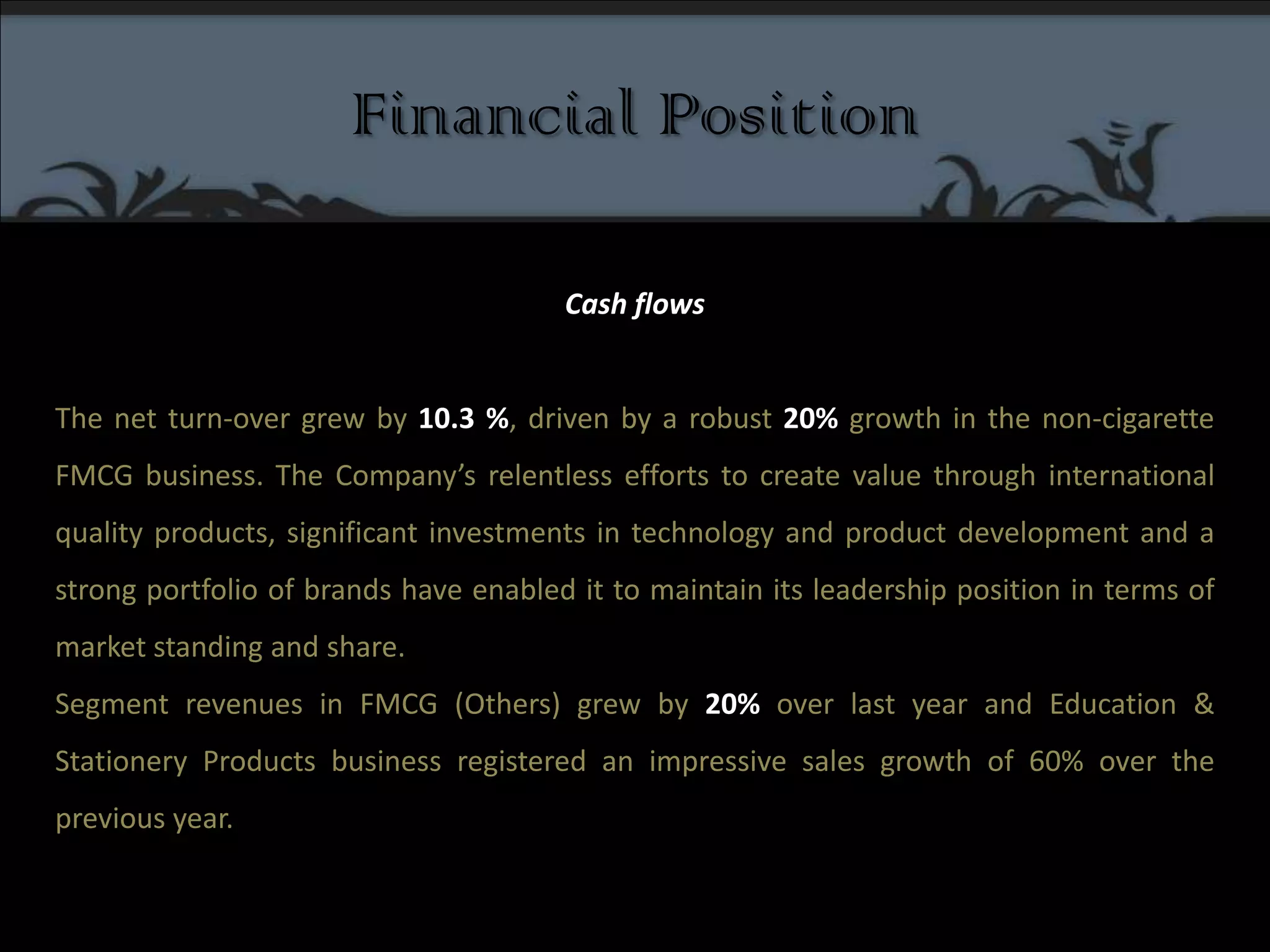

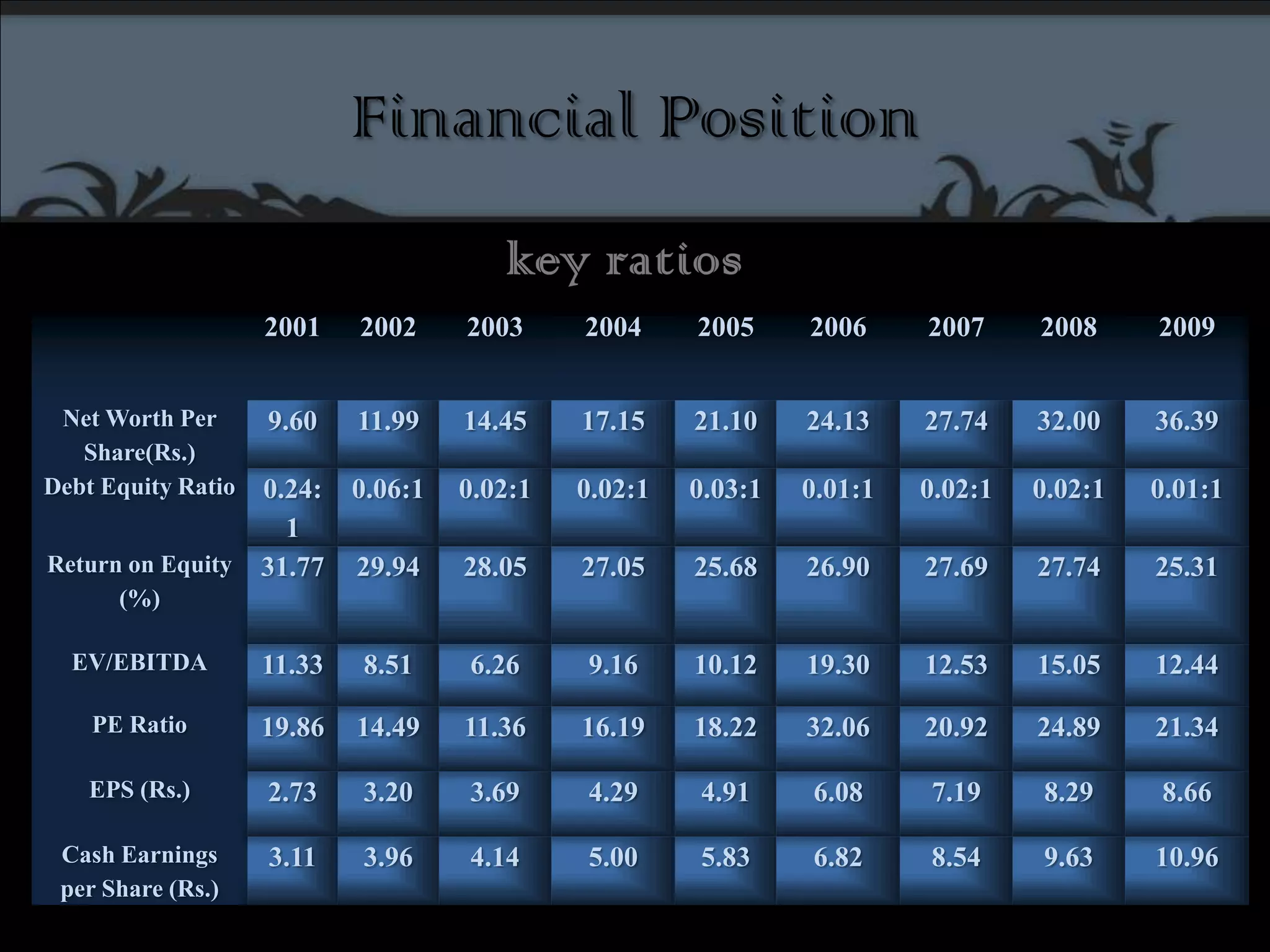

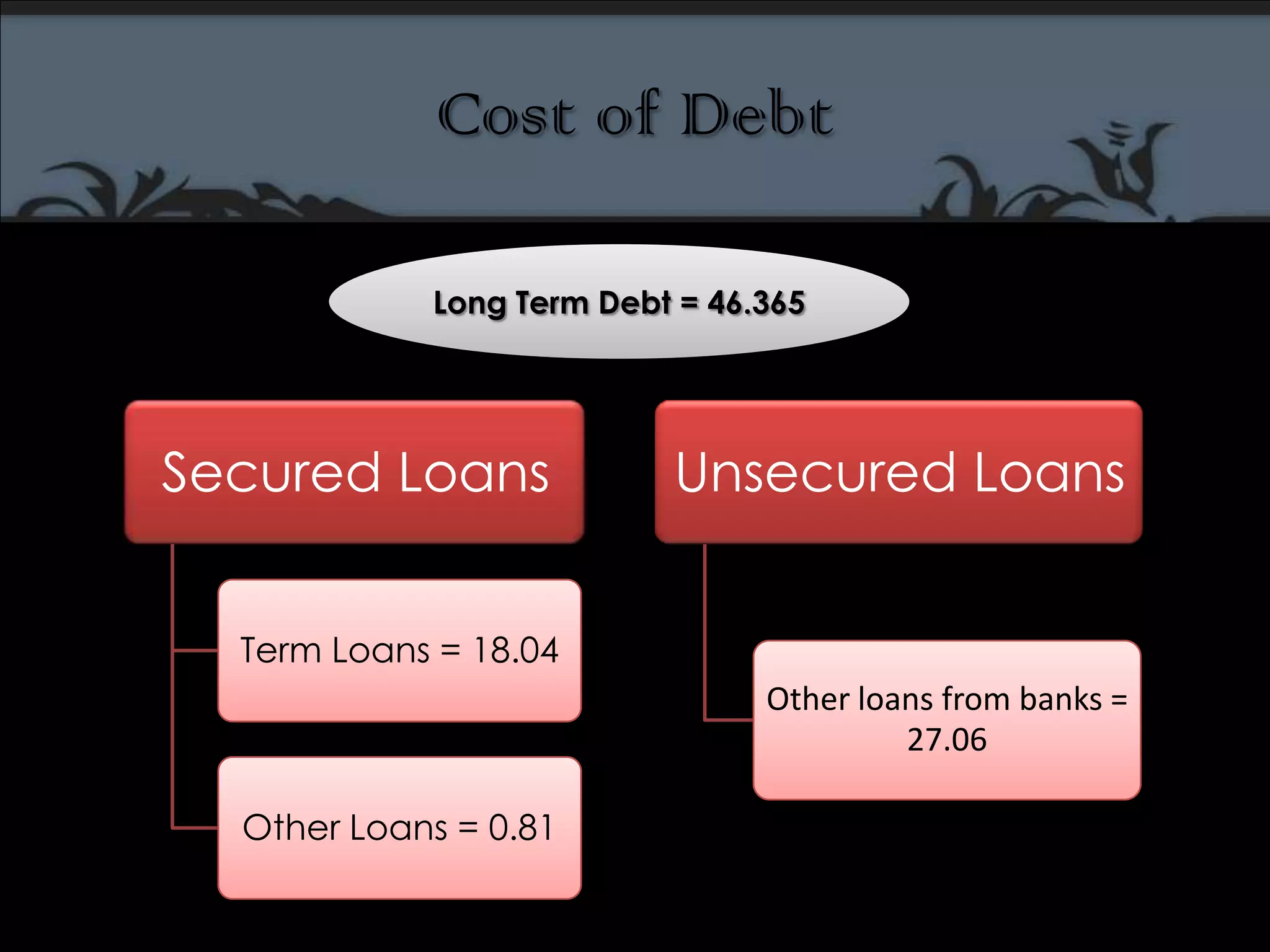

