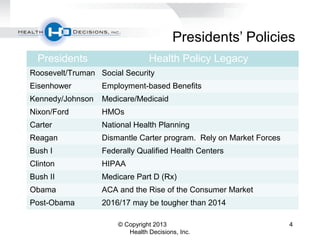

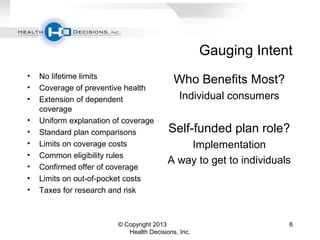

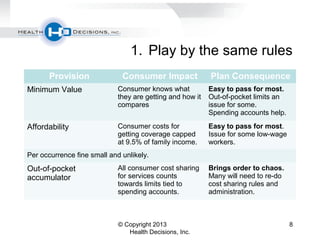

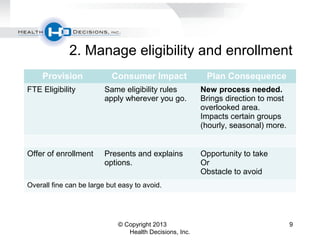

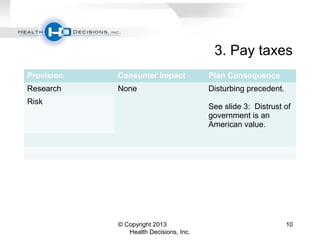

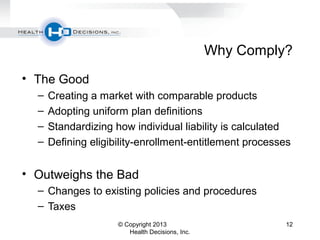

The document discusses the implications of the Affordable Care Act (ACA) for self-funded health plans, emphasizing the need for compliance with ACA regulations such as shared responsibility and standard eligibility rules. It highlights the benefits for individual consumers, alongside the challenges that self-funded plans may face in adapting to these new requirements. Ultimately, the presentation advocates for compliance as a means to foster a market for comparable health products while managing individual liabilities and eligibility processes.