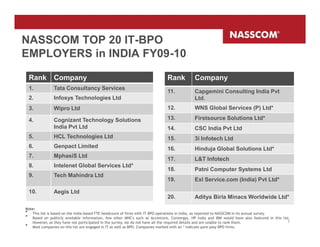

The document outlines the growth and transformation of India's IT-BPO industry, highlighting a significant increase in employment and a diverse workforce over the past decade. Key initiatives focus on training and development, addressing people challenges, and ensuring organizations are future-ready through investments in skill enhancement and career growth opportunities. By 2020, the industry aims to create 10 million direct and 20 million indirect jobs, while promoting inclusivity by hiring from tier 2/3 cities and supporting the differently abled.