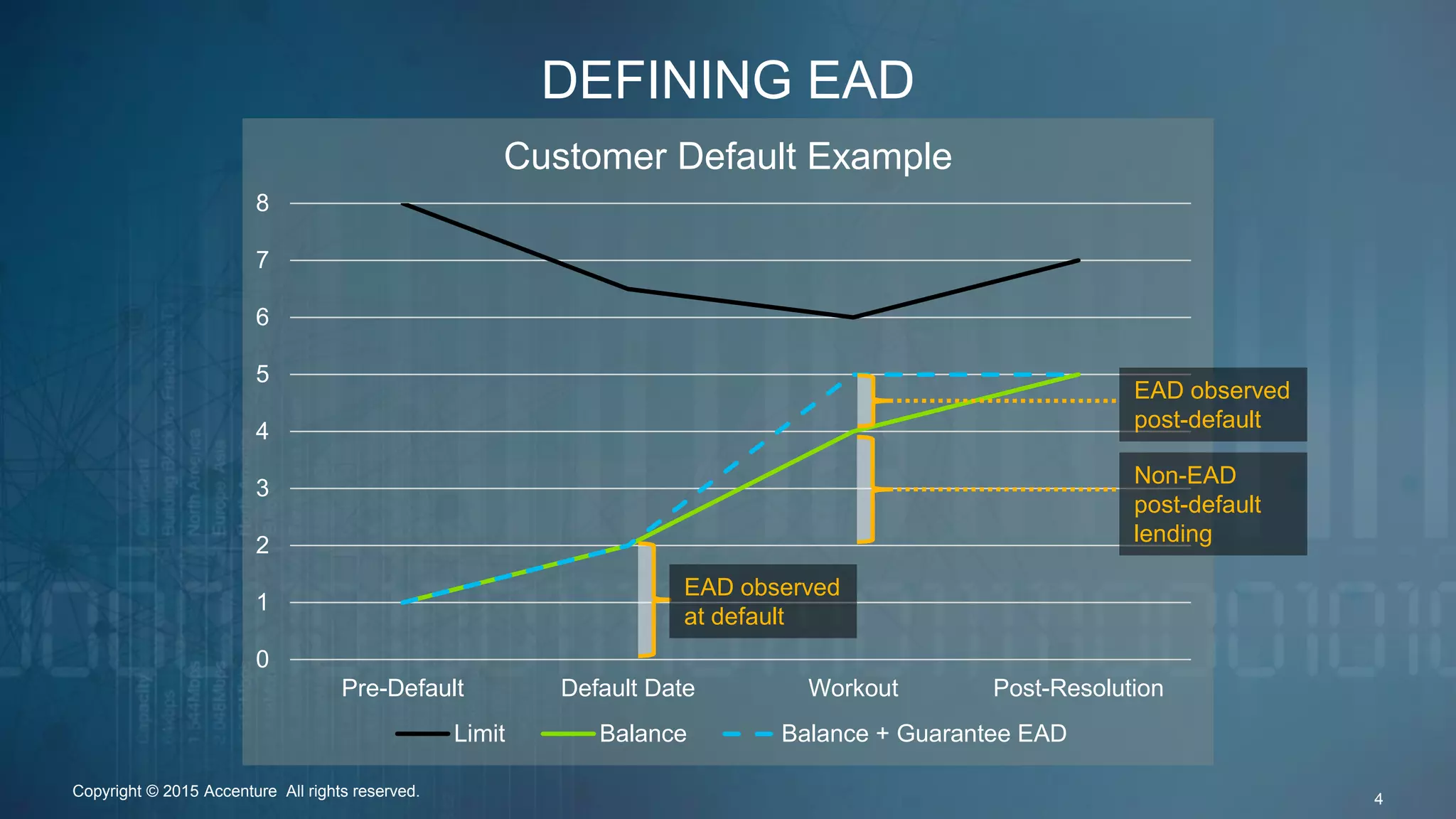

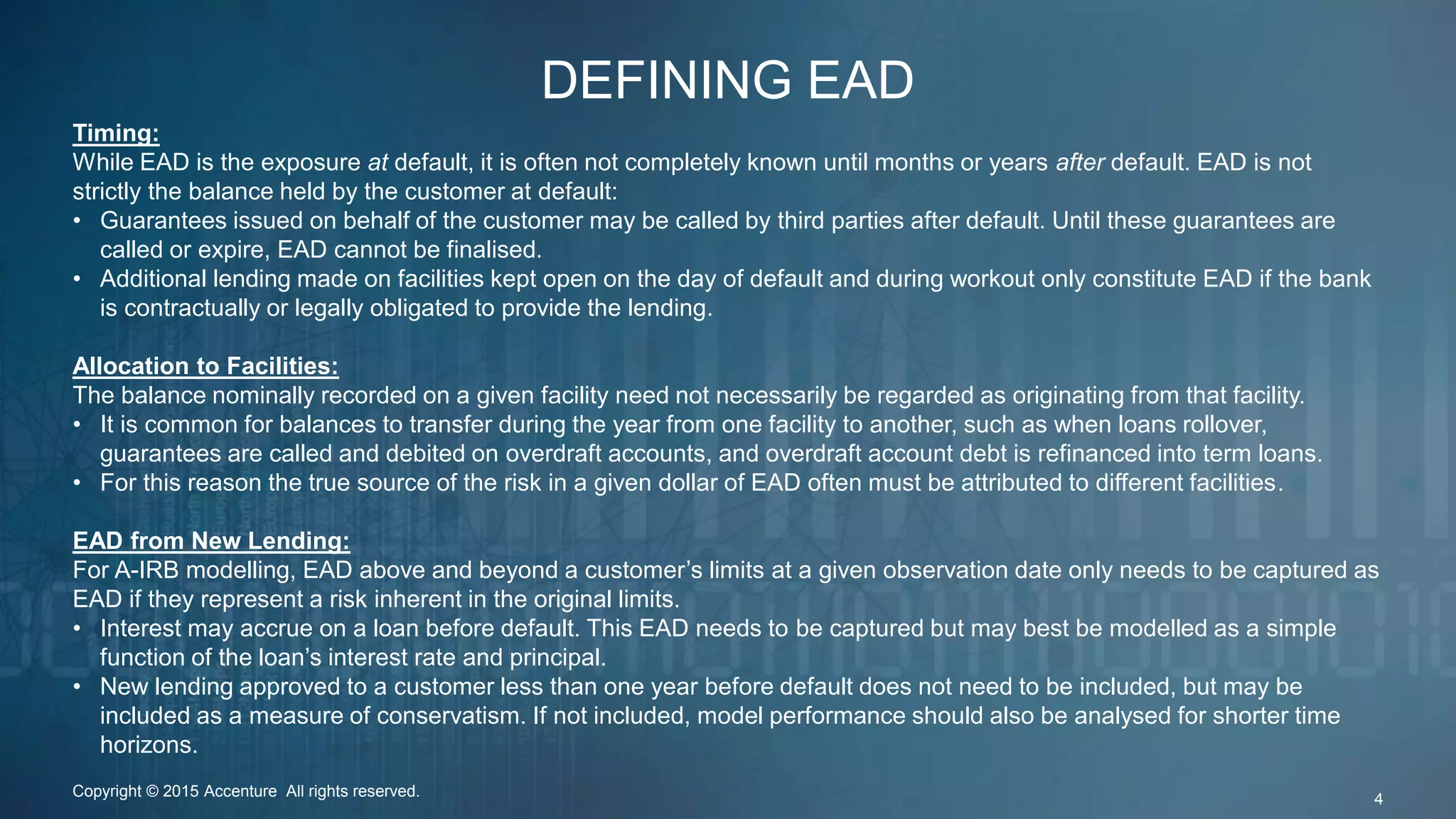

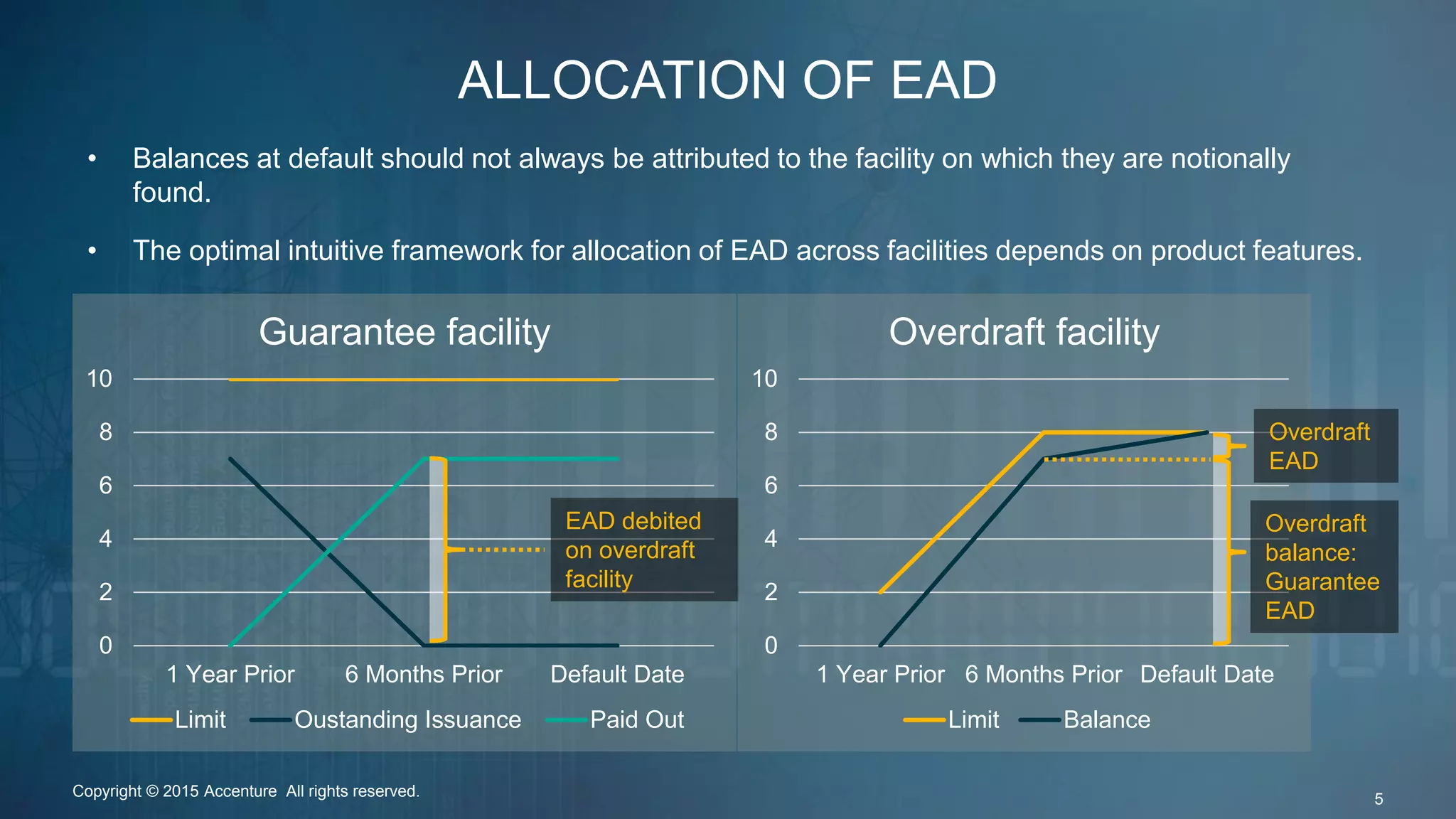