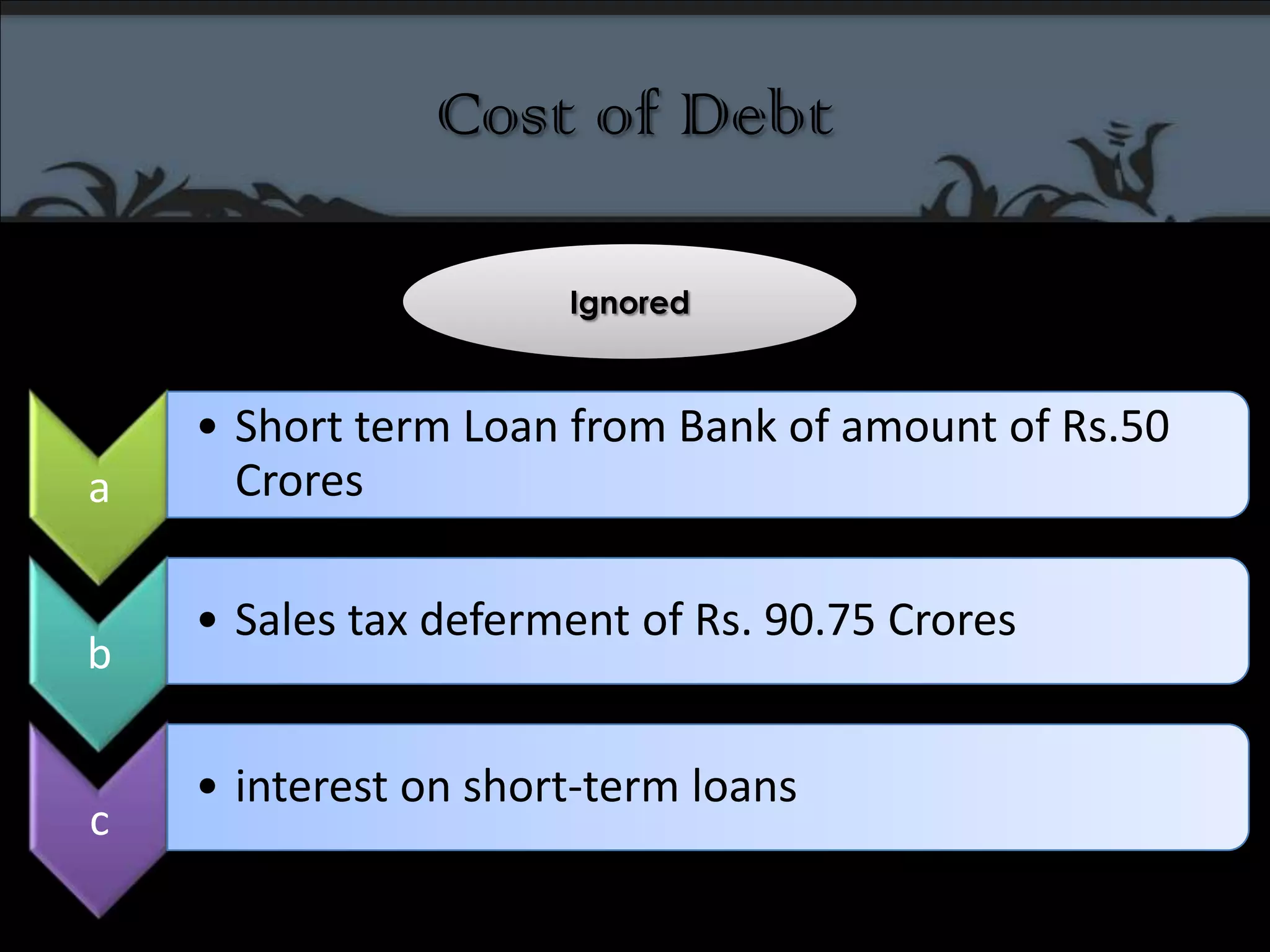

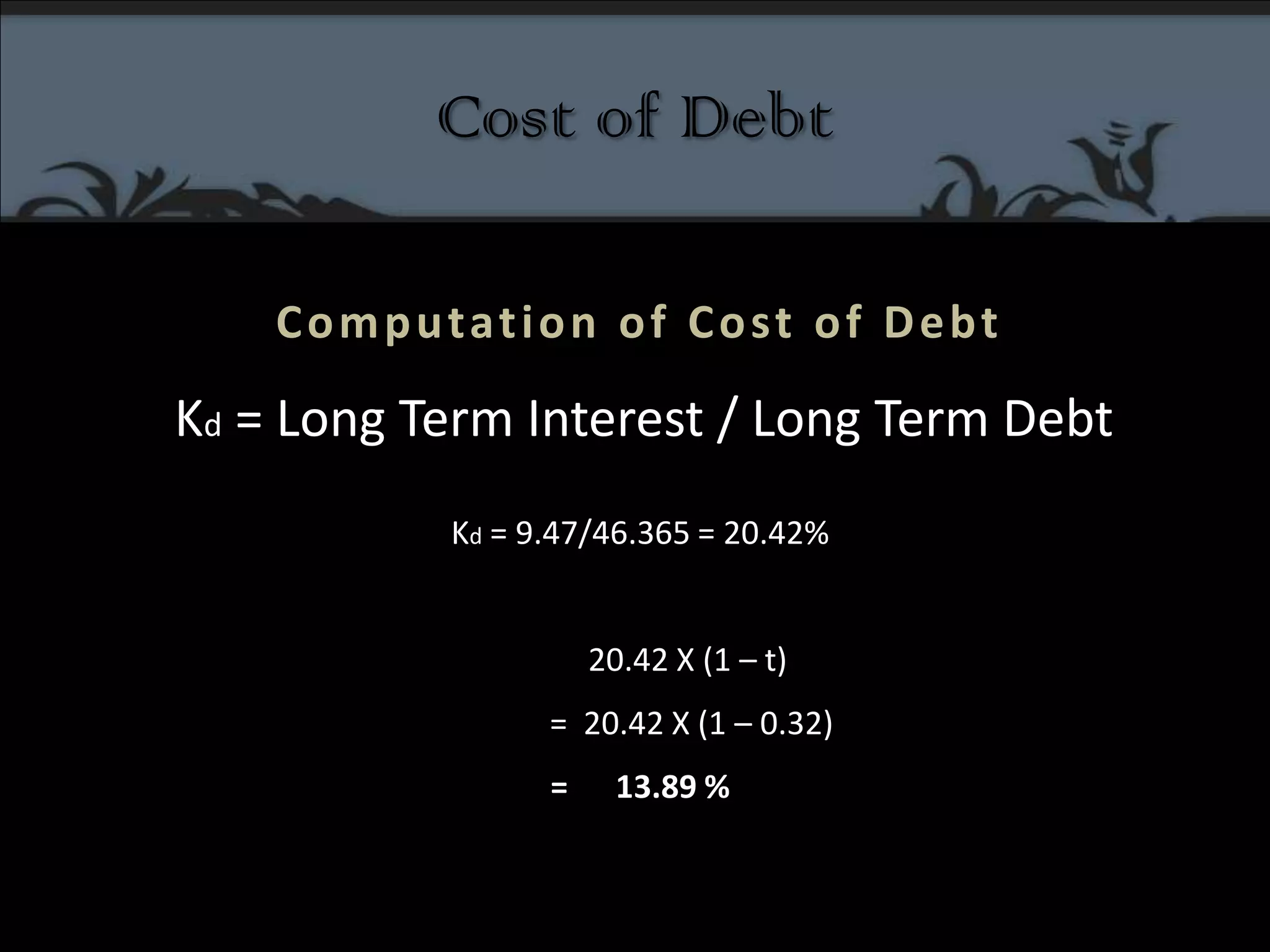

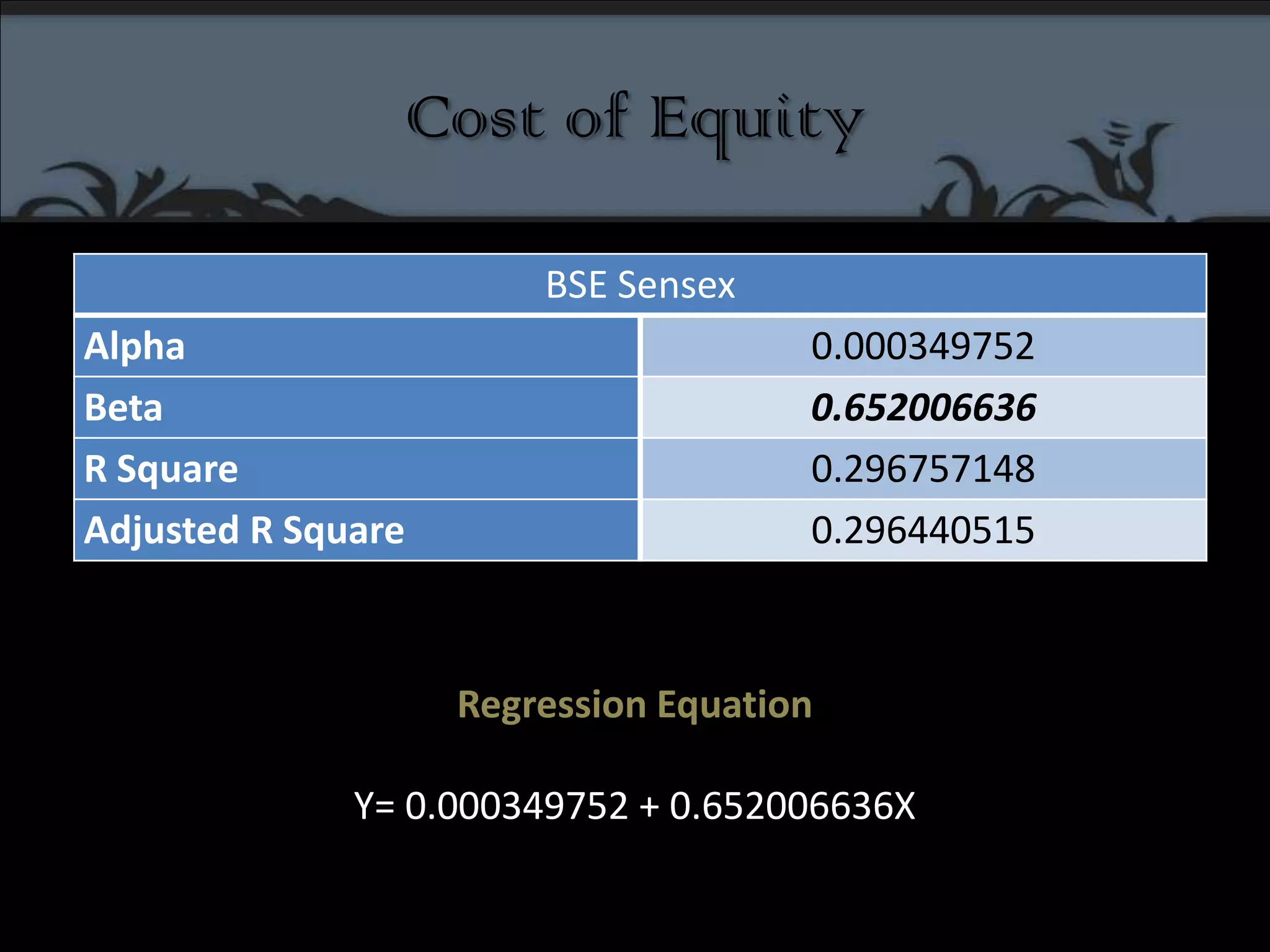

