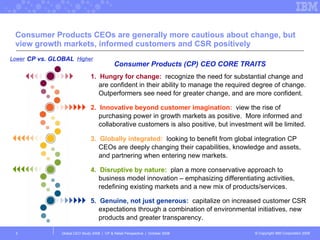

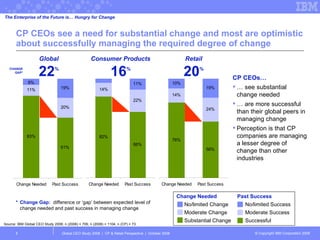

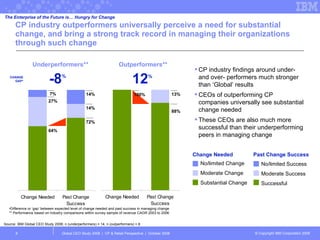

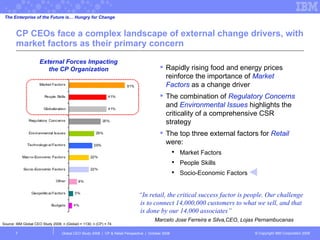

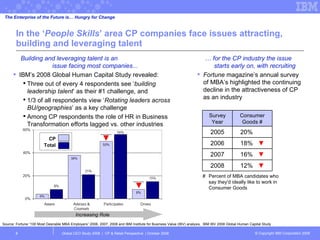

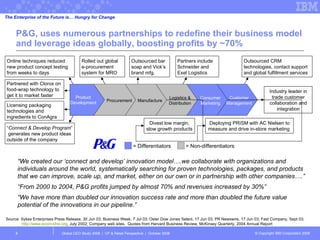

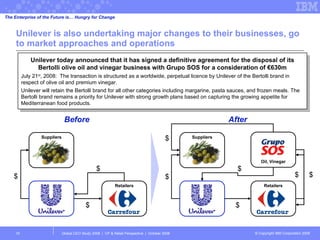

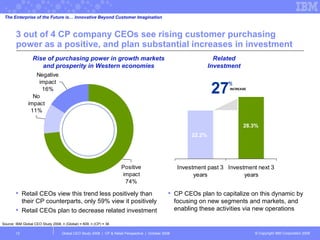

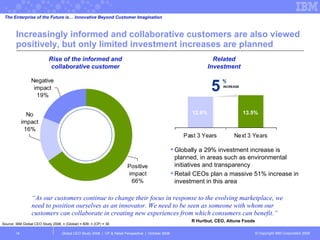

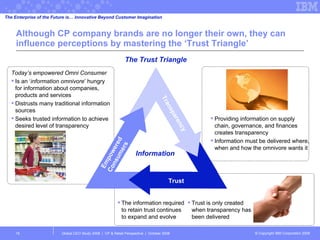

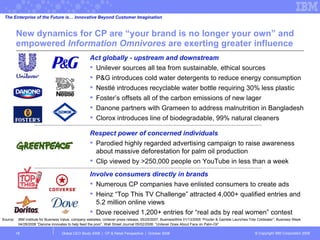

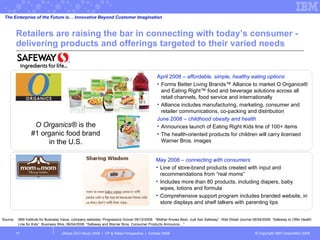

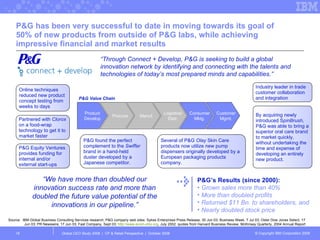

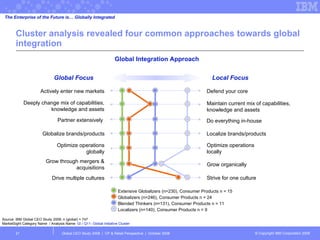

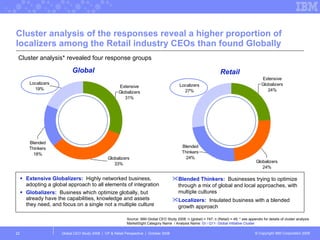

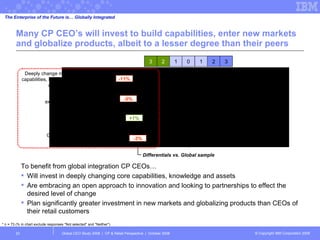

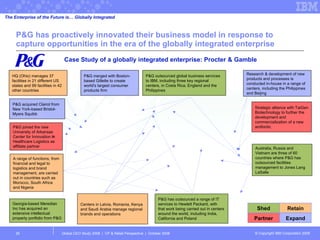

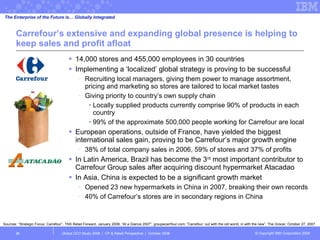

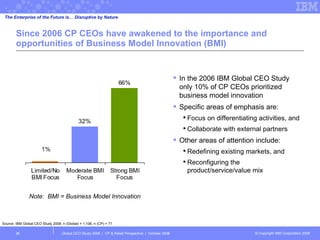

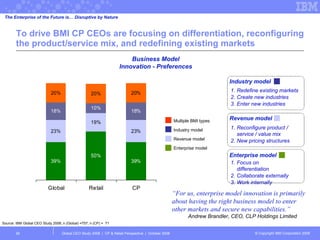

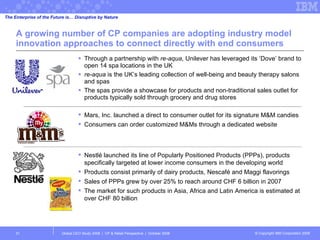

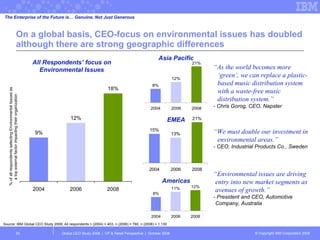

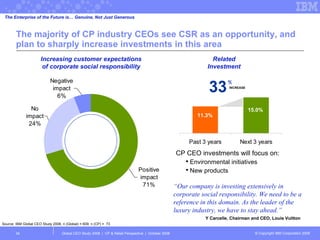

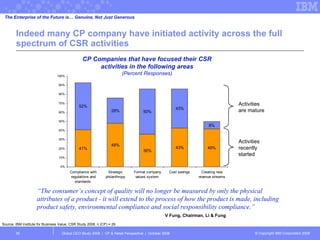

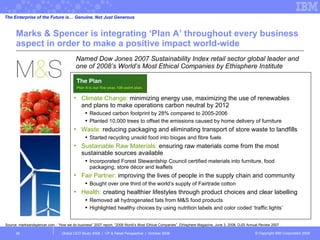

The document discusses key findings from an IBM study on consumer products and retail companies. It finds that while CP CEOs see a need for substantial change, they are more cautious than other industries. CP outperformers universally see major change as needed and have a strong track record of managing change. CP companies face challenges in attracting talent and plan limited investment in responding to more informed customers, but view rising consumer purchasing power positively. The document highlights strategies companies like P&G, Unilever, IKEA and others are using to drive innovation, collaborate with customers, and adapt their business models.