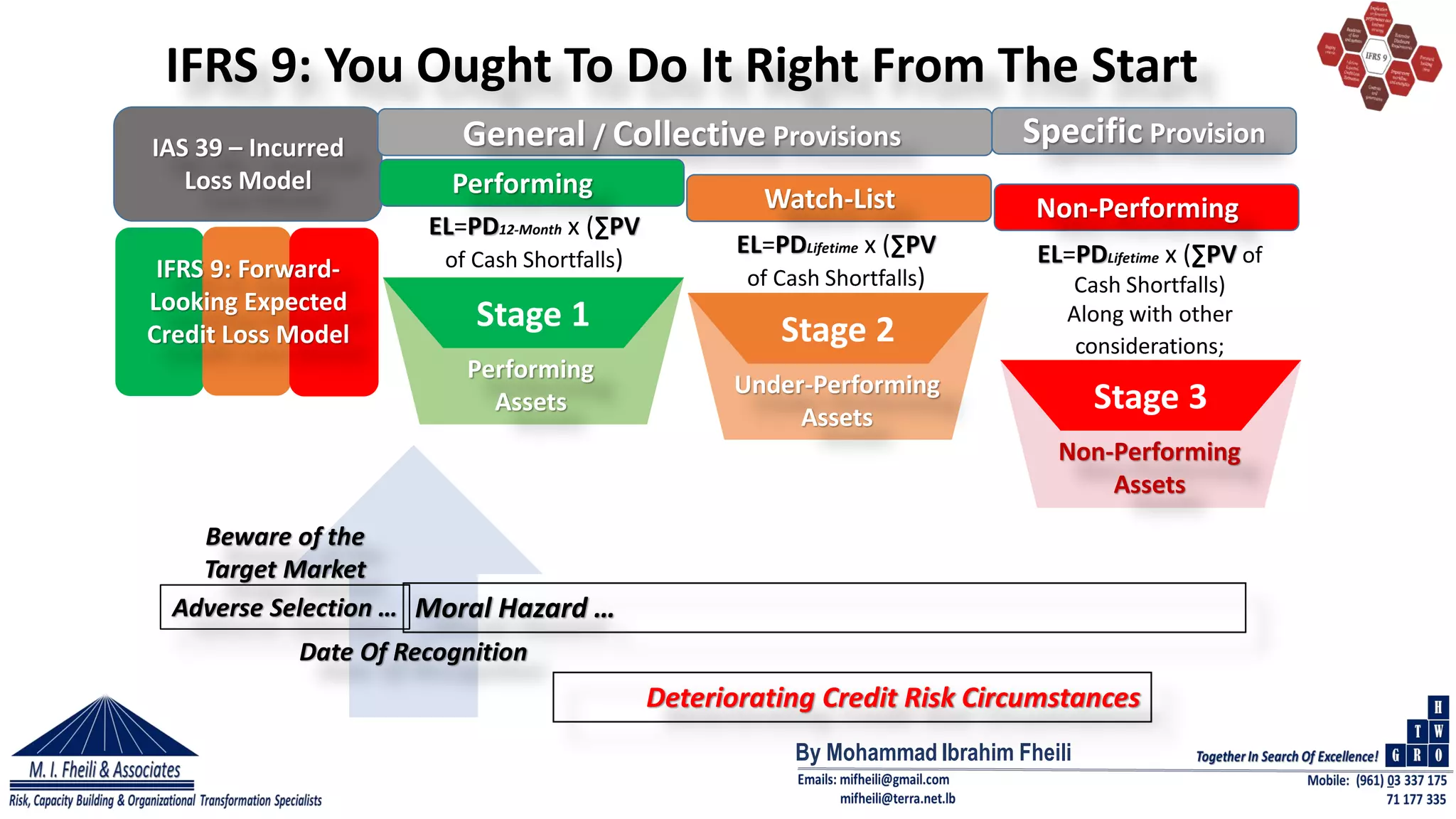

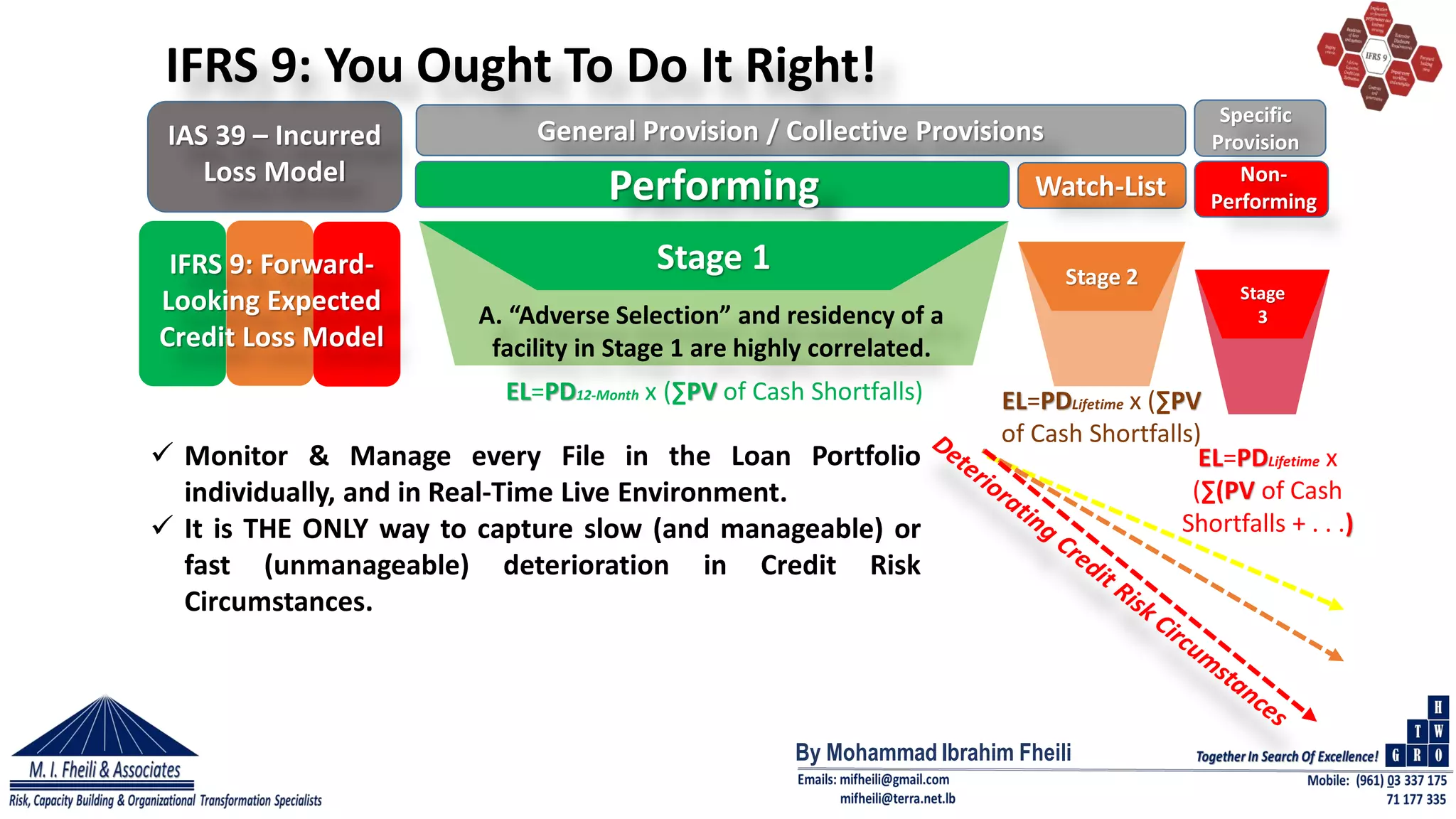

This document discusses the Basel II framework, focusing on its three pillars for risk and capital management in banks, with an emphasis on Internal Capital Adequacy Assessment Process (ICAAP) and how it addresses risks not fully captured by Pillar 1. It highlights the changes introduced by IFRS 9, which replaced IAS 39, emphasizing the forward-looking expected credit loss model and the importance of effective risk management and compliance. The author asserts that banks need to demonstrate compliance and adjust their internal capital management strategies to adequately address emerging risks and improve asset quality.

![By Mohammad Ibrahim Fheili

Consequences:

Losses

Risk

Event:

Loan

Default

a) Dried up Cash Flow Sources: Client’s business

received a bad hit causing dramatic changes in his

business environment.

b) Collaboration between the RM and the Client in the

provision of inflated figures (Sales, Revenues, Cash

Flows, …) leading to a false-favorable credit decision.

c) Over-worked, and Under-Staffed Business Unit

leading to overlooking some critical changes in

Operational Environment of the Client.

d) Incompetent Bank Employee(s) Gave False analysis

and Recommendation which led to a False-favorable

Credit Decision.

e) Poor/Inadequate Follow-up and Reviews rendering

the process weak in capturing “Early Warning

Signals”

f) Etc….. there could be Violations to AML and/or

other Rules

Numbers Are Not Enough! These are Noted [Actual] Causes of Asset Failures.

Possible

Causes

Causes of Default.

a) Credit Risk

b) Ethics & Moral Value

c) Workforce Planning

d) Training & Development

e) Performance Management

f) AML Concerns](https://image.slidesharecdn.com/ifrs9assessmentandstrategicimplications-190705200024/75/Ifrs9-assessment-and-strategic-implications-36-2048.jpg)