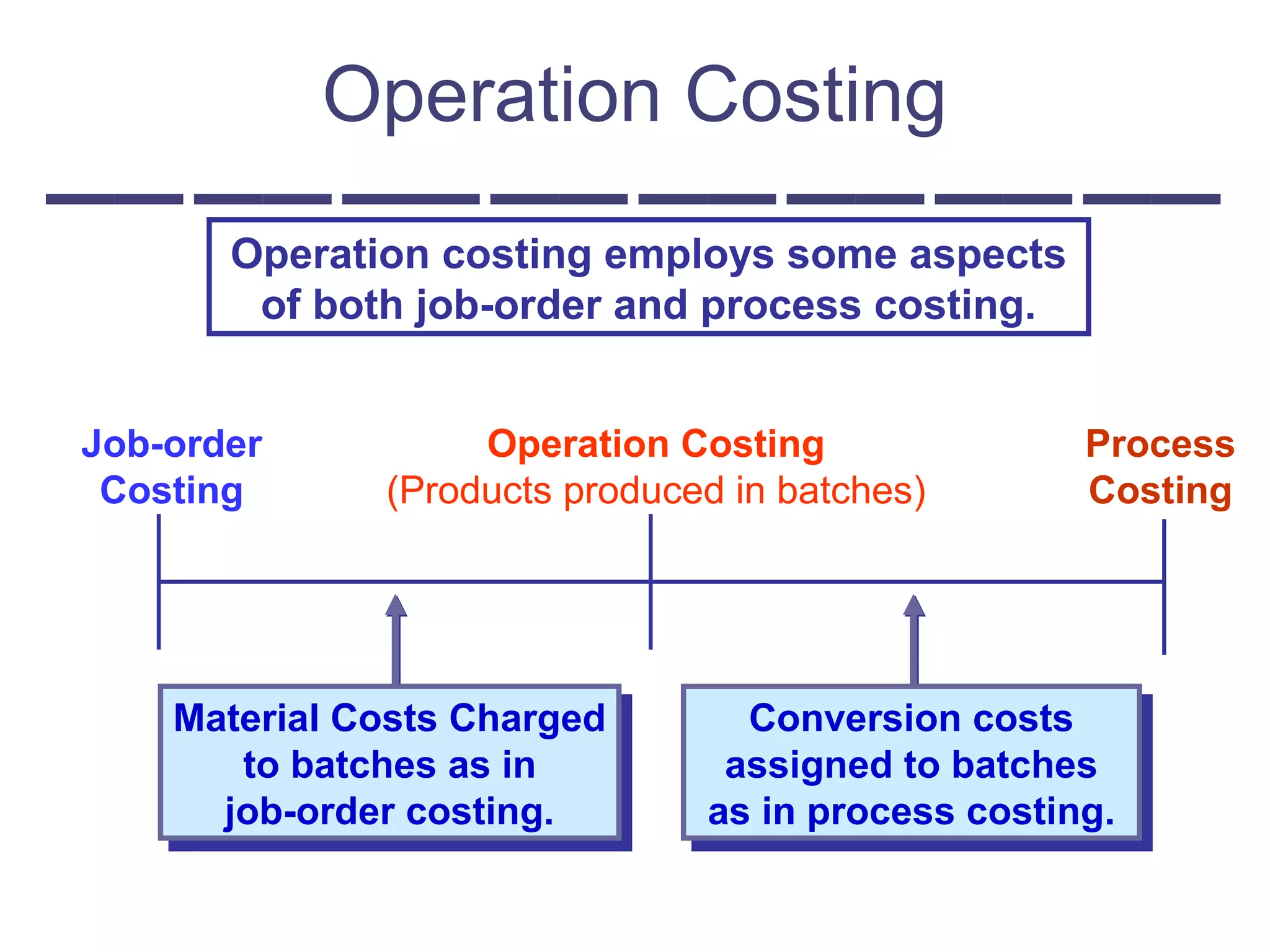

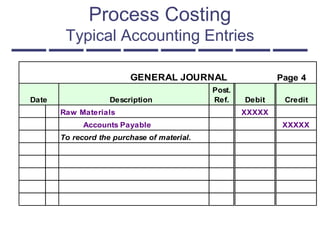

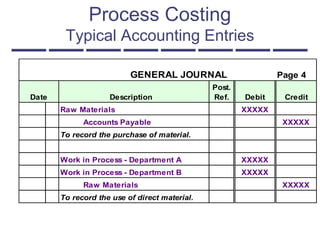

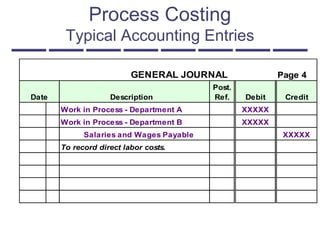

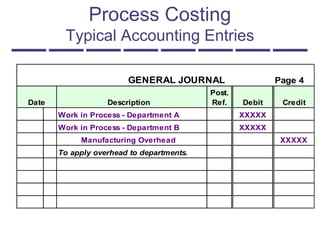

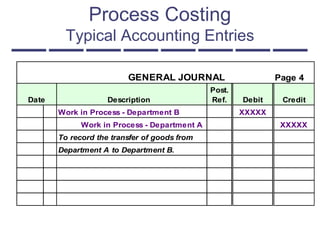

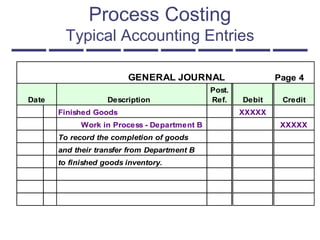

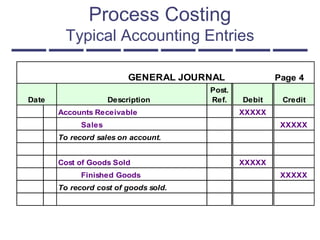

Operation costing employs aspects of both job-order and process costing. Conversion costs are assigned to batches like in process costing, while material costs are charged to batches like in job-order costing. The document then provides examples of typical accounting entries for a process costing system, including entries to record the purchase and use of raw materials, application of direct labor and overhead costs, transfer of goods between departments, transfer of completed goods to finished goods inventory, recording of sales, and cost of goods sold.