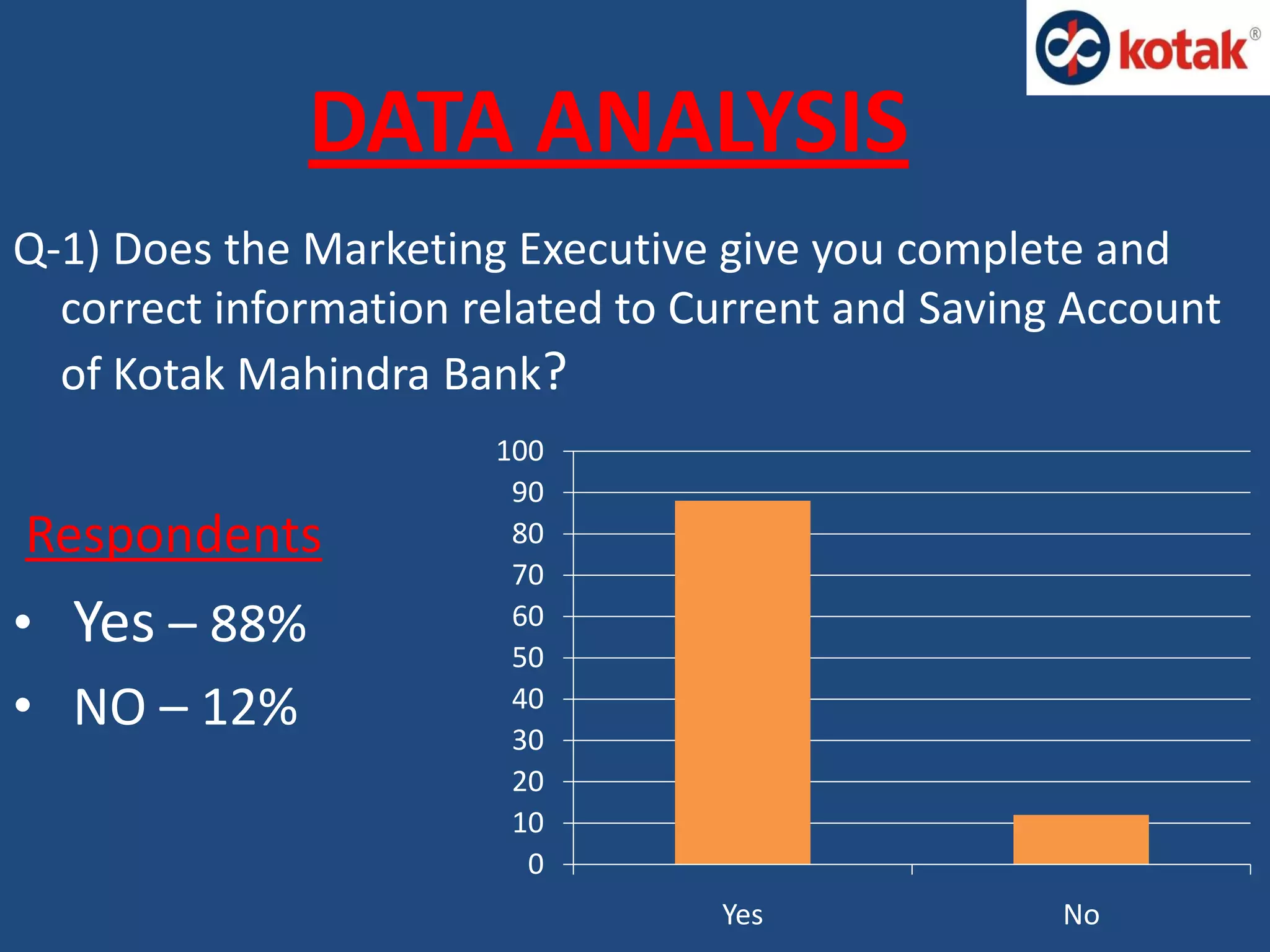

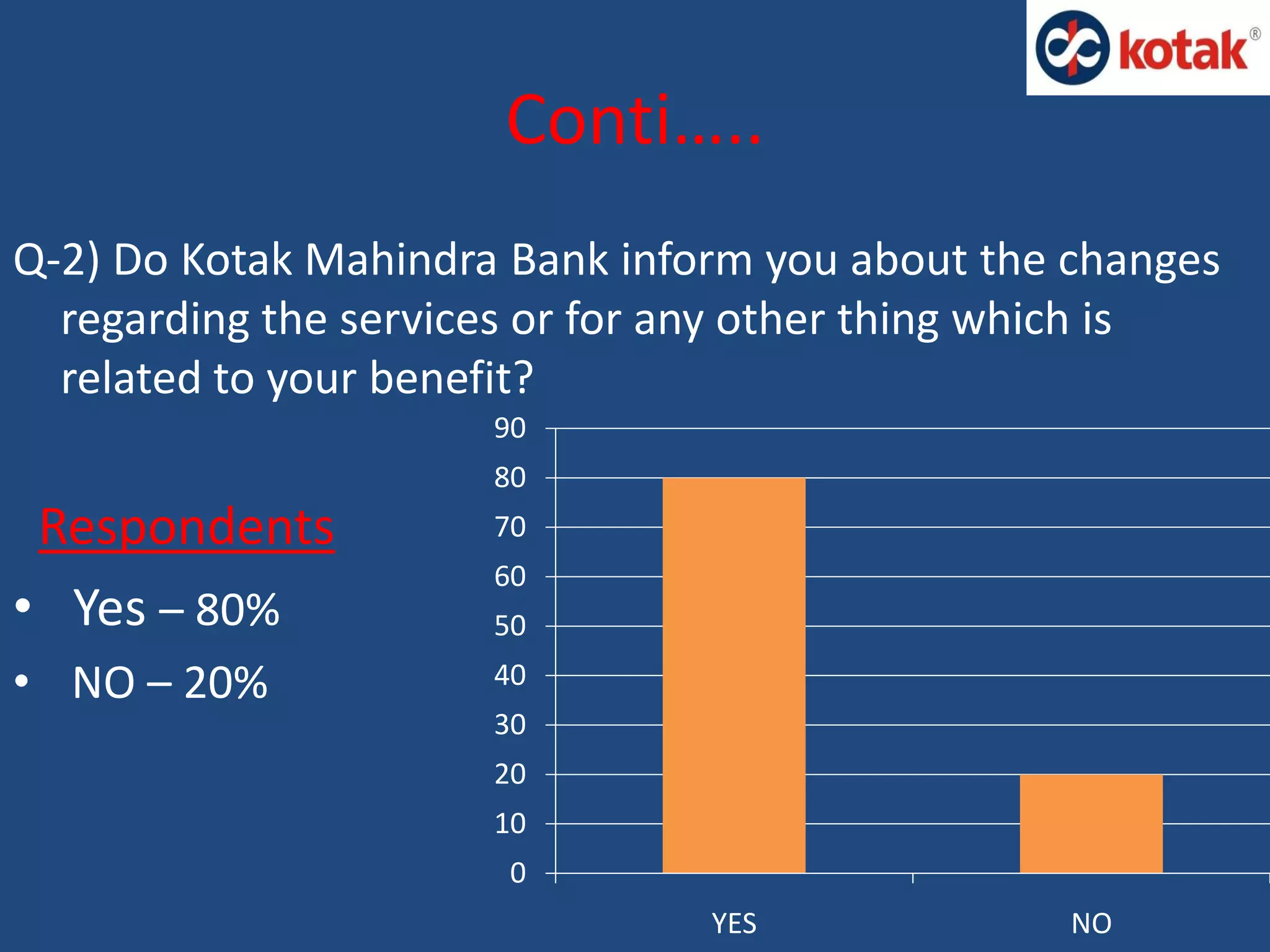

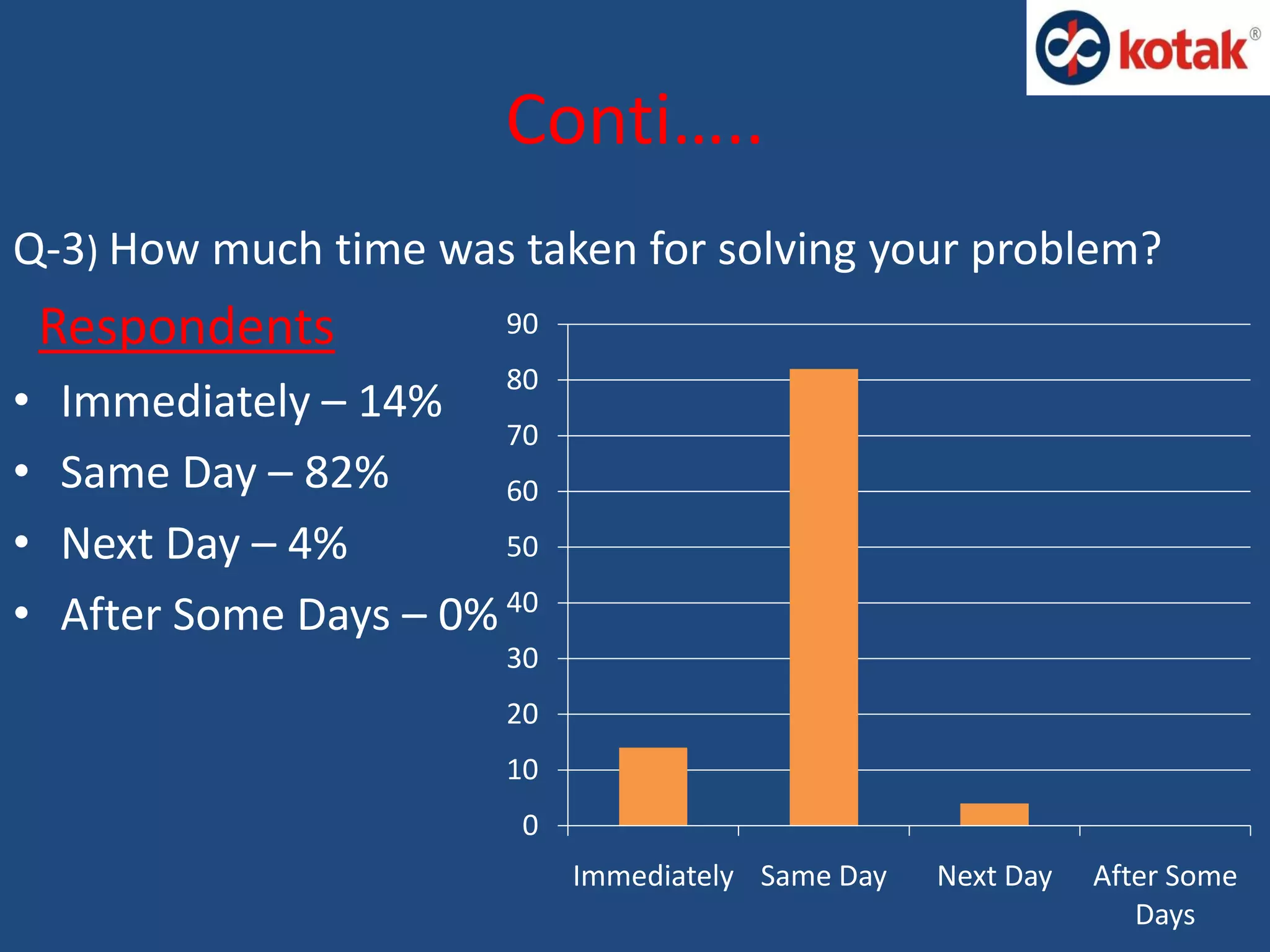

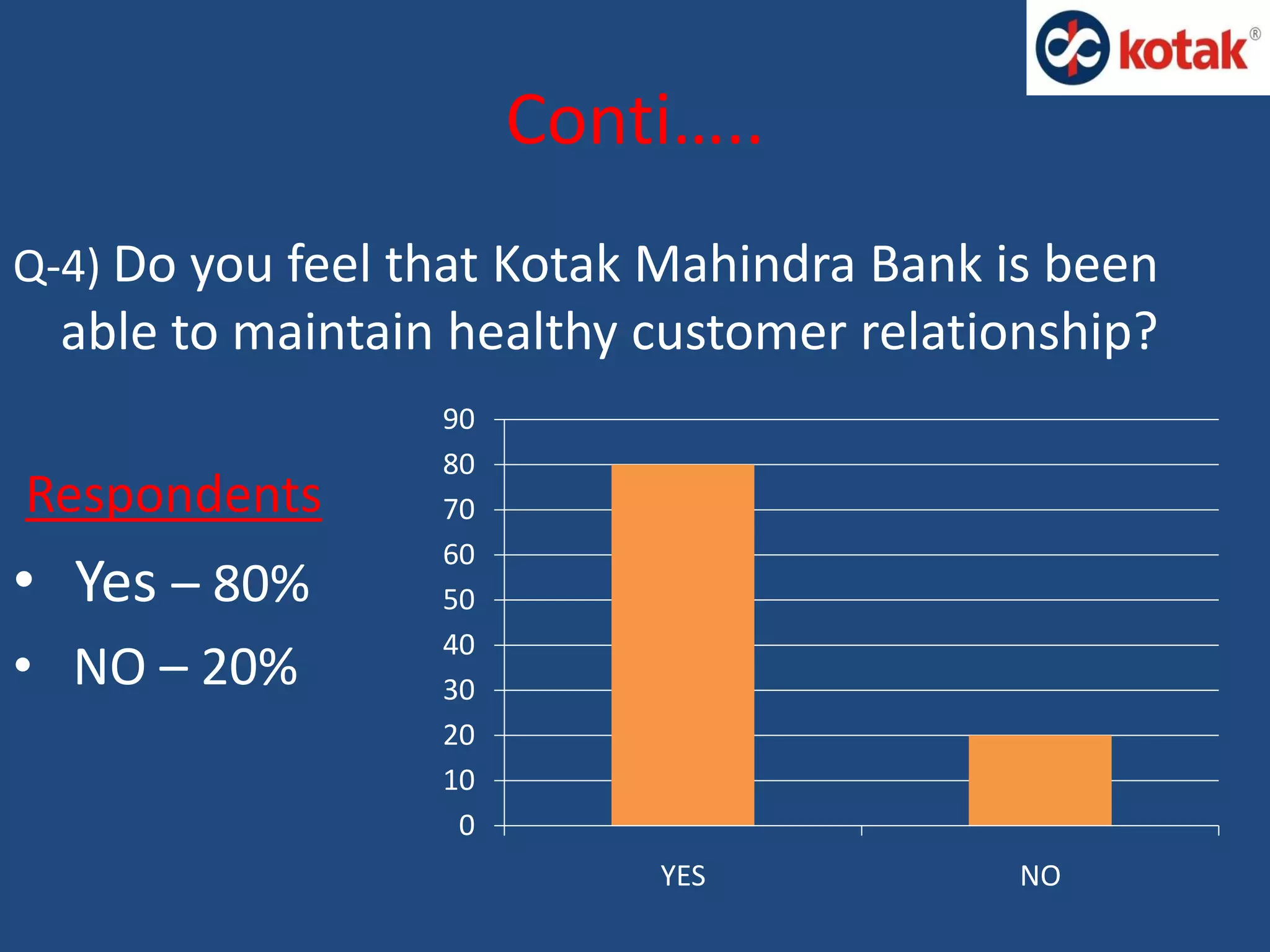

Kotak Mahindra Bank was established in 1985 as a non-banking financial company and was granted a banking license in 2003, making it the first company to convert to a bank. The document discusses Kotak Mahindra Bank's customer relationship management practices, including maintaining effective communication with customers, resolving issues in a timely manner, and gathering customer feedback to understand their needs and maintain healthy relationships. A survey of 100 customers found that the majority felt they received correct information from the bank and that their problems were resolved quickly, demonstrating that Kotak Mahindra Bank effectively manages customer relationships.