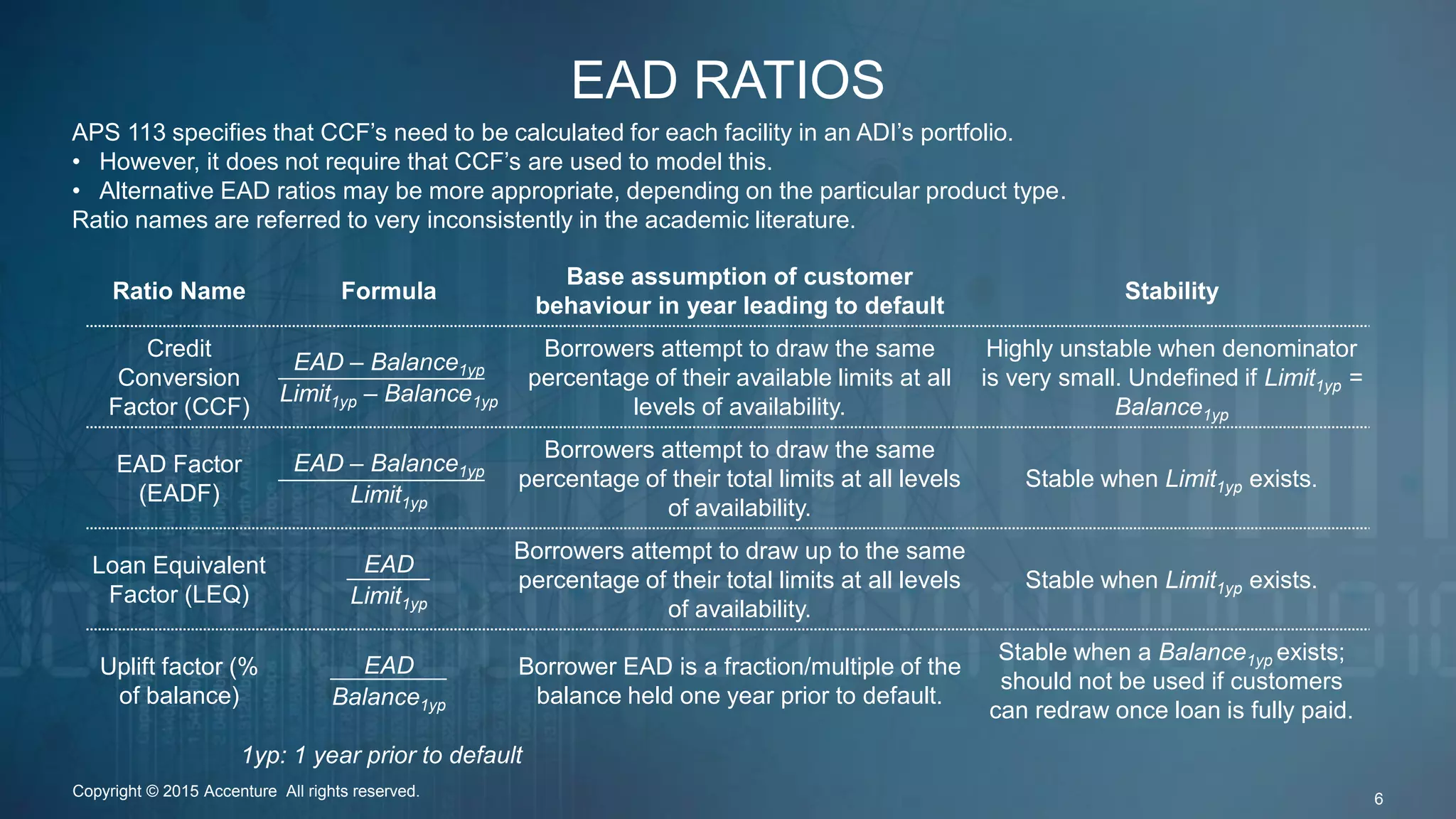

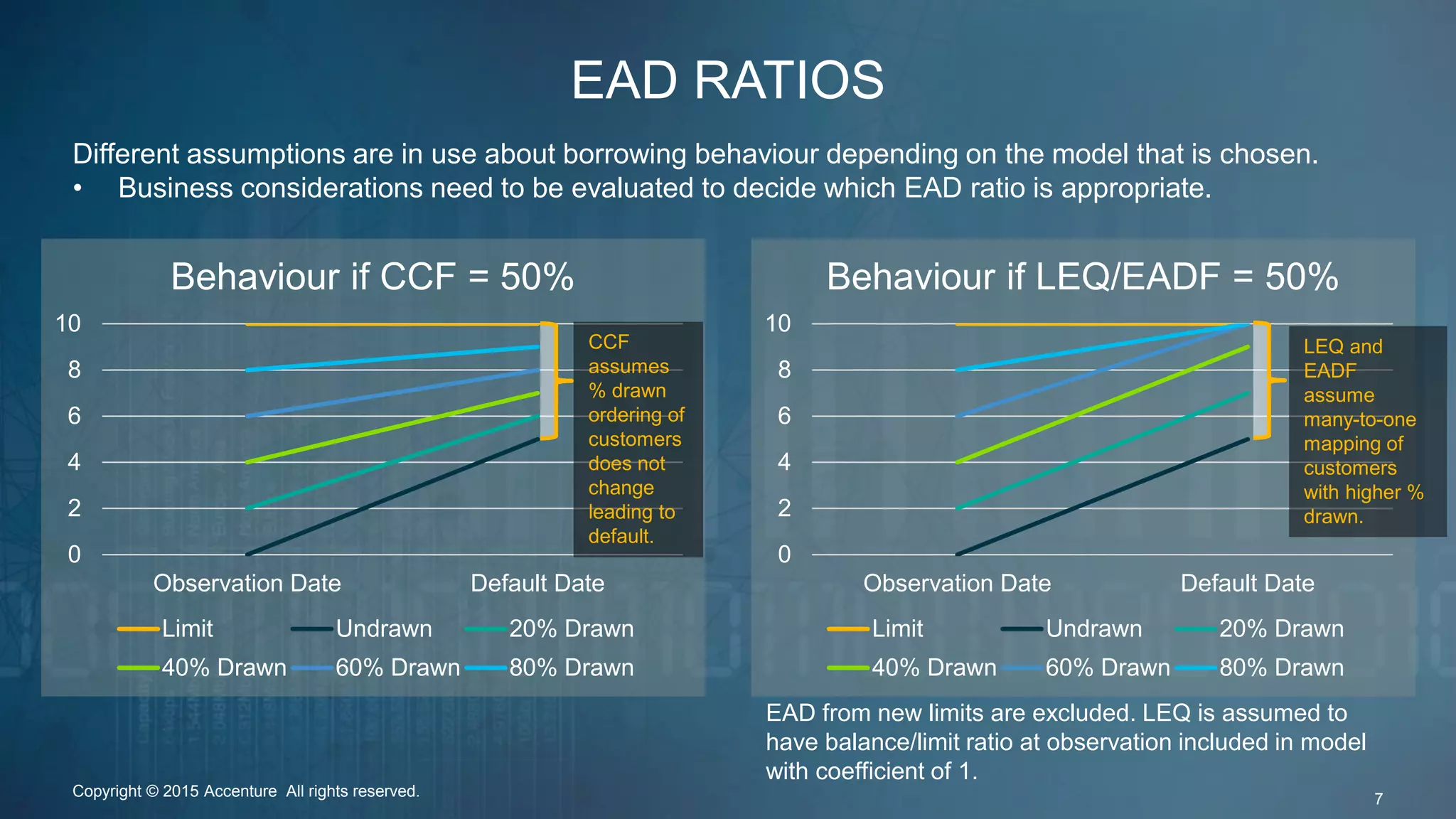

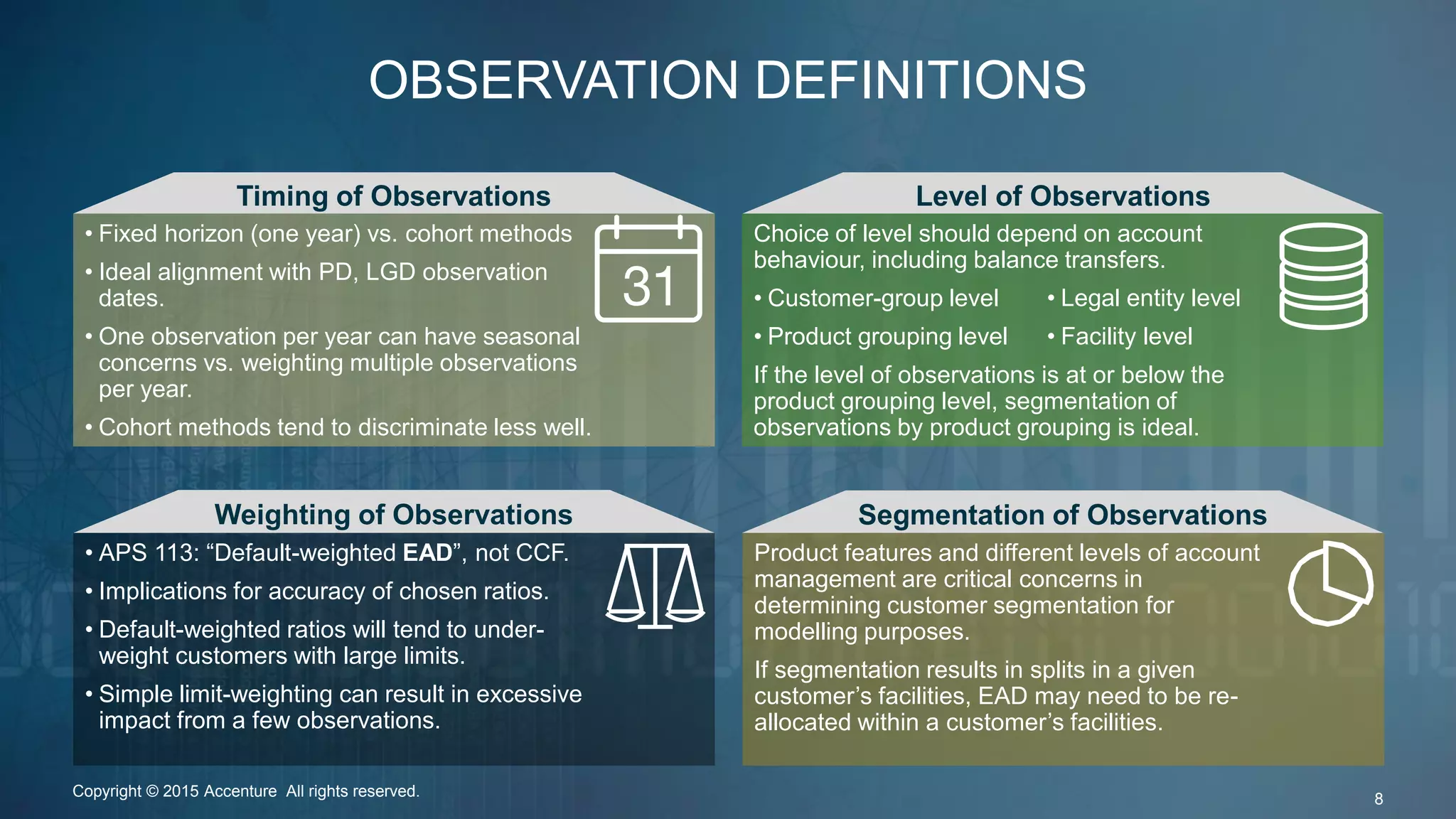