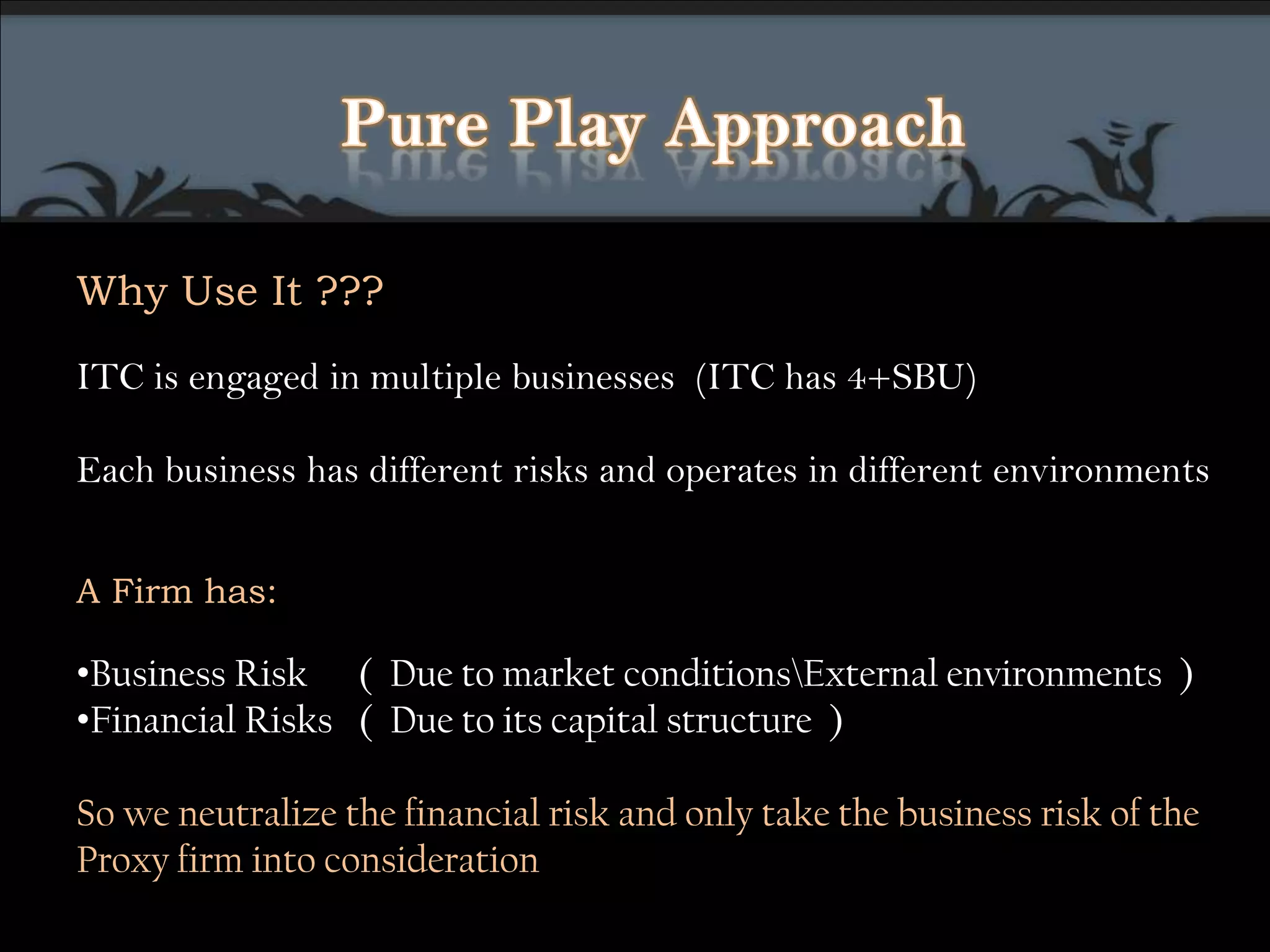

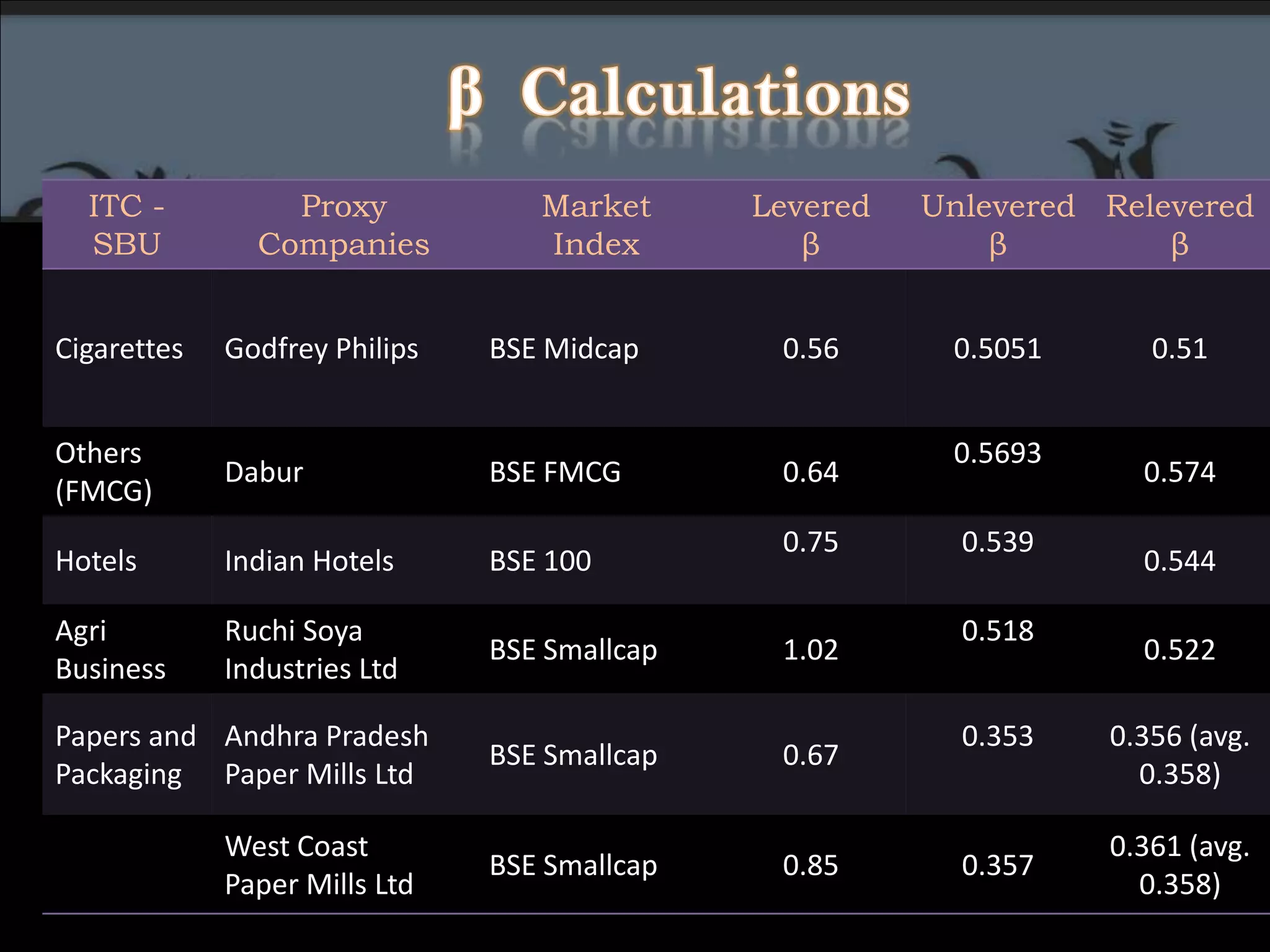

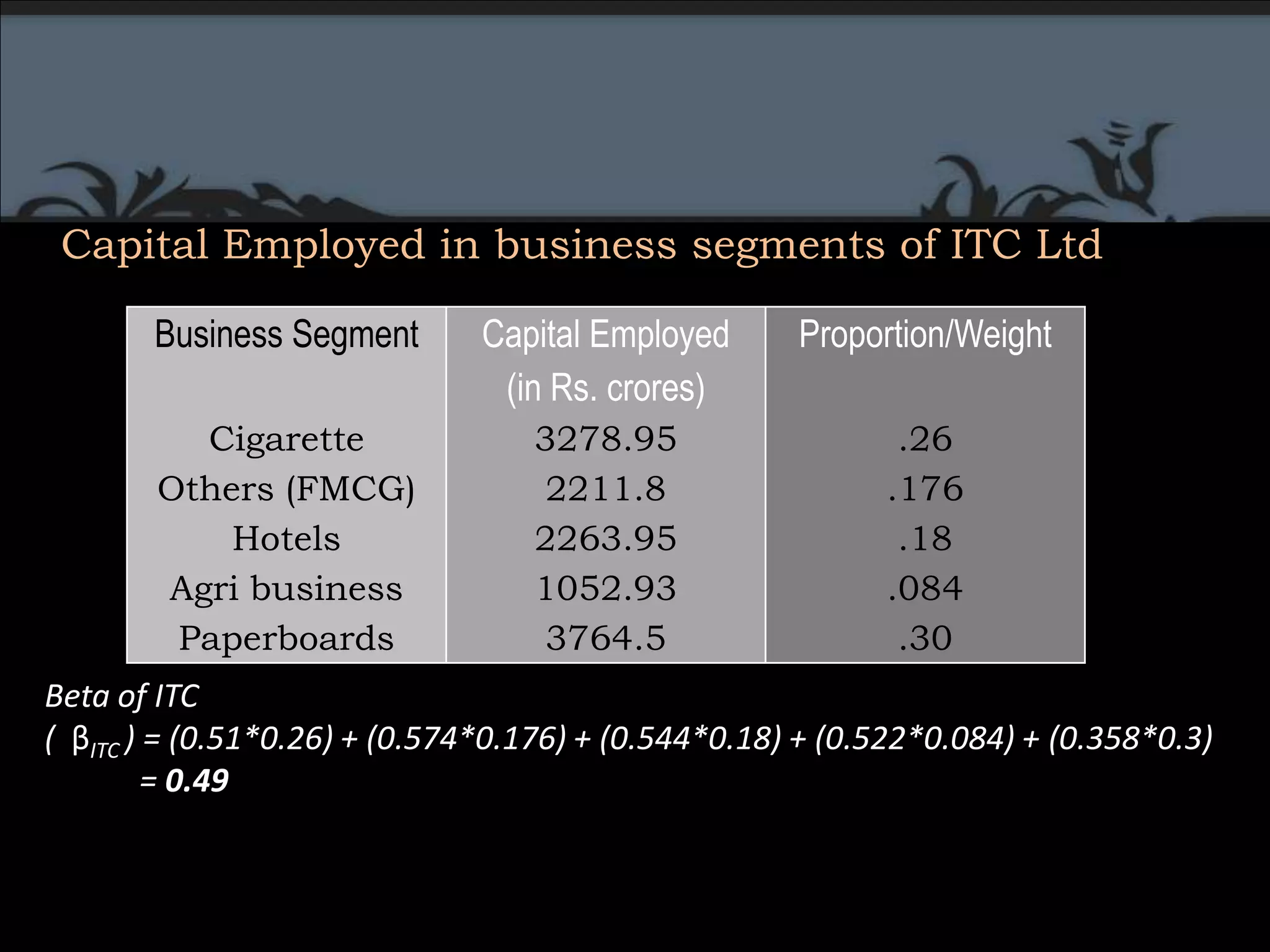

