The document discusses Keynes' consumption function, which posits that consumption is a function of income. It states that according to Keynes:

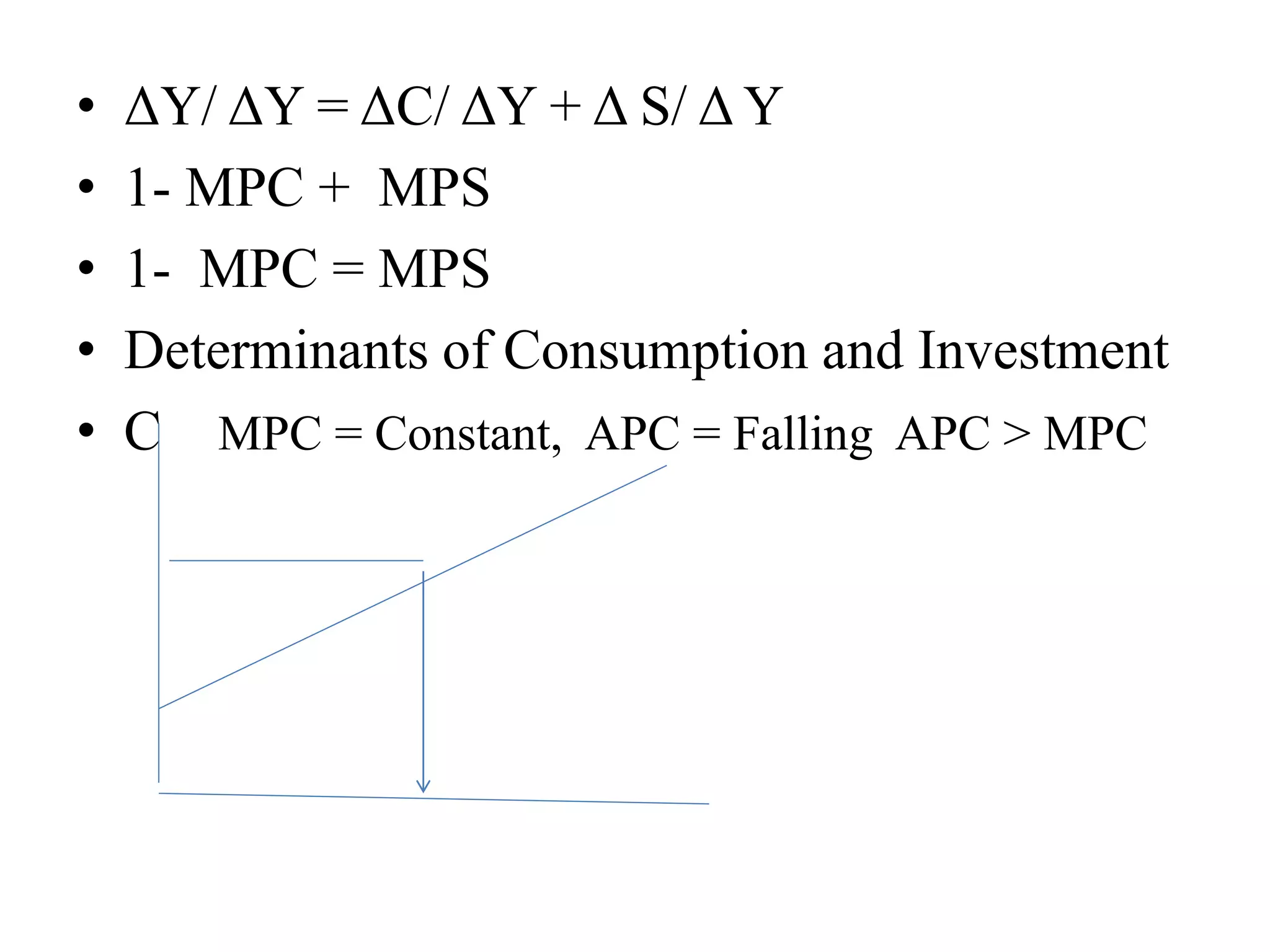

1) Consumption increases as income increases, but not by as much as the increase in income.

2) When income increases, the increment is divided between consumption spending and savings.

3) Both consumption spending and savings will rise as income increases.

The document then defines key terms in Keynes' consumption function analysis, such as average propensity to consume, marginal propensity to consume, average propensity to save, and marginal propensity to save.