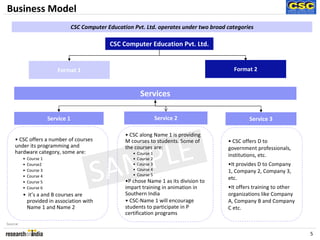

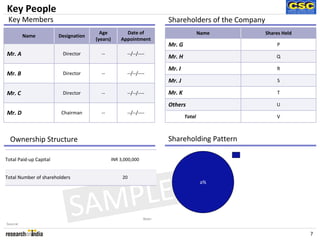

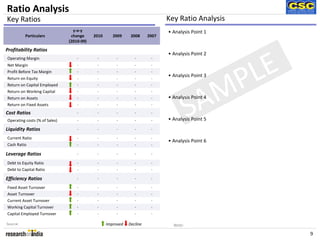

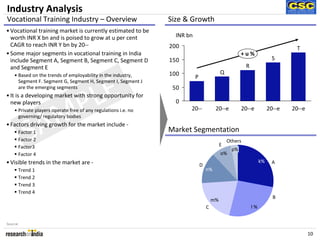

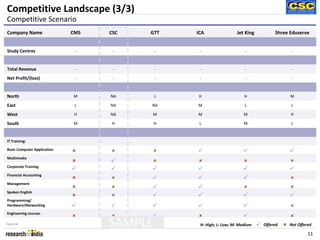

CSC Computer Education Pvt. Ltd. specializes in programming and hardware training, operating over X centers in Southern India and Sri Lanka, training Y government officials and Z students annually. The company faced a financial decline in FY 20--, generating INR mn in revenue and incurring a net loss of INR 10.6 mn. The Indian vocational training market is growing, presenting opportunities for CSC despite increasing competition and threats to its strategic initiatives.