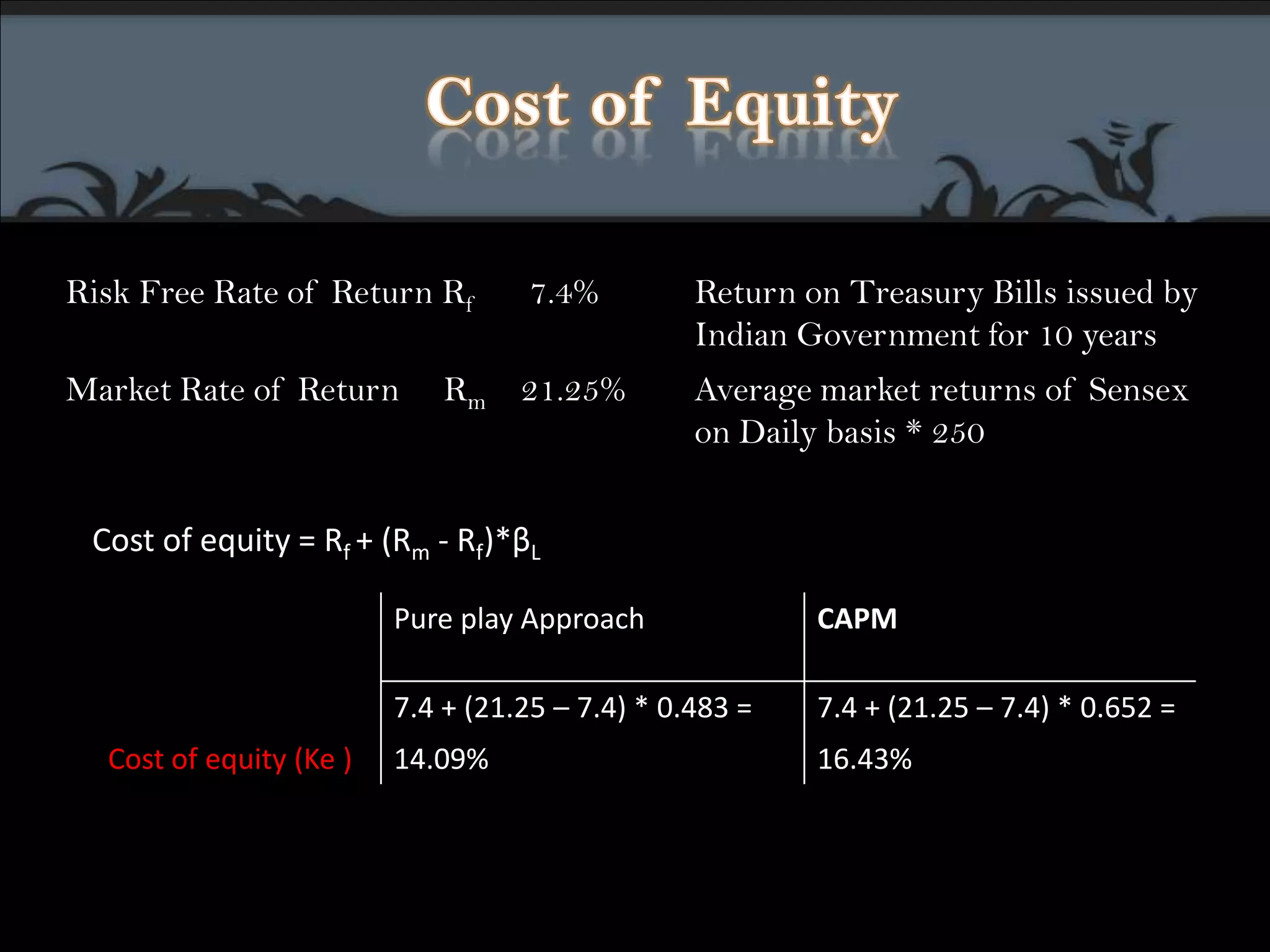

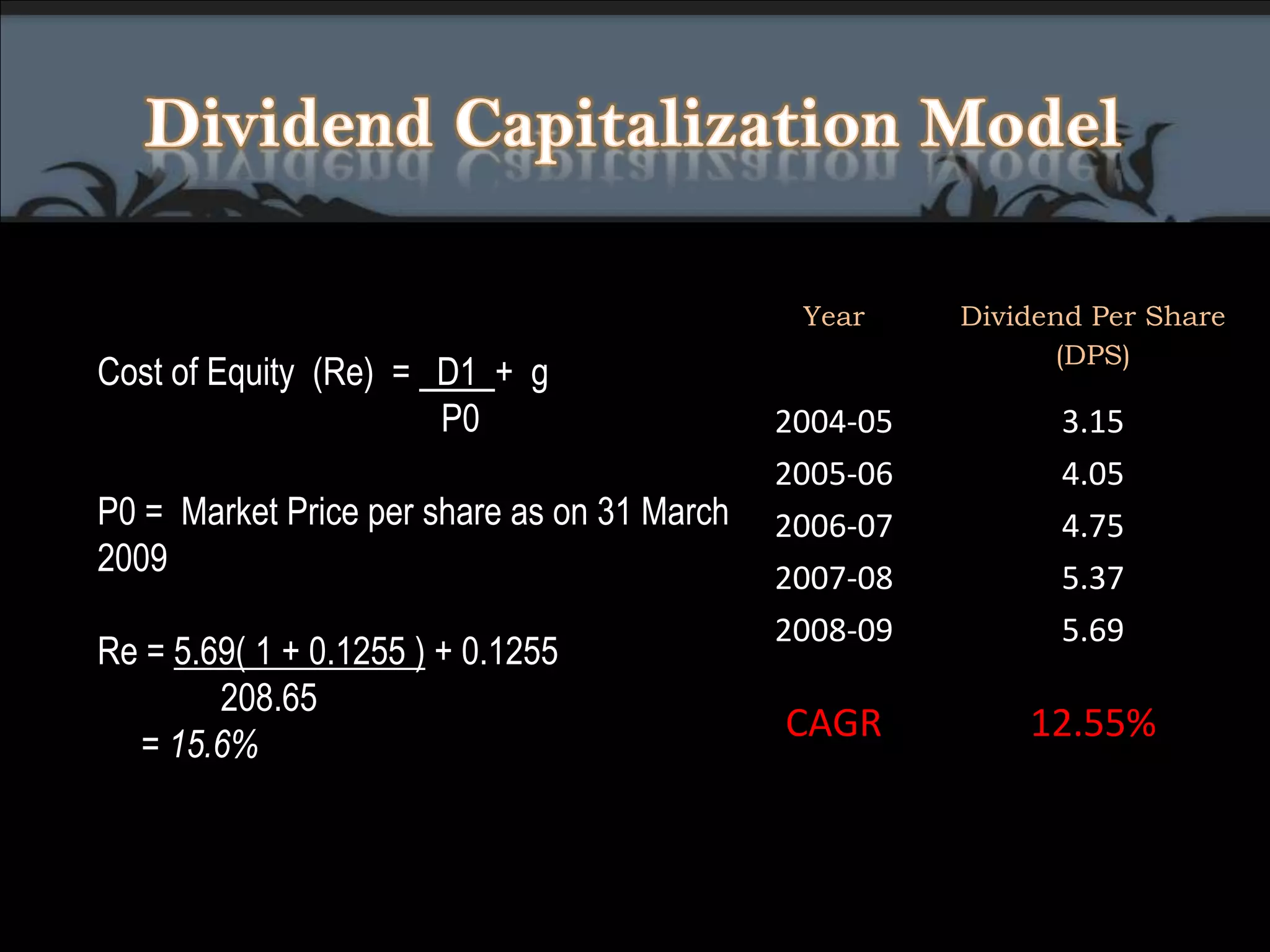

