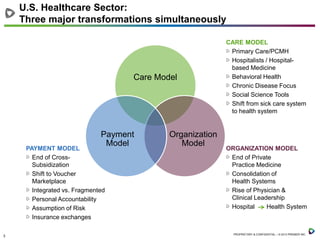

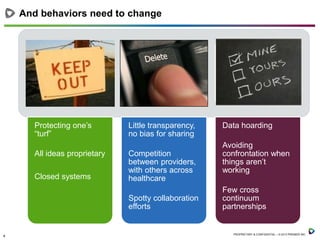

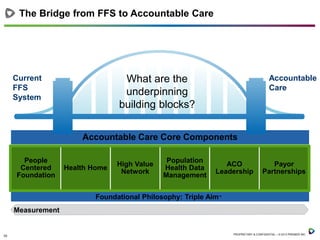

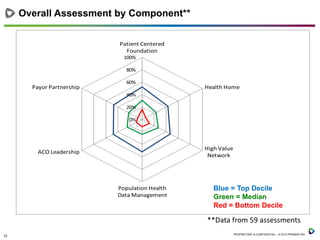

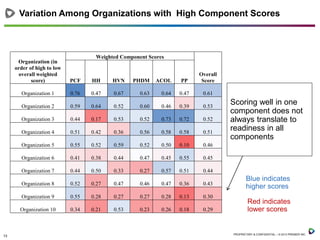

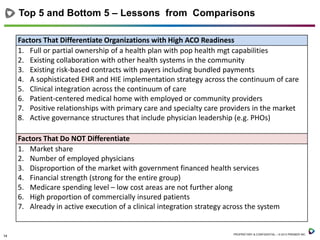

This document summarizes lessons learned from 59 pioneering hospitals transitioning to accountable care models. It finds that while individual components like health homes and data management scored highly for some hospitals, readiness requires strength in all areas. Top factors for readiness included risk-based payer contracts, clinical integration, and health IT infrastructure. Market factors like size and location mattered less. Successful implementation involved starting with high-need patients, engaging physicians, and focusing on culture change. Challenges included slow physician and payer adoption, while strategies that worked were piloting programs and maintaining momentum through incremental changes.