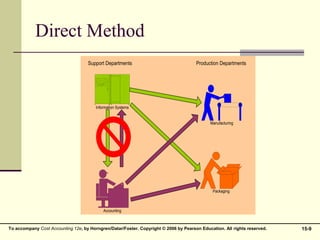

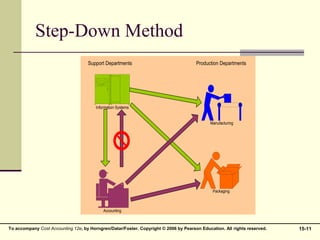

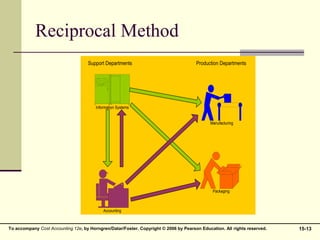

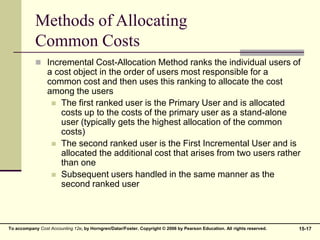

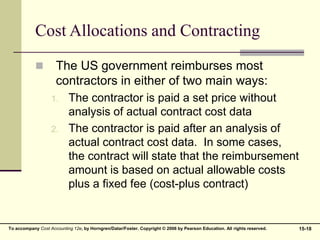

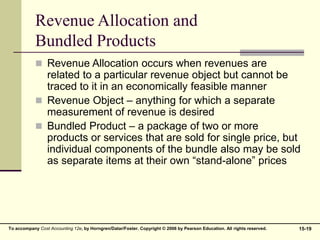

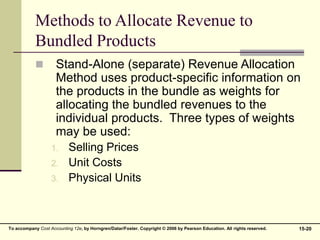

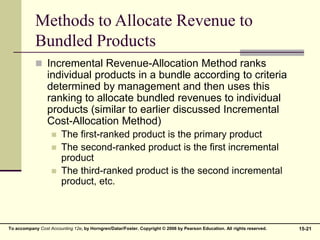

The document discusses various methods for allocating support department costs, common costs, and revenues. It describes the single-rate and dual-rate methods for allocating support department costs, as well as the direct, step-down, and reciprocal methods. For common costs, it outlines the stand-alone and incremental cost allocation methods. Finally, it discusses revenue allocation for bundled products using stand-alone and incremental revenue allocation approaches.