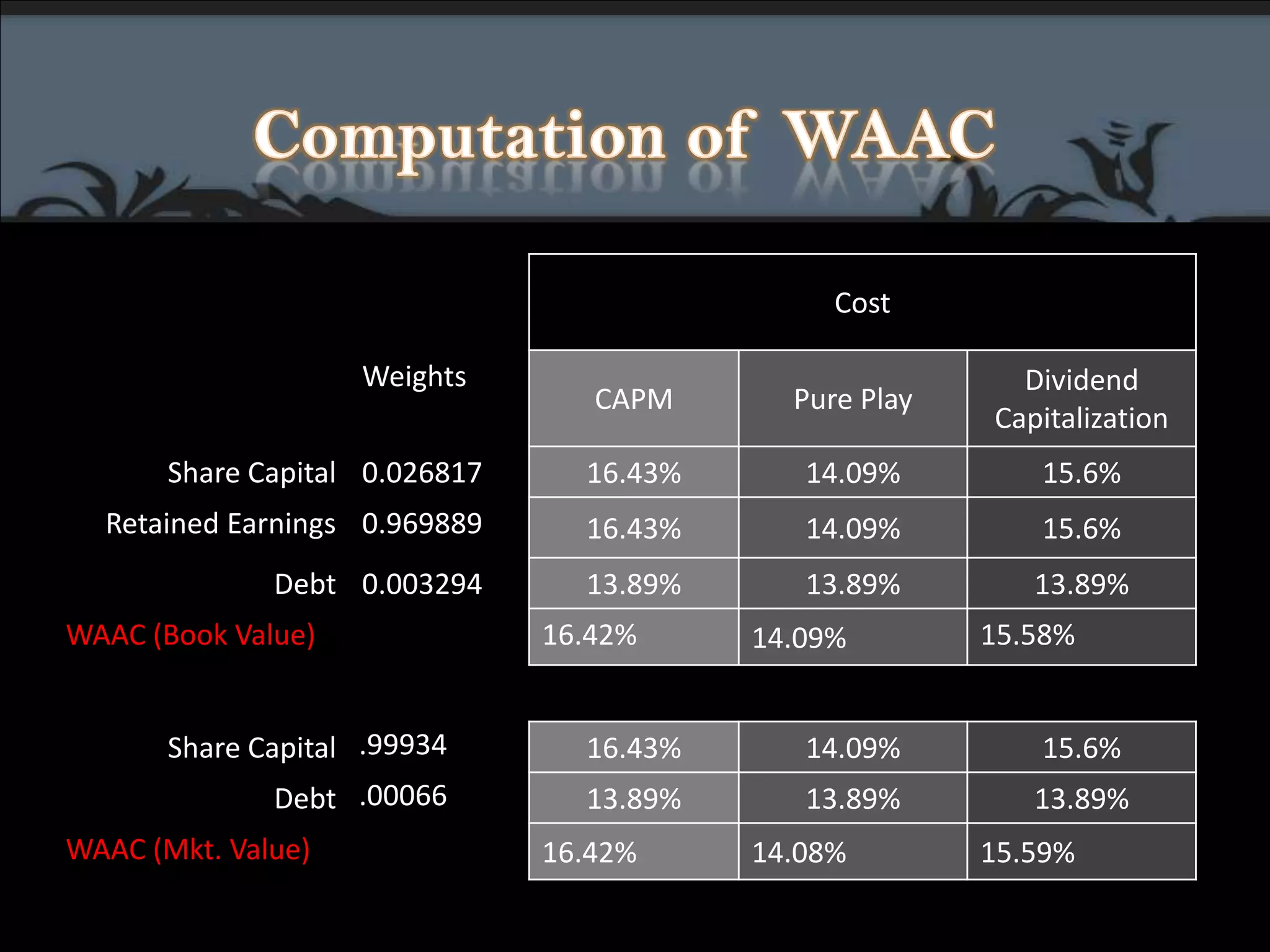

The document analyzes the cost of capital for ITC Ltd, highlighting its strong financial position with a low debt-to-equity ratio and significant growth in non-cigarette FMCG business. It calculates the cost of equity and cost of debt, concluding that the overall cost of capital is low, enhancing the firm's value and investment attractiveness. The firm has shown consistent performance with increasing earnings per share and effective cash profit generation.