Embed presentation

Downloaded 224 times

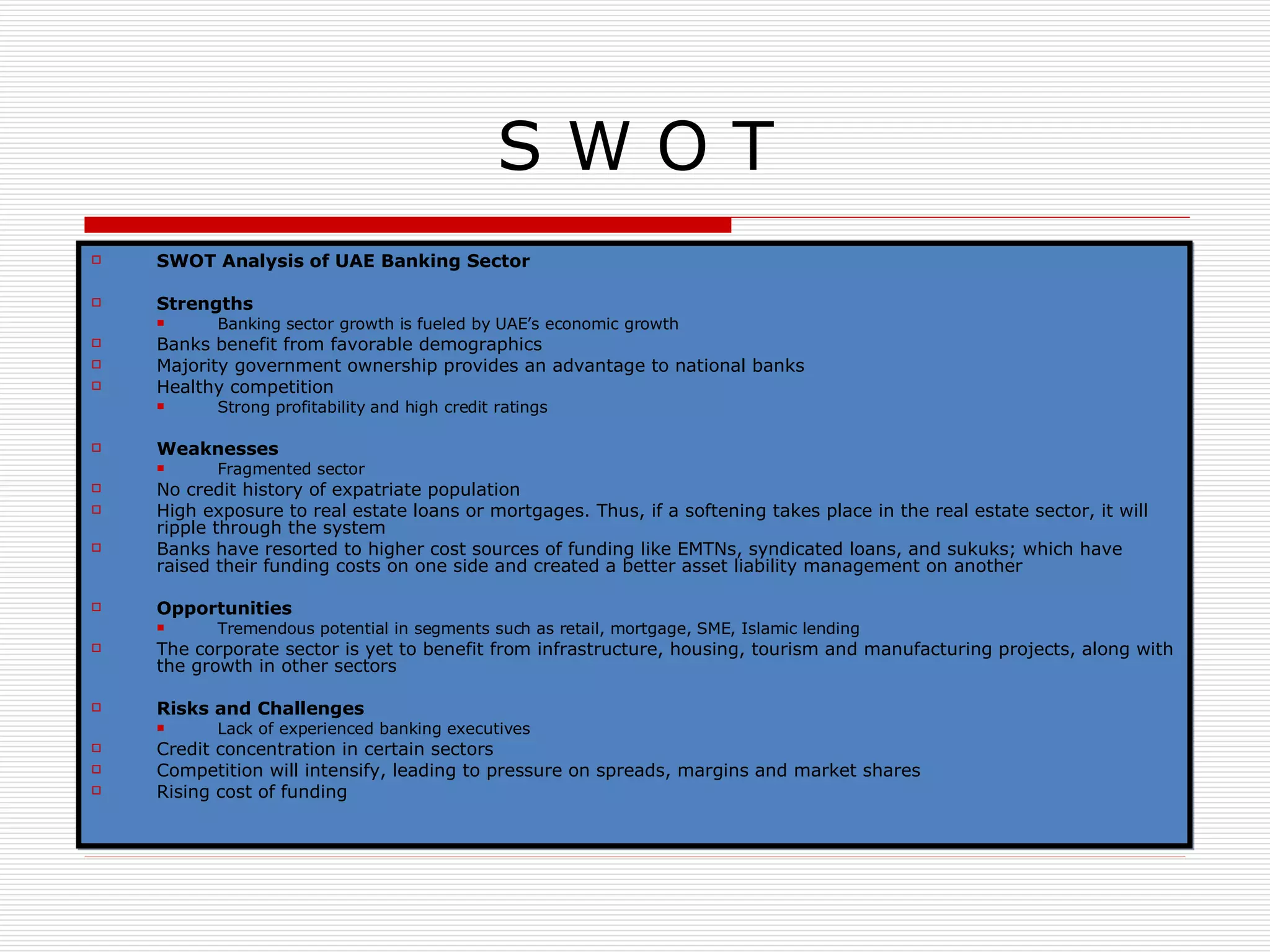

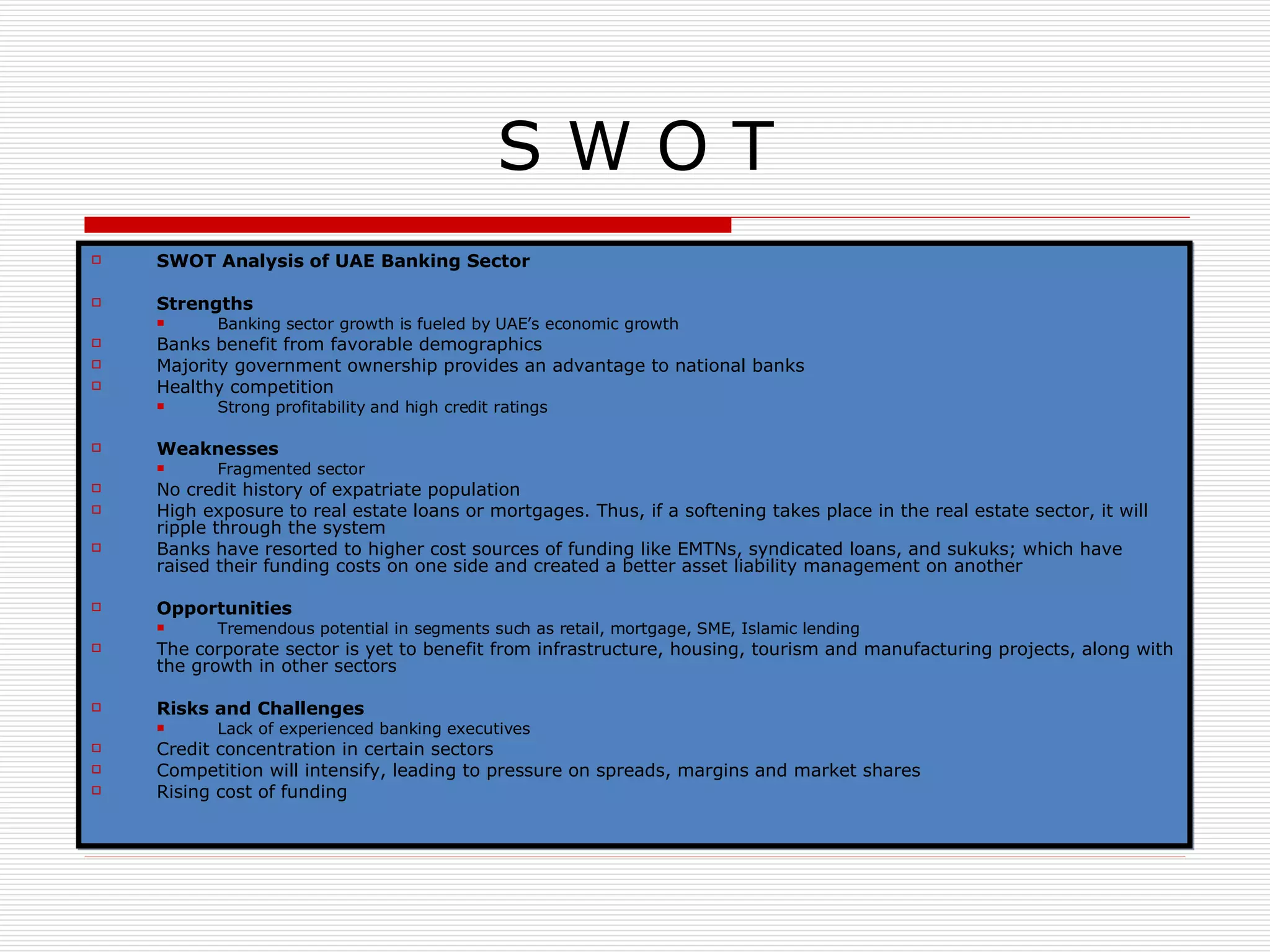

The document summarizes the UAE banking sector. It notes that the sector is governed by the UAE Central Bank and consists of 48 licensed national banks and 27 foreign banks. A SWOT analysis identifies strengths like economic growth fueling sector growth and high profitability. Weaknesses include a fragmented sector and high exposure to real estate loans. Opportunities exist in retail, mortgage, and Islamic lending. Risks include a lack of experienced executives and credit concentration in certain sectors.