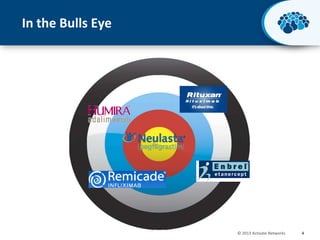

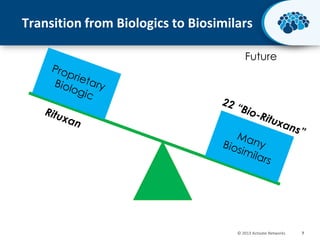

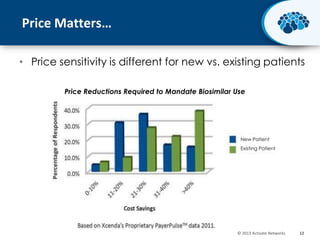

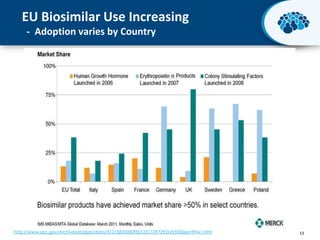

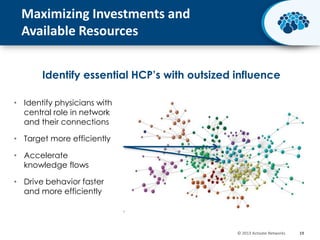

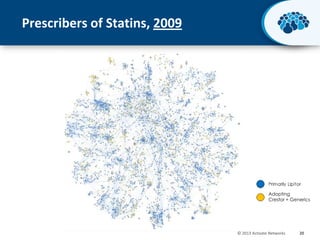

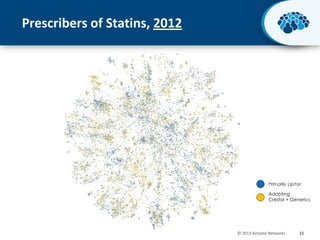

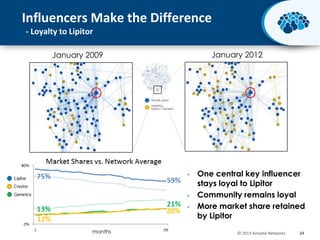

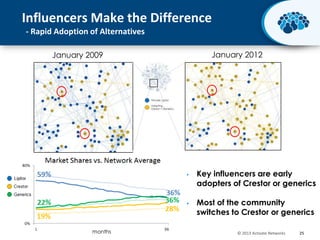

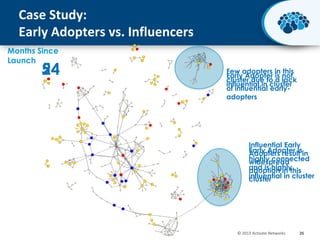

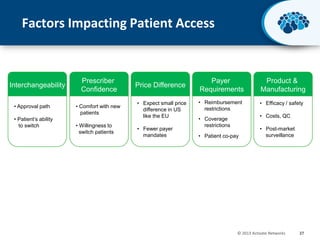

This document discusses the transition from biologics to biosimilars in the pharmaceutical industry. It notes that biosimilars face manufacturing challenges to demonstrate equivalence to their reference biologic products. While biosimilars may receive regulatory approval, concerns around their efficacy, safety and manufacturing processes could slow their adoption by physicians and patients. Marketing strategies like identifying influential prescribers and developing brand awareness will be important to maximize the successful utilization of biosimilars.