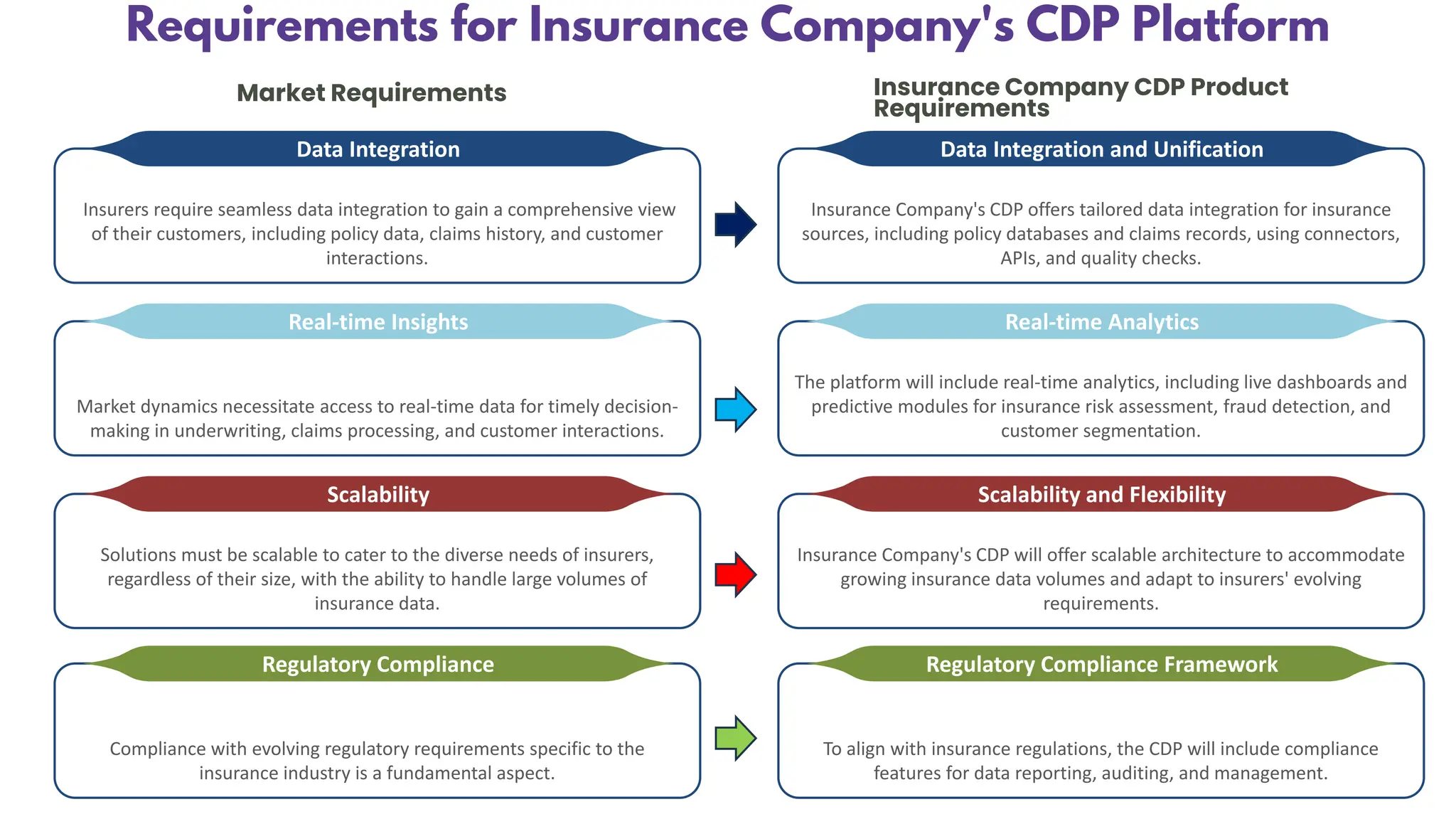

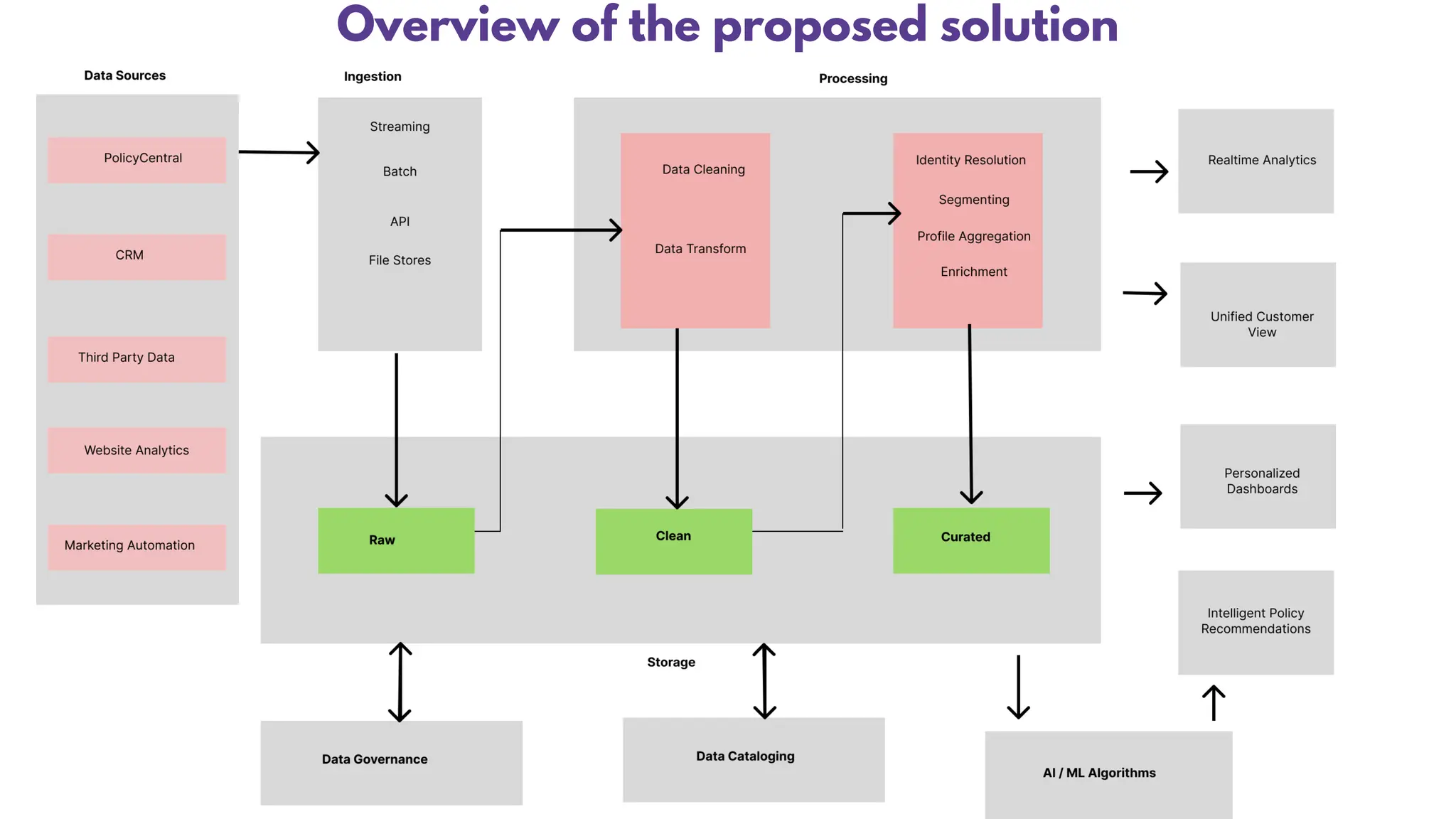

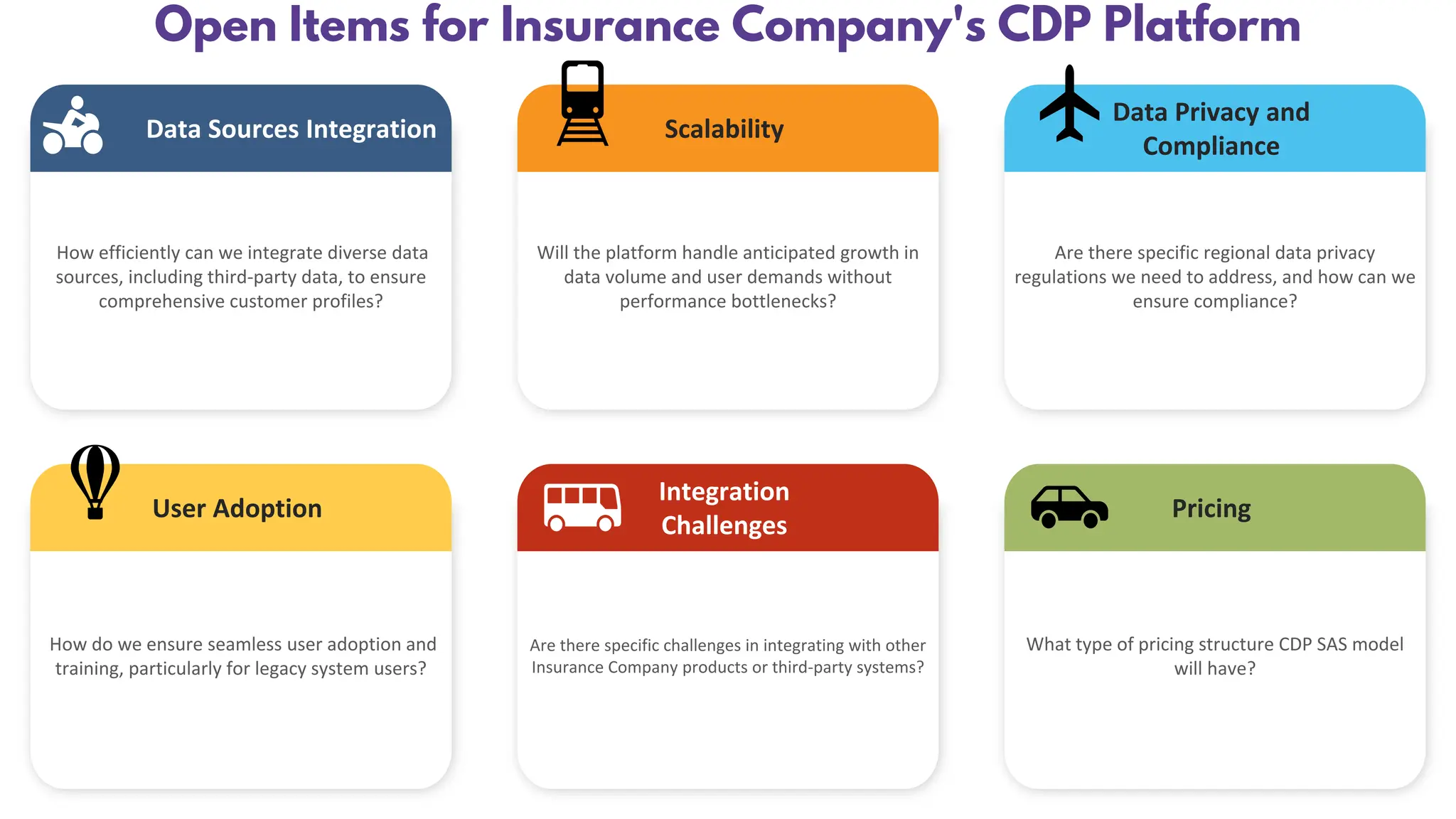

