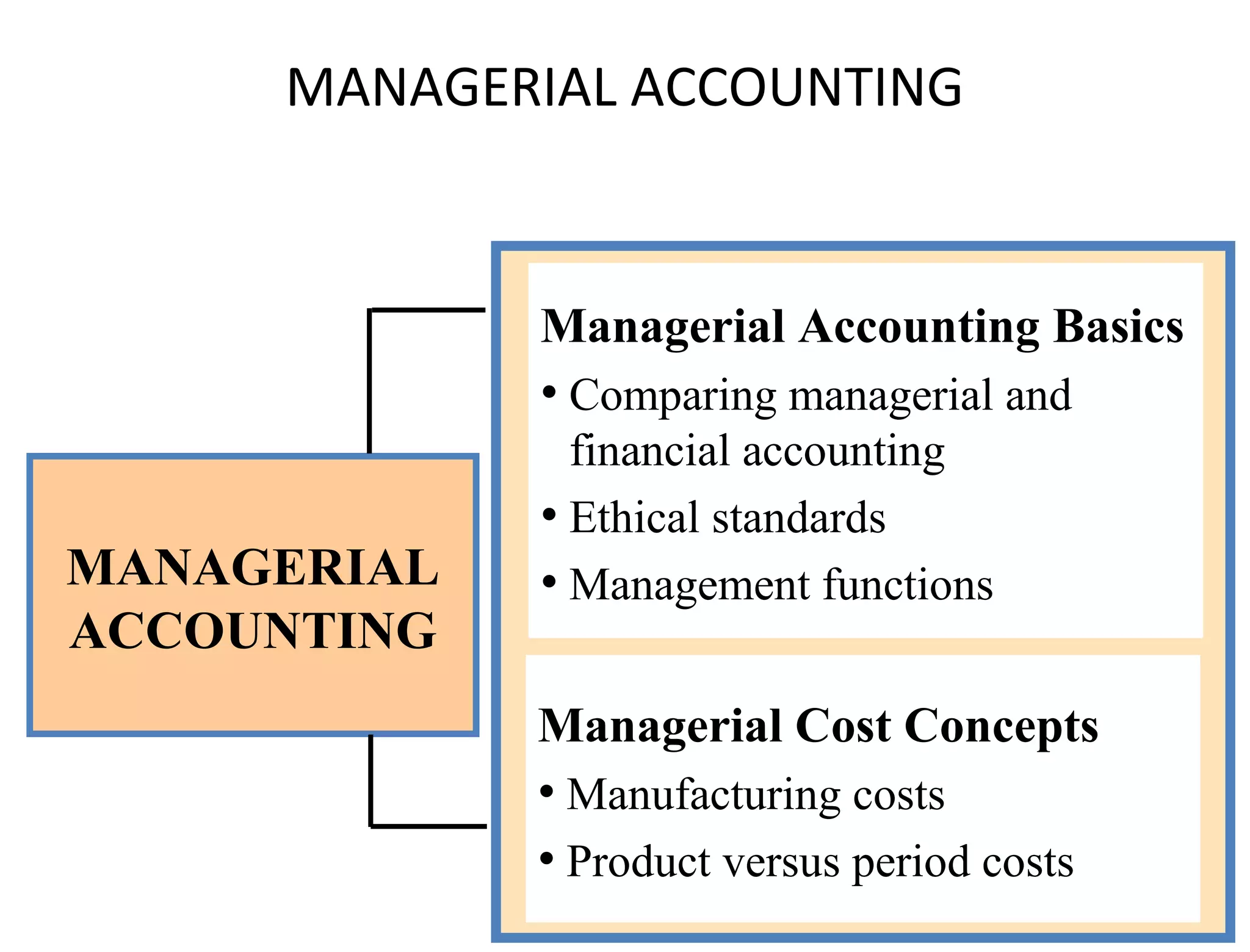

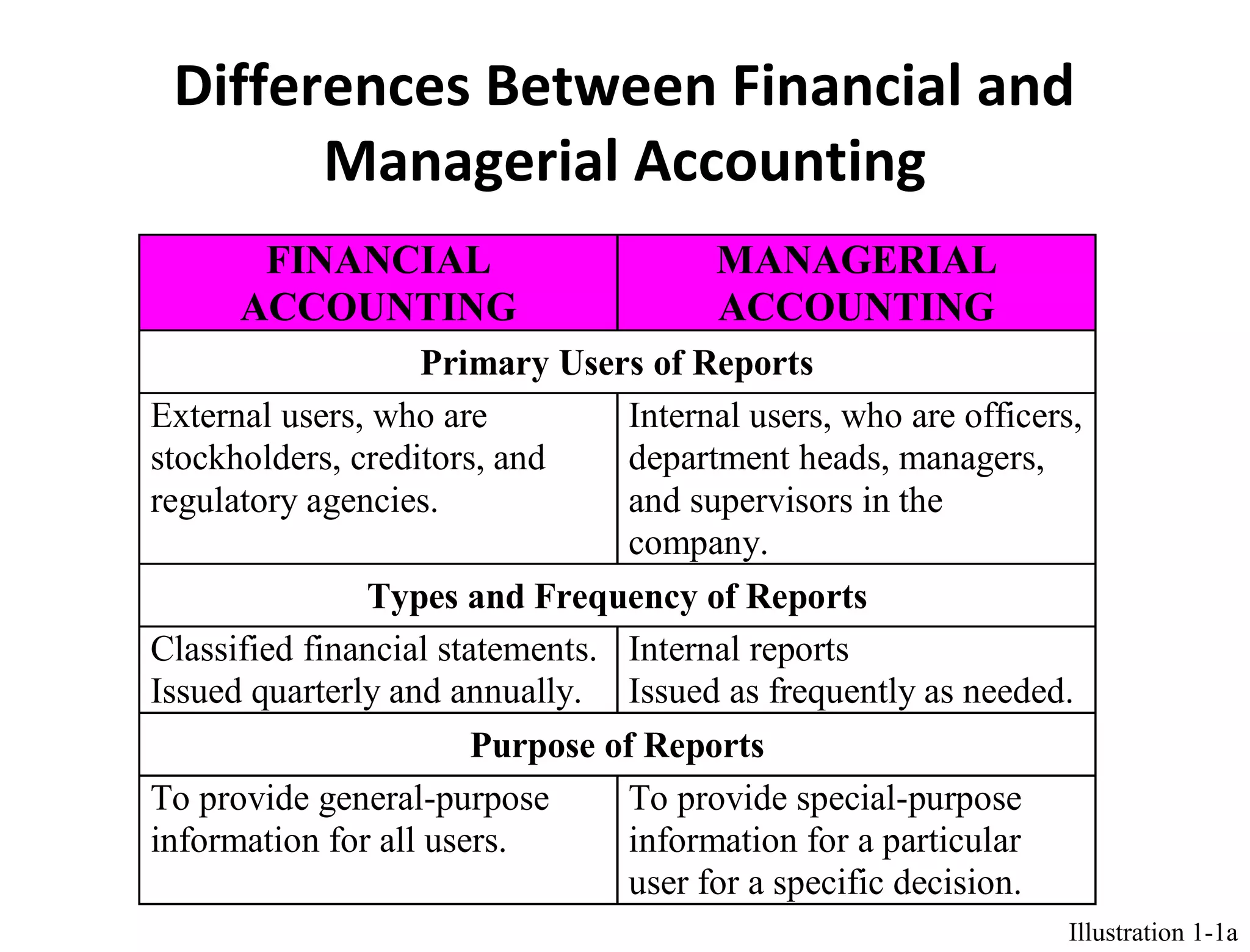

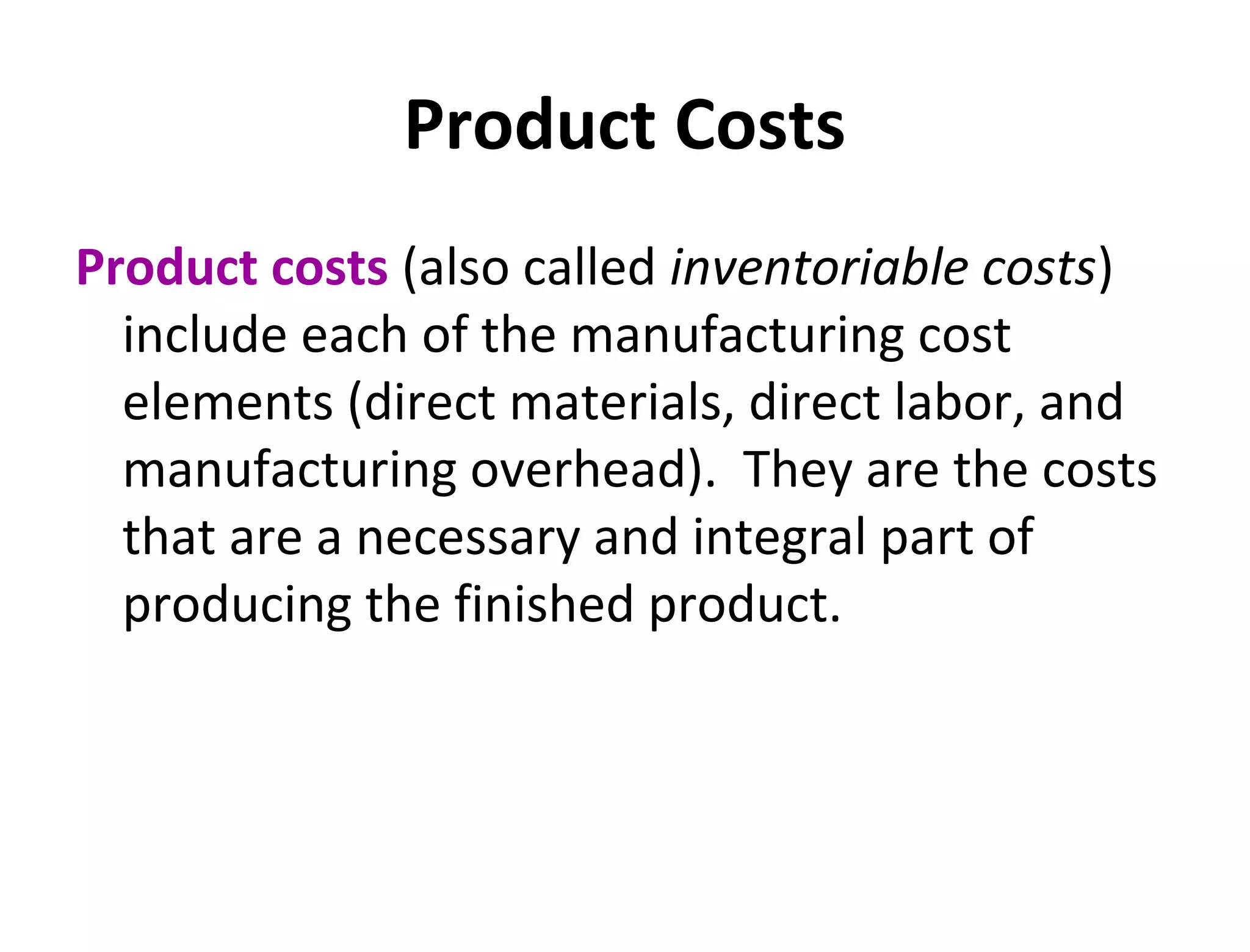

