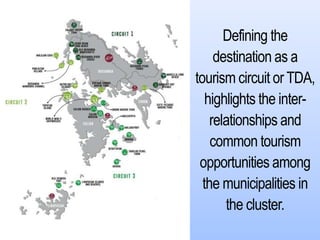

The document discusses strategies for enhancing local tourism sector development to build competitive destinations, emphasizing the importance of identifying tourism circuits that connect municipalities. It outlines the role of local government units (LGUs) in creating business-friendly environments, supporting the tourism sector, and ensuring infrastructure sustainability. The goal is to increase investments and visitor arrivals while promoting inclusivity and protection of vulnerable groups within the tourism value chain.