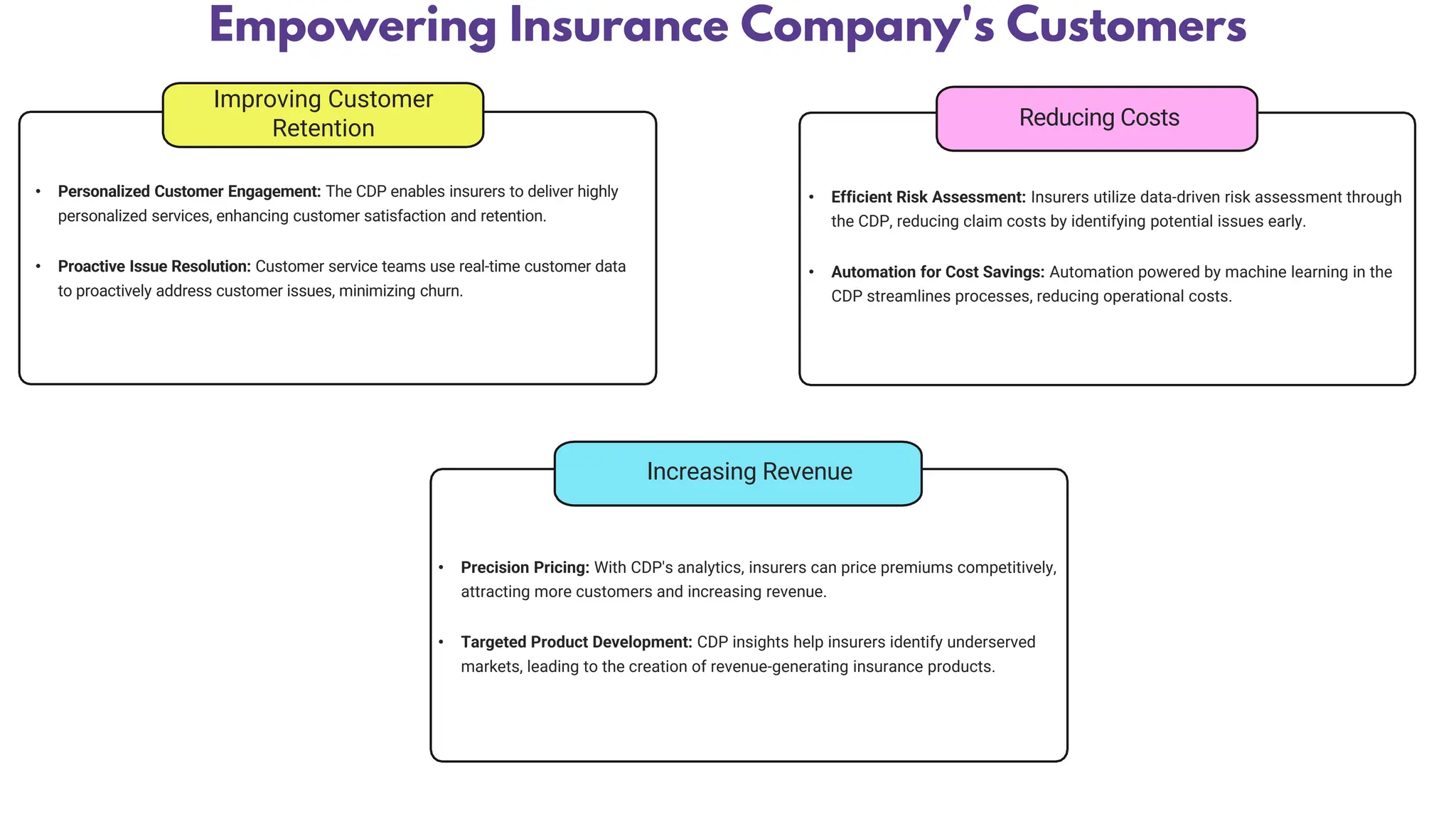

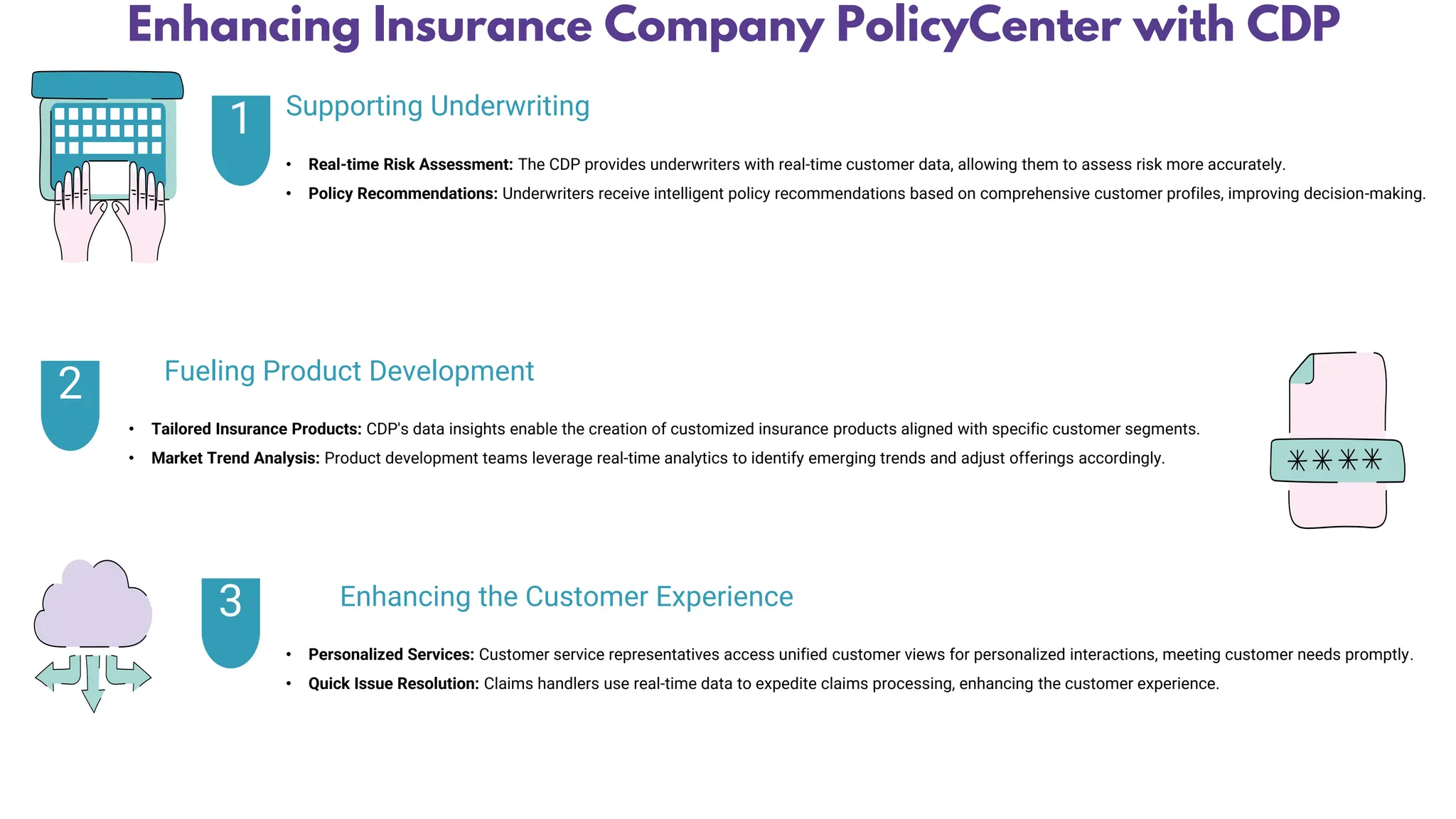