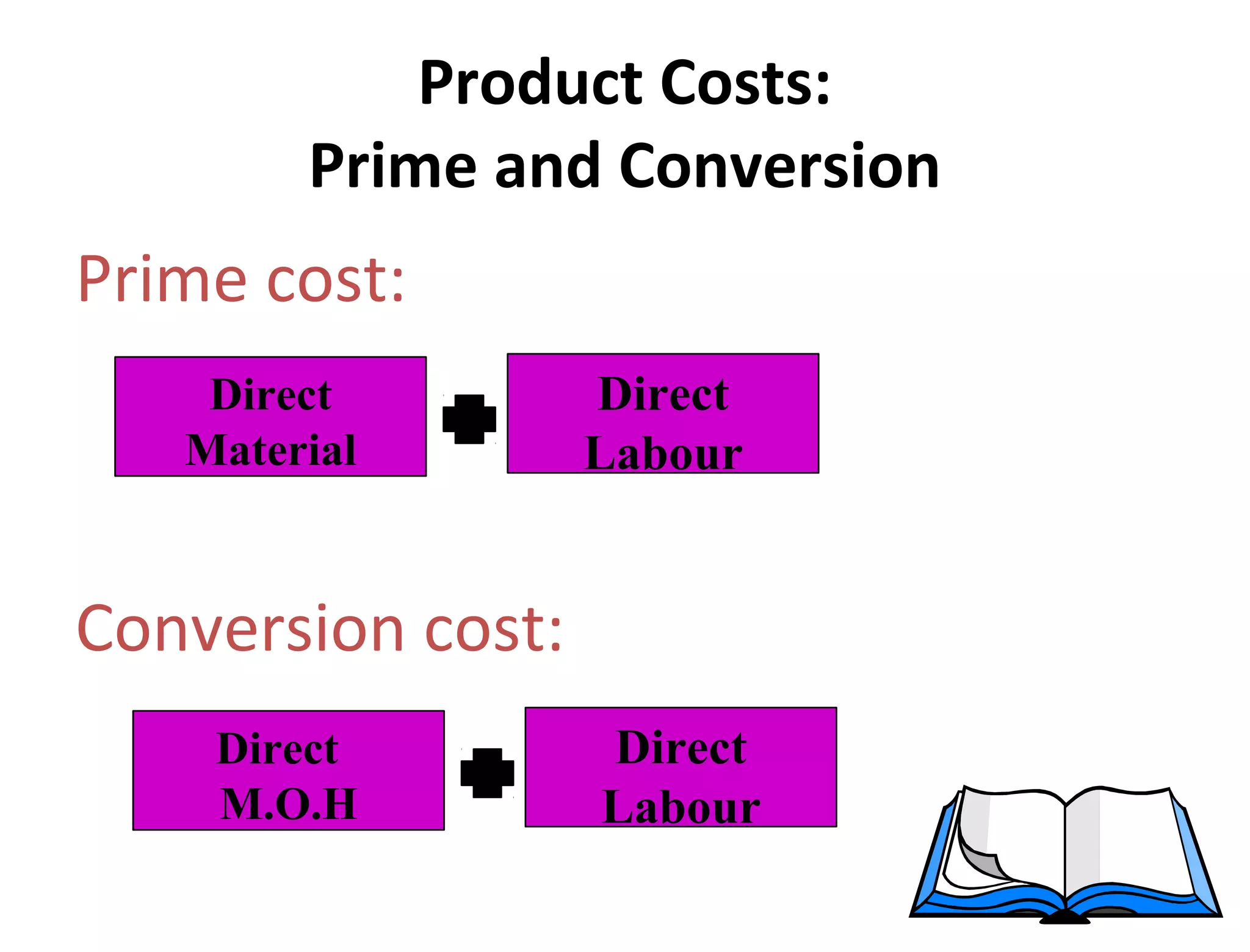

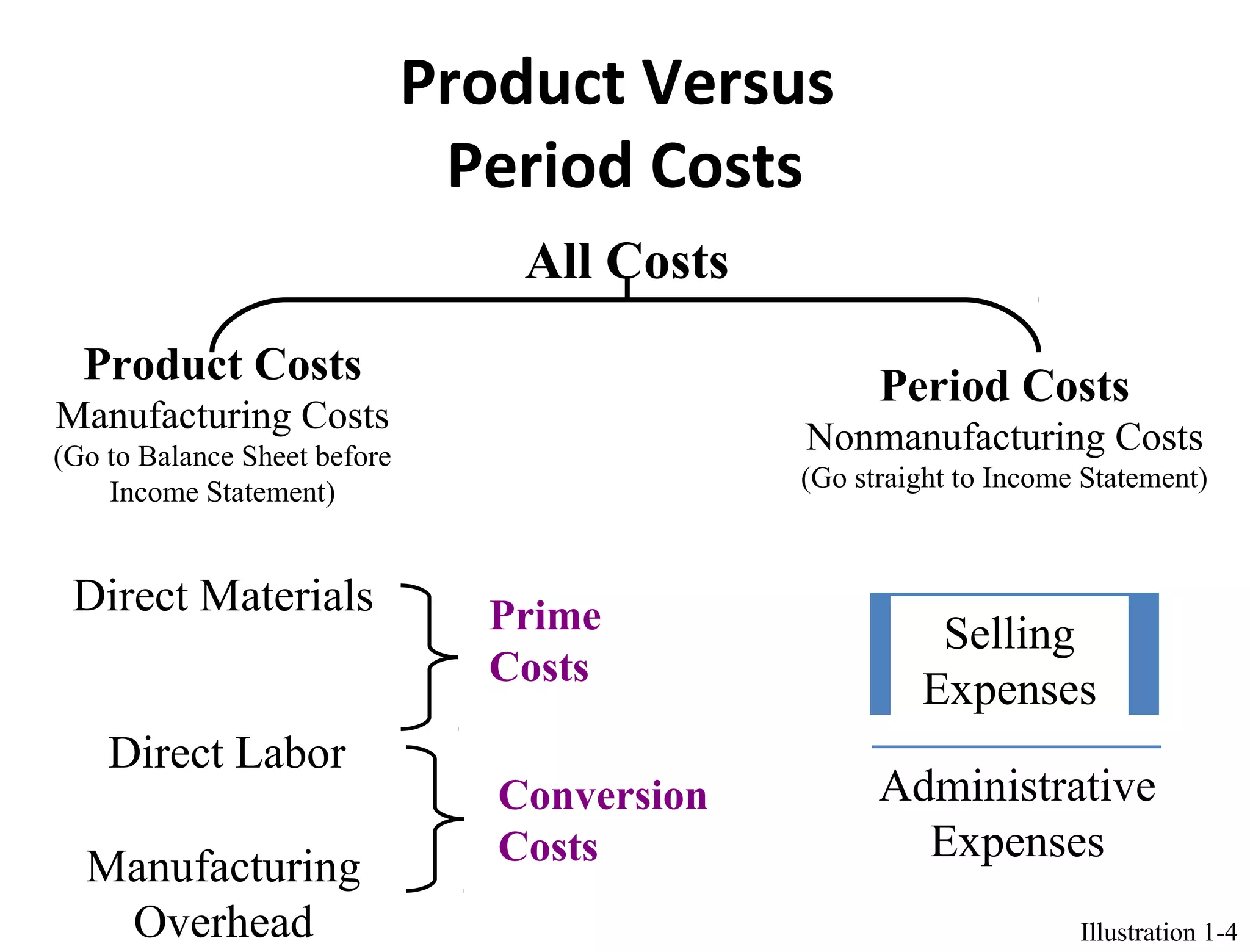

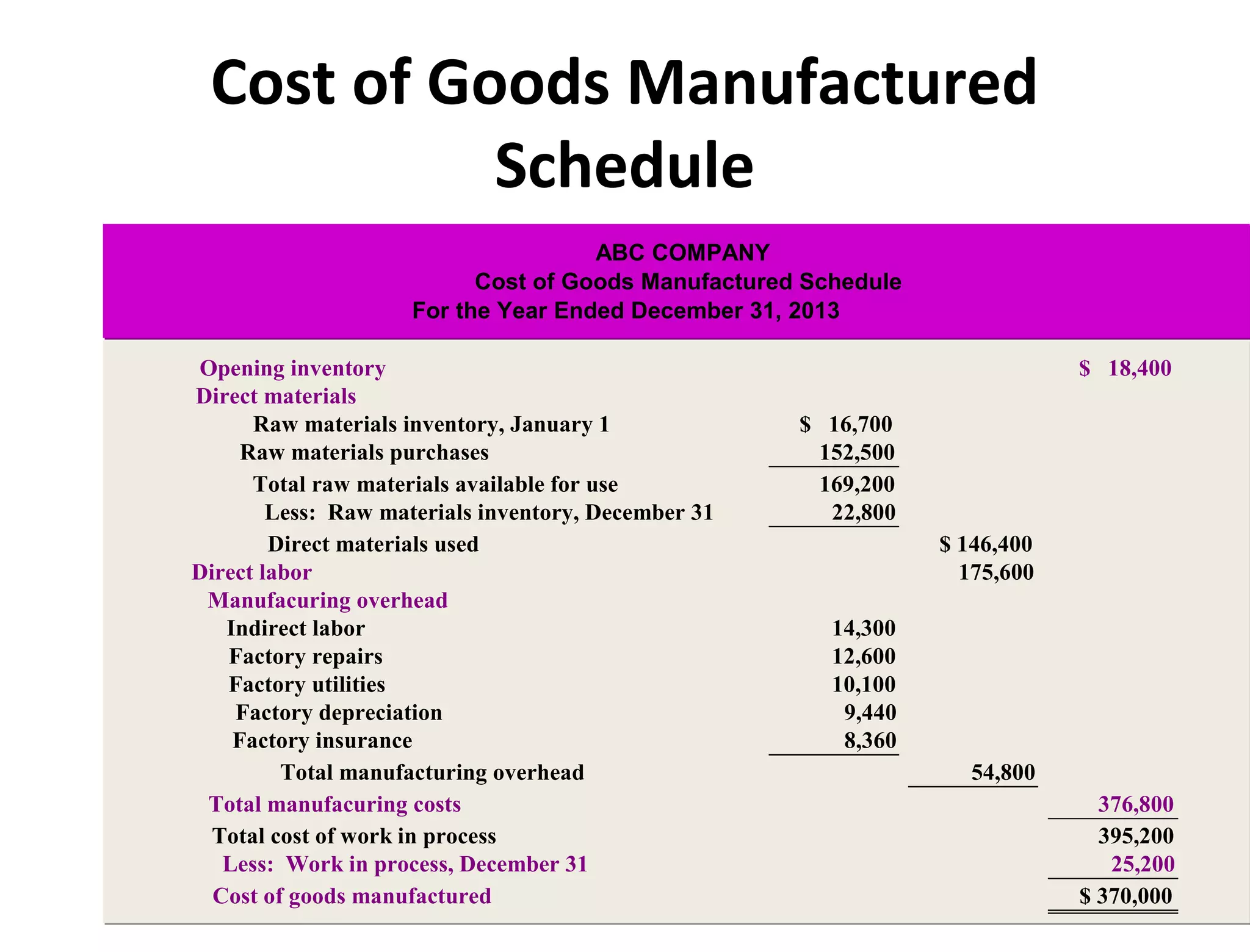

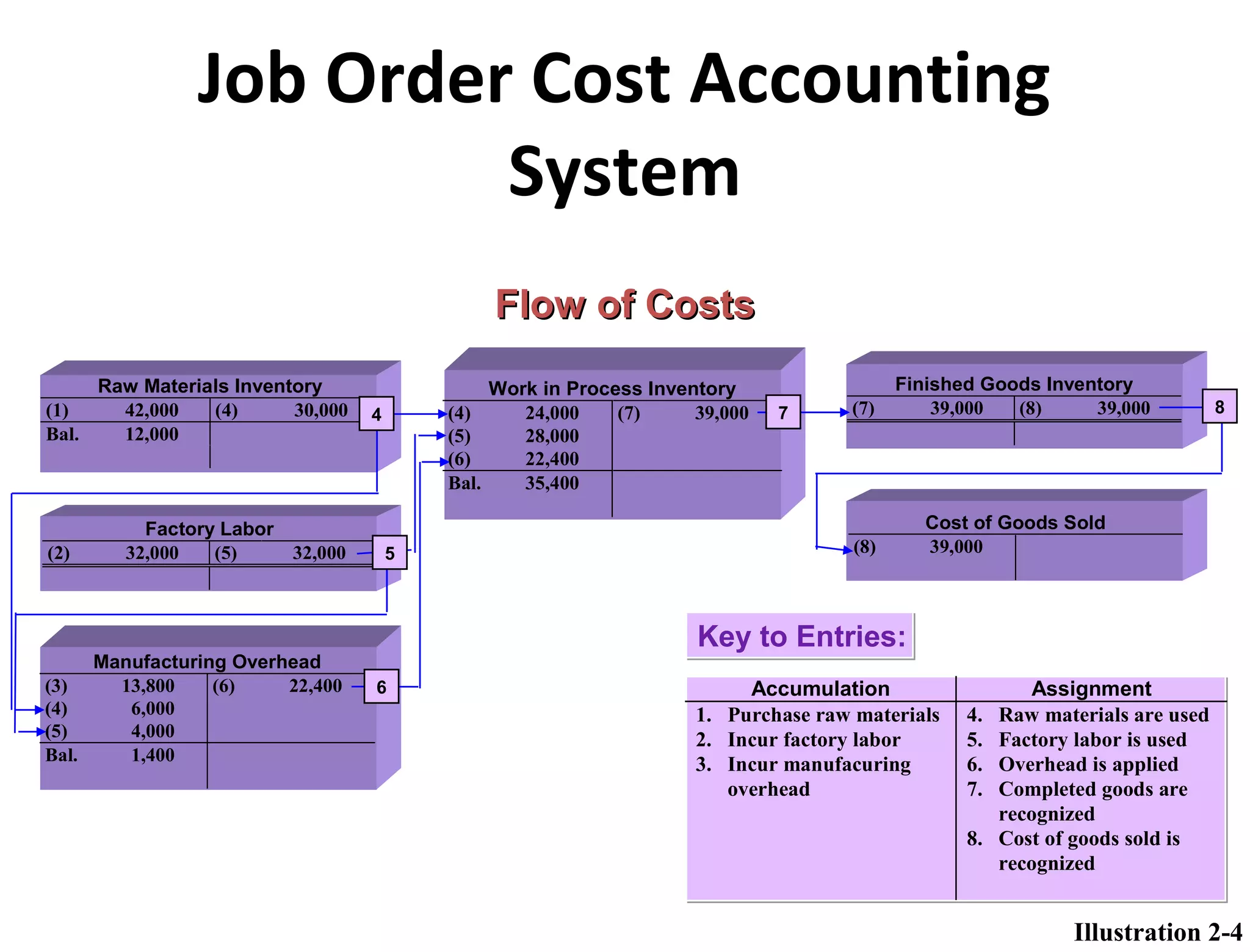