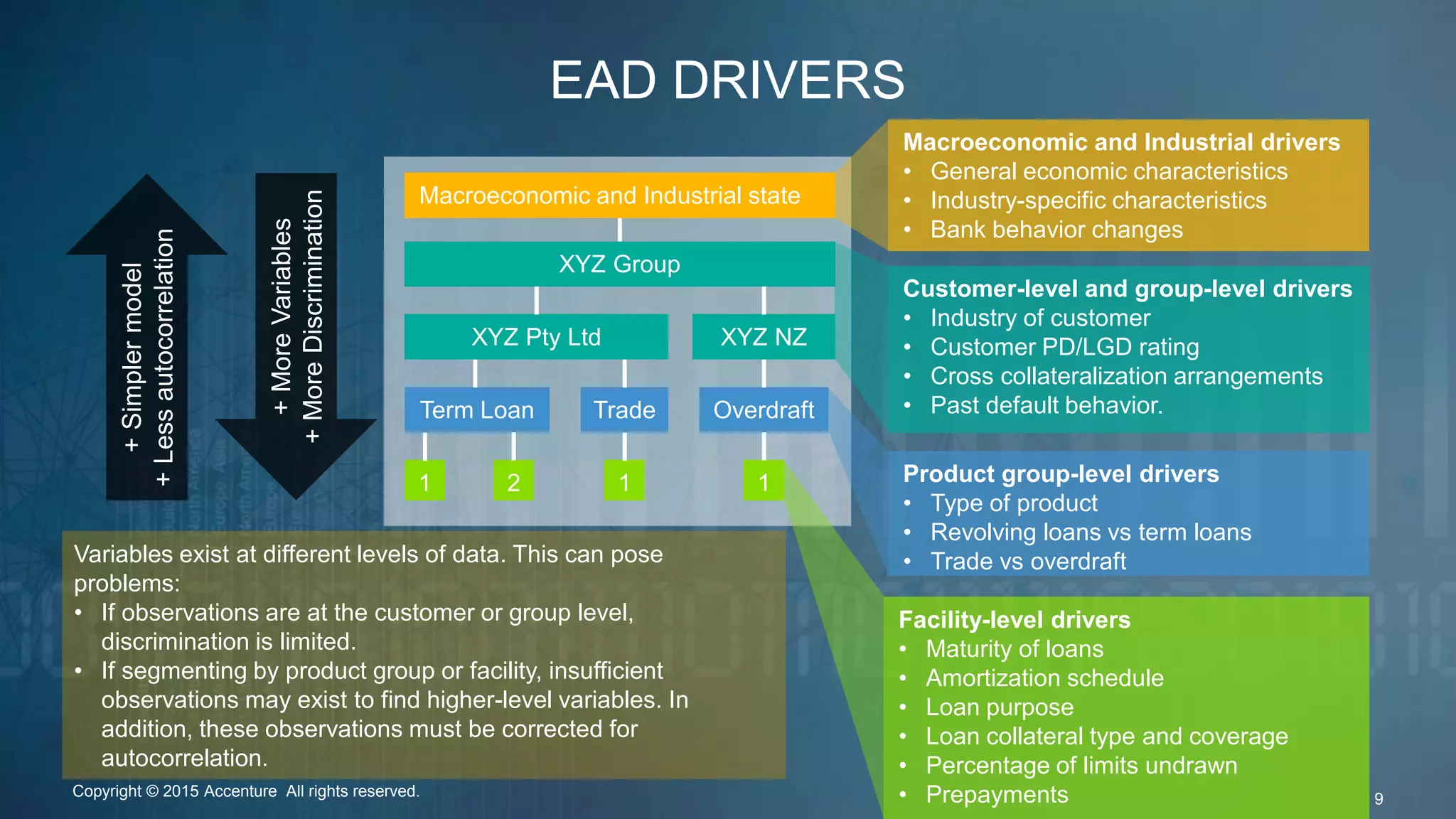

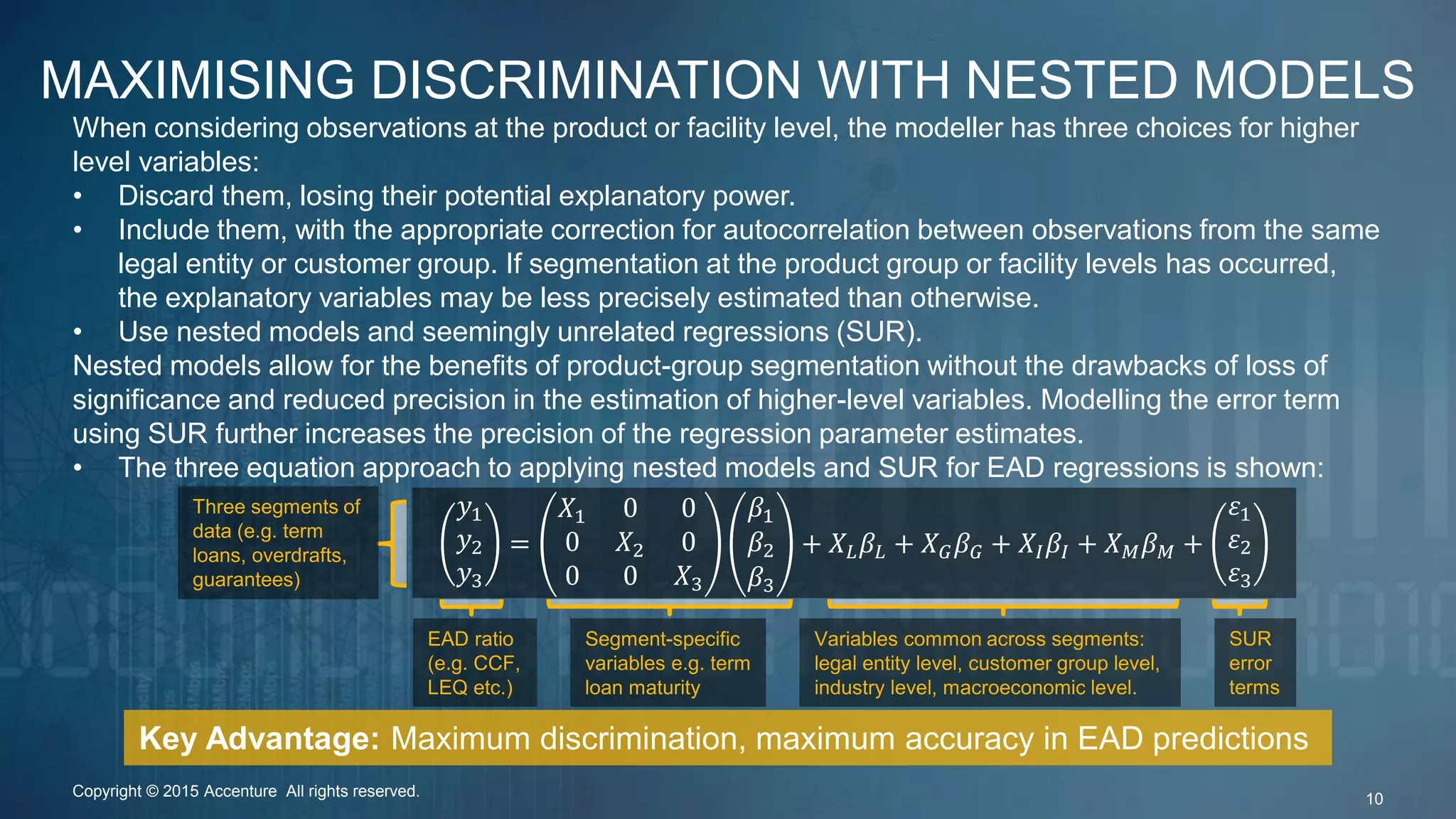