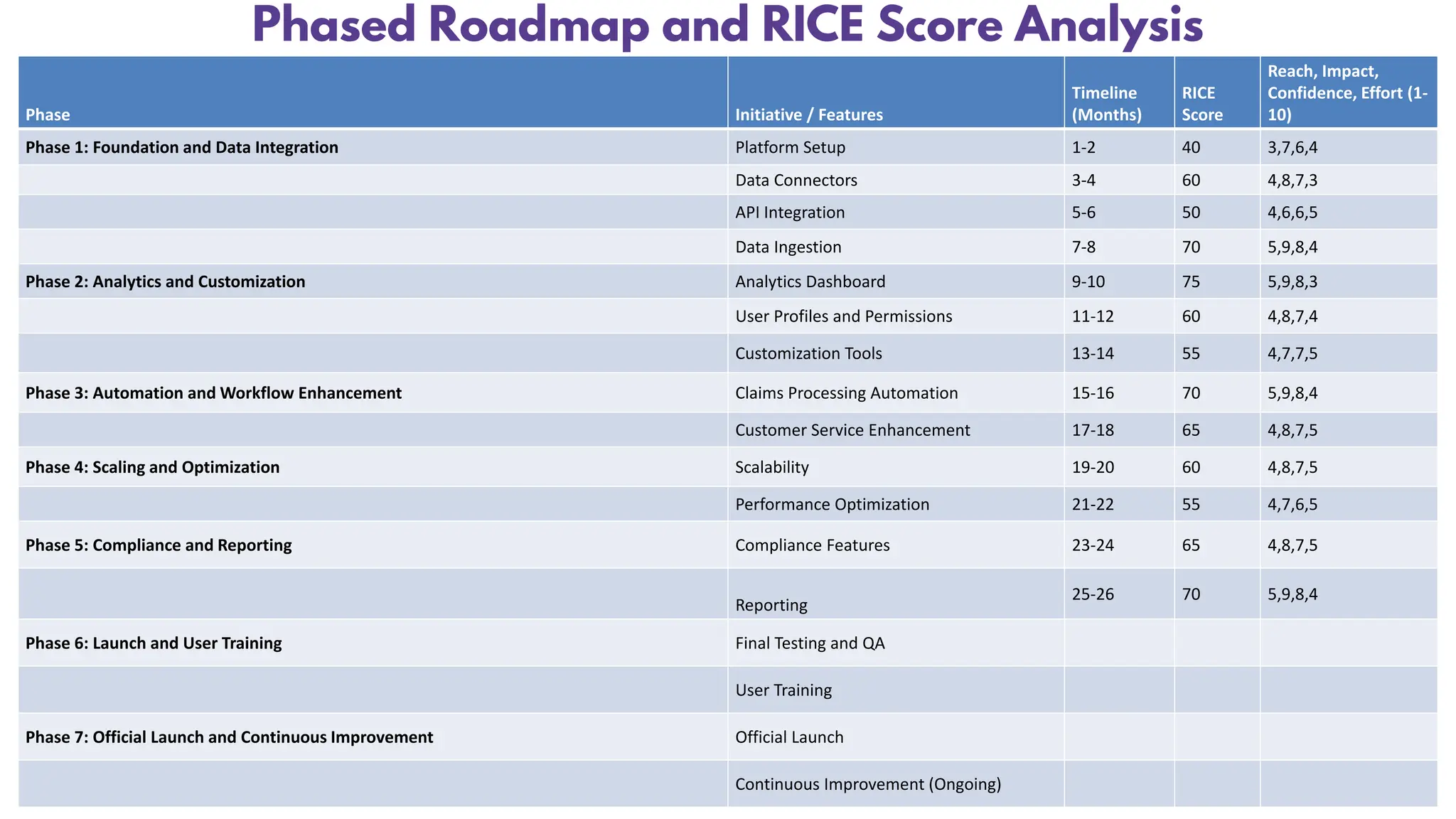

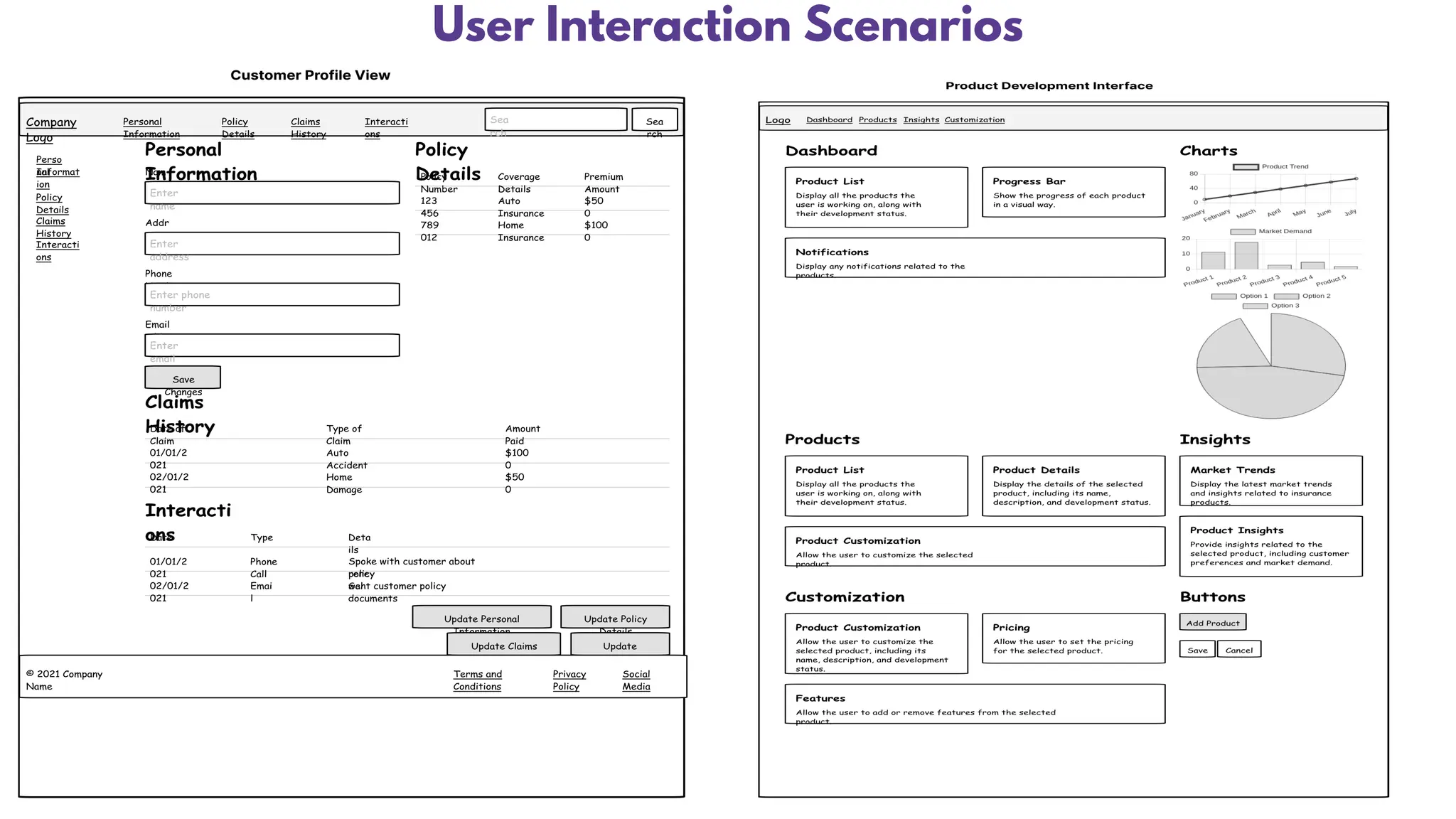

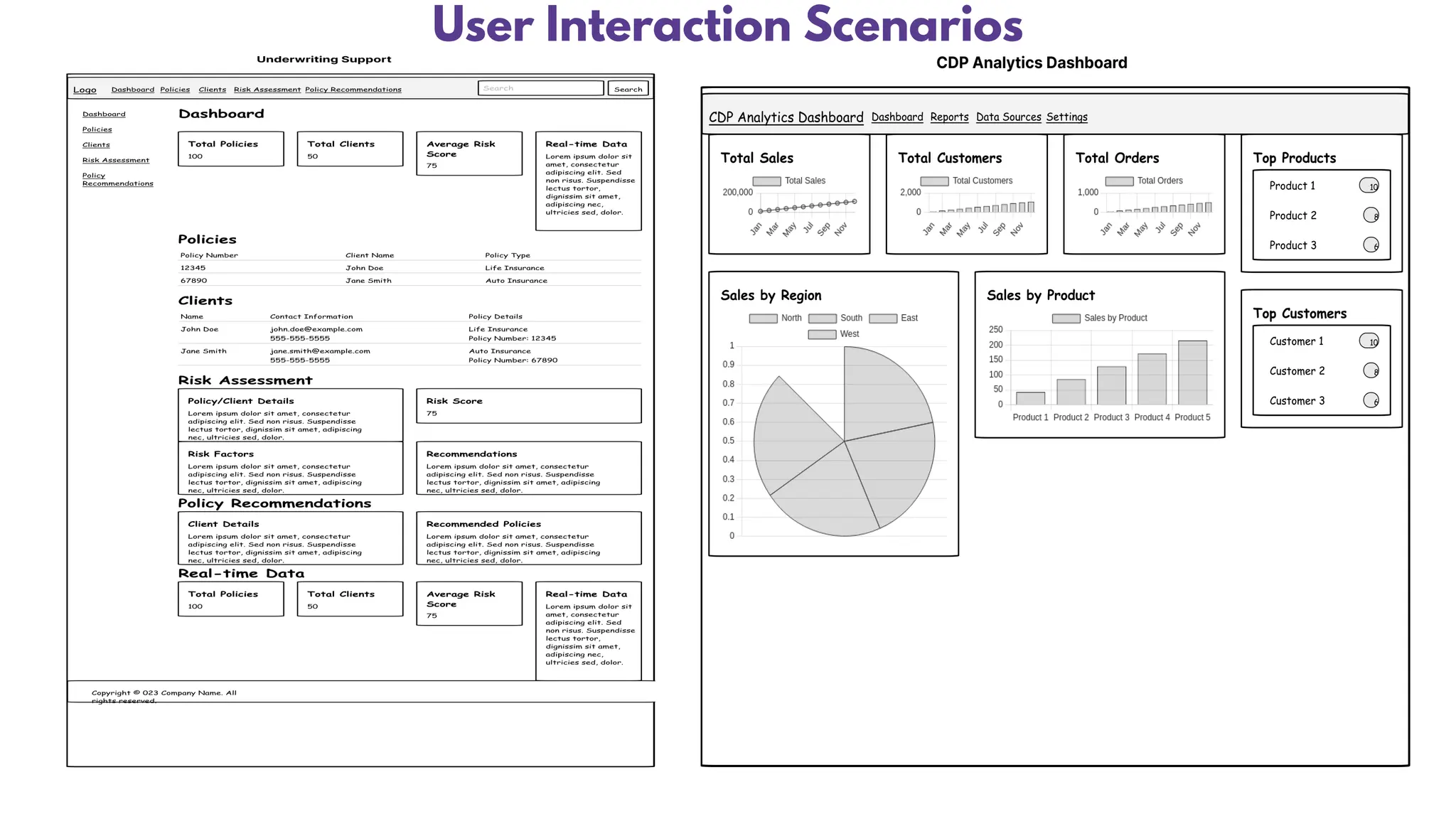

