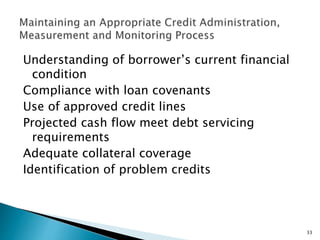

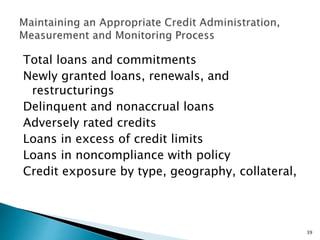

The board of directors is responsible for overseeing the bank's credit risk strategy and policies. They should approve a credit risk strategy that defines the bank's risk appetite. Senior management is then responsible for implementing this strategy through establishing a sound credit granting and administration process. This includes setting credit policies, limits, and criteria and monitoring loans. An effective credit risk management system involves identifying, measuring, monitoring, and controlling credit risk, and includes internal risk ratings, management reporting, and independent credit reviews.