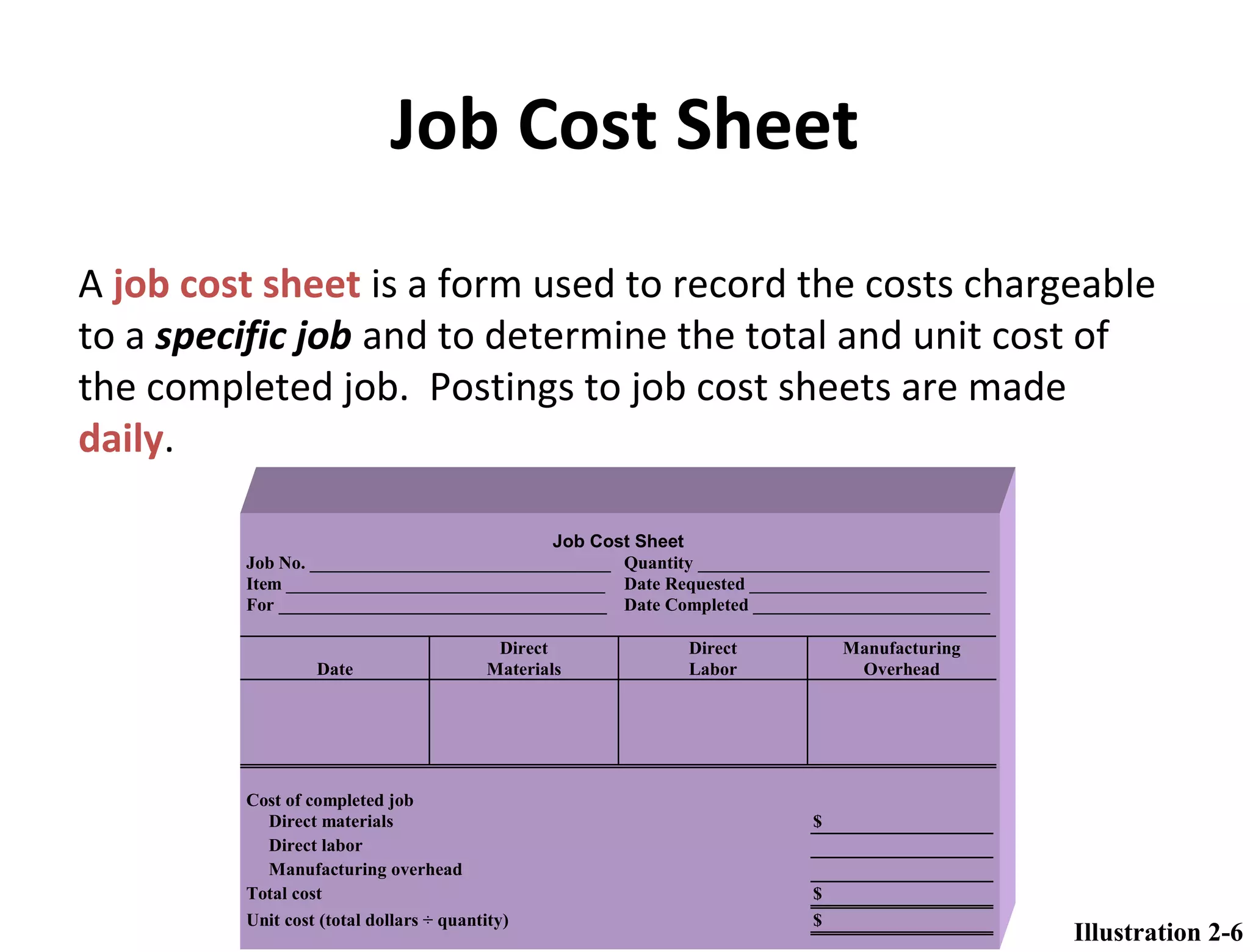

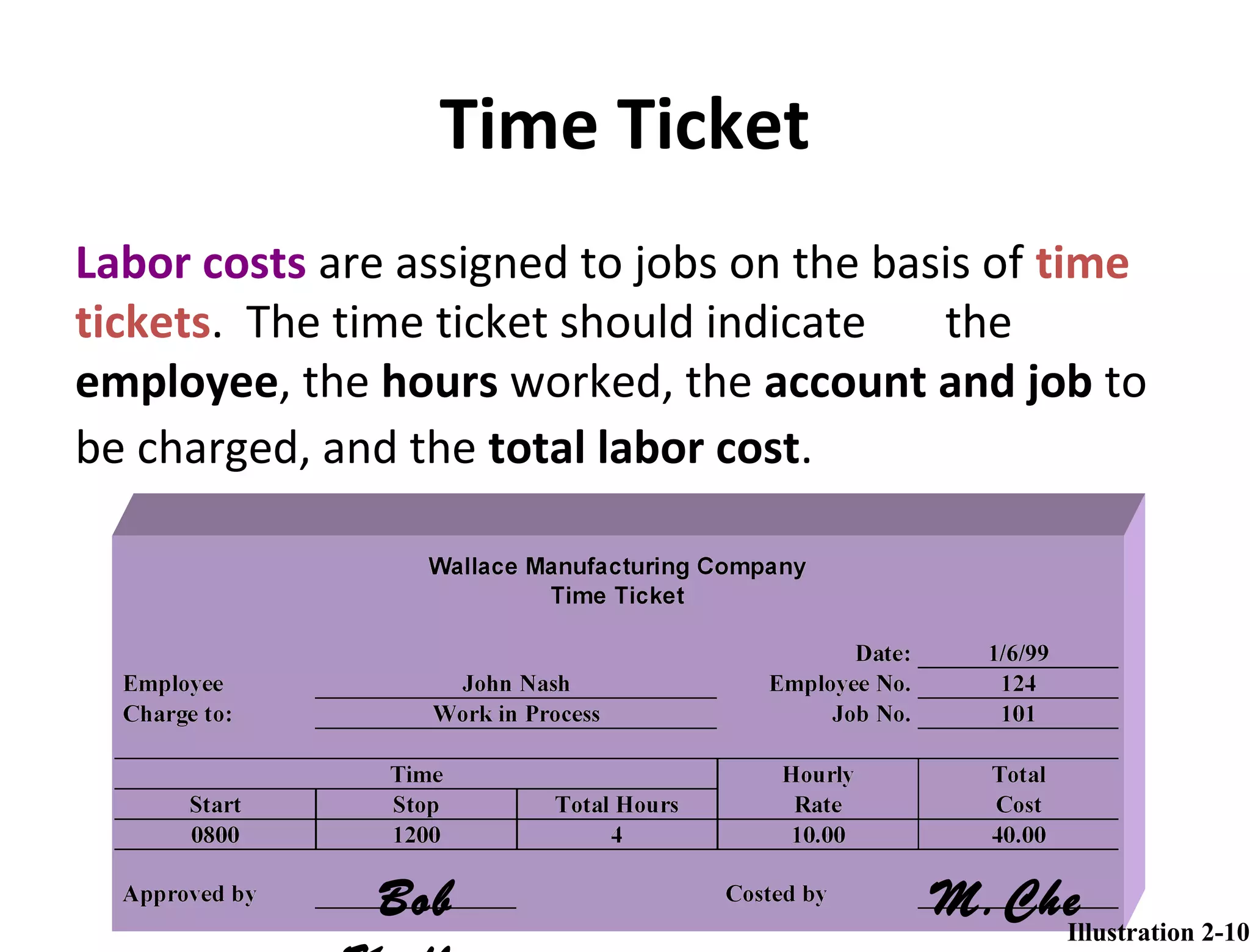

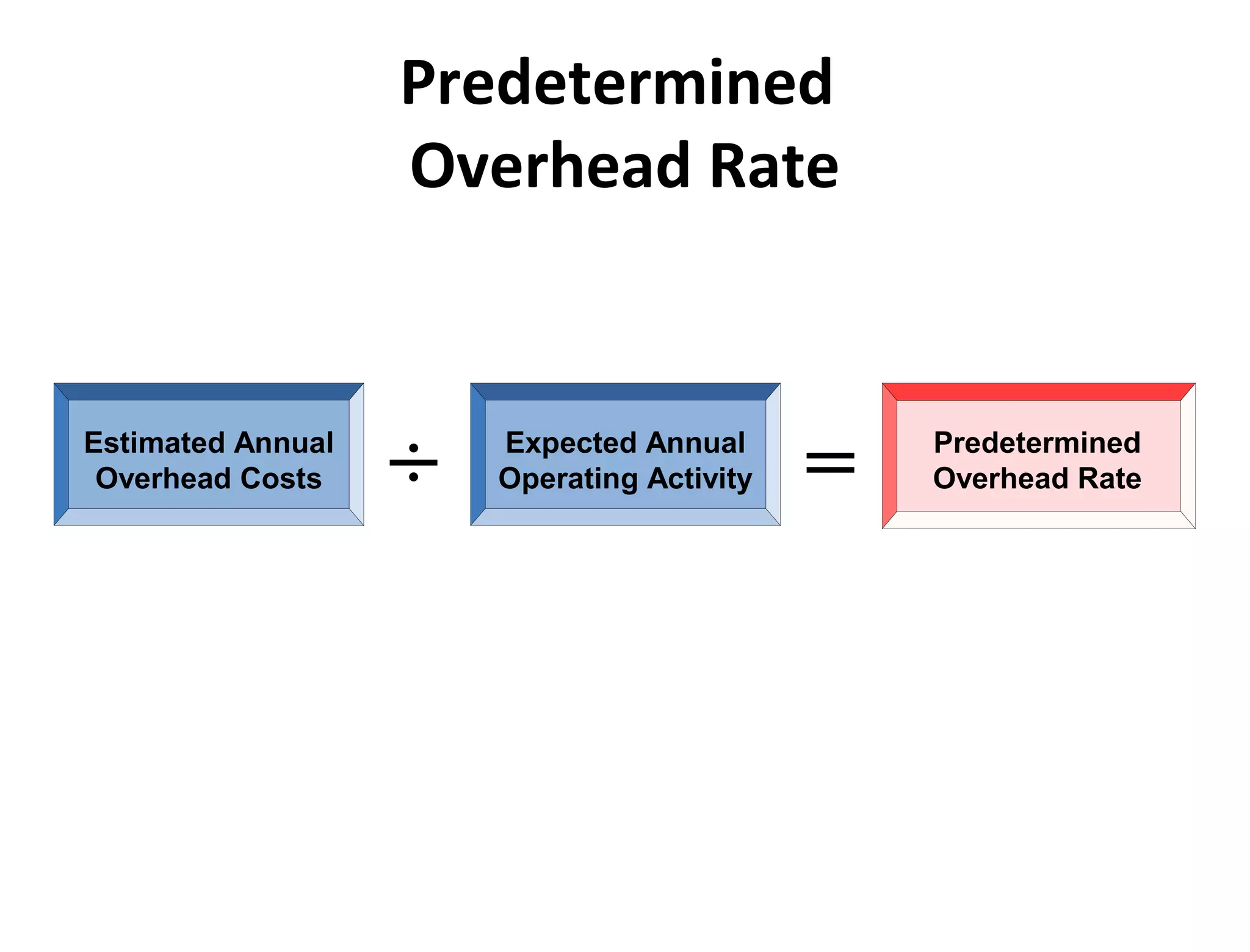

