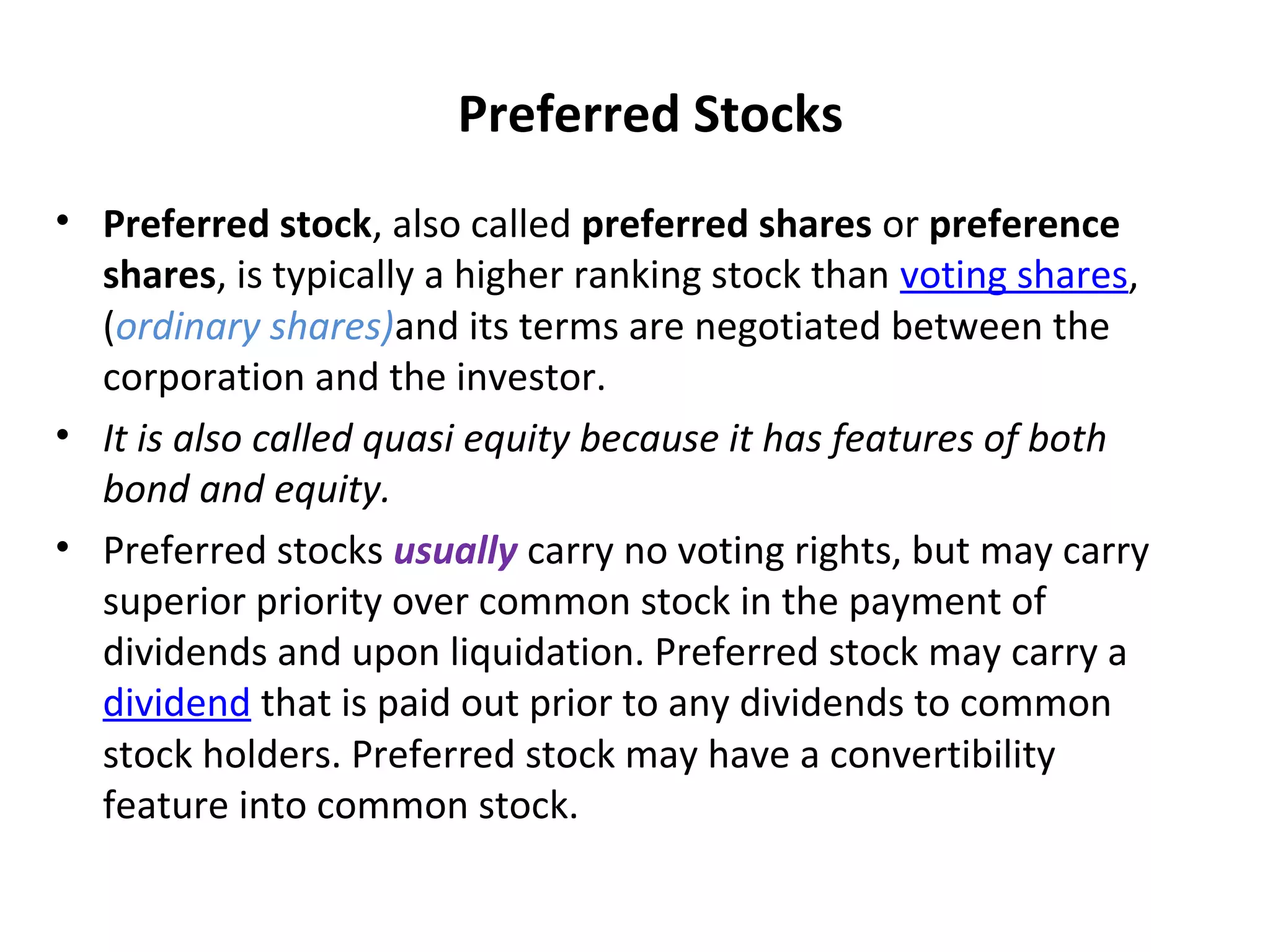

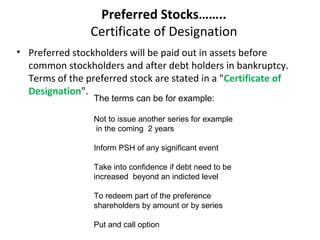

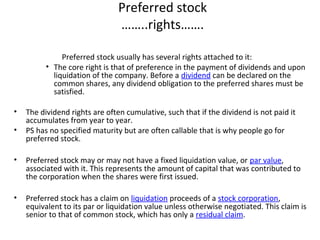

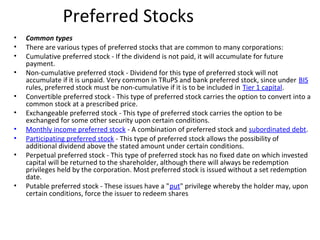

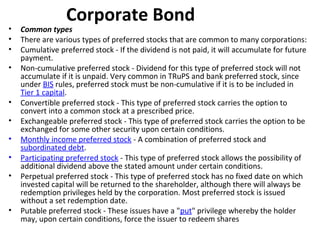

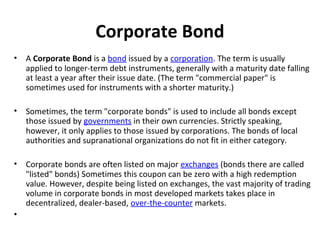

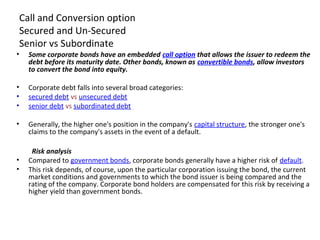

Preferred stock is a type of equity security that has characteristics of both debt and equity. It has a higher claim on assets and earnings than common stock, but is subordinate to bonds and other debt. Key features include: a fixed dividend that must be paid out before common dividends; no voting rights unless dividends are in arrears; and seniority over common stock in liquidation. Preferred stock comes in different classes with varying rights, and provides tax advantages for corporations.

![Dividends

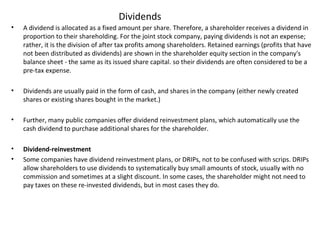

• The word "dividend" comes from the Latin word "dividendum" ("thing to

be divided)

• Dividends are payments made by a corporation to its shareholder

members. It is the portion of corporate profits paid out to stockholders.[1]

• When a corporation earns a profit or surplus, that money can be put to

two uses: it can either be re-invested in the business (called retained

earnings), or it can be distributed to shareholders. There are two ways to

distribute cash to shareholders: share repurchases or dividends.[

• Many corporations retain a portion of their earnings and pay the

remainder as a dividend.](https://image.slidesharecdn.com/prefstockbonds1-160904165903/85/Pref-stock-amp-bonds-1-14-320.jpg)