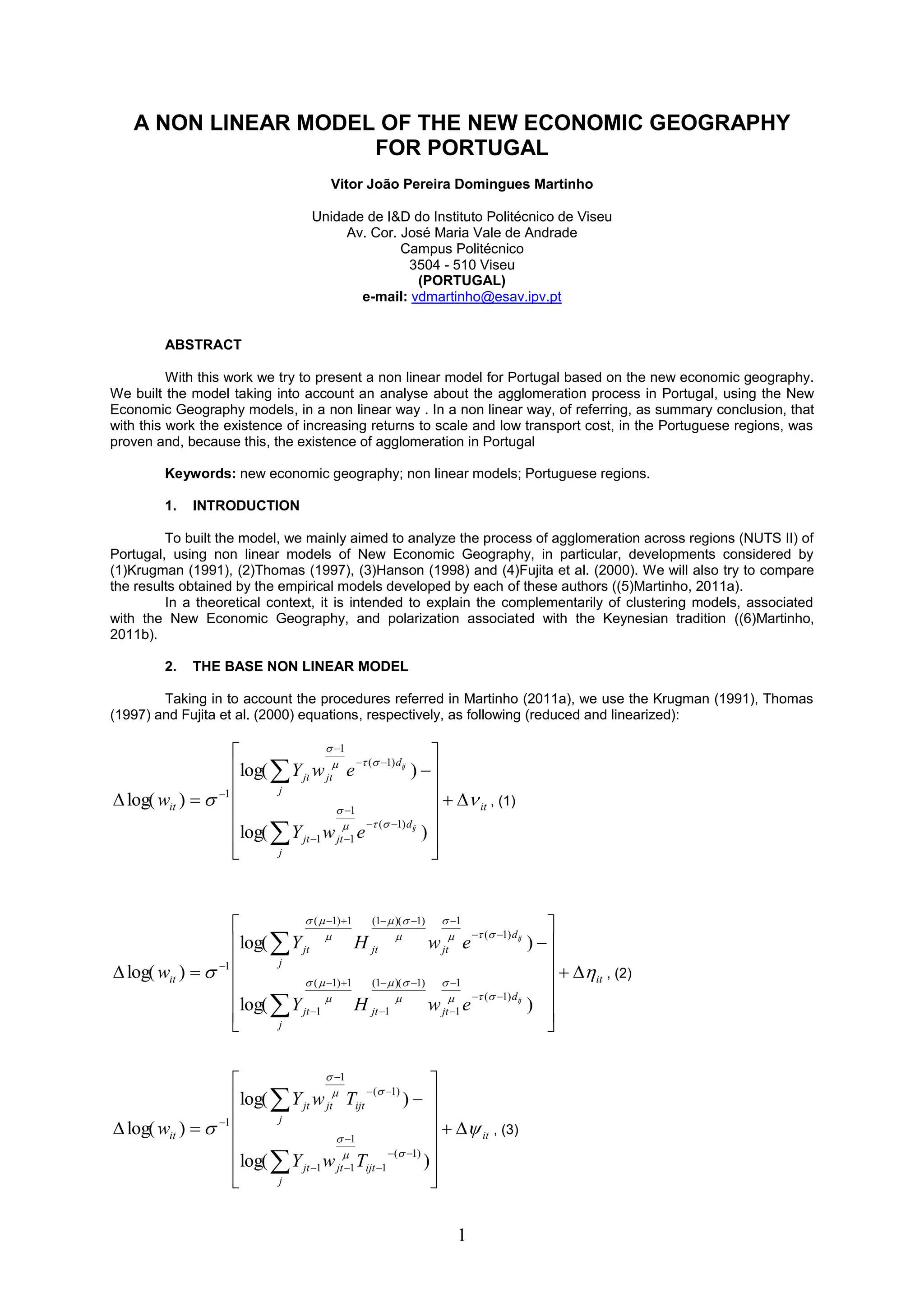

This document presents a non-linear model of agglomeration in Portugal based on New Economic Geography theories. The model uses equations from Krugman, Thomas, and Fujita to analyze agglomeration across Portuguese regions from 1987 to 1994. The results show low but significant transport costs and increasing returns to scale, indicating agglomeration occurred in Portugal during this period, particularly around Lisbon. The data comes from Eurostat on Portuguese regions and industries.