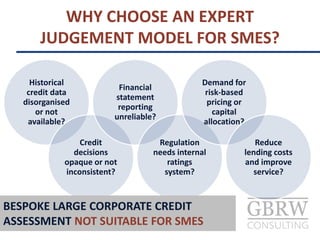

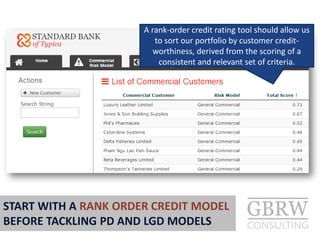

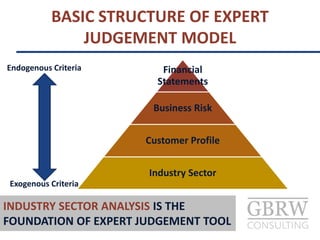

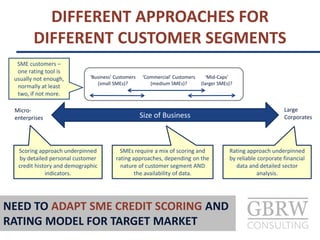

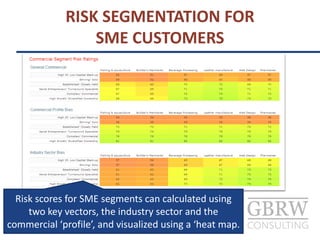

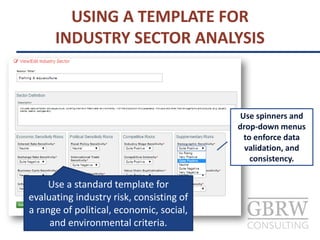

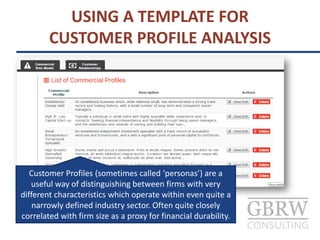

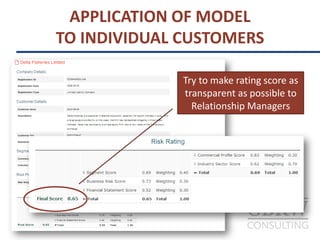

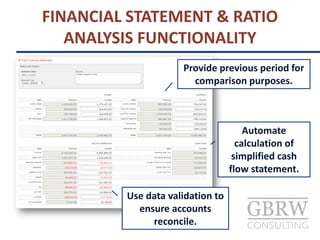

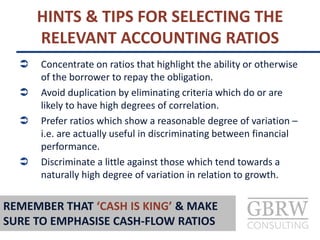

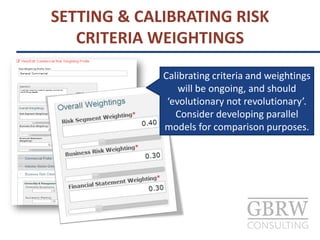

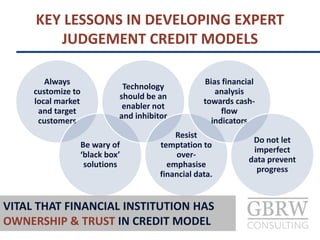

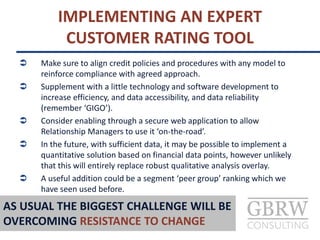

The document discusses the implementation of an expert judgement credit rating tool for SMEs to enhance the consistency, reliability, and efficiency of credit assessments. It highlights the importance of tailored credit models based on various customer segments, along with the need for reliable financial data and detailed sector analysis. Additionally, it provides insights into risk segmentation, scoring methodologies, and best practices for effectively managing SME credit assessments.