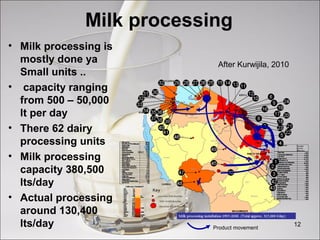

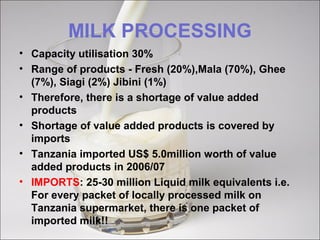

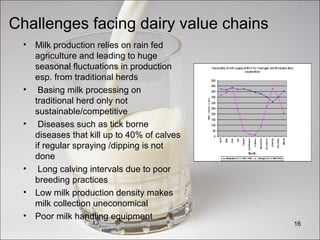

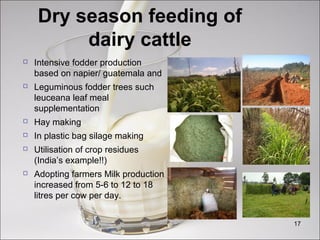

The Tanzanian dairy industry faces numerous challenges, including low milk production, poor organization among farmers, and inadequate processing facilities, yet there are significant opportunities for improvement. Strategies proposed to enhance the sector include increasing milk production through better animal husbandry, improving milk processing capabilities, and expanding market access for dairy products. Successful implementation of these strategies, alongside strengthening dairy development institutions, could transform the livelihoods of many smallholder farmers in Tanzania.