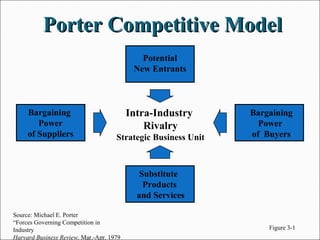

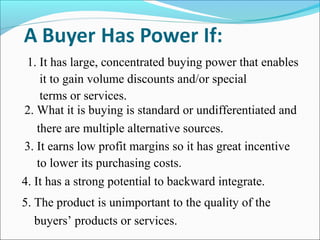

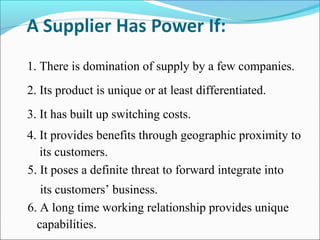

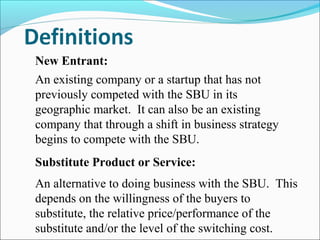

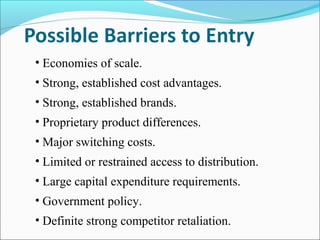

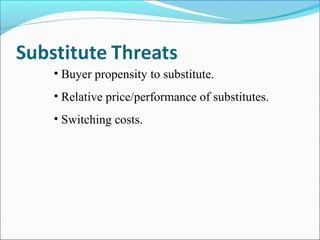

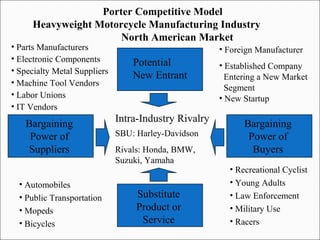

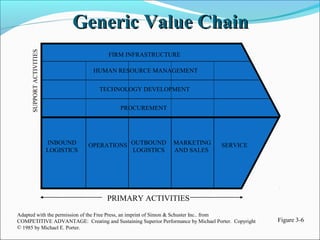

This document discusses concepts related to competitiveness including competitive advantage, Porter's competitive model, and the value chain. It defines competitiveness and outlines factors that influence competitive advantage such as focusing on core competencies, customers, competitors, and inputs. Porter's competitive model is introduced as a framework to understand industry competition by analyzing five forces: rivalry, potential new entrants, substitutes, bargaining power of suppliers, and bargaining power of buyers. The document also discusses primary and supporting business strategies and outlines Porter's generic value chain as a tool to analyze value added activities within a company.