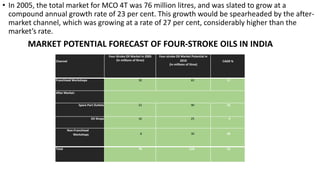

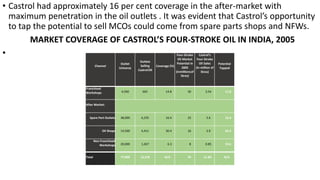

Castrol India Limited is the largest manufacturer of automotive and industrial lubricants in India with a 48% market share. It has 5 manufacturing plants and distributes products through 270 distributors serving over 70,000 retail outlets. The document discusses Castrol's distribution channels and market share in India. It notes opportunities for Castrol to expand its market share from non-franchised workshops (NFWs), which are becoming an important distribution channel as consumer behavior shifts from dealerships to workshops. However, directly supplying NFWs presents challenges around credit risk, remote locations, and low order volumes.