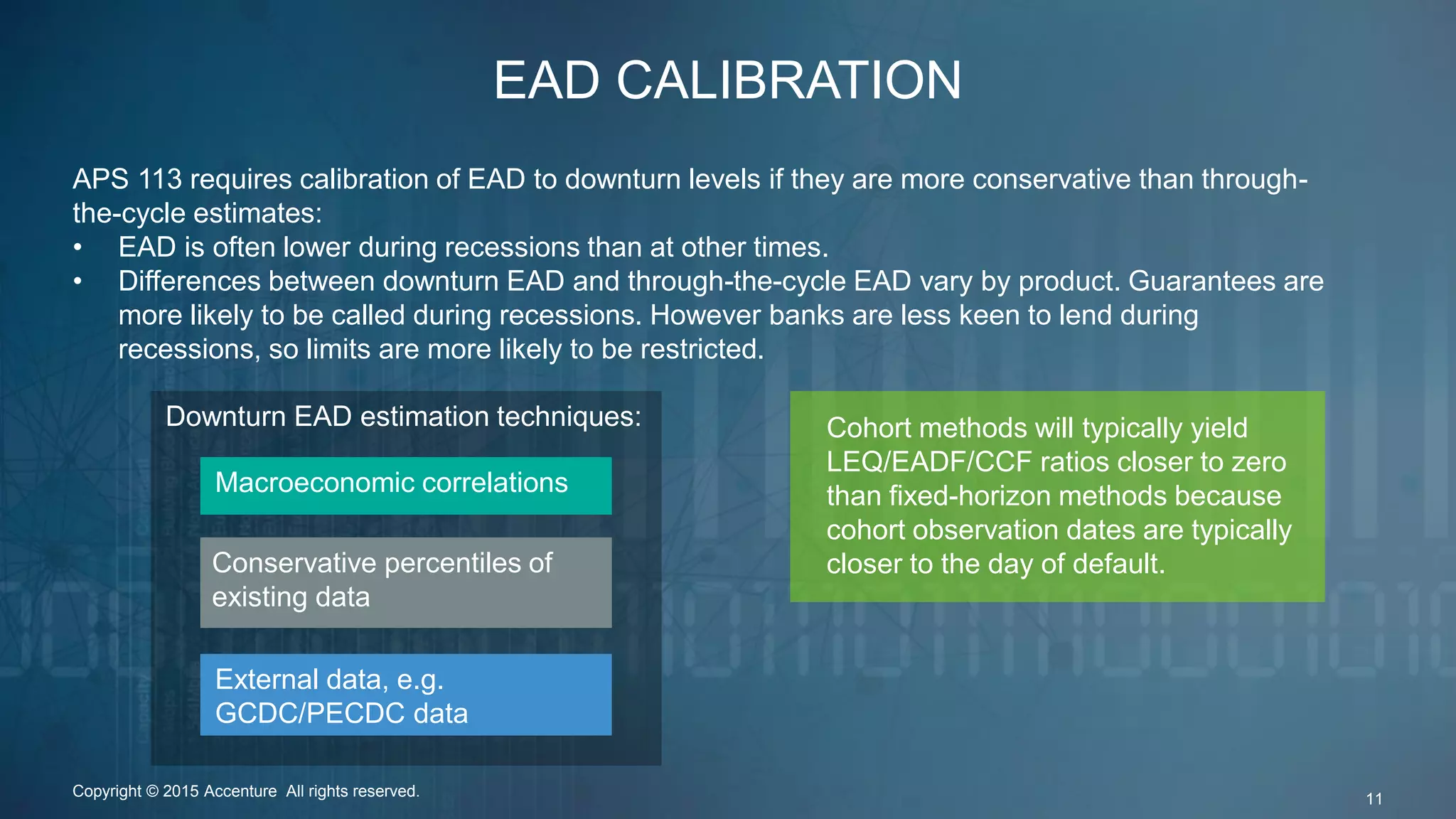

This document discusses best practices for modelling exposure at default (EAD) for calculating regulatory capital requirements. It covers defining and allocating EAD, different EAD ratio methodologies, segmentation of observations, identifying EAD drivers, maximizing discrimination through nested models, and calibrating EAD estimates to downturn levels as required. The key benefits of redeveloping EAD models are identified as improved capital optimization, pricing optimization, customer and product discrimination, and compliance with IFRS 9 and A-IRB requirements.