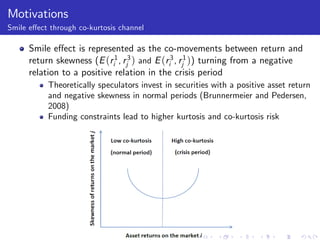

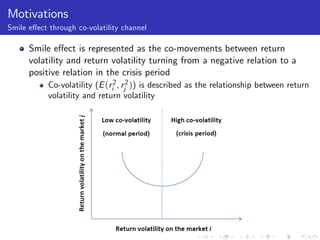

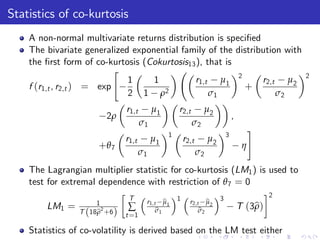

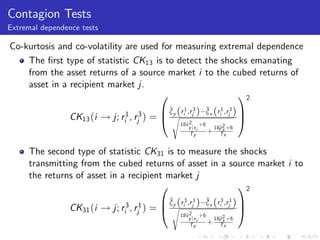

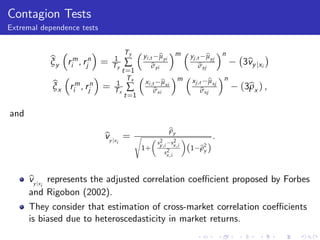

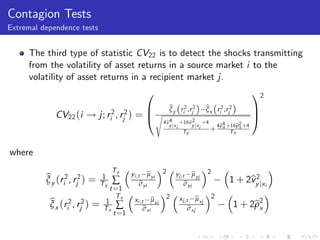

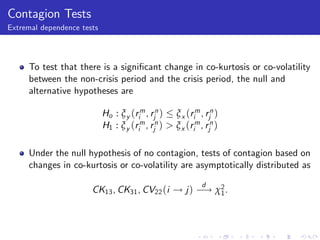

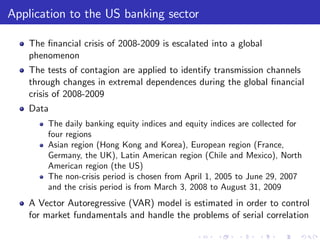

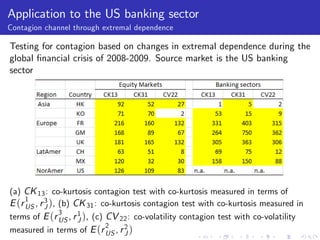

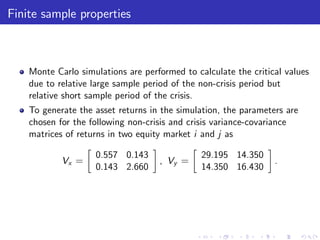

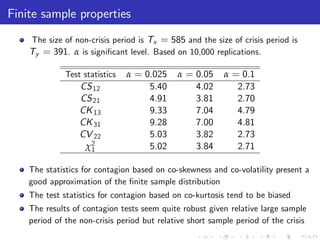

This document presents a new test for financial contagion based on changes in co-kurtosis and co-volatility between a non-crisis period and crisis period. The author applies this test to analyze contagion in the US banking sector during the 2008-2009 financial crisis. Specifically, the author 1) develops new statistics to measure extremal dependence through co-kurtosis and co-volatility, 2) applies these statistics to test for contagion from the US banking sector to other markets, and 3) finds significant contagion effects spreading from the US through these channels to global equity markets and banking sectors.