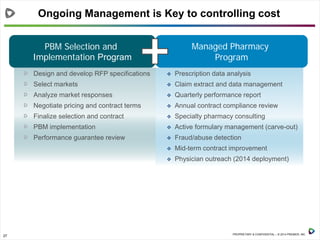

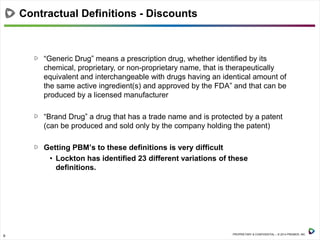

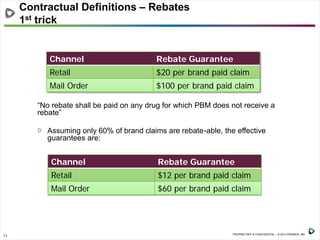

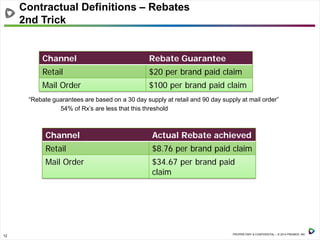

The document discusses key issues in the pharmacy marketplace affecting employers, including rising costs, specialty pharmacy dynamics, and the complexities of pharmacy benefit management (PBM). It highlights the financial impact of specialty drugs, challenges with contract negotiations, and the importance of clear contract terms for managing pharmacy costs. Additionally, it outlines strategies for employers to manage pharmacy expenses through predictive modeling and ongoing contract evaluation.

![26 PROPRIETARY & CONFIDENTIAL – © 2014 PREMIER, INC.

No Benefit Changes

No Vendor Changes

Total Savings: $102M

[EMPLOYER]

Group

E-1

Group

E-2

Group

E-3

Group

E-4

$15.2M

$2.99M

$8.9M

$61.5M

$5.9M

$1.5M

$3.8M

$1.4M $860K

Group

T-1

Group

T-2

Group

T-3

Group

H-1

Group

H-2

[TPA/COMMERCIAL]

[HEALTH PLAN]

$11.61

AVERAGE SAVINGS PER SCRIPT

Case Study

2014 Pharmacy Contract Savings](https://image.slidesharecdn.com/2016utopianscenariosforpbms-160707215314/85/A-Pharmacy-Discussion-26-320.jpg)