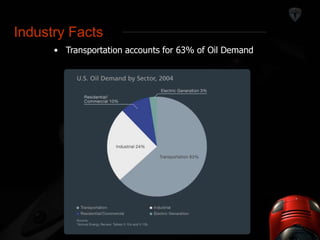

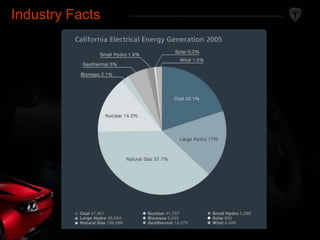

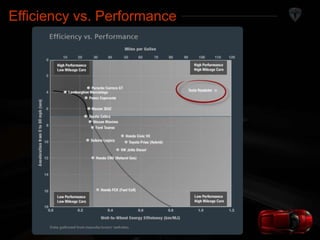

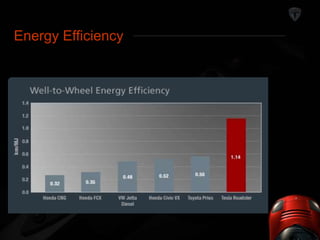

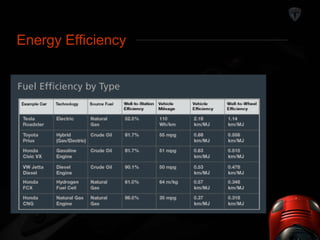

This document provides an analysis of Tesla Motors, a startup electric vehicle manufacturer. It discusses Tesla's high performance electric sports car, the internal competition in the green vehicle market from electric, hybrid, hydrogen and flexible fuel vehicles, and the barriers to entry in the automotive industry. It also examines factors like substitutes, complements, supplier power, and buyer power. The conclusion covers Tesla's short and long term strategies to establish brand recognition and ultimately compete in the mass market.