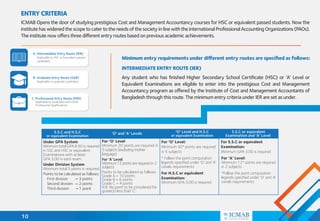

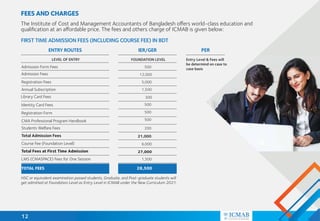

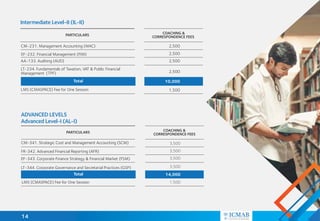

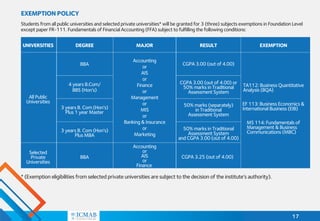

The document provides information about the Institute of Cost and Management Accountants of Bangladesh (ICMAB). ICMAB is the statutory national professional accountancy body constituted by the Government of Bangladesh. Its vision is to help Bangladesh become an industrialized nation by promoting and regulating cost and management accounting. Its mission is to develop, equip and promote the cost and management accounting profession to high professional standards to benefit society. ICMAB is responsible for formulating accounting and cost standards in Bangladesh.