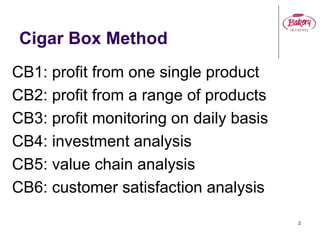

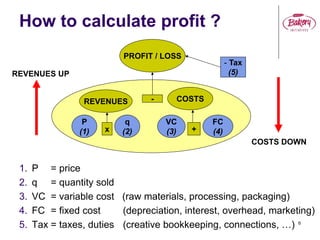

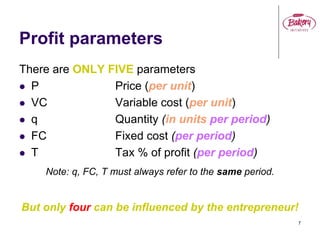

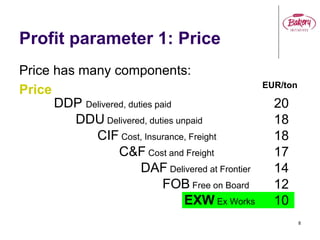

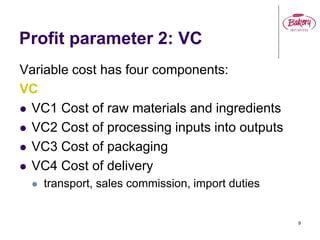

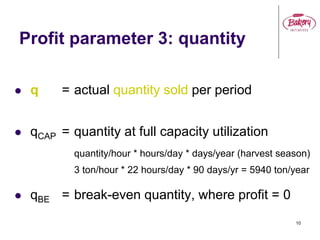

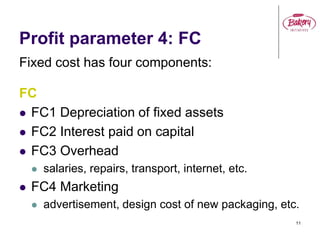

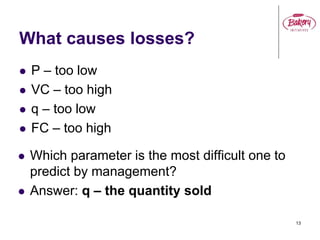

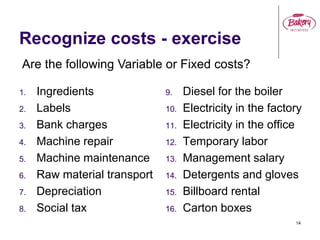

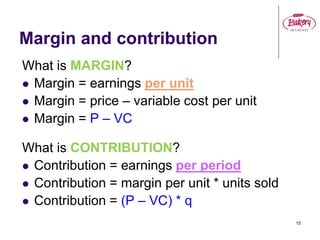

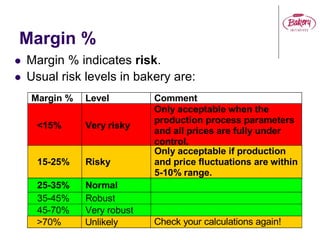

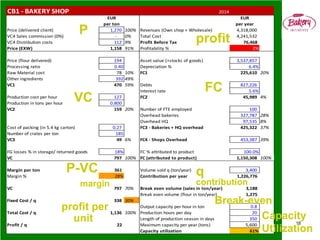

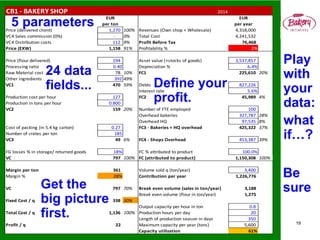

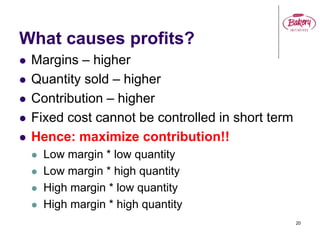

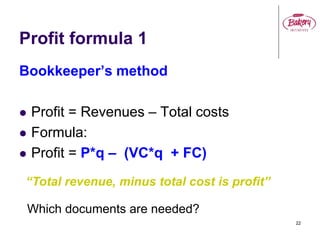

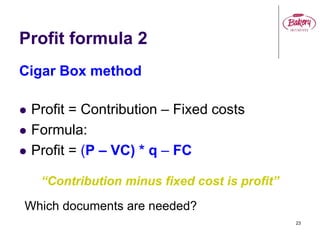

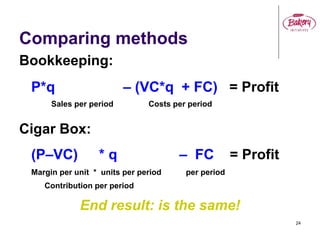

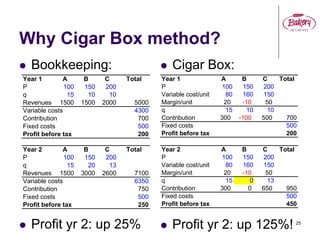

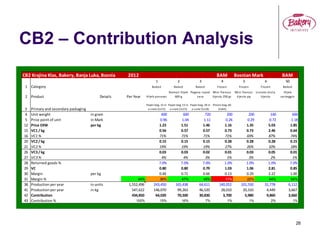

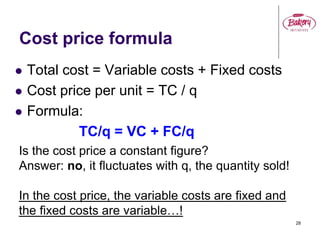

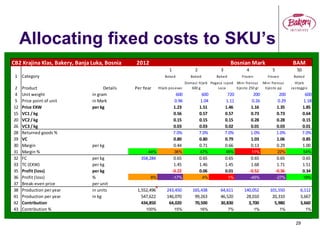

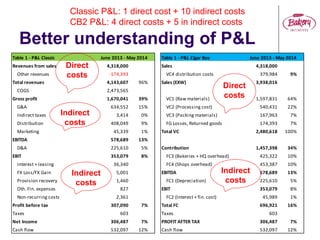

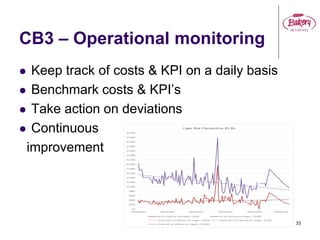

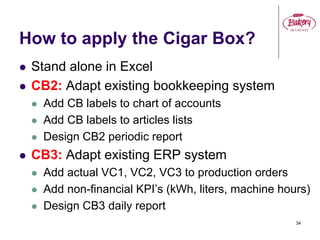

The document presents the Cigar Box® method, designed to help bakers improve business decision-making and profitability by analyzing five key profit parameters: price, variable cost, quantity, fixed cost, and tax. It details how these parameters impact profit calculations, emphasizing the distinction between traditional bookkeeping and the Cigar Box method's approach to profitability. Additionally, the methodology includes practical applications, contribution analysis, and the significance of understanding costs to optimize profit margins.