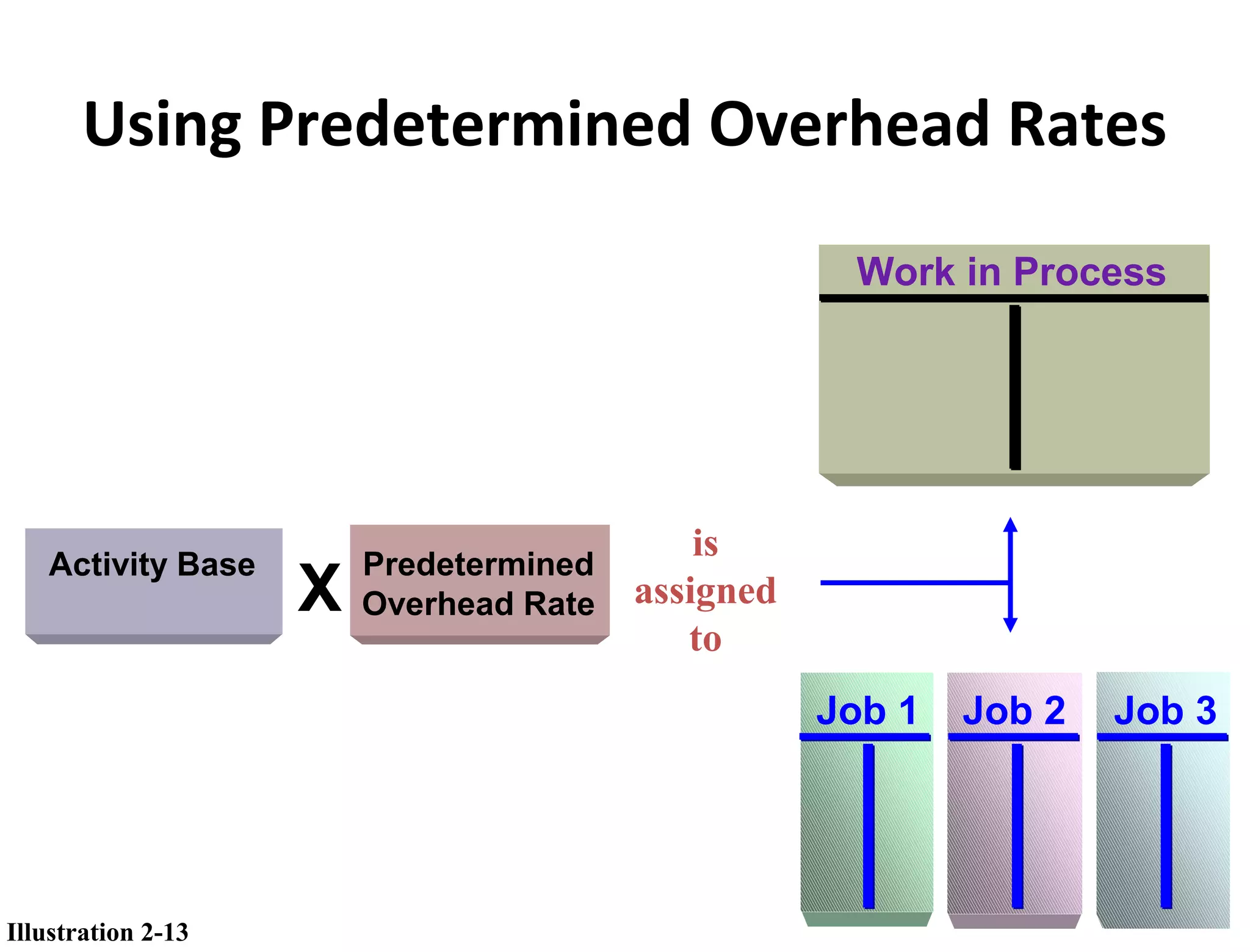

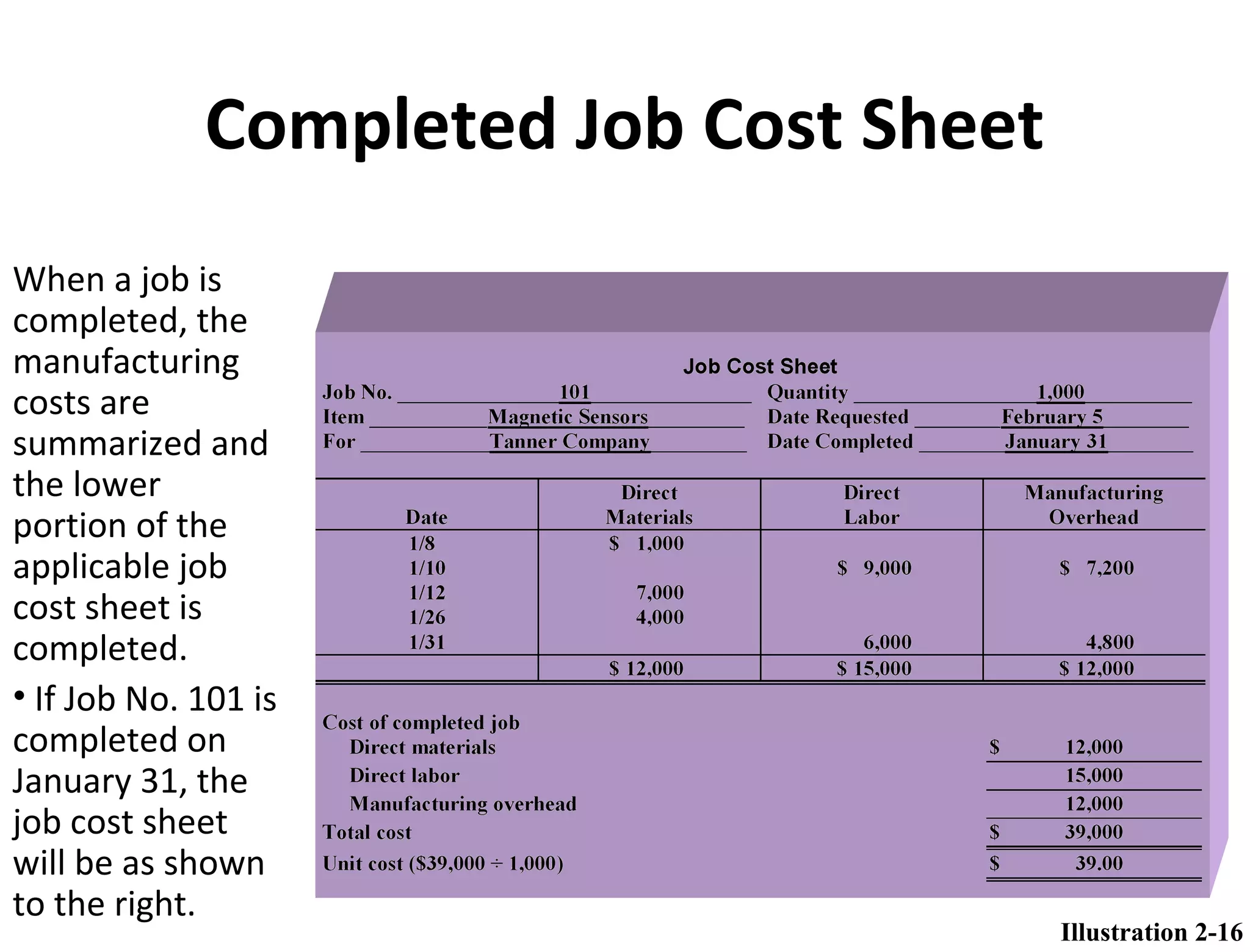

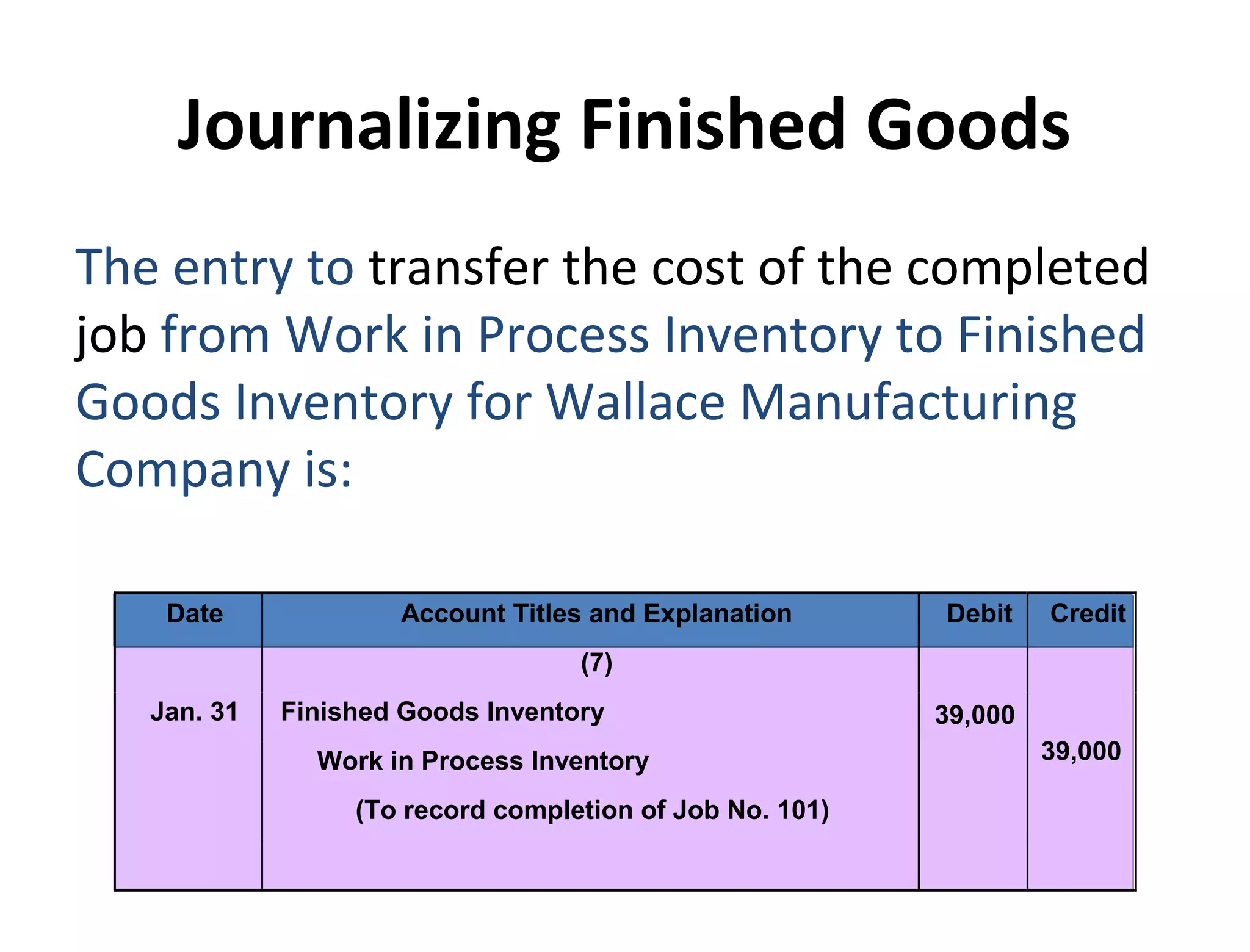

