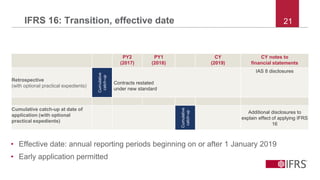

The document provides an overview of IFRS 16 Leases by Fred Nieto, Head of Investor Engagement at the IASB. It discusses key facts about IFRS 16 including the sectors most affected, the effective date of 2019, and accounting changes for lessees and lessors. The presentation then covers the essentials of IFRS 16 including the definition of a lease, recognition of right-of-use assets and lease liabilities, income statement impact, and intended benefits of improved comparability. Finally, it discusses new disclosure requirements and how restatement under the new standard will work.