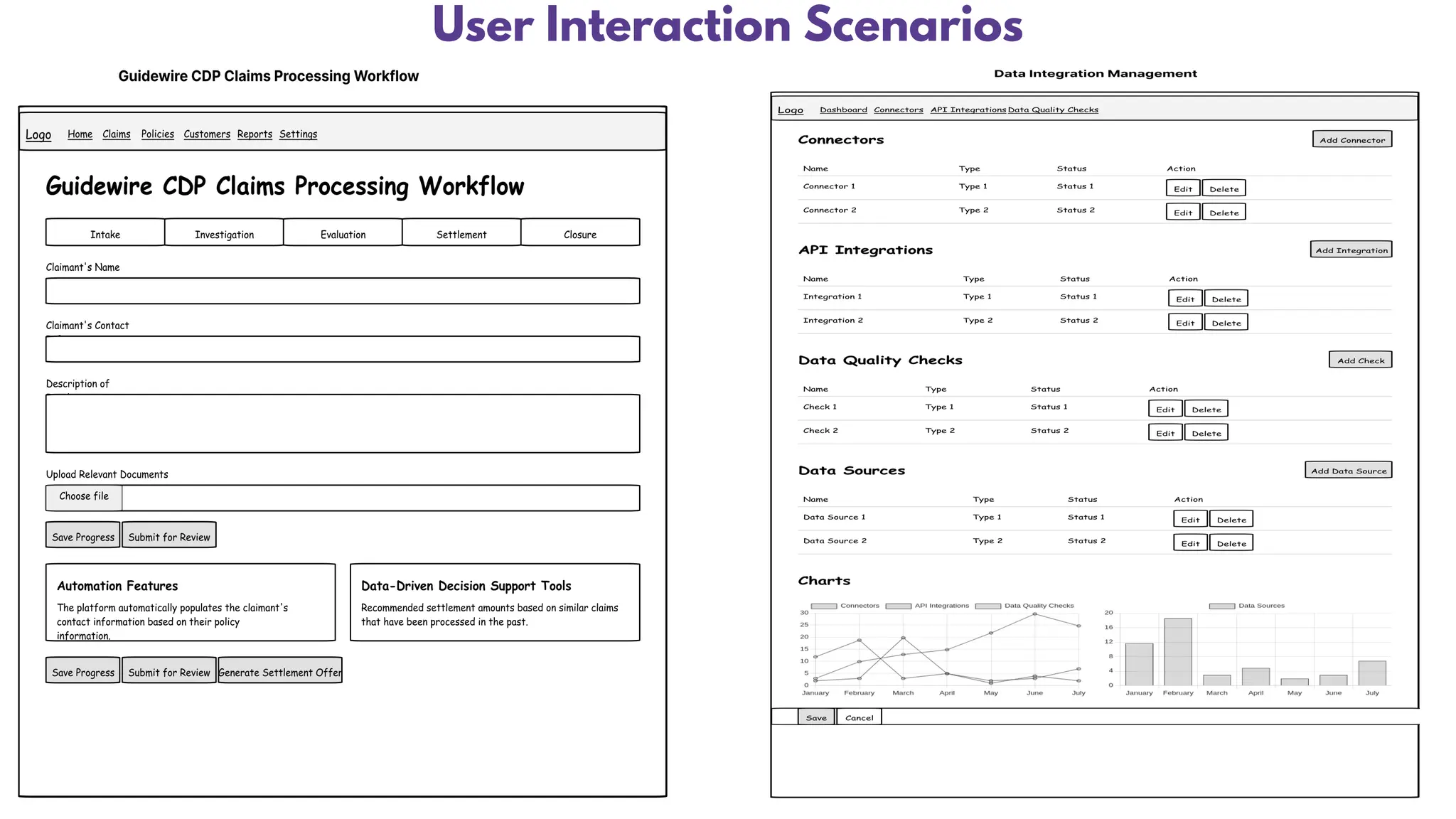

The document introduces a Customer Data Platform (CDP) designed to help insurance companies collect, unify, and analyze customer data to improve decision-making, marketing, and customer service. It highlights the importance of real-time data for personalizing services, optimizing risk assessment, and enhancing product development. The document outlines specific use cases, success metrics, and the phased implementation roadmap to support insurers in achieving their goals through effective data integration and analytics.