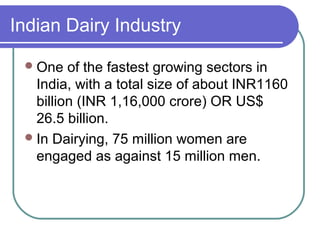

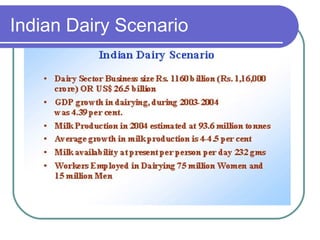

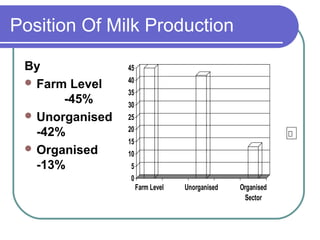

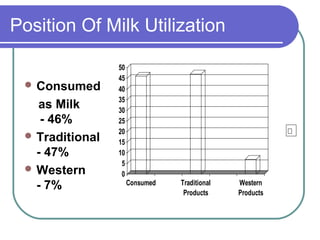

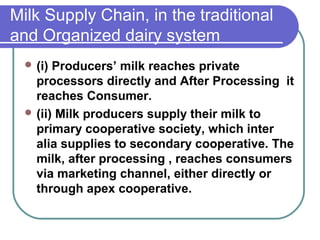

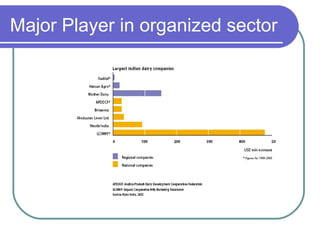

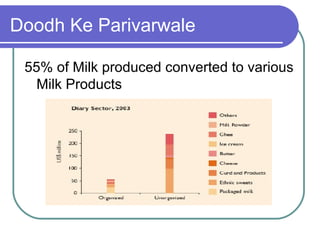

The document discusses the dairy industry in India. It notes that 50% of buffaloes and 20% of cows reside in India. It explains the difference between the unorganized and organized dairy sectors. The organized sector accounts for only 13% of milk production compared to 45% at the farm level and 42% in the unorganized sector. It also discusses major players like Amul and Mother Dairy and how Operation Flood helped develop the dairy cooperative system in India.