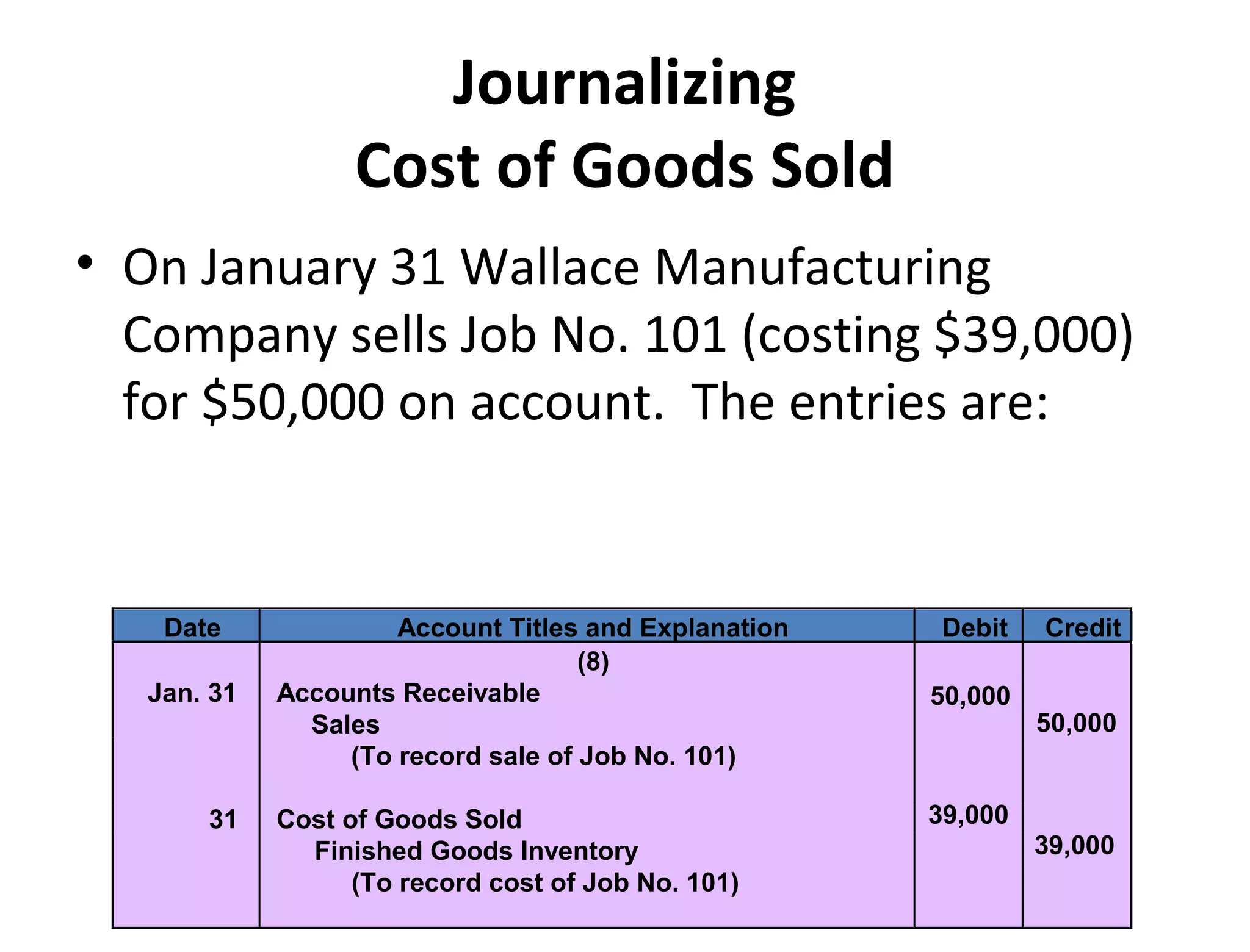

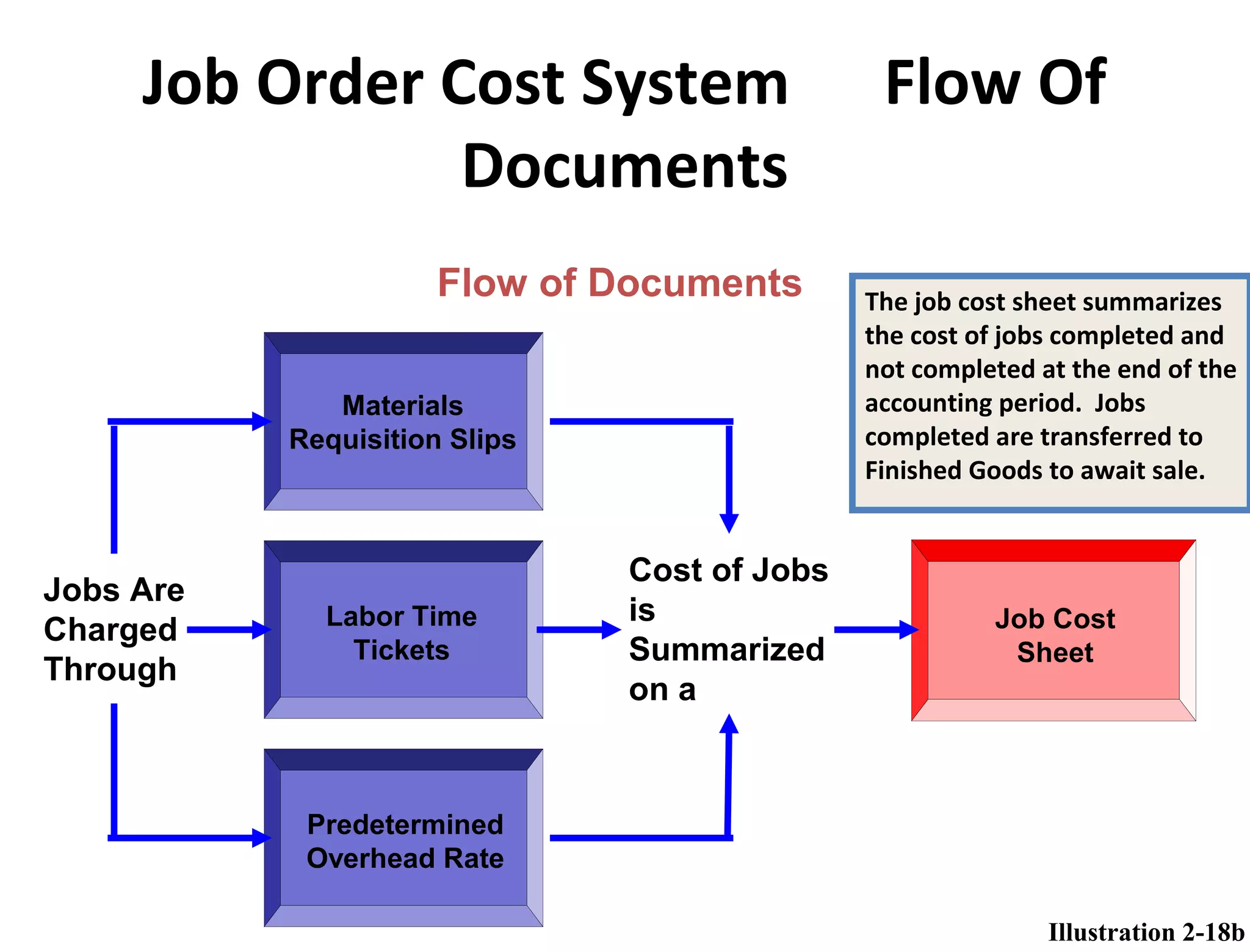

This document provides an overview of managerial accounting. It discusses the differences between managerial and financial accounting, managerial cost concepts including direct materials, direct labor, and manufacturing overhead, and job order cost accounting. Job order cost accounting involves accumulating manufacturing costs, assigning costs to work in process and finished goods, and recognizing cost of goods sold. Costs flow through the job cost sheet which tracks costs by job.