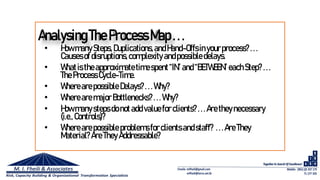

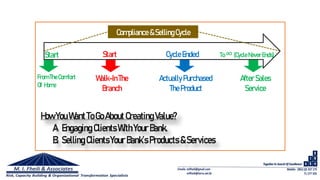

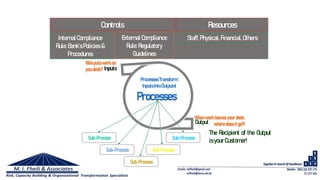

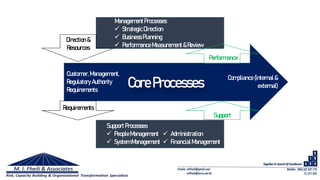

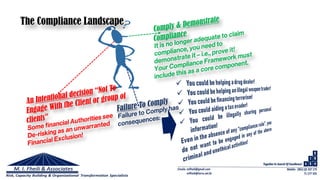

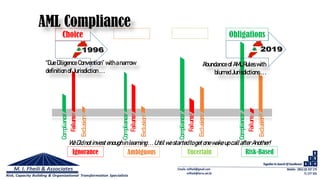

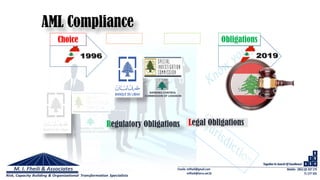

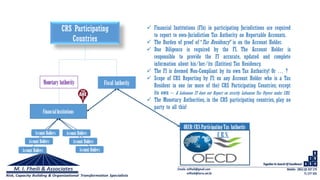

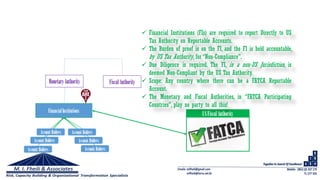

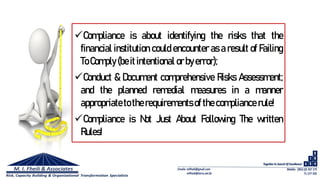

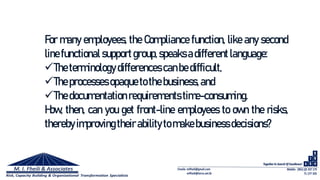

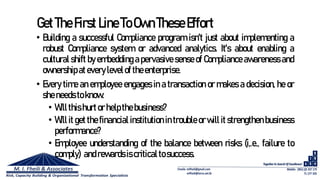

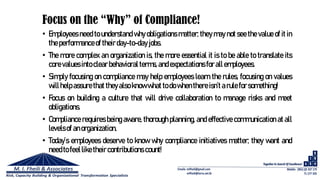

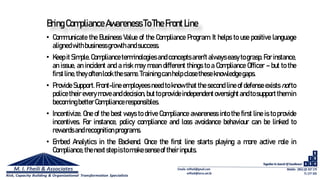

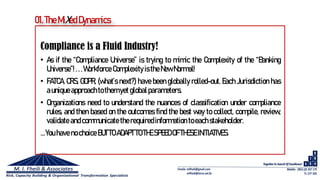

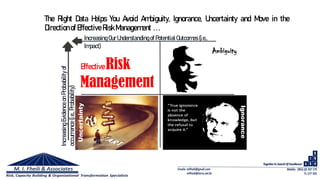

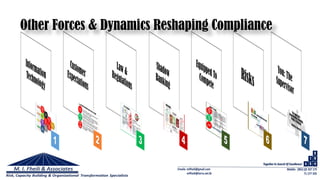

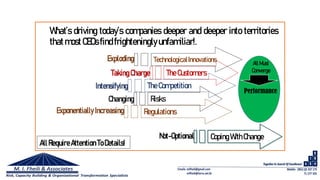

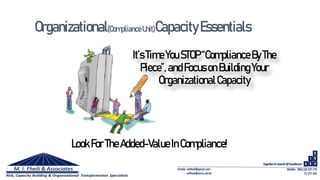

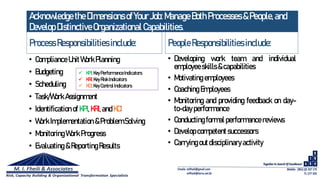

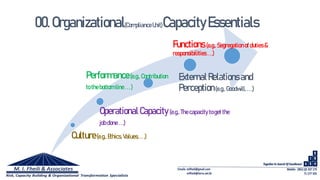

The document discusses the evolving landscape of compliance, particularly focusing on anti-money laundering (AML) obligations amid fragmented jurisdictional challenges. It emphasizes the importance of integrating compliance processes into business operations, fostering a culture of compliance awareness among employees, and adapting to new technologies and regulatory expectations. The text highlights the need for organizations to proactively address risks and enhance their compliance capabilities to navigate the complexities of modern financial regulations.

![ItIsAboutCreatingValue!

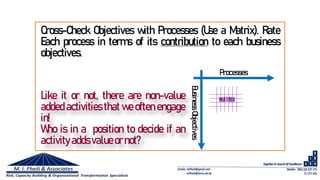

The notion of creating value for [Internal] customers [Sale] is critical to

understanding customer needs and expectations and setting the right

objectivesfor businessactivities.

Value depends on the full range of support services the customer experiences

in “conducting the business”: Speed & Accuracy in Account-Opening

Procedures;ClarityinRequired ComplianceForms,etc.](https://image.slidesharecdn.com/complianceataninflectionpoint-190407174301/85/Compliance-at-an-inflection-point-59-320.jpg)