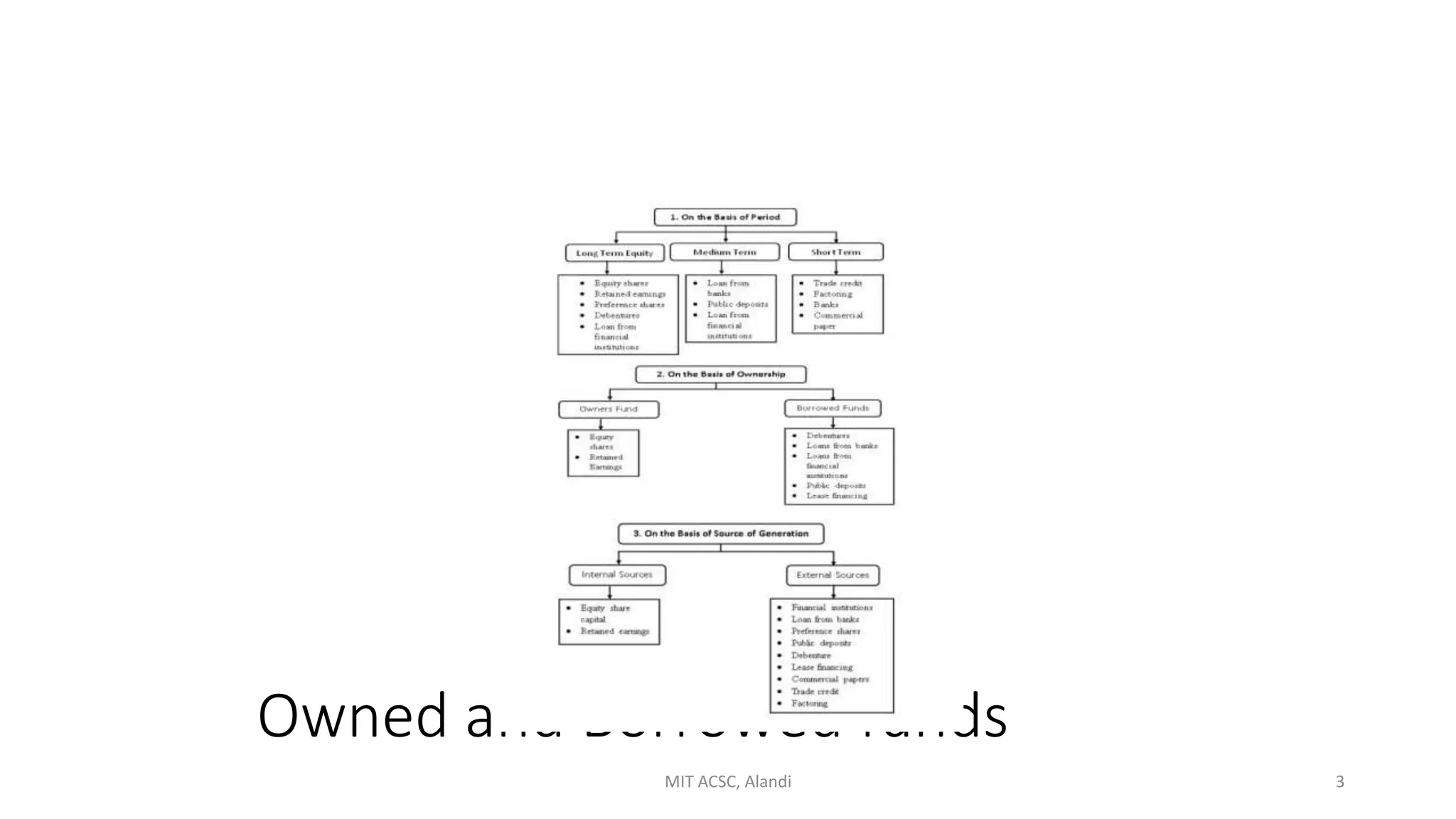

The document outlines various sources of finance including equity shares, preference shares, and debentures. It discusses the features, merits, and demerits of each financing type, with a detailed overview of their characteristics and considerations for businesses. It highlights retained earnings as an internal financing method and compares the rights and claims associated with each source of finance.

![• The Companies Act, 1956 has not defined as to what debenture means. It simply

states that a “debenture includes debenture stock, bonds and any other securities

of a company whether constituting a charge on the assets of the company or not

[Sec. 2 (12)]. Thus, the Act only states that it is a kind of security which constitutes

a charge by way of security on issuing debentures. In sum, debenture is a long-

term promissory note which usually runs for a duration of not less than ten

years”.

• At the very outset it is necessary to have a clear understanding of two terms viz.

debenture and bond, used very frequently to denote a security for raising loan

capital. In America, the term bond refers to a security instrument that has lien on

specific assets of the enterprise and the word ‘mortgage bond’ is very often used as

alternative to the word bond.

• Debenture, on the other hand, refers to unsecured bond which is not secured by a

lien on any specific asset. Of course, it is secured by all the assets of the company

not otherwise mortgaged. In the event of liquidation, debenture-holders become

general creditors.

• In our country, no such distinction is made between the two terms. For debentures

which are secured by pledging certain assets, term ‘secured debentures’ or bonds

is used and unsecured debentures refer to those having no lien on specific assets.

MIT ACSC, Alandi 18](https://image.slidesharecdn.com/sourcesoffinance-240212175914-da57aeba/75/Sources-of-Finance-in-Business-detailed-notes-